Reasons to Delete a PayPal Account

PayPal is undoubtedly a popular and convenient online payment platform that has been serving millions of individuals and businesses worldwide. However, there may come a time when you consider closing your PayPal account for various reasons. Here are a few common reasons why people choose to delete their PayPal accounts:

- Security Concerns: While PayPal implements strong security measures, some individuals might still have concerns about the safety of their personal and financial information. If you have experienced unauthorized transactions or are worried about potential security breaches, you may decide to close your PayPal account.

- Limited Features: PayPal provides a range of features to facilitate online payments. However, if you find that the available options are inadequate for your specific needs or if you prefer using alternative payment platforms that offer more functionalities, you might choose to delete your PayPal account.

- High Fees: PayPal charges fees for certain transactions, such as receiving money from international sources or processing large payments. If you frequently engage in transactions that incur substantial fees, closing your PayPal account and exploring other payment methods with lower fees may be a sensible choice.

- Change in Business Strategy: If you are a business owner and your business model or target audience has shifted, you may find that PayPal no longer aligns with your goals. In such cases, closing your PayPal account and utilizing alternative payment solutions that cater to your evolving business needs may be more beneficial.

- Unsatisfactory Customer Service: While PayPal strives to provide excellent customer service, some users may have encountered instances where their issues were not resolved to their satisfaction. If you have consistently faced unhelpful or unsatisfactory support experiences, you might decide to delete your PayPal account and seek alternative platforms with better customer service.

These are just a few reasons why individuals choose to delete their PayPal accounts. It is important to carefully consider your specific circumstances and evaluate whether deleting your account is the right decision for you.

How to Prepare to Close Your PayPal Account

Closing your PayPal account requires some careful preparation to ensure a smooth and hassle-free process. Here are the steps to follow in order to adequately prepare before closing your PayPal account:

- Review Your Account Activity: Before taking any further steps, thoroughly review your PayPal account activity to ensure there are no pending transactions, open disputes, or unresolved issues. It’s important to tie up any loose ends and resolve any outstanding matters before closing your account.

- Update Your Payment Methods: If you have any recurring payments or subscriptions linked to your PayPal account, make sure to update those payment methods to avoid any disruptions or missed payments. Transitioning your payment information to an alternative method will help ensure a smooth transition.

- Backup Important Information: Take a moment to download and save any important account information, such as transaction history, invoices, or receipts. This will help you maintain your financial records and have access to any necessary documentation in the future.

- Remove Linked Bank Accounts and Cards: To safeguard your financial information, unlink any bank accounts or debit/credit cards associated with your PayPal account. This will help prevent any unauthorized access or potential misuse of your financial details.

- Resolve Outstanding Disputes: If you have any unresolved disputes with other PayPal users, it is crucial to address and resolve them before closing your account. Communication and resolution will help avoid any negative consequences or potential conflicts in the future.

- Inform Relevant Parties: If you use PayPal for any business-related purposes, notify your clients or customers in advance about your intention to close your PayPal account. Provide them with alternative payment methods or platforms you will be using moving forward to avoid any disruptions in your business transactions.

- Clear your PayPal Balance: Before initiating the closure, make sure to withdraw or transfer any remaining balance from your PayPal account. This can be done by transferring the funds to your linked bank account or using other available withdrawal options provided by PayPal.

By following these steps, you’ll be well-prepared to close your PayPal account without encountering any unexpected issues or difficulties during the process. Take the time to carefully go through each step to ensure a seamless transition away from PayPal.

How to Cancel Any Subscriptions or Automatic Payments

If you have any subscriptions or automatic payments linked to your PayPal account, it’s important to cancel them before closing your account to avoid any unwanted charges or disruptions. Here are the steps to follow in order to cancel any subscriptions or automatic payments:

- Identify Subscriptions and Automatic Payments: Make a list or take note of all the subscriptions and automatic payments that are currently connected to your PayPal account. This will help you keep track of what needs to be canceled or transferred to an alternative payment method.

- Contact the Service Provider: Reach out to the service providers or merchants associated with each subscription or automatic payment. Inform them about your intention to cancel the payment arrangement and ask them for guidance on the cancellation process. Some service providers may have specific cancellation instructions or requirements.

- Cancel Subscriptions and Automatic Payments: Follow the instructions provided by the service provider to cancel your subscriptions or automatic payments. This may involve accessing your account on their website or contacting their customer support. Make sure to complete the cancellation process for each subscription or automatic payment.

- Set Up Alternative Payment Methods: If you still wish to continue using the services or subscriptions after closing your PayPal account, set up alternative payment methods, such as linking your bank account or using another payment platform accepted by the service provider. Make sure the new payment method is active and ready for use.

- Monitor Your Account: After canceling the subscriptions or automatic payments, monitor your PayPal account closely to ensure that no additional charges are deducted. If you notice any unusual or unauthorized transactions, contact the service provider immediately and report the issue to PayPal.

It’s important to ensure that you cancel all subscriptions and automatic payments before closing your PayPal account to avoid any unexpected charges or complications. By following these steps and staying proactive, you can smoothly transition your payments to alternative methods and maintain control over your financial commitments.

How to Withdraw or Transfer Your PayPal Balance

Before you close your PayPal account, it’s crucial to withdraw or transfer any remaining balance to avoid leaving funds idle or inaccessible. Here’s how you can withdraw or transfer your PayPal balance:

- Access Your PayPal Account: Sign in to your PayPal account using your credentials to access your account dashboard.

- Check Your Balance: Take a moment to review your account balance to determine the amount you wish to withdraw or transfer. Ensure that you have enough funds available for any pending transactions or fees.

- Withdraw to Bank Account: If you have a linked bank account, you can choose to withdraw your PayPal balance directly to your bank account. Select the “Transfer Money” option and follow the prompts to complete the transfer. Typically, it takes a few business days for the funds to appear in your bank account.

- Transfer to Another PayPal Account: If you prefer to transfer your balance to another PayPal account, ensure that the recipient has an active and verified PayPal account. Select the “Send & Request” option, then click on “Send to Friends and Family” and enter the recipient’s email address. Follow the instructions to complete the transfer.

- Request a Check: If you don’t have a linked bank account or prefer a different method, you can request a check to be mailed to your registered address. Select the “Transfer Money” option and choose the “Request a Check” option. Follow the prompts and provide the necessary details. Please note that there might be a fee associated with this option.

- Consider Other Available Options: Depending on your location and PayPal account type, you might have additional withdrawal options, such as PayPal’s Instant Transfer feature or using a PayPal debit card. Explore these options within your account to see if they are applicable to you.

Make sure to keep track of your withdrawals or transfers and retain any confirmation receipts or emails for future reference. By efficiently transferring or withdrawing your PayPal balance, you can ensure that your funds are accessible and properly accounted for.

How to Remove Bank Accounts and Debit/Credit Cards

When closing your PayPal account, it’s important to remove any linked bank accounts and debit/credit cards to protect your financial information. Follow these steps to remove bank accounts and cards from your PayPal account:

- Access Your PayPal Account: Sign in to your PayPal account using your credentials to access your account dashboard.

- Go to Wallet: Navigate to the “Wallet” section of your PayPal account, which allows you to manage your linked bank accounts and cards.

- Remove Bank Accounts: Select the bank account you wish to remove and click on the “Remove” or “Delete” option next to it. Confirm the removal when prompted. Take note that you cannot remove a bank account if it is currently your primary funding source or if there are pending transactions associated with it.

- Remove Debit/Credit Cards: Similarly, locate the debit/credit card you want to remove and click on the “Remove” or “Delete” option. Confirm the removal when prompted. It’s important to note that you cannot remove a card if it is currently being used for an active subscription or automatic payment.

- Verify Removal: After confirming the removal of bank accounts and cards, double-check your Wallet section to ensure that they are no longer listed. This will provide reassurance that your financial information is no longer associated with your PayPal account.

- Keep Records: It’s always a good practice to keep a record of the removal process for your own reference. Take screenshots or save any confirmation emails or receipts related to the removal of bank accounts and cards from your PayPal account.

By following these steps, you can remove your linked bank accounts and debit/credit cards from your PayPal account, minimizing the risk of any unauthorized access or misuse of your financial information. Ensure that you have alternative payment methods set up if needed before removing any bank accounts or cards.

How to Cancel or Resolve Any Disputes or Claims

Before closing your PayPal account, it’s essential to address any disputes or claims that may be pending. Follow these steps to cancel or resolve any ongoing disputes or claims with PayPal:

- Access Your PayPal Account: Sign in to your PayPal account using your credentials to access your account dashboard.

- Navigate to the Resolution Center: Locate and click on the “Resolution Center” tab or link, which is typically found in the top navigation menu or in the sidebar of your PayPal account.

- Review Open Cases: In the Resolution Center, you will find any ongoing disputes or claims associated with your account. Review each case and understand the details, including any communication or evidence submitted.

- Communicate with the Other Party: Reach out to the other party involved in the dispute or claim to discuss and attempt to resolve the issue. Maintain open and honest communication to better understand each other’s perspectives and explore potential solutions.

- Escalate the Dispute: If you are unable to reach a resolution through direct communication, you can escalate the dispute to PayPal for further assistance. Follow the instructions in the Resolution Center to escalate the case, and provide any necessary additional information or evidence to support your claim.

- Collaborate with PayPal: Once a case has been escalated, PayPal will review the information provided by both parties and make a decision based on their policies and guidelines. Collaborate with PayPal by providing any requested information or clarification promptly to expedite the resolution process.

- Accept the Resolution: If PayPal reaches a decision in your favor, carefully review the resolution provided and accept it if it is acceptable to you. If the resolution is not satisfactory, you may have the option to provide additional information or request further review if applicable.

- Close the Case: Once the dispute or claim has been resolved and a decision has been made, close the case in the Resolution Center. This will help ensure that all outstanding matters are properly concluded before closing your PayPal account.

By following these steps, you can cancel or resolve any ongoing disputes or claims through PayPal’s Resolution Center. Make sure to address all outstanding issues before closing your PayPal account to avoid any potential complications or unresolved matters.

How to Delete Your PayPal Account

If you have made the decision to permanently close your PayPal account, follow these steps to delete it:

- Access Your PayPal Account: Sign in to your PayPal account using your credentials to access your account dashboard.

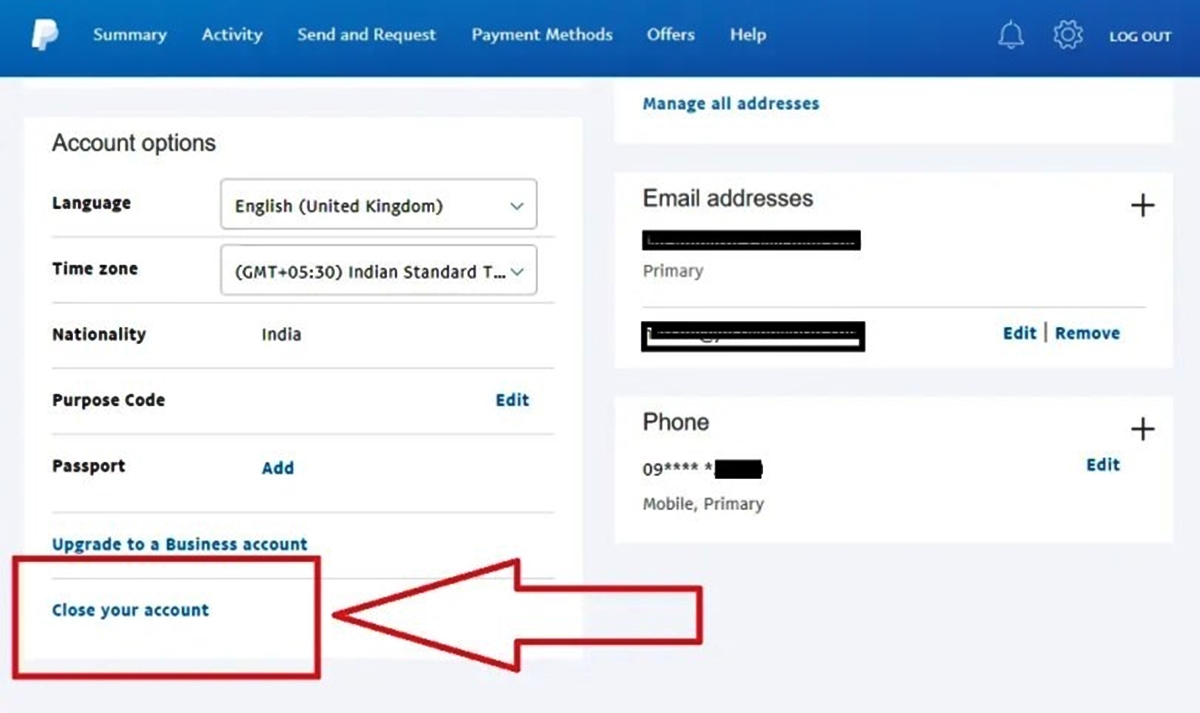

- Go to Account Settings: Navigate to the “Settings” section of your PayPal account. Look for the gear or cogwheel icon, which typically represents the settings menu.

- Select “Close Your Account”: Within the account settings, locate the option to “Close Your Account.” This option is generally found in the Account Information or Account Management section. Click on it to begin the closure process.

- Confirm Your Identity: PayPal may require you to verify your identity before proceeding to delete your account. Follow the provided instructions and provide any necessary personal information to confirm your identity.

- Review Account Information: Before closing your account, PayPal may present you with a summary or overview of your account information, such as your transaction history and any remaining balance. Take a moment to review this information to ensure it is accurate.

- Read and Understand the Consequences: PayPal will likely provide a list of the consequences and limitations associated with closing your account. Read these carefully to understand any potential impacts on your financial and online activities.

- Confirm Closure: After considering the consequences, confirm your intention to close your PayPal account. This action is usually irreversible, so double-check your decision before proceeding.

- Follow Additional Steps (if applicable): Depending on your account activity and specific circumstances, PayPal may require you to complete additional steps or provide further information before finalizing the account closure. Follow any provided instructions to successfully close your account.

- Receive Confirmation: Once you have successfully completed the closure process, PayPal should provide a confirmation of the account closure. Keep this confirmation for your records.

It’s important to note that after deleting your PayPal account, you will no longer have access to your transaction history, invoices, or any other account-related information. Make sure to save any necessary documents or records before closing your account.

Before taking the final step to delete your PayPal account, ensure that you have resolved any pending disputes, withdrawn your balance, and updated or canceled any subscriptions or automatic payments associated with the account.

What You Need to Know After Deleting Your PayPal Account

After deleting your PayPal account, there are several important points to keep in mind. Here’s what you need to know:

- No Access to Account: Once your PayPal account is deleted, you will no longer have access to it. This means you won’t be able to view any transaction history, invoices, or other account-related information. Make sure to save any necessary documents or records before closing your account.

- Loss of Payment History: Deleting your PayPal account means losing your payment history associated with that account. If you require this information for financial or record-keeping purposes, make sure to download and save it before closing your account.

- Cancel Any Recurring Payments: Ensure that you have canceled any recurring payments or subscriptions that were linked to your PayPal account. Failure to do so may result in those payments being attempted and potentially causing issues or fees.

- Update Payment Methods: If you relied solely on PayPal for online payments, make sure to update your payment methods with alternative options. This will ensure that you have a seamless transition for future transactions.

- Check for Refunds or Issues: After closing your PayPal account, monitor your bank account or alternative payment methods for any refunds, issues, or disputes that may arise due to the closure. Stay proactive in resolving any outstanding matters.

- Explore Other Payment Platforms: If you still require online payment services, consider exploring other payment platforms that may better suit your needs. Research alternative options and choose one that aligns with your preferences and requirements.

- Keep Track of Finances: Moving forward, it’s important to maintain diligent record-keeping and financial management. Track your expenses, payments, and receipts to ensure accurate bookkeeping and financial organization.

- Protect Personal Information: Even after closing your PayPal account, it’s essential to continue protecting your personal and financial information. Be cautious when sharing sensitive details online and regularly monitor your accounts for any suspicious activity.

- Stay Informed: Remain updated on changes to PayPal’s policies, practices, and services, as these may impact your future online payment preferences and decisions.

By keeping these points in mind, you can navigate your financial activities effectively after deleting your PayPal account. Stay organized, informed, and proactive to ensure a smooth transition and to protect your personal and financial well-being.

Frequently Asked Questions about Deleting a PayPal Account

Here are answers to some commonly asked questions about deleting a PayPal account:

- Can I reopen a deleted PayPal account?

- Can I delete my PayPal account if it has a negative balance?

- What happens to my linked bank account and cards after closing my PayPal account?

- Will deleting my PayPal account affect my credit score?

- What happens to any pending transactions or refunds after closing my account?

- Can I keep my PayPal account active but stop using it?

- Are there any fees for closing my PayPal account?

No, once you have deleted your PayPal account, it cannot be reopened. You will need to create a new PayPal account if you wish to use their services again.

You cannot delete your PayPal account if it has a negative balance. You must resolve the balance to zero or positive before closing the account. PayPal may provide options for repayment or set up a payment plan to help you clear the debt.

After closing your PayPal account, your linked bank accounts and cards will no longer be associated with your account. However, it is recommended to unlink them directly from your PayPal account for added security.

Deleting your PayPal account itself does not have a direct impact on your credit score. However, if you had outstanding debts or unresolved disputes before closing your account, those issues might have an impact on your credit depending on how they are resolved.

Any pending transactions or refunds will be processed according to PayPal’s policies even after you close your account. If you have concerns about specific transactions or refunds, it’s best to reach out to PayPal’s customer support for assistance.

Yes, you can choose to keep your PayPal account active without using it for transactions. You may disable certain features or remove payment methods to prevent any unwanted activity. However, it is important to maintain account security even if you are not actively using it.

No, PayPal does not charge any fees for closing your account. However, you may still be responsible for any outstanding fees or charges associated with your account, such as transaction fees or unresolved disputes.

If you have additional questions or concerns about deleting your PayPal account, it is recommended to directly contact PayPal’s customer support for personalized guidance and assistance.