Using a PayPal Cash Plus Account

If you’re looking for a convenient way to add money to your PayPal account without linking a bank account, you can consider using a PayPal Cash Plus account. This feature allows you to load money onto your PayPal balance at select retail locations, giving you the flexibility to manage your funds without the need for a traditional bank account.

To get started, you’ll need to sign up for a PayPal Cash Plus account if you don’t already have one. Simply visit the PayPal website or download the app to create your account. Once you have your account set up, you can follow these steps to add money:

- Locate a participating retail location that offers PayPal Cash or PayPal Cash Plus services. Examples include retailers like Walmart, CVS, and 7-Eleven.

- Go to the cashier and request to add money to your PayPal Cash Plus account. You’ll need to provide them with the required amount in cash and your PayPal Cash barcode or mobile number.

- The cashier will scan your barcode or enter your mobile number into their system to initiate the transaction. It’s important to double-check that the information is correct to ensure a successful transfer.

- Once the transaction is complete, the money will be added to your PayPal Cash Plus account balance, and you can start using it for online purchases, sending money to others, or withdrawing it to your linked debit or credit card.

It’s important to note that some retail locations may charge a service fee when adding money to your PayPal Cash Plus account. It’s advisable to check with the specific retailer beforehand to understand any associated fees.

Using a PayPal Cash Plus account is a simple and effective way to add money to your PayPal balance without the need for a bank account. It allows you to have greater control over your finances and access the benefits of using PayPal for online transactions.

Adding Money with a Debit Card

If you have a debit card linked to your bank account, you can easily add money to your PayPal account in just a few simple steps. This method provides a convenient and quick way to have funds available for online purchases or to send money to friends and family.

To add money to your PayPal account using a debit card, follow these steps:

- Log in to your PayPal account and go to the “Wallet” section.

- Select the option to “Link a card or bank” and then choose “Link a debit or credit card.”

- Enter the required information for your debit card, including the card number, expiration date, and security code.

- Review and confirm the details, making sure that all the information provided is accurate.

- Once your debit card is successfully linked, go back to the “Wallet” section and click on the option to “Add money.”

- Choose the linked debit card as the source and enter the amount you want to add to your PayPal account.

- Follow the prompts to complete the transaction, including any additional verification steps if required.

- Once the transaction is processed, the money will be added to your PayPal account, and you can start using it for your online transactions.

It’s important to note that there may be limits on the amount you can add to your PayPal account using a debit card. These limits can vary depending on factors such as your account status and transaction history. Additionally, some banks may charge a fee for adding money to your PayPal account using a debit card. It’s advisable to check with your bank to understand any associated fees or restrictions.

By adding money to your PayPal account using a debit card, you can easily manage your funds and have them readily available for your online transactions. It’s a convenient and secure method that allows you to enjoy the benefits of using PayPal for your financial needs.

Linking a Credit Card to Your PayPal Account

If you prefer to use a credit card to add money to your PayPal account, you can easily link it for convenient and secure transactions. Linking a credit card provides you with the flexibility to make online purchases, send money, and access the various features PayPal offers.

To link a credit card to your PayPal account, follow these steps:

- Log in to your PayPal account and navigate to the “Wallet” section.

- Select “Link a card or bank” and then choose “Link a debit or credit card.”

- Enter the required information for your credit card, including the card number, expiration date, and security code.

- Review and confirm the details, ensuring that all the information provided is accurate.

- Once your credit card is successfully linked, you can choose it as a payment method when making purchases or adding money to your PayPal account.

When using a linked credit card to add money to your PayPal account, it’s essential to understand the associated fees and limits. Depending on your credit card provider or PayPal’s policies, there may be fees for certain transactions, such as cash advances. It’s advisable to review your credit card terms and conditions or contact your credit card issuer for further information.

Keep in mind that adding money to your PayPal account using a credit card may also accrue interest charges if not paid off promptly. It’s important to manage your finances responsibly to avoid any interest or fees.

By linking a credit card to your PayPal account, you can make secure online transactions and have the convenience of accessing your funds whenever needed. It’s an excellent option for those who prefer using a credit card for their payments, providing flexibility and peace of mind.

Using MoneyPak to Add Funds

If you’re looking for an alternative way to add funds to your PayPal account, you can consider using MoneyPak. MoneyPak allows you to purchase a prepaid card with a specific amount loaded onto it, which can then be used to add funds to your PayPal balance.

Here’s how you can use MoneyPak to add funds to your PayPal account:

- Find a retailer that sells MoneyPak cards. Some popular options include Walmart, Walgreens, and CVS.

- Purchase a MoneyPak card with the desired amount of funds. Be sure to activate the card when you make the purchase.

- Log in to your PayPal account and navigate to the “Wallet” section.

- Select the option to “Link a card or bank” and choose “Link a card.”

- Enter the required information for the MoneyPak card, including the card number and the expiration date.

- Review and confirm the details, ensuring that the information provided is accurate.

- Once your MoneyPak card is successfully linked, you can use it to add funds to your PayPal account.

- Go to the “Wallet” section again and select the option to “Add money.”

- Choose the linked MoneyPak card as your payment method and enter the amount you want to add to your PayPal account.

- Complete the transaction following the prompts and your funds will be added to your PayPal balance.

It’s important to note that there may be fees associated with using MoneyPak to add funds to your PayPal account. These fees can vary depending on the retailer and the amount of funds you add. Be sure to check the terms and conditions of the MoneyPak card or contact the retailer for details on any applicable fees.

Using MoneyPak can be a convenient and secure method for adding funds to your PayPal account without the need for a bank account. It offers flexibility and accessibility, providing you with the ability to manage your finances and make online transactions with ease.

Transferring Money from a Prepaid Card

If you have a prepaid card and want to add funds to your PayPal account, you’ll be glad to know that it’s possible to transfer money from a prepaid card to your PayPal balance. This provides you with the flexibility to manage your funds and use them for online purchases, sending money, and more.

Here’s how you can transfer money from a prepaid card to your PayPal account:

- Ensure that your prepaid card allows transfers to external accounts. Not all prepaid cards have this feature, so it’s important to check with the card issuer.

- Log in to your PayPal account and navigate to the “Wallet” section.

- Select “Link a card or bank” and then choose “Link a card.”

- Enter the required information for your prepaid card, including the card number, expiration date, and security code.

- Review and confirm the details, ensuring that all the information provided is accurate.

- Once your prepaid card is successfully linked, go back to the “Wallet” section and click on the option to “Add money.”

- Choose the linked prepaid card as your payment method and enter the amount you want to transfer to your PayPal account.

- Complete the transaction following the prompts, and the funds will be transferred to your PayPal balance.

It’s important to note that there may be fees associated with transferring money from a prepaid card to your PayPal account. These fees can vary depending on your prepaid card issuer, so it’s advisable to check with them for any applicable fees.

Additionally, keep in mind that there may be limits on the amount you can transfer from your prepaid card to your PayPal account. These limits can vary depending on your prepaid card provider and your account status.

By transferring money from a prepaid card to your PayPal account, you can ensure that your funds are easily accessible and ready for use in your online transactions. It’s a convenient and secure method that allows you to make the most out of your prepaid card while enjoying the benefits of PayPal’s services.

Utilizing PayPal’s Mobile App to Deposit Cash

If you prefer to deposit cash directly into your PayPal account without the need for a bank account, you can take advantage of PayPal’s mobile app. The app provides a convenient and secure way to add funds to your PayPal balance, allowing you to use the money for online purchases, sending money, and more.

Here’s how you can utilize PayPal’s mobile app to deposit cash:

- Download and install the PayPal mobile app from your device’s app store.

- Log in to the app using your PayPal account credentials. If you don’t have an account, you can easily create one from the app.

- Tap on the “Add money” option, typically located prominently on the home screen.

- Choose the option for “In-store” or “Cash” depending on the app’s interface.

- Enter the amount of cash you wish to deposit into your PayPal account.

- Follow the instructions provided, which may include providing a barcode or showing a personalized QR code at a participating retail location.

- Visit a participating retail location, such as Walmart, 7-Eleven, or Rite Aid, and show the barcode or QR code to the cashier.

- Pay the cash amount you entered on the app to the cashier.

- Once the transaction is completed, the cash will be added to your PayPal balance, and you can start using it for your online transactions.

It’s important to note that some retail locations may charge a service fee for adding cash to your PayPal account. Additionally, keep in mind that there may be limits on the amount of cash you can deposit through the mobile app. These limits can vary depending on PayPal’s policies and your account status.

By utilizing PayPal’s mobile app to deposit cash, you can conveniently manage and access your funds without the need for a bank account. It’s a hassle-free method that provides you with the flexibility to add cash and enjoy the benefits of using PayPal for your financial needs.

Getting Paid with PayPal and Keeping Money in Your Account

PayPal offers a seamless and secure platform for receiving payments from clients, customers, or even friends and family. When you receive money through PayPal, you have the option to keep the funds in your PayPal account, providing you with a centralized and easily accessible source of funds.

Here’s how you can get paid with PayPal and keep the money in your account:

- Ensure that you have a PayPal account set up. If you don’t have one yet, you can easily create an account on the PayPal website or through the PayPal mobile app.

- Once your account is set up, share your PayPal email address or your unique PayPal.me link with the person or business who needs to pay you.

- When the payment is sent to your PayPal account, you will receive a notification via email or in the PayPal mobile app.

- Log in to your PayPal account to view and confirm the received payment.

- If you choose to keep the money in your PayPal account, it will be added to your PayPal balance, and you can access it for online purchases, send money to others, or even withdraw it to your linked bank account.

Keeping money in your PayPal account offers several advantages. Firstly, it provides a centralized platform to manage your funds, making it convenient to track your transactions and maintain a clear overview of your financial activity.

Secondly, if you frequently make online purchases or payments, keeping money in your PayPal account allows for faster and more efficient transactions. You can use your PayPal balance directly, without the need to transfer money from your bank account each time.

Lastly, having funds in your PayPal account can also act as a buffer for unexpected expenses. If you encounter an urgent payment or unforeseen circumstance, having money readily available in your PayPal balance can provide peace of mind.

It’s important to note that PayPal offers various tools and features to help you manage and utilize the money kept in your account. You can set up automatic transfers to your bank account, create savings goals using PayPal’s MoneyPool feature, or even invest your funds through PayPal’s Money Market Fund.

By getting paid with PayPal and keeping the money in your account, you can enjoy the convenience, flexibility, and financial control that PayPal offers. It’s a simple and secure way to manage your funds and access them whenever you need.

Using PayPal’s MoneyPool Feature to Add Money

PayPal’s MoneyPool feature offers an innovative way to add money to your PayPal account by creating a shared fund among friends, family, or colleagues. This powerful tool allows you to pool money from multiple contributors, making it easy to collect funds for a specific goal or event.

Here’s how you can use PayPal’s MoneyPool feature to add money:

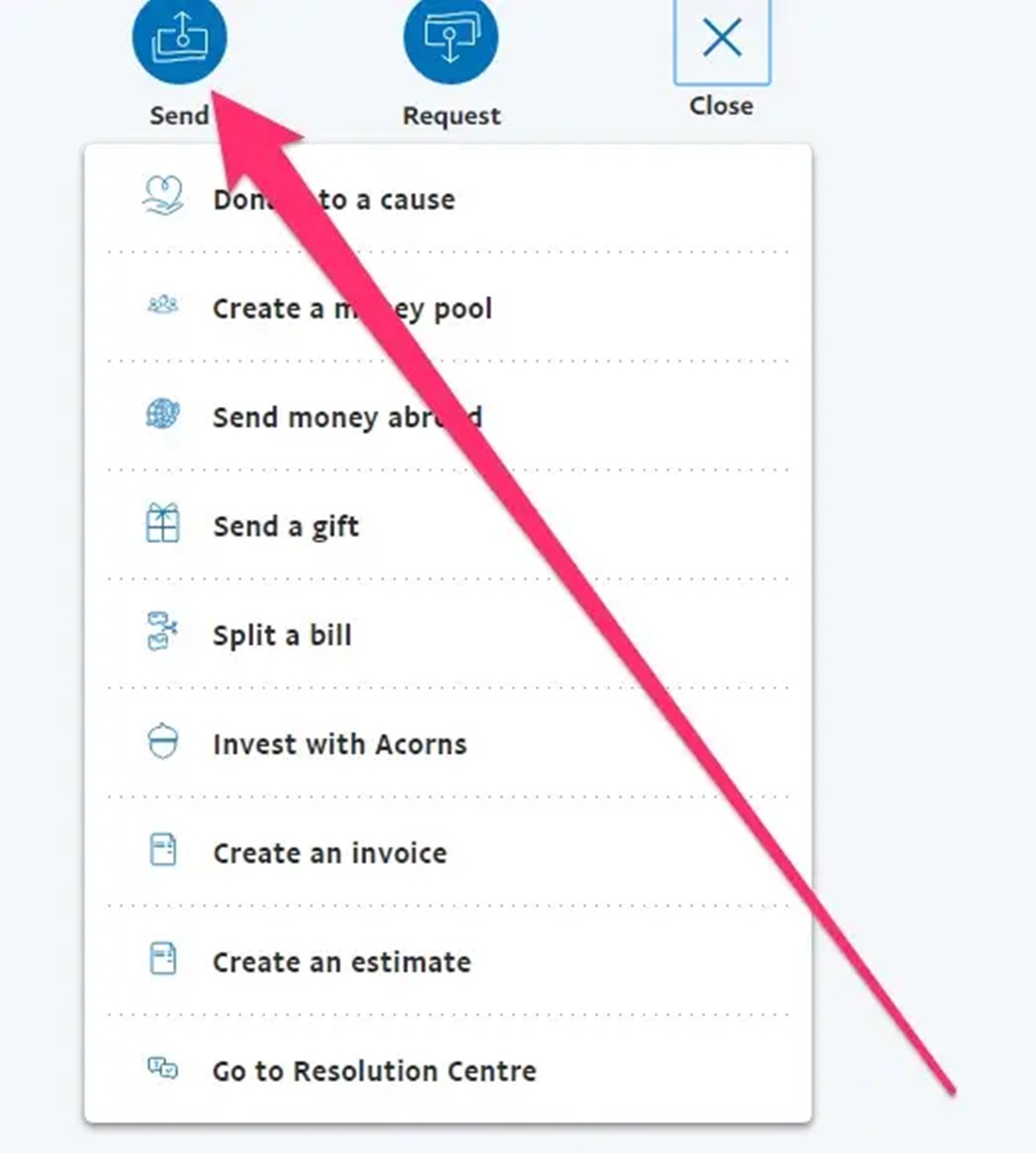

- Log in to your PayPal account and navigate to the “Money” section.

- Select the option to “Create a MoneyPool.”

- Name your MoneyPool accordingly, and provide a brief description to inform contributors about the purpose of the pool.

- Set a funding goal by entering the desired amount of money you aim to collect.

- Choose whether to make the MoneyPool public or private. Public MoneyPools can be viewed by anyone with the link, while private MoneyPools require an invitation.

- Share the MoneyPool link with friends, family, or other contributors, allowing them to add money to the shared fund. You can easily share the link via email, social media, or other messaging platforms.

- Contributors can click on the link and follow the prompts to add their desired amount of money to the MoneyPool using their PayPal account or a debit/credit card.

- As the funds are added, you can track the progress towards your funding goal and keep contributors updated on the MoneyPool page.

Using PayPal’s MoneyPool feature offers several advantages. Firstly, it simplifies the process of collecting money from multiple individuals by centralizing all contributions in one place. It eliminates the need for cash exchanges or multiple transactions.

Secondly, the MoneyPool feature allows for transparency and accountability, as contributors can see the progress towards the funding goal and ensure the funds are being used for the intended purpose. This level of transparency builds trust and encourages participation.

Lastly, the MoneyPool feature can be used for various scenarios, whether it’s hosting a group gift, crowdfunding a project, or raising funds for a charitable cause. It provides a flexible platform to collect and manage money for any shared goal.

It’s important to note that PayPal may charge a small fee for receiving contributions through the MoneyPool feature. The fee depends on various factors such as the country and the payment method used by the contributors.

By using PayPal’s MoneyPool feature to add money, you can easily collect funds and reach your financial goals with the help of friends, family, or colleagues. It’s a convenient and collaborative way to pool resources and make progress towards a common objective.

Adding Funds through a Green Dot MoneyPak

If you’re looking for another option to add funds to your PayPal account, you can consider using a Green Dot MoneyPak. MoneyPak allows you to purchase a reloadable prepaid card and load it with funds, which can then be transferred to your PayPal balance.

Here’s how you can add funds to your PayPal account through a Green Dot MoneyPak:

- Visit a participating retailer that sells Green Dot MoneyPak cards, such as Walmart, Walgreens, or CVS.

- Purchase a MoneyPak card and ensure that it is authorized for PayPal transfers.

- Activate the MoneyPak card by following the instructions provided on the packaging.

- Log in to your PayPal account and go to the “Wallet” section.

- Select the option to “Link a card or bank” and then choose “Link a card.”

- Enter the required information for the MoneyPak card, including the card number and expiration date.

- Review and confirm the details to link the MoneyPak card to your PayPal account.

- Once the MoneyPak card is successfully linked, go back to the “Wallet” section and click on the option to “Add money.”

- Choose the linked MoneyPak card as your payment method and enter the amount you want to add to your PayPal account.

- Complete the transaction following the prompts, and the funds will be transferred to your PayPal balance.

It’s important to note that using a Green Dot MoneyPak to add funds to your PayPal account may have applicable fees. These fees can vary depending on the specific MoneyPak card and the retailer where you purchased it. Be sure to check the terms and conditions or contact the retailer for any associated fees.

Adding funds through a Green Dot MoneyPak offers a convenient and secure method to transfer money to your PayPal account without the need for a bank account. It provides you with flexibility and control over your funds, allowing you to use them for online purchases, send money, and more.

Receiving Money as a Refund to Your PayPal Account

When making online purchases or transactions, there may be instances where you need to return an item or receive a refund. PayPal offers a seamless process for receiving money back as a refund directly into your PayPal account. This ensures a hassle-free and convenient way to manage your funds.

Here’s how you can receive money as a refund to your PayPal account:

- Firstly, ensure that the purchase was made using PayPal as your payment method. Many online retailers offer PayPal as a payment option, so be sure to use it when making the initial purchase.

- If you need to request a refund or return an item, reach out to the seller or retailer according to their specific return policy. This may involve contacting their customer service, submitting a return request, or following their designated refund process.

- Once the return or refund request is approved, the seller will initiate the refund process. They will typically refund the money directly to the original payment method used—your PayPal account.

- You will receive an email notification from PayPal indicating that the refund has been processed. The funds will be added to your PayPal account balance.

- Log in to your PayPal account and navigate to the “Wallet” section to view your updated balance.

- You can now use the refunded funds within your PayPal account for future purchases, transfer them to your linked bank account, or keep them in your PayPal balance to use later.

Receiving money as a refund to your PayPal account offers several advantages. Firstly, it allows you to have a centralized place to manage your refunds, making it easy to track and access your refunded funds.

Secondly, having the refund processed through PayPal adds an extra layer of security. PayPal offers buyer protection policies, ensuring that you have recourse in the event of any disputes or issues with the refund process.

Lastly, having the refunded money within your PayPal account provides flexibility and convenience. You can easily use the funds for future purchases without having to transfer money between different payment methods or wait for the refund to be credited back to your bank account.

It’s important to note that the time it takes for the refund to appear in your PayPal account will depend on the specific seller’s refund policies and processes. In some cases, it may take a few days for the refund to be processed and reflected in your balance.

By receiving money as a refund to your PayPal account, you can enjoy a streamlined and secure process for managing your online refunds. It offers flexibility and ease of use, ensuring that your funds are readily available for your future transactions.