Setting up a Bank Account for Withdrawals

Before you can transfer money from your PayPal account to your bank account, you will need to ensure that you have a bank account linked to your PayPal account. This enables you to easily withdraw funds and access your money in a convenient and secure way.

To set up a bank account for withdrawals on PayPal, follow these simple steps:

- Log in to your PayPal account and navigate to the “Wallet” section.

- Click on the “Link a bank account” option.

- Select your country and enter the required details of your bank account, such as the account number and routing number.

- Review the information you provided and confirm the linkage between your PayPal account and your bank account.

Once you have successfully linked your bank account, PayPal will send you a small test deposit to verify the account. You will need to check your bank statement to find the exact amount of the test deposit and enter it on PayPal to confirm the verification.

It is important to note that only verified bank accounts can be used for withdrawals on PayPal. Verifying your bank account adds an extra layer of security to your financial transactions and ensures that your money is transferred to the correct recipient.

Furthermore, make sure that the bank account you link to PayPal is in your name or the name of your business, as PayPal does not allow withdrawals to third-party accounts.

By setting up a bank account for withdrawals, you are ready to transfer funds from your PayPal account whenever you need them. This seamless integration between PayPal and your bank account provides you with fast access to your money and simplifies your financial transactions.

Verifying and Linking your Bank Account

Once you have set up a bank account for withdrawals on PayPal, the next step is to verify and link the account to ensure seamless transfer of funds. Verifying your bank account adds an extra layer of security and enables you to utilize all the features and benefits of PayPal.

To verify and link your bank account on PayPal, follow these steps:

- Log in to your PayPal account and go to the “Wallet” section.

- Locate the bank account you want to verify and click on the “Confirm” button.

- PayPal will then initiate two small test deposits to your bank account, typically within 1-2 business days.

- Check your bank statement or online banking portal to identify the amounts of the test deposits.

- Return to your PayPal account and enter the two test deposit amounts.

After successfully entering the test deposit amounts, PayPal will verify your bank account and complete the linkage process. This verification step is crucial for ensuring that your funds are securely transferred to the correct bank account.

It’s important to note that when linking a bank account, PayPal will only display the last few digits of your bank account number for security reasons. This ensures that your sensitive financial information remains protected.

In some cases, you may encounter issues while verifying and linking your bank account. If you face any problems, double-check that you have entered the correct test deposit amounts and ensure that your bank account information is accurate.

By successfully verifying and linking your bank account, you will gain access to a range of features, such as the ability to transfer funds, make online purchases, and receive payments. It also enables you to enjoy the convenience of withdrawing money from your PayPal account directly to your bank account without any hassle.

Understanding PayPal Withdrawal Limits and Fees

Before initiating a withdrawal from your PayPal account to your linked bank account, it’s important to familiarize yourself with the withdrawal limits and associated fees. Understanding these factors will help you plan your transactions and manage your finances efficiently.

Withdrawal Limits:

PayPal imposes certain withdrawal limits to ensure the security of your funds and prevent unauthorized transactions. The specific limits may vary depending on your account type, country, and verification status. Typically, there are both daily and weekly withdrawal limits in place.

To check your withdrawal limits on PayPal:

- Log in to your PayPal account and go to the “Summary” or “Wallet” section.

- Select the bank account you wish to withdraw to.

- Under the “Withdraw” section, you’ll find the available balance along with the applicable withdrawal limits.

Fees:

PayPal charges certain fees for processing withdrawals. The fees may vary based on factors such as the withdrawal amount, currency conversion, and the speed of the transfer. It’s important to review the fee structure on the PayPal website or contact their customer support to stay informed about the current fee rates.

It’s worth noting that if you are withdrawing funds from PayPal in a different currency than your bank account, PayPal will apply a currency conversion fee. This fee covers the cost of converting the funds into your desired currency at the prevailing exchange rate.

When reviewing the withdrawal limits and fees, it’s essential to consider your specific financial needs and transaction requirements. If you anticipate frequent large withdrawals or transfers involving different currencies, carefully evaluate the associated costs to ensure optimal usage of your funds.

By understanding the withdrawal limits and fees associated with PayPal, you can effectively plan your transactions, maximize the use of your funds, and minimize any potential financial costs.

Initiating a Withdrawal from PayPal

Once you have set up and verified your bank account on PayPal, you can easily initiate a withdrawal and transfer your funds from your PayPal account to your linked bank account. The process is straightforward and can be completed in just a few steps:

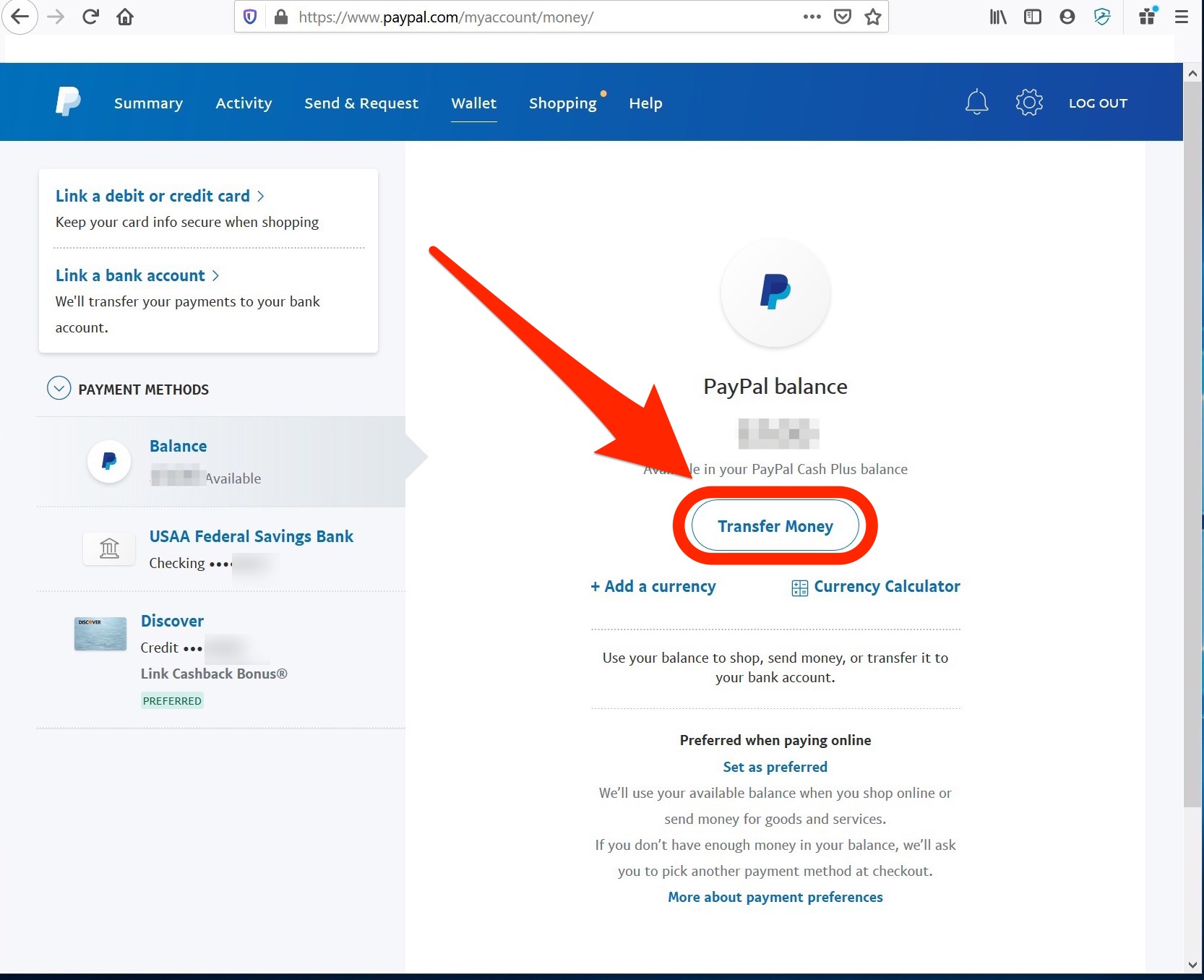

- Log in to your PayPal account and navigate to the “Wallet” section.

- Locate your available PayPal balance and click on the “Transfer Money” option.

- Select the bank account you wish to withdraw to from the drop-down menu.

- Enter the amount you want to transfer. You can choose to transfer the full available balance or specify a specific amount.

- Review the transaction details, including the withdrawal amount and any associated fees.

- If everything looks correct, click on the “Continue” button to proceed with the withdrawal.

Once you have initiated the withdrawal, PayPal will process the transfer based on the speed option you have selected. The available withdrawal speeds may vary depending on your country and account type.

Choosing the right transfer speed is important, as it determines how quickly the funds will be available in your bank account:

- Standard Transfer: This is the default option and usually takes 1-3 business days for the funds to appear in your bank account.

- Instant Transfer: This option allows you to transfer the funds instantly, but it comes with an additional fee. The availability of this option may depend on your country and account eligibility.

It’s important to note that the standard transfer is typically free, but there may be fees associated with the instant transfer option. Be sure to review the fees and understand the implications before choosing a transfer speed.

By following these steps and selecting the appropriate transfer speed, you can easily initiate a withdrawal from your PayPal account and have your funds transferred to your bank account in a timely manner.

Choosing the Transfer Speed and Reviewing the Estimated Arrival Time

When initiating a transfer from your PayPal account to your linked bank account, it’s important to choose the transfer speed that best suits your needs. PayPal offers different options for transferring funds, each with its own advantages and estimated arrival times.

Here’s what you need to know about choosing the transfer speed and reviewing the estimated arrival time:

1. Standard Transfer:

The standard transfer is the default option for withdrawing funds from PayPal to your bank account. It is typically free of charge, and the estimated arrival time is usually between 1 to 3 business days.

Keep in mind that the actual arrival time may vary depending on various factors, such as weekends, public holidays, and the processing time of your bank. So it’s always a good idea to allow some extra time for the transfer to be completed.

2. Instant Transfer:

If you need immediate access to your funds, PayPal offers an instant transfer option, which allows you to receive the money in your bank account almost instantly. However, this service may come with an additional fee.

It’s important to note that the availability of instant transfers may depend on your country and account eligibility. You should carefully review the fee structure and ensure that the benefits of instant access outweigh the associated cost.

3. Estimated Arrival Time:

When initiating a transfer, PayPal provides you with an estimated arrival time for the funds to be available in your bank account. This estimate is based on the transfer speed you have chosen and is a helpful reference for planning your financial transactions.

However, it’s important to remember that the estimated arrival time is not guaranteed and may be subject to delays or changes beyond PayPal’s control. External factors such as bank processing times or unforeseen issues can impact the actual arrival time of the funds.

Therefore, it’s advisable to consider these factors and plan accordingly, especially if you have any time-sensitive or urgent financial obligations.

By carefully choosing the transfer speed and reviewing the estimated arrival time, you can ensure that your funds are transferred to your bank account in a timely manner that aligns with your needs and priorities.

Confirming the Withdrawal and Reviewing the Details

After initiating a withdrawal from your PayPal account to your linked bank account, it’s important to take the time to confirm the transaction and review the details to ensure accuracy and a smooth transfer process. Paying attention to these steps can help prevent any errors or issues that may arise during the withdrawal.

Here’s what you need to do to confirm the withdrawal and review the details:

- After initiating the withdrawal, PayPal will provide you with a confirmation message or page displaying the transaction details. Take a moment to carefully read through this information.

- Check the withdrawal amount to ensure that it matches your intended transfer. Verify that the correct bank account is selected for the withdrawal.

- Review any associated fees that may be charged for the transfer. Make sure you understand the fee structure and the total cost of the transaction.

- If you need a record of the withdrawal for your own records or accounting purposes, consider printing or saving a copy of the transaction details or confirmation page.

By confirming the withdrawal and reviewing the details, you can catch any discrepancies or errors early on and take appropriate action. If you notice any incorrect information, it is recommended to contact PayPal customer support for assistance.

It’s worth mentioning that PayPal provides you with a transaction ID, which serves as a unique identifier for the withdrawal. This ID can be useful for reference in case you need to communicate with PayPal support regarding any issues or inquiries related to the withdrawal.

Remember, double-checking and confirming the withdrawal details helps ensure the accuracy of the transfer and minimizes the chances of encountering any setbacks. It’s a good practice to review the information every time you initiate a withdrawal from your PayPal account.

By following these steps and being attentive to the confirmation and details review process, you can have peace of mind knowing that your funds are being transferred accurately and securely from your PayPal account to your bank account.

Checking the Status of Your Withdrawal

Once you have initiated a withdrawal from your PayPal account to your linked bank account, you may be curious about the progress and status of the transfer. PayPal provides you with tools and features that allow you to easily check the status of your withdrawal.

Here are the steps to check the status of your withdrawal:

- Log in to your PayPal account and navigate to the “Summary” or “Activity” section.

- Locate the recent withdrawal transaction you made from your PayPal account to your bank account.

- Click on the transaction to view the details.

- PayPal will display the current status of the withdrawal, such as “Pending” or “Completed”.

- If the withdrawal is pending, you may see an estimated completion date or a note indicating that it is under review.

It’s important to note that the time it takes for a withdrawal to complete and for the funds to be available in your bank account may vary depending on several factors. These factors include the withdrawal speed chosen, the processing time of your bank, and any potential delays or reviews initiated by PayPal for security reasons.

If your withdrawal is marked as completed but you still do not see the funds in your bank account, here are a few steps you can take:

- Double-check that you provided the correct bank account details and that the account is linked and verified on PayPal.

- Allow for the estimated arrival time mentioned during the withdrawal process, as it may take a few business days for the funds to be fully processed by your bank.

- If there are any concerns or if you believe there is an issue with the withdrawal, you can reach out to PayPal customer support for assistance.

By checking the status of your withdrawal regularly, you can stay updated on the progress of your funds and take necessary action if there are any unexpected delays or issues. The information provided by PayPal through its platform helps you stay informed and maintain control over your financial transactions.

Remember to exercise patience and understand that certain factors, such as bank processing times or security checks, may impact the withdrawal completion time. Regularly monitoring the status ensures transparency and gives you peace of mind regarding your funds.

Dealing with Common Issues and Errors During the Withdrawal Process

While the withdrawal process from PayPal to your bank account is typically smooth and hassle-free, there may be instances where you encounter common issues or errors. It’s important to know how to address these situations effectively to ensure that your funds are transferred successfully.

Here are some common issues and errors that you may encounter during the withdrawal process and how to deal with them:

1. Insufficient Funds:

If you receive an error message indicating insufficient funds during the withdrawal, double-check that you have enough available balance in your PayPal account to cover the desired withdrawal amount. If not, consider transferring additional funds to your PayPal account or adjusting the withdrawal amount accordingly.

2. Incorrect Bank Account Information:

If you realize that you have entered incorrect bank account details during the withdrawal process, it’s crucial to take immediate action. Contact PayPal customer support as soon as possible, providing them with the correct information. They will guide you on the necessary steps to rectify the error to ensure the funds are transferred to the correct bank account.

3. Withdrawal Delays or Holds:

In some cases, PayPal may place a withdrawal on hold for security or review purposes. If you experience a withdrawal delay or hold, reach out to PayPal customer support for assistance. They will provide you with an explanation of the hold and guide you through the steps to resolve the issue and proceed with the withdrawal.

4. Bank Account Verification Failure:

If your bank account verification fails during the withdrawal process, ensure that you have entered the correct test deposit amounts provided by PayPal. If you continue to experience issues, double-check that the bank account information entered matches the details on the account. If necessary, contact your bank for assistance in resolving the issue.

5. Reach Out to PayPal Customer Support:

If you encounter any other issues or errors during the withdrawal process that are not addressed above, it’s always advisable to contact PayPal customer support. They have knowledgeable representatives who can assist you in resolving the specific issue and provide guidance based on your unique situation.

Remember to remain patient and proactive when dealing with common issues and errors during the withdrawal process. By promptly addressing the problem and seeking assistance when necessary, you can ensure a smooth and successful transfer of funds from your PayPal account to your bank account.

Transferring Money from PayPal to a Different Currency Bank Account

If you need to transfer money from your PayPal account to a bank account in a different currency, PayPal offers convenient currency conversion services to facilitate the process. With this feature, you can easily convert your funds to the desired currency and transfer them to your foreign bank account.

Here’s what you need to know about transferring money from PayPal to a different currency bank account:

1. Currency Conversion:

When initiating a withdrawal to a different currency bank account, PayPal automatically converts the funds from your PayPal account currency to the currency of your bank account. This ensures that the funds are transferred in the local currency and can be easily used in the receiving country.

2. Exchange Rate:

PayPal applies an exchange rate when converting the funds from one currency to another. The exchange rate used is typically the prevailing market rate at the time of conversion. Keep in mind that PayPal may charge a small fee for the currency conversion, which is usually transparently displayed during the withdrawal process.

3. Estimated Arrival Time:

The estimated arrival time for funds transferred to a different currency bank account may be slightly longer compared to transfers within the same currency. This is due to additional processing required for currency conversion. The exact time may vary depending on the receiving bank and the currency involved.

4. Currency Conversion Options:

If you frequently deal with different currencies, PayPal offers various currency conversion options to cater to your needs. You can choose between PayPal’s default conversion process or opt for other currency conversion providers available through PayPal’s platform. These options allow you to compare exchange rates and select the one that best fits your requirements.

5. Considerations:

Before initiating the transfer, it’s important to consider any potential fees associated with the currency conversion. Familiarize yourself with the applicable exchange rates and be aware of any withdrawal limits that may apply when transferring funds to a different currency bank account.

By utilizing PayPal’s currency conversion services, you can easily transfer money from your PayPal account to a different currency bank account without the need for additional third-party services. This streamlined process enhances convenience and ensures that your funds are available in the desired currency for use in the receiving country.

Ensuring Security and Protecting Your Financial Information

When it comes to transferring money from your PayPal account to a bank account, ensuring the security of your financial information is of utmost importance. PayPal employs several measures to safeguard your account and protect your sensitive data, but there are additional steps you can take to enhance your security:

1. Strong Password and Two-Factor Authentication:

Create a strong, unique password for your PayPal account and enable two-factor authentication. This adds an extra layer of protection by requiring an additional verification step when logging in, further securing your account from unauthorized access.

2. Secure Internet Connection:

Always use a secure internet connection when accessing your PayPal account. Avoid using public or unsecured Wi-Fi networks, as they may pose a higher risk of data interception. Opt for private, password-protected networks to minimize the chances of unauthorized access.

3. Regularly Monitor Account Activity:

Frequently review your PayPal account activity to detect any suspicious or unauthorized transactions. Report any unauthorized activity immediately to PayPal’s customer support for investigation and resolution.

4. Be Wary of Phishing Attempts:

Beware of phishing emails or fraudulent websites that mimic PayPal’s login page or request personal information. PayPal will never ask for sensitive information via email. Always independently type in the PayPal website address or use a trusted bookmark to access your account.

5. Keep Software Updated:

Ensure that your computer or mobile device’s operating system, web browser, and antivirus software are up to date. Regular updates include security patches that protect against known vulnerabilities.

6. Use Secure Banking Networks:

If accessing your bank account online, ensure that the bank’s website uses secure encryption and that you follow their recommended security guidelines. Keep your bank accounts and PayPal account passwords separate to add an extra layer of protection.

7. Monitor and Protect Personal Information:

Never share your PayPal account password or personal information with anyone. PayPal will never ask for your password directly. Be cautious when providing personal information online and only share it on secure, trusted websites.

By implementing these security measures, you can safeguard your PayPal account and protect your financial information. PayPal’s robust security features combined with your proactive approach will help ensure a safe and secure process when transferring funds from your PayPal account to your bank account.