Creating a PayPal Account

PayPal is a widely used online payment platform that allows users to send and receive money securely. If you want to receive money on PayPal, the first step is to create a PayPal account. Follow these simple steps to get started:

- Go to the PayPal website (www.paypal.com) and click on the “Sign Up” button.

- Choose between the two options – “Personal Account” or “Business Account”. For individuals who want to receive money for personal purposes, a personal account is sufficient.

- Fill in the required information, including your email address and a secure password. Make sure to choose a strong password that includes a combination of upper and lowercase letters, numbers, and special characters.

- Provide your personal information, including your name, address, and phone number.

- Agree to the terms and conditions and click on the “Agree and Create Account” button.

- Verify your email address by clicking on the confirmation link sent to your email. This step is crucial to activate your PayPal account.

- Once your email is verified, you can log in to your PayPal account and start customizing your account settings.

Creating a PayPal account is free and can be done in just a few minutes. It’s important to provide accurate information during the registration process to ensure the security and legitimacy of your account.

After creating your PayPal account, you can proceed to the next steps of linking your bank account or credit card to enable receiving money and other features on PayPal.

Linking Your Bank Account or Credit Card to PayPal

Once you have created a PayPal account, the next step is to link your bank account or credit card to enable seamless transactions and receiving money. To link your bank account or credit card to PayPal, follow these steps:

- Log in to your PayPal account using your email address and password.

- Click on the “Wallet” tab at the top of the page.

- Under the “Bank accounts and cards” section, click on the “Link a bank account” or “Link a credit card” option, depending on your preference.

- Provide the required information, including your bank account number, routing number, or credit card details.

- Confirm the linking process by following the verification instructions. In most cases, PayPal will make small deposits to your bank account or initiate a small charge on your credit card that you will need to verify.

- Once the verification process is complete, your bank account or credit card is successfully linked to your PayPal account.

Linking your bank account or credit card to PayPal allows you to withdraw funds, receive money, and make payments seamlessly. It adds an extra layer of convenience and security to your online transactions.

Remember to review and update your account settings regularly to ensure that the linked bank account or credit card information is up to date. This will help prevent any issues when receiving or transferring funds on PayPal.

Verifying Your PayPal Account

Verifying your PayPal account is an important step to increase your account’s security and access certain features. It also builds trust with buyers and sellers when conducting transactions. Follow these steps to verify your PayPal account:

- Log in to your PayPal account using your email address and password.

- Click on the “Settings” icon, usually represented by a gear or a profile picture, located at the top right corner of the page.

- Select “Account Settings” from the drop-down menu.

- In the Account Settings page, click on the “Get Verified” or “Verify Your Account” option.

- Choose the verification method: “Link and Confirm Your Bank Account” or “Confirm Your Credit or Debit Card”.

- If you choose to link and confirm your bank account, enter your bank account details and follow the instructions to complete the verification process. This may involve confirming a small deposit made by PayPal into your bank account.

- If you choose to confirm your credit or debit card, enter your card details and follow the instructions to complete the verification process. This may involve a small charge that you will need to confirm.

- Once the verification process is complete, PayPal will update the status of your account to “Verified”.

Verifying your PayPal account not only enhances security, but it also allows you to lift certain transaction limits that may be imposed on unverified accounts. Additionally, it gives you access to additional PayPal features and ensures a smoother experience when receiving money.

It’s important to note that the specific verification options may vary depending on your country and the requirements of your financial institution. PayPal will guide you through the verification process with clear instructions and prompts at each step.

Setting up a PayPal.me Link for Receiving Money

A PayPal.me link is a personalized URL that allows you to easily receive money from others. By sharing your PayPal.me link, anyone can send you money securely and conveniently. Setting up a PayPal.me link is simple:

- Log in to your PayPal account using your email address and password.

- Click on the “Profile” icon, usually represented by a silhouette or a profile picture, located at the top right corner of the page.

- Under “Profile,” click on the “More Options” button and select “PayPal.me.”

- Click on the “Get Started” button to set up your PayPal.me link.

- Choose a unique username or customize the link with your preferred name or business name. This will be the part of the PayPal.me URL that others will use to send you money, for example, paypal.me/YourName.

- Click on “Next” and review your link. If you’re satisfied, click on the “Create Your Link” button.

- Your PayPal.me link is now created. You can copy the link or share it directly through email, social media, or messaging apps.

When someone clicks on your PayPal.me link, they will be directed to a payment page where they can enter the desired amount and send the payment.

Setting up a PayPal.me link makes it incredibly convenient for others to send you money. It eliminates the need for sharing lengthy account numbers or email addresses, simplifying the payment process for both parties involved.

Remember to keep your PayPal.me link private and only share it with trusted individuals to ensure the security of your transactions.

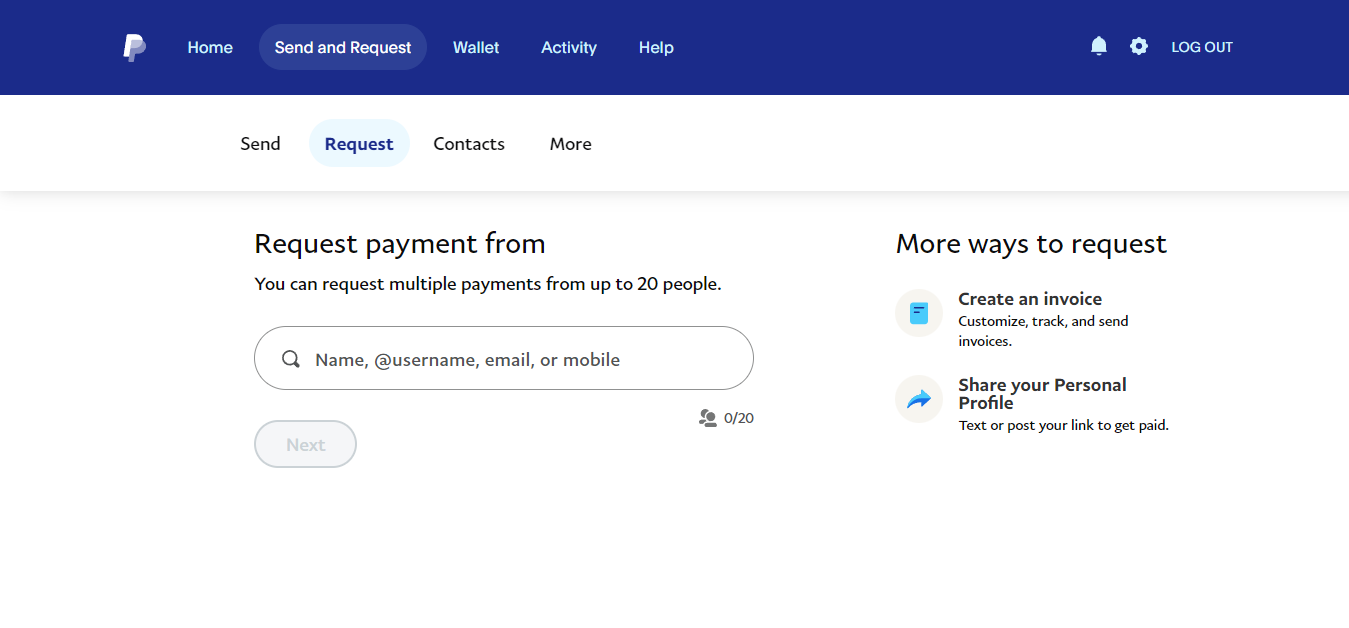

Requesting Money from Someone on PayPal

Requesting money from someone on PayPal is a convenient way to receive payments for goods, services, or shared expenses. Whether you are a freelancer, running a small business, or simply splitting the bill with friends, you can easily request money using PayPal. Here’s how:

- Log in to your PayPal account using your email address and password.

- Click on the “Send & Request” tab at the top of the page.

- Under the “Request” section, click on the “Create a Request” button.

- Enter the email address or mobile number of the person you want to request money from.

- Specify the amount you are requesting and select the currency.

- Add a note to provide details about the transaction, such as the reason for the request or any additional instructions.

- Review the request details and click on the “Request Now” button.

- The request will be sent to the recipient, and they will receive a notification with an option to fulfill the request by sending the requested amount to your PayPal account.

Additionally, you can track and manage your money requests by going to the “Activity” tab in your PayPal account. You can view the status of your requests and send reminders to recipients if needed.

It’s important to communicate clearly and provide accurate information when requesting money on PayPal. Include all relevant details and ensure that the recipient understands the purpose and amount being requested.

By using the “Request Money” feature on PayPal, you can streamline the payment process, reduce the need for manual invoicing, and keep track of your transactions more efficiently.

Receiving Money from an Online Sale or Service

If you sell products or provide services online, PayPal offers a secure and convenient way to receive payments from your customers. Here’s how you can receive money from an online sale or service using PayPal:

- Ensure that you have set up a PayPal account and have linked it to your bank account or credit card, as mentioned before.

- Create a payment link or button for your product or service. PayPal provides various tools and options to generate payment buttons that you can easily integrate into your website or share with customers.

- Add the payment link or button to your website or send it directly to your customers via email, social media, or messaging apps. Include clear instructions on how customers can make the payment using their PayPal accounts.

- When a customer clicks on the payment link or button, they will be directed to a payment page where they can enter the payment amount and complete the transaction using their PayPal accounts.

- After a successful transaction, you will receive a notification from PayPal informing you of the payment received. You can also view the transaction details in your PayPal account’s “Activity” section.

- Once the money is in your PayPal account, you can choose to leave it there for future online purchases or transfer it to your linked bank account for easy access to the funds.

It is important to provide a smooth and secure payment experience for your customers. Ensure that your website and payment process are user-friendly and offer clear instructions. For added security, consider enabling PayPal’s Seller Protection for eligible transactions.

Receiving money from an online sale or service through PayPal offers both peace of mind and convenience. You can easily track your payments, manage your transactions, and make use of PayPal’s additional features to enhance your online business.

Setting up Automatic Payments for Recurring Income

If you receive recurring payments or have regular clients, setting up automatic payments on PayPal can save you time and ensure a consistent flow of income. Here’s how you can set it up:

- Log in to your PayPal account using your email address and password.

- Click on the “Tools” tab at the top of the page and select “Invoicing” from the drop-down menu.

- Create an invoice template by filling in your business details, including your logo, contact information, and payment terms.

- Specify the details of your recurring payments, such as the amount, frequency (monthly, quarterly, annually), and duration.

- Select the option for “Automatic Billing” or “Automatically send invoices.”

- Add your recurring clients’ email addresses and choose the invoice delivery method (email, PayPal message, or both).

- Review the invoice template and automatic payment settings to ensure accuracy.

- Save the settings and activate the automatic payments.

Once the automatic payment settings are activated, PayPal will send out the invoices on the specified frequency to your recurring clients. The clients will receive notification emails with the invoice details, and the payments will be processed automatically based on their preferred payment methods.

Setting up automatic payments not only streamlines your billing process, but it also ensures that you receive regular payments without having to manually send invoices and follow up with clients.

It’s important to keep track of your automatic payments and monitor any changes in client details or payment amounts. PayPal provides tools and reports to help you stay organized and manage your recurring income efficiently.

Remember to communicate with your clients about the automatic payment setup, making sure they are aware of the billing schedule and the amounts they will be charged.

Note that depending on your business needs, you may also consider integrating PayPal’s subscription services or other third-party platforms that offer more advanced recurring payment features.

Transferring Money from PayPal to Your Bank Account

One of the key benefits of using PayPal is the ability to transfer money from your PayPal account to your linked bank account. This allows you to easily access your funds and use them for personal or business purposes. Follow these steps to transfer money from PayPal to your bank account:

- Log in to your PayPal account using your email address and password.

- Click on the “Wallet” tab at the top of the page.

- Under the “Balance” section, click on the “Withdraw Funds” button.

- Choose the bank account you want to transfer the money to from the drop-down menu. Make sure the bank account is linked and verified.

- Enter the amount you wish to transfer. You may have the option to transfer the full balance or specify a specific amount.

- Review the details of the transfer and click on the “Continue” button.

- Confirm the transfer by clicking on the “Transfer” button.

PayPal will process the transfer, and depending on your bank, it may take a few business days for the funds to be available in your bank account.

It’s important to note that PayPal may charge a fee for certain types of transfers. Review the fee structure and any applicable charges before initiating the transfer.

Additionally, PayPal offers the option to set up automatic transfers, allowing you to schedule regular transfers from your PayPal account to your bank account. This can be useful if you have recurring income or need to regularly move funds from your PayPal account to your bank account.

Transferring money from PayPal to your bank account provides flexibility and accessibility for your funds, allowing you to use them for your financial needs. Keep track of your transfers and monitor your bank account for incoming funds to ensure a smooth and accurate transfer process.

Understanding PayPal Fees and Transaction Limits

When using PayPal to receive money, it’s important to have a clear understanding of the fees and transaction limits associated with the platform. By being aware of these details, you can effectively manage your finances and make informed decisions. Here’s what you need to know:

1. Fees: PayPal charges fees based on the type and amount of transactions. For receiving money, the standard fee is typically around 2.9% of the transaction amount, plus a fixed fee. However, the exact fees may vary depending on factors such as the country you reside in and the type of transaction (personal or business). It’s crucial to review PayPal’s fee structure for your specific circumstances to accurately calculate the charges associated with receiving money.

2. Transaction Limits: PayPal has certain transaction limits in place to ensure security and comply with regulatory requirements. These limits may be based on factors such as your account type, verification status, and history of transactions. It’s important to be aware of these limits when receiving money to avoid any disruptions. If you reach your transaction limit, you may need to upgrade your account or contact PayPal for further assistance.

3. Currency Conversion: If you receive money in a different currency than your PayPal account’s currency, PayPal will apply a currency conversion fee. This fee is typically a percentage of the transaction amount, and the exact rate can be found in PayPal’s fee structure. It’s advisable to consider the currency conversion fees when receiving international payments to accurately assess the total amount you will receive.

4. Seller Protection: PayPal offers Seller Protection for eligible transactions, which can provide additional security and peace of mind for receiving payments. It protects sellers against unauthorized payments and certain instances of buyer claims or chargebacks. Review PayPal’s Seller Protection policy to understand the criteria for coverage and any associated requirements or limitations.

It’s important to regularly review PayPal’s fee structure and policy updates, as fees and limits may change over time. Understanding the fees and transaction limits associated with receiving money on PayPal allows you to effectively manage your finances, accurately calculate costs, and make informed decisions related to your financial activities.

Handling Disputes or Issues with Received Money

While PayPal provides a secure platform for receiving money, there may be instances where disputes or issues arise with the received funds. It’s important to know how to handle these situations effectively to protect your interests. Here’s what you can do:

1. Communicate with the Sender: If there is an issue or dispute regarding the received funds, it’s best to reach out to the sender to address the matter directly. Open and clear communication can often help resolve misunderstandings or address any concerns. Explain your perspective and try to find a mutual agreement or solution.

2. Review PayPal’s Seller Protection: PayPal’s Seller Protection may provide coverage for eligible transactions. Familiarize yourself with the criteria and requirements for Seller Protection to determine if your situation qualifies. If applicable, follow the necessary steps to file a claim and provide any required supporting documentation.

3. Respond to PayPal Disputes or Claims: If a dispute or claim is opened by the sender, PayPal will notify you and provide an opportunity to respond. Carefully review the details of the dispute or claim and provide a thorough and accurate response, including any supporting evidence or relevant information. Be prompt in your response to ensure a timely resolution.

4. Seek PayPal’s Customer Support: If the issue cannot be resolved directly with the sender or through the dispute process, contact PayPal’s customer support for assistance. Explain the situation, provide any relevant details, and follow their guidance to address the issue effectively.

5. Consider Professional Advice: In complex or significant cases, it may be beneficial to seek professional advice, such as consulting an attorney or a financial advisor. They can provide guidance tailored to your specific situation and help navigate any legal or financial complexities.

Remember to document all correspondence, transactions, and relevant information related to the dispute or issue. This documentation can serve as evidence or support in case further action is required.

Handling disputes or issues with received money requires patience, clear communication, and a proactive approach. By following these steps and seeking the necessary support, you can protect your rights and work towards a satisfactory resolution.

Tips for Receiving Money Safely and Securely on PayPal

When receiving money on PayPal, it’s crucial to prioritize safety and security. By following these tips, you can ensure a smooth and protected transaction process:

1. Keep Your Account Information Secure: Protect your PayPal account by using a strong, unique password. Enable two-factor authentication for an extra layer of security. Be cautious of phishing emails or suspicious links that could be attempting to gather your account information.

2. Verify Senders: Confirm that the senders are reliable and reputable. Review their profiles, feedback, or ratings if applicable. If the sender is unfamiliar or their request seems suspicious, exercise caution and consider communicating directly with the sender to verify their intentions.

3. Use Verified Accounts: Preferably conduct transactions with verified PayPal accounts as they have gone through additional verification processes. Avoid dealing with unverified or suspicious accounts, especially when large sums of money are involved.

4. Review Payment Details: Double-check the payment details, including the amount and currency, before accepting any payments. Ensure that the payment aligns with your expectations and the terms of the transaction.

5. Secure Communication: When communicating with the sender, use secure channels such as PayPal’s messaging system or verified email addresses. Avoid sharing sensitive information outside of secure platforms.

6. Track and Confirm Transactions: Regularly review your PayPal account activity to ensure all received payments are legitimate. Confirm the funds are successfully transferred into your account and match the expected amount.

7. Regularly Update Account Information: Keep your account information up to date, including your email address, contact number, and linked bank accounts or credit cards. This ensures you receive important notifications and allows for smooth transactions.

8. Monitor Account Security: Stay vigilant for any unauthorized activity or suspicious transactions. Report any potential security breaches or issues to PayPal’s customer support immediately.

9. Read PayPal Policies and Guidelines: Familiarize yourself with PayPal’s policies, terms, and conditions to understand your rights and responsibilities when receiving money. This knowledge helps you make informed decisions and know what to expect throughout the transaction process.

10. Stay Informed: Keep up to date with the latest security practices and recommendations from PayPal regarding receiving money. This ensures you are equipped to protect yourself and adapt to any changes in security protocols.

By implementing these tips, you can enhance the safety and security of your PayPal transactions when receiving money. Always prioritize caution, trust your instincts, and report any concerns or incidents to PayPal’s customer support for further assistance.

Best Practices for Managing and Tracking Incoming Funds on PayPal

Effectively managing and tracking incoming funds on PayPal is essential for maintaining financial transparency and organization. Implementing the following best practices will help you stay on top of your finances:

1. Create a dedicated business account: If you use PayPal for business purposes, create a separate business account. This allows you to keep personal and business finances separate, making it easier to manage and track incoming funds specifically related to your business.

2. Keep transaction records: Maintain a record of all incoming transactions. PayPal provides detailed transaction history, which you can download and store for future reference or accounting purposes. Keep track of payment dates, amounts, and any relevant details and reconcile them with your own records regularly.

3. Utilize labels or tags: Use labels or tags to categorize incoming funds based on their sources or purposes. For example, create labels for different clients, products, or services. This helps you quickly identify and analyze incoming funds for specific projects or business activities.

4. Set up notifications: Enable email or mobile notifications for incoming payments. This allows you to stay informed about any funds received and take immediate action if necessary. Timely notifications also enable you to maintain good communication with your clients or customers regarding their transactions.

5. Monitor payment statuses: PayPal provides payment status updates, such as “Pending” or “Completed.” Regularly review payment statuses to ensure funds are successfully processed and transferred into your PayPal account. Follow up on any pending payments or discrepancies to prevent potential delays or issues.

6. Regularly reconcile with your bank account: If you transfer funds from your PayPal account to your linked bank account, regularly reconcile these transfers with your bank statements. This helps you track the flow of funds between PayPal and your bank account and ensures accurate financial reporting.

7. Generate reports: PayPal offers reporting features that allow you to generate detailed reports of your incoming funds, including sales summaries and transaction summaries. Use these reports to gain insights into your revenue streams, identify trends, and analyze your business performance.

8. Automate where possible: Set up automated processes, such as recurring invoices, automatic transfers to your bank account, or integration with accounting software. This reduces manual efforts and improves efficiency in managing and tracking incoming funds on PayPal.

9. Regularly review and update your account settings: Stay updated with the latest account features and options available on PayPal. Periodically review your account settings to ensure they align with your current business requirements and preferences for managing incoming funds.

10. Educate yourself: Continuously educate yourself about PayPal’s features, policies, and best practices for managing finances. Stay informed about any updates or changes to PayPal’s services that may impact how you manage and track incoming funds.

By implementing these best practices, you can effectively manage and track incoming funds on PayPal, ensuring accurate financial reporting, and maintaining control over your finances.