Why Use a Digital Wallet?

In today’s fast-paced digital world, convenience and efficiency are essential. This is where digital wallets come into play. A digital wallet, also known as a mobile wallet or e-wallet, is a secure virtual platform that allows you to store and manage your payment information digitally. Instead of carrying around a physical wallet loaded with numerous credit and debit cards, you can now simply use your smartphone or smartwatch to make payments with just a few taps.

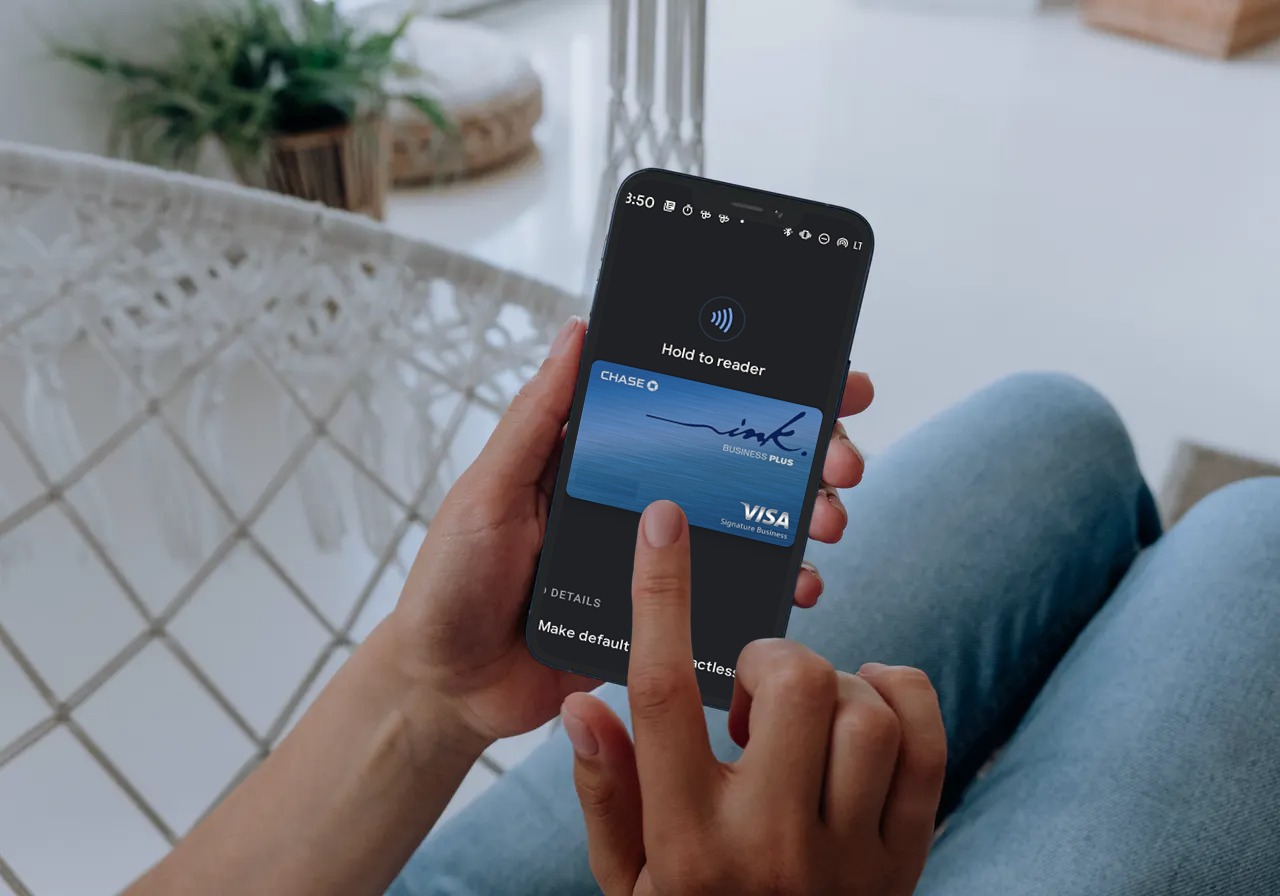

One of the main reasons to use a digital wallet is the hassle-free and contactless payment experience it offers. Instead of fumbling for cash or swiping your card, a digital wallet allows you to make payments by simply tapping your device on a contactless payment terminal. This not only eliminates the need for physical contact, but it also speeds up the checkout process, making it more convenient for both customers and businesses.

Another advantage of using a digital wallet is the added layer of security. When you add your payment cards to a digital wallet, the actual card information is not shared during transactions. Instead, a unique token is created, adding an extra level of protection against fraud and identity theft. Additionally, most digital wallet platforms offer features like fingerprint or face recognition, PIN codes, and biometric authentication, ensuring that only authorized users can access and use the wallet.

Furthermore, digital wallets often offer enhanced features and functionalities compared to traditional payment methods. Many wallets allow you to store not only credit and debit cards but also loyalty cards, gift cards, boarding passes, event tickets, and even identification cards. This eliminates the need to carry a bulky wallet filled with various cards and documents, making it more convenient and organized.

Lastly, using a digital wallet can also provide you with access to exclusive discounts, rewards, and cashback offers. Some digital wallet providers collaborate with merchants to offer special deals and promotions to their users. By taking advantage of these offers, you can save money and earn rewards on your purchases, making the digital wallet experience even more beneficial.

Overview of Chase Cards

Chase, one of the leading financial institutions in the United States, offers a wide range of credit and debit cards to suit various consumer needs. Whether you’re looking for a cashback card, travel rewards card, or a card with low-interest rates, Chase has options to cater to different preferences.

Chase credit cards are known for their generous rewards programs, offering opportunities to earn cashback, points, or miles on eligible purchases. Some popular Chase credit cards include the Chase Freedom Unlimited®, Chase Sapphire Preferred®, and Chase Freedom Flex℠. These cards provide benefits such as no annual fees, bonus sign-up offers, and flexible redemption options.

In addition to credit cards, Chase also offers debit cards that can be linked to your checking account. Chase debit cards provide convenient access to your funds, allowing you to make purchases or withdraw cash from ATMs.

One of the advantages of using Chase cards is the seamless integration with digital wallets. Chase has made sure that its cards are compatible with popular mobile payment platforms, such as Apple Pay, Google Pay, Samsung Pay, and more. This enables Chase cardholders to enjoy all the benefits of using a digital wallet while managing their finances with Chase.

Chase cards also come with built-in security features to protect against unauthorized use. With real-time fraud monitoring, zero liability protection, and chip technology, Chase ensures that your transactions are safe and secure.

Furthermore, Chase provides a user-friendly online portal and mobile app that allows you to manage your cards, track your spending, and set up alerts for account activity. This seamless digital experience makes it easy to track and control your expenses, providing you with peace of mind.

What is a Digital Wallet?

A digital wallet, also known as a mobile wallet or e-wallet, is a virtual platform that allows you to securely store and manage your payment information on your smartphone, smartwatch, or other digital devices. It’s a convenient way to make contactless payments, track transactions, and manage different payment methods in one place.

At its core, a digital wallet functions as a digital representation of your physical wallet. Instead of carrying multiple credit cards, debit cards, and loyalty cards, you can store all that information digitally on your device.

When it comes to making a payment using a digital wallet, you simply need to unlock your device, open the wallet app, and select the card you want to use. Depending on the digital wallet platform, you can make payments in-store by tapping your device on a contactless payment terminal or online by choosing the digital wallet as your payment option during checkout.

It’s important to note that the information stored in a digital wallet is encrypted and protected by various security measures. This means that your payment details stay secure even if your device is lost or stolen. Most digital wallet providers also offer additional security features like fingerprint or face recognition, PIN codes, and two-factor authentication to ensure that only authorized users can access the wallet.

Not only can you store payment cards in a digital wallet, but some platforms also allow you to store other important documents such as ID cards, boarding passes, loyalty cards, and even event tickets. This makes it even more convenient as you can access these items with just a few taps on your device, eliminating the need to carry physical copies.

Furthermore, digital wallets can offer integration with budgeting and financial management tools, allowing you to track your expenses, set spending limits, and receive transaction alerts. This level of financial control and visibility can help you make better-informed decisions about your money and manage your finances more effectively.

Supported Digital Wallets for Chase Cards

Chase cards are compatible with various popular digital wallet platforms, providing cardholders with a wide range of options for making mobile payments securely and conveniently. Let’s explore the supported digital wallets for Chase cards:

- Apple Pay: Apple Pay is a widely used digital wallet that allows users to make payments using their iPhone, Apple Watch, iPad, or Mac devices. To add a Chase card to Apple Pay, simply open the Wallet app on your device, tap the “+” button, and follow the instructions to add your Chase card.

- Google Pay: Google Pay is a mobile wallet developed by Google for Android devices. To add a Chase card to Google Pay, download the Google Pay app from the Google Play Store, open the app, tap the “+ Payment method” button, and follow the prompts to add your Chase card.

- Samsung Pay: Samsung Pay is a digital wallet available on Samsung Galaxy smartphones and smartwatches. To add a Chase card to Samsung Pay, open the Samsung Pay app, tap the “+” button, and follow the on-screen instructions to add your Chase card.

- PayPal: PayPal is a widely recognized digital wallet that allows users to make secure online payments. To add a Chase card to PayPal, log in to your PayPal account, go to “Wallet,” click on “Link a card or bank,” and enter your Chase card details.

- Venmo: Venmo, owned by PayPal, is a mobile payment platform that allows users to send and receive money. To add a Chase card to Venmo, open the Venmo app, tap the “☰” icon, select “Settings,” choose “Payment Methods,” and follow the prompts to add your Chase card.

- Other Digital Wallets: Chase cards are also supported by other digital wallets such as Garmin Pay, Fitbit Pay, and more. Check with the specific digital wallet provider for instructions on how to add your Chase card.

By utilizing these supported digital wallet platforms, Chase cardholders can enjoy the convenience and security of making contactless payments, while also gaining access to additional features and benefits offered by these digital wallet providers.

Adding a Chase Card to Apple Pay

Apple Pay is a popular digital wallet that allows iPhone, Apple Watch, iPad, and Mac users to make secure and convenient payments with ease. Adding a Chase card to Apple Pay is a straightforward process that can be done in just a few simple steps:

- Open the Wallet app on your device. If you cannot find the app, check if it is hidden in a folder or search for it using Spotlight.

- Tap the “+” button, which is usually located at the top-right corner of the screen.

- You will be prompted to position your Chase card within the frame on the screen so that the card information can be captured. You can align your card manually or choose the option to enter the card details manually.

- Once your card details are captured, follow the on-screen instructions to verify your identity. This may involve receiving a verification code via email or SMS.

- Agree to any terms and conditions or additional security prompts that may appear during the setup process.

- After completing the setup, you will see your Chase card displayed in the Wallet app.

Once your Chase card is added to Apple Pay, you can start using it for contactless payments at participating merchants and within supported apps and websites. Simply place your device near a contactless payment terminal and authenticate using Face ID, Touch ID, or your passcode. You can also use Apple Pay to make online purchases on apps and websites that display the Apple Pay logo.

It’s important to note that in some cases, you may need to contact Chase or use the Chase mobile app to verify your card before it can be added to Apple Pay. If you encounter any issues during the setup process, it is recommended to reach out to Chase customer support for assistance.

Adding your Chase card to Apple Pay not only offers convenience and ease of use, but it also enhances the security of your transactions. Apple Pay utilizes tokenization, which means that your actual card number is not shared during a transaction. Instead, a unique and encrypted code, called a token, is used to authorize the payment, adding an extra layer of protection against fraud.

Adding a Chase Card to Google Pay

Google Pay is a widely used digital wallet that allows Android device users to make secure and convenient payments. Adding your Chase card to Google Pay is a simple process that can be completed in just a few easy steps:

- Download the Google Pay app from the Google Play Store if it is not already installed on your device.

- Open the Google Pay app and tap the “+” button to add a payment method.

- Choose “+ Credit or debit card” as the payment method you want to add.

- Position your Chase card within the frame on the screen so that the card information can be captured. You can also manually enter your card details if necessary.

- Follow the on-screen instructions to verify your identity. This may involve receiving a verification code via email or SMS.

- Agree to any terms and conditions or additional security prompts that may appear during the setup process.

- Once you have successfully added your Chase card to Google Pay, you will see it displayed in the Google Pay app.

After adding your Chase card to Google Pay, you can start using it for contactless payments at participating merchants. Simply unlock your device, hold it near a contactless payment terminal, and authenticate the payment using your device’s security method, such as a fingerprint, PIN, or pattern scan.

In addition to in-store payments, Google Pay also allows you to make online purchases within supported apps and websites. When checking out, select Google Pay as your payment method and follow the prompts to complete the transaction.

Adding your Chase card to Google Pay offers a secure way to make payments. With Google Pay, your actual card number is not shared with merchants during transactions. Instead, a virtual account number, known as a token, is used, providing an added layer of security.

Should you encounter any difficulties during the setup process, it is advisable to contact Chase customer support or refer to the Google Pay help center for further assistance. Adding your Chase card to Google Pay not only enhances convenience but also ensures that you can enjoy the benefits of a digital wallet when using your Android device for payments.

Adding a Chase Card to Samsung Pay

Samsung Pay is a popular digital wallet that allows Samsung Galaxy smartphone and smartwatch users to make secure and convenient payments. Adding your Chase card to Samsung Pay is a quick and easy process that can be done in a few simple steps:

- Open the Samsung Pay app on your Samsung device. If it is not pre-installed, you can download it from the Galaxy Store.

- Tap the “+” button, usually found at the top-right corner of the screen, to add a new card.

- Position your Chase card within the frame on the screen so that the card information can be captured. You can also choose to enter the card details manually.

- If necessary, enter the required card details, such as the card number, expiration date, and CVV code.

- Follow the on-screen instructions to verify your card. This may involve receiving a verification code via email or SMS.

- Agree to any terms and conditions or additional security prompts that may appear during the setup process.

- Once your Chase card is successfully added to Samsung Pay, it will be displayed in the app.

Once your Chase card is added to Samsung Pay, you can use it to make contactless payments at supported merchants by simply holding your Samsung device near a payment terminal. The payment can be authorized using your device’s security method, such as a fingerprint, PIN, or iris scan.

Samsung Pay also allows you to make payments within supported apps and websites by selecting Samsung Pay as the payment method during checkout.

When it comes to security, Samsung Pay uses multiple layers of protection to ensure the safety of your transactions. It employs tokenization, which means that your actual card details are not shared during the payment process. Instead, a unique token is generated and used to authorize the payment, preventing your card information from being compromised.

If you encounter any issues during the setup process or have questions, you can reach out to Chase customer support or refer to the Samsung Pay support resources for assistance. Adding your Chase card to Samsung Pay offers the convenience of making secure payments with just a tap of your Samsung device, allowing you to enjoy the benefits of a digital wallet.

Adding a Chase Card to PayPal

PayPal is a widely recognized digital wallet that offers a secure way to make online payments. If you have a Chase card and want to add it to your PayPal account, follow these simple steps:

- Log in to your PayPal account either through the PayPal website or the PayPal mobile app.

- Once logged in, navigate to the “Wallet” section of your account. This is where you can manage your payment methods.

- Select the option to “Link a card or bank” to add a new payment method.

- Choose the “Card” option to add your Chase card.

- Enter the required card details including the card number, expiration date, and CVV code.

- Complete any additional prompts or security verifications that PayPal may require to verify your card.

- Once your Chase card is successfully added, PayPal will typically provide a confirmation message, and you will be able to see your Chase card listed in your wallet.

Once your Chase card is added to PayPal, you can use it to make online purchases on websites that accept PayPal as a payment method. During the checkout process, simply select PayPal as your payment option and choose your Chase card as the funding source.

Adding your Chase card to PayPal offers several advantages. It allows you to consolidate your payment methods into one convenient platform, making it easier to keep track of your transactions. Additionally, PayPal provides buyer protection and adheres to strict security measures, ensuring that your card details are safeguarded during transactions.

If you encounter any issues while adding your Chase card to PayPal, it’s recommended to contact PayPal customer support for assistance. They can guide you through the process and help resolve any problems you may encounter.

By adding your Chase card to PayPal, you can enjoy the ease and security of making online payments, expanding your options for convenient and hassle-free shopping experiences.

Adding a Chase Card to Venmo

Venmo is a popular mobile payment platform that allows users to send and receive money conveniently. If you have a Chase card and want to add it to your Venmo account, you can do so by following these steps:

- Open the Venmo app on your mobile device. If you don’t have the app, you can download it from the App Store or Google Play Store.

- Tap the “☰” icon to access the main menu.

- From the menu, select “Settings.”

- In the Settings menu, choose “Payment Methods.”

- Select the option to “Add a bank or card.”

- Choose “Card” as the payment method you want to add.

- Enter the required card details, including the card number, expiration date, and CVV code.

- Follow any additional prompts or security verifications Venmo may require to link your Chase card.

- Once your Chase card is successfully linked, it will be listed as a payment method in your Venmo account.

After adding your Chase card to Venmo, you can use it to make payments to friends, split bills, and even make purchases at participating merchants.

Venmo provides a convenient and secure way to transact with your Chase card. When making a payment, you can select your Chase card as the funding source and authorize the transaction. Venmo also offers additional security features such as PIN codes, fingerprint recognition, and two-factor authentication to ensure that your account and transactions are protected.

If you experience any difficulties or have questions while adding your Chase card to Venmo, it is recommended to contact Venmo customer support for assistance. They can provide guidance and help troubleshoot any issues you may encounter during the process.

By adding your Chase card to Venmo, you gain the flexibility to send and receive money conveniently and securely, expanding the usability of your Chase card beyond traditional payment methods.

Adding a Chase Card to Other Digital Wallets

In addition to popular digital wallets like Apple Pay, Google Pay, Samsung Pay, and PayPal, Chase cards can also be added to other digital wallet platforms, expanding your options for making secure and convenient mobile payments. Here are some steps to add your Chase card to other digital wallets:

- Garmin Pay: If you own a Garmin smartwatch, you can add your Chase card to Garmin Pay by navigating to the Garmin Connect app on your smartphone. From there, access the Wallet section and follow the prompts to add your Chase card.

- Fitbit Pay: Fitbit users can add their Chase card to Fitbit Pay by opening the Fitbit app on their smartphone. Navigate to the Wallet section, select the “+” button, and follow the instructions to add your Chase card.

- Other Digital Wallets: Depending on your region and available digital wallet options, there may be other digital wallet platforms that support Chase cards. Check with your preferred digital wallet provider for specific instructions on adding a Chase card to their platform.

The process of adding a Chase card to these digital wallets may vary slightly from platform to platform, but generally, you will need to provide your Chase card details and follow the on-screen instructions to complete the setup process.

Once your Chase card is added to these digital wallet platforms, you can use your compatible device or wearable to make contactless payments at supported merchants. Simply follow the instructions provided by the specific digital wallet for making payments using your Chase card.

Adding your Chase card to these alternative digital wallets offers the convenience of contactless payments and the security of tokenization, ensuring the protection of your card information during transactions.

If you encounter any difficulties while adding your Chase card to other digital wallets, it is advisable to refer to the support resources provided by the specific digital wallet platform or contact their customer support for further assistance.

By adding your Chase card to various digital wallets, you can enjoy the flexibility of making mobile payments and expand your options for accessing and managing your Chase card digitally.

Troubleshooting Tips for Adding a Chase Card to a Digital Wallet

While adding a Chase card to a digital wallet is typically a straightforward process, you may encounter some issues along the way. Here are some troubleshooting tips to help you overcome common challenges:

- Verify card eligibility: Ensure that your Chase card is compatible with the digital wallet you are trying to add it to. Not all Chase cards may be supported by every digital wallet platform.

- Update your device: Make sure that your mobile device’s operating system is up to date. Outdated software can sometimes cause compatibility issues with digital wallet apps.

- Double-check card details: Ensure that you enter the correct card information, including the card number, expiration date, and CVV code. Mistyped or inaccurate details can prevent successful card addition.

- Check connectivity: Make sure your device is connected to a reliable internet connection, as network issues can interfere with the card addition process.

- Clear app cache: If you are experiencing issues with a specific digital wallet app, try clearing the app’s cache in your device settings to refresh it.

- Contact customer support: If you have followed all the necessary steps and are still unable to add your Chase card, reach out to the customer support of the digital wallet platform or Chase for assistance. They can provide further guidance and help troubleshoot the issue.

- Consider alternative digital wallets: If you are having persistent issues with adding your Chase card to a specific digital wallet, consider trying an alternative digital wallet that supports Chase cards. There may be other options available that provide a seamless card addition experience.

It’s important to note that each digital wallet platform may have its own specific troubleshooting methods. Therefore, it is advisable to refer to the support resources provided by the digital wallet platform or contact their customer support for further assistance tailored to their platform.

By utilizing these troubleshooting tips, you can address common challenges and successfully add your Chase card to a digital wallet, enabling you to enjoy the convenience and benefits of mobile payments.

Benefits of Using a Chase Card with a Digital Wallet

Using a Chase card with a digital wallet offers numerous benefits that enhance your payment experience and provide added convenience and security. Here are some key advantages:

- Contactless payments: With a digital wallet, you can make contactless payments by simply tapping or waving your smartphone, smartwatch, or other compatible device near a contactless payment terminal. This eliminates the need for physical contact with cards or cash, providing a hygienic and convenient payment method.

- Convenience and ease of use: By adding your Chase card to a digital wallet, you no longer need to carry multiple physical cards. Instead, you can access and manage your payment information digitally in one place. This makes it easier to make payments on the go without the hassle of searching for your wallet or specific cards.

- Enhanced security: Digital wallets utilize advanced security features to protect your payment information. When you add your Chase card to a digital wallet, your actual card details are not shared during transactions. Instead, a unique token is used, providing an extra layer of protection against fraud and reducing the risk of your card information being compromised.

- Rewards and discounts: Many digital wallet platforms offer exclusive rewards, cashback, or discounts for using their service. By utilizing your Chase card with a digital wallet, you may have access to these special offers, allowing you to earn rewards or save money on your purchases.

- Easy budget tracking: Digital wallets often provide features that help you track your spending. You can view transaction history, set spending limits, receive alerts for account activity, and gain better insights into your spending habits. This can help you manage your finances more effectively and stay on top of your budget.

- Access to additional features: Some digital wallets offer additional functionalities beyond payment capabilities. This may include storing loyalty cards, gift cards, boarding passes, event tickets, and even identification cards. Having all these items conveniently accessible on your digital wallet app further reduces the need to carry physical cards and documents.

By utilizing a Chase card with a digital wallet, you can enjoy the benefits of contactless and secure payments, convenient management of your payment information, and access to exclusive rewards and features. Explore the digital wallet options available, choose the one that suits your needs, and experience the enhanced payment experience that a digital wallet provides.

Security Considerations for Using a Digital Wallet

While using a digital wallet offers convenience and ease of use, it’s essential to consider the security aspects to protect your financial information. Here are some key security considerations when using a digital wallet:

- Tokenization: Digital wallets use a technology called tokenization to protect your payment information. When you add your payment cards to a digital wallet, the actual card details are replaced with a unique token. This ensures that your sensitive card information is not stored or transmitted during transactions, reducing the risk of it being compromised.

- Authentication methods: Digital wallets require authentication before making a payment. This can include using biometric authentication methods such as fingerprint or face recognition, or a PIN code. These additional layers of authentication help ensure that only authorized users can access and use the digital wallet.

- Device security: It’s crucial to keep your device secure. Set a strong lock screen PIN or password to prevent unauthorized access. Keep your device’s operating system and apps updated to ensure you have the latest security patches and enhancements.

- Secure network: When making payments with a digital wallet, use a secure and trusted network. Avoid using public Wi-Fi or networks that may be susceptible to hacking or eavesdropping. Stick to secure Wi-Fi networks or use your mobile data connection for secure transactions.

- Monitor transaction activity: Regularly review your transaction history and account statements to identify any unauthorized or suspicious activity. Many digital wallet apps provide transaction notifications and alerts that can help you stay informed about your payment activity.

- Take care when using shared devices: If you’re using a shared device, be cautious when accessing your digital wallet. Always log out or lock your digital wallet app when you’re finished to prevent unauthorized access to your payment information.

- Report any issues promptly: If you suspect any fraudulent activity or encounter any problems with your digital wallet, such as unauthorized transactions or lost/stolen device, report it to your digital wallet provider and your card issuer immediately. They can take the necessary steps to protect your account and help resolve any issues.

By following these security considerations, you can use a digital wallet confidently and minimize the risks associated with unauthorized access or fraudulent activities. It’s important to remain vigilant and take necessary precautions to protect your financial information when using a digital wallet.