What is NFC?

Near Field Communication (NFC) is a short-range wireless technology that enables devices to communicate with each other when they are brought into close proximity, typically within a few centimeters. NFC has gained popularity for its convenience and security in various applications, including contactless payments, access control, and data exchange.

NFC operates at 13.56 megahertz and allows for two-way communication between devices, making it ideal for secure transactions. It is widely used in modern smartphones, payment cards, and other compatible devices, offering a seamless and efficient way to transfer data and complete transactions with just a simple tap or wave.

One of the key features of NFC is its ability to facilitate contactless transactions, making it an integral part of mobile payment systems. By leveraging NFC technology, users can make secure and convenient payments without the need to physically swipe a card or enter a PIN. This streamlined process has revolutionized the way people conduct transactions, offering a faster and more user-friendly alternative to traditional payment methods.

NFC technology has also extended beyond payments, enabling users to share information, connect devices, and access digital content with ease. Its versatility and reliability have positioned NFC as a leading solution for bridging the gap between the physical and digital worlds, creating a seamless and interconnected experience for users across various applications.

How does PayPal work with NFC?

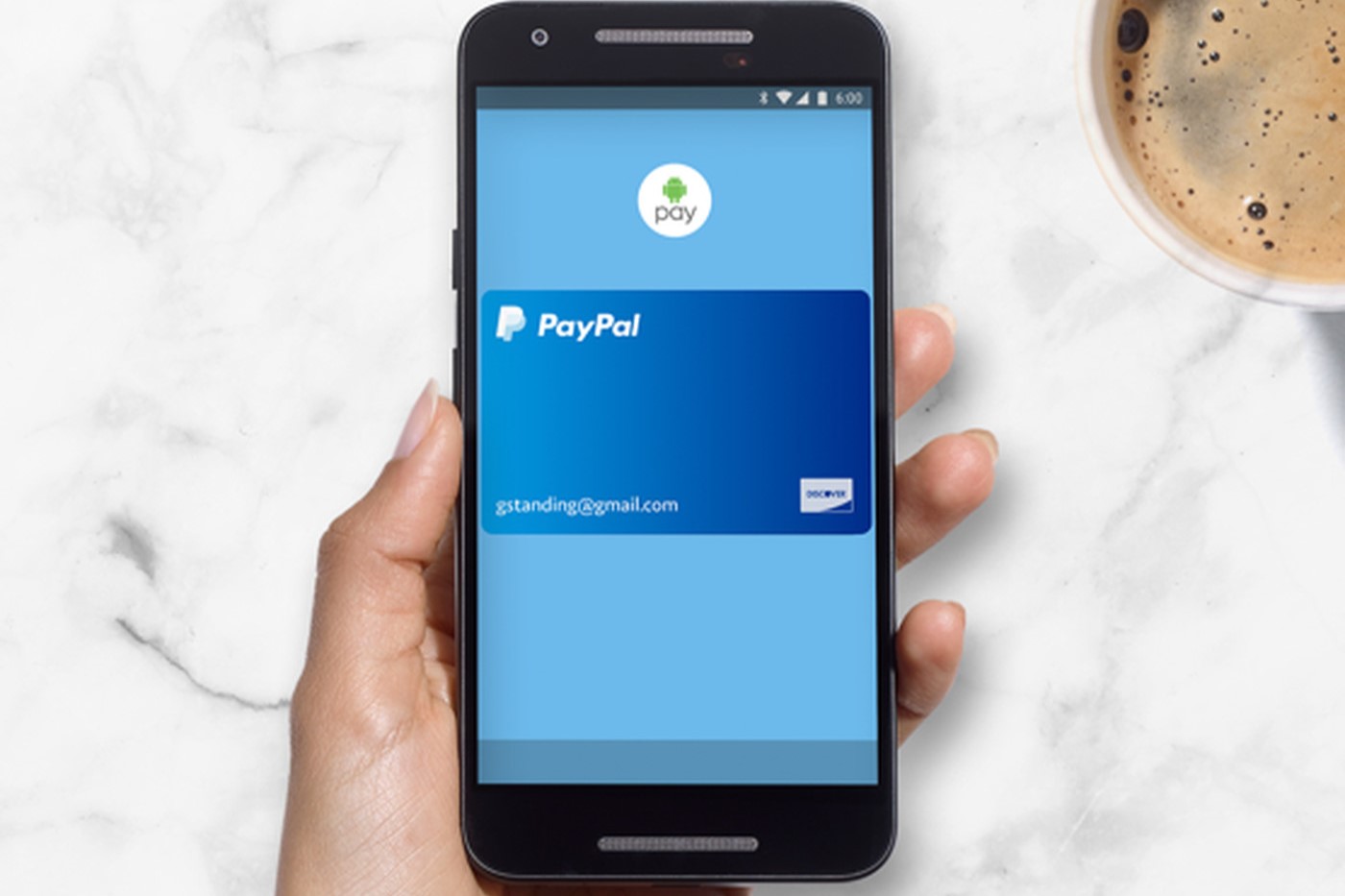

PayPal, a widely-used digital payment platform, has integrated NFC technology to offer users a seamless and secure way to make contactless payments. By leveraging the capabilities of NFC-enabled devices, PayPal allows users to link their accounts to their smartphones or smartwatches, enabling them to conduct transactions with a simple tap or wave.

When a user adds their PayPal account to a compatible NFC-enabled device, such as a smartphone, the device becomes a digital wallet, capable of securely storing payment information and facilitating contactless transactions. This integration empowers users to make purchases at NFC-enabled point-of-sale terminals by tapping their devices, eliminating the need for physical cards or cash.

PayPal’s integration with NFC technology extends beyond traditional point-of-sale transactions. Users can also utilize their NFC-enabled devices to send and receive peer-to-peer payments through PayPal’s platform. This functionality enhances the versatility of PayPal’s services, allowing users to conveniently transfer funds to family and friends or split bills with ease.

Furthermore, PayPal’s compatibility with NFC technology extends to online and in-app purchases. Through the use of NFC-enabled devices, users can securely authorize payments within supported apps and websites, streamlining the checkout process and enhancing the overall user experience.

Overall, PayPal’s seamless integration with NFC technology empowers users to embrace the convenience of contactless payments across a wide range of transactions, from in-store purchases to peer-to-peer transfers and online shopping.

Setting up PayPal with NFC

Setting up PayPal to work with NFC technology is a straightforward process that enables users to enjoy the convenience of contactless payments. To begin, users need to ensure that their smartphone or smartwatch is equipped with NFC capabilities and that the device is compatible with PayPal’s NFC functionality.

The first step involves linking the user’s PayPal account to their NFC-enabled device. This typically requires downloading the PayPal mobile app and following the prompts to add a payment method, which may include linking a bank account, debit card, or credit card to the PayPal account. Once the payment method is added, users can proceed to enable the NFC functionality within the app.

After the PayPal account is successfully linked and the NFC feature is activated, users can proceed to set up their device for contactless payments. This may involve configuring the device’s settings to ensure that NFC is enabled and that the device is ready to communicate with NFC-enabled terminals. Additionally, users may need to set a default payment method within the PayPal app to streamline the transaction process.

Once the setup is complete, users can test the functionality of PayPal with NFC by approaching an NFC-enabled point-of-sale terminal and tapping their device to initiate a payment. If the transaction is successful, users can proceed to enjoy the convenience of contactless payments across a variety of retail locations and businesses that support NFC technology.

It is important for users to familiarize themselves with the specific features and capabilities of PayPal’s NFC integration, as well as any security measures that may be in place to safeguard their transactions. Additionally, users should stay informed about any updates or enhancements to PayPal’s NFC functionality to ensure that they are leveraging the latest features for a seamless payment experience.

Making Secure Payments with PayPal and NFC

When utilizing PayPal with NFC for contactless payments, users benefit from a secure and efficient transaction process that prioritizes the protection of their financial information. The integration of NFC technology with PayPal’s robust security features ensures that users can make payments with confidence, knowing that their sensitive data is safeguarded throughout the transaction.

One of the key security measures employed in contactless payments with PayPal and NFC is tokenization. This process involves replacing sensitive card information with a unique token, which is transmitted during the transaction instead of the actual card details. By utilizing tokenization, PayPal enhances the security of NFC transactions, reducing the risk of unauthorized access to users’ payment information.

Additionally, PayPal’s implementation of encryption protocols further fortifies the security of NFC-enabled transactions. Data transmitted between the user’s device and the NFC terminal is encrypted, preventing unauthorized interception and ensuring that sensitive information remains protected throughout the payment process.

Moreover, PayPal’s robust fraud detection and prevention measures extend to NFC transactions, providing users with an additional layer of security. The platform’s advanced algorithms and monitoring systems continuously analyze transaction patterns and detect any suspicious activity, allowing PayPal to proactively address potential security threats and safeguard users from fraudulent transactions.

Furthermore, PayPal offers users the flexibility to set up additional security features, such as biometric authentication or PIN verification, to further enhance the protection of their NFC-enabled payments. These authentication methods add an extra layer of security, ensuring that only authorized users can initiate and authorize contactless transactions using PayPal and NFC.

Overall, the combination of PayPal’s robust security infrastructure and the inherent security features of NFC technology empowers users to make secure and convenient payments with peace of mind. By leveraging these protective measures, users can confidently embrace the benefits of contactless payments while minimizing the risk of unauthorized access to their financial data.

Benefits of Using PayPal with NFC

Utilizing PayPal in conjunction with NFC technology offers users a host of compelling benefits, enhancing the overall convenience, security, and versatility of digital payments. The seamless integration of PayPal with NFC-enabled devices unlocks a range of advantages that elevate the payment experience for users across various contexts.

- Convenience: By leveraging PayPal with NFC, users can enjoy the convenience of swift and hassle-free transactions. The ability to simply tap or wave a compatible device to complete a payment streamlines the checkout process, minimizing the need to handle physical cards or cash. This convenience is particularly valuable in high-traffic retail environments and during peak shopping periods.

- Enhanced Security: The combination of PayPal’s robust security measures and the inherent security features of NFC technology ensures that users can make payments with confidence. Tokenization, encryption protocols, and advanced fraud detection mechanisms bolster the security of NFC transactions, reducing the risk of unauthorized access to sensitive payment information.

- Versatility: PayPal’s compatibility with NFC technology extends beyond traditional point-of-sale transactions, encompassing peer-to-peer payments and online purchases. This versatility empowers users to leverage NFC-enabled devices for a wide range of transactions, from splitting bills with friends to securely authorizing payments within supported apps and websites.

- Seamless Integration: The integration of PayPal with NFC technology offers a seamless and intuitive payment experience. Users can easily link their PayPal accounts to their NFC-enabled devices and set up their preferred payment methods, ensuring a smooth transition to contactless payments across a variety of retail locations and businesses that support NFC technology.

- Efficiency: The speed and efficiency of NFC transactions contribute to a more streamlined payment process. With reduced wait times at checkout and the elimination of physical card swiping or PIN entry, PayPal with NFC enables users to complete transactions swiftly, enhancing the overall efficiency of the payment experience.

Overall, the combination of PayPal’s versatile digital payment platform and the seamless integration with NFC technology presents users with a compelling array of benefits, ranging from enhanced convenience and security to expanded transaction versatility and operational efficiency.

Tips for Using PayPal with NFC Safely

While PayPal’s integration with NFC technology offers a secure and convenient payment solution, it is essential for users to adopt best practices to ensure the safe and responsible use of contactless payments. By adhering to the following tips, users can maximize the security of their transactions and mitigate potential risks associated with utilizing PayPal with NFC.

- Enable Two-Factor Authentication: To enhance the security of PayPal transactions, users should consider enabling two-factor authentication (2FA) for their PayPal accounts. By requiring a secondary form of verification, such as a unique code sent to a mobile device, 2FA adds an extra layer of protection against unauthorized access to the account.

- Regularly Monitor Account Activity: Users are encouraged to actively monitor their PayPal account activity, reviewing transaction history and statements regularly. Promptly reporting any unauthorized or suspicious transactions to PayPal can help mitigate potential financial impacts and safeguard the account from fraudulent activity.

- Protect Device Security: It is crucial to maintain the security of the NFC-enabled device used for contactless payments. This includes implementing strong device passcodes or biometric authentication, keeping the device’s software up to date, and utilizing security features such as remote locking or wiping in the event of loss or theft.

- Avoid Public Wi-Fi for Sensitive Transactions: When initiating NFC transactions via PayPal, users should refrain from conducting sensitive transactions over public Wi-Fi networks. Utilizing secure and trusted networks helps minimize the risk of unauthorized interception of data during the transaction process.

- Be Mindful of Device Placement: When tapping an NFC-enabled device for a payment, users should be mindful of their surroundings to prevent unauthorized attempts to intercept the transaction. Keeping the device in a secure location, such as a wallet or designated pocket, can help minimize the risk of unintended or unauthorized transactions.

- Stay Informed About Security Updates: Remaining informed about security updates and best practices for utilizing PayPal with NFC is essential for maintaining a secure payment experience. Users should stay attuned to any security-related communications from PayPal and proactively implement recommended security measures.

By incorporating these tips into their usage of PayPal with NFC, users can bolster the security of their contactless payments and navigate the digital payment landscape with heightened confidence and awareness.