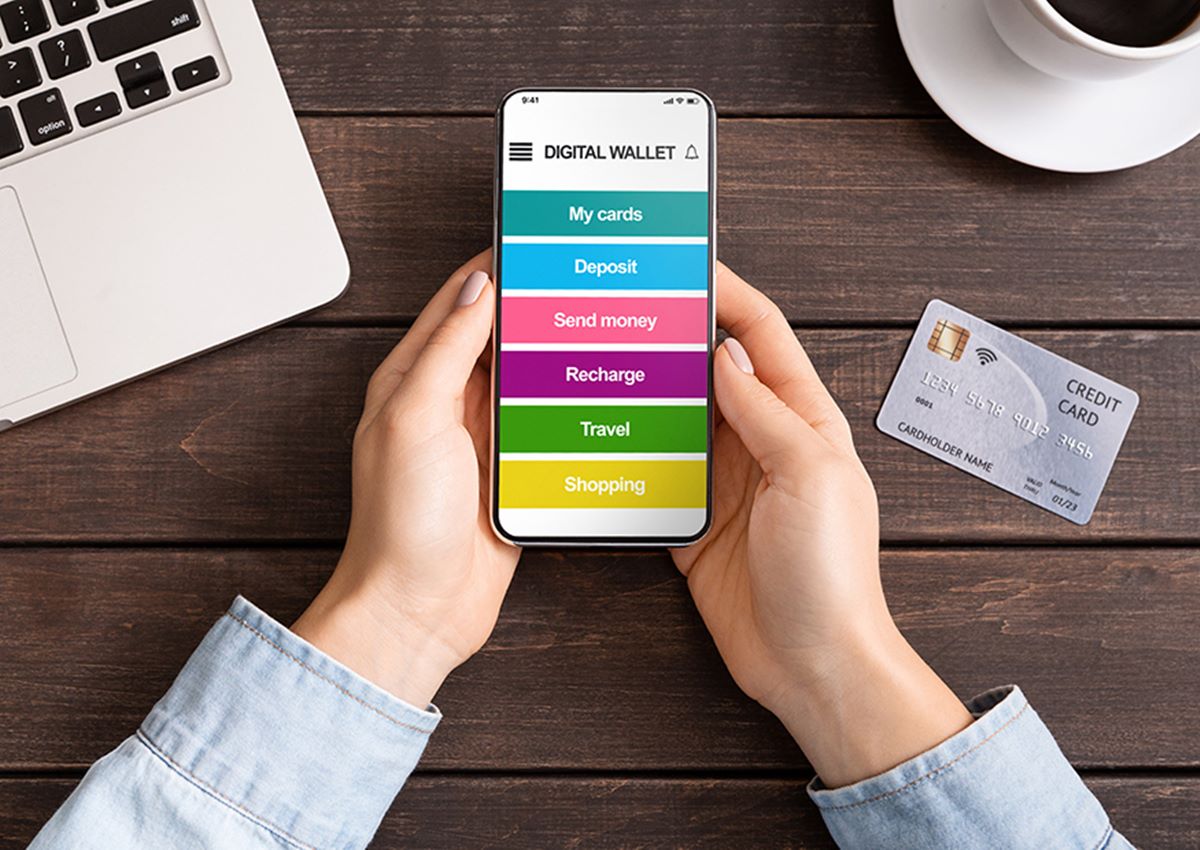

Why You Need a Digital Wallet

With the rapid advancement of technology, the traditional ways of carrying cash and making payments are becoming outdated. This is where a digital wallet comes in handy. A digital wallet, also known as an e-wallet or mobile wallet, is a virtual storage space that allows you to securely store your payment information and make transactions online or through your mobile device. There are several compelling reasons why you should consider using a digital wallet:

- Convenience: One of the main advantages of having a digital wallet is the convenience it offers. Instead of carrying around a bulky wallet with physical cash or multiple cards, you can easily store and access all your payment information in one place, right from your smartphone or computer. This eliminates the need to dig through your bag or wallet to find the right card or count your cash.

- Security: Digital wallets provide a secure way to make payments. Unlike traditional payment methods where you may be at risk of losing your cash or having your card information stolen, digital wallets use encryption and tokenization techniques to ensure that your transactions are secure. Additionally, most digital wallet providers offer additional layers of security, such as two-factor authentication and biometric authentication, to protect your account from unauthorized access.

- Speed: Making payments with a digital wallet is generally faster than traditional methods. With a few taps on your device, you can complete a transaction within seconds. This is especially useful for online shopping or when you’re in a rush to make a payment, such as at a crowded store or during peak hours.

- Rewards and Discounts: Many digital wallet providers offer rewards and discounts to their users. By linking your loyalty cards or utilizing special offers, you can earn cashback, loyalty points, or exclusive discounts on your purchases. This can lead to significant savings over time.

- Accessibility: A digital wallet allows you to access your funds anytime, anywhere, as long as you have an internet connection. This means you can make payments even when you’re traveling, during non-business hours, or in situations where you may not have access to physical cash or a card reader.

Choosing the Right Digital Wallet

When it comes to choosing a digital wallet, there are several factors that you should consider to ensure you find the one that best suits your needs. Here are some key points to keep in mind:

- Compatibility: Make sure the digital wallet you choose is compatible with your device and operating system. Most digital wallets are available for both iOS and Android, but it’s always a good idea to double-check.

- Security: Look for a digital wallet that prioritizes security. Ensure that the provider uses strong encryption and robust security measures to protect your payment information. Check if the wallet offers features like two-factor authentication or biometric authentication for added security.

- User-Friendly Interface: The user interface of the digital wallet should be intuitive and easy to navigate. Look for a wallet with a clean design, clear instructions, and a smooth user experience to ensure that managing your transactions is hassle-free.

- Supported Payment Methods: Check if the digital wallet supports your preferred payment methods. Whether it’s credit cards, debit cards, bank transfers, or digital currencies, make sure the wallet has the options you need to easily add funds and make payments.

- Merchant Acceptance: Consider the number of merchants and online platforms that accept the digital wallet. The wider the acceptance, the more versatile and convenient your digital wallet will be for making purchases.

- Customer Support: Look for a digital wallet that offers reliable customer support. In case you encounter any issues or have questions, it’s important to have access to timely assistance and reliable support channels.

- Reviews and Ratings: Take the time to read reviews and ratings of different digital wallet providers. This will give you insights into the experiences of other users and help you make an informed decision.

By considering these factors, you can choose a digital wallet that aligns with your preferences and needs. Remember, it’s essential to do your research and compare different options before finalizing your decision.

Downloading and Installing the Digital Wallet App

To start using a digital wallet, you’ll first need to download and install the corresponding app onto your smartphone or tablet. Follow these simple steps to get started:

- Go to your device’s app store. If you’re using an iOS device, head to the App Store. For Android users, go to the Google Play Store.

- Search for the digital wallet app you want to use. You can either type in the name of the specific digital wallet or search for terms like “digital wallet,” “mobile wallet,” or “e-wallet” to browse through different options.

- Once you’ve found the app you want to download, tap the “Install” or “Get” button (depending on your device). The app will start downloading and installing automatically.

- After the installation is complete, you’ll find the digital wallet app on your device’s home screen or in the app drawer.

- Tap on the digital wallet app icon to launch it. You may be prompted to create a new account or sign in if you already have an existing account.

It’s important to note that some digital wallet apps may require additional permissions to function properly, such as access to your device’s camera for scanning QR codes. Make sure to review these permissions and grant them if you’re comfortable doing so.

If you encounter any issues during the download or installation process, check your internet connection, ensure that your device meets the app’s system requirements, and try reinstalling the app if necessary.

Once you have successfully downloaded and installed the digital wallet app, you can proceed to create a new account and start setting up your digital wallet to make secure and convenient payments.

Creating a New Account

After downloading and installing the digital wallet app, the next step is to create a new account. Follow these steps to set up your digital wallet:

- Launch the digital wallet app on your device.

- On the app’s main screen, look for a “Sign Up” or “Create Account” button and tap on it.

- You’ll be presented with a registration form. Fill in the required information, such as your name, email address, and password. Make sure to create a strong and unique password to protect your account.

- Some digital wallet apps may require you to verify your email or phone number. Follow the instructions provided to complete the verification process.

- Once your account is successfully created and verified, you may be prompted to set up additional security measures, such as enabling two-factor authentication. It’s highly recommended to enable any additional security features provided by the digital wallet app to further safeguard your account.

- Read and accept the terms and conditions or user agreement, if prompted. It’s important to familiarize yourself with the terms and policies of the digital wallet app.

- After completing the account setup process, you’ll be logged in to your new digital wallet account.

Remember to keep your login credentials secure and avoid sharing them with anyone. If you ever forget your password, most digital wallet apps have a password recovery option that allows you to reset your password through an email link or a verification code.

Now that you have successfully created your digital wallet account, you can proceed to add funds to your wallet, link your bank account or credit card, and explore the various features and functionalities of your chosen digital wallet.

Verifying Your Identity

In order to ensure the security and legitimacy of transactions, many digital wallet providers require users to verify their identity. This process helps in preventing fraud, money laundering, and other illegal activities. Here’s what you need to know about verifying your identity:

1. Required Information: Digital wallet apps typically ask for personal information such as your full name, date of birth, residential address, and sometimes your social security number or passport information. This information is used to verify your identity and comply with regulatory requirements.

2. Document Submission: Depending on the level of verification required, you may be asked to submit identification documents. This can include a scanned copy or photo of your government-issued ID, passport, driver’s license, or utility bills to verify your address.

3. Upload Process: Digital wallet apps usually have a dedicated section within the app where you can upload your identification documents. The app will guide you through the process, providing instructions on how to capture a clear photo or scan of your documents.

4. Verification Time: The time it takes to verify your identity can vary depending on the volume of verifications being processed by the digital wallet provider. In some cases, it can take a few minutes, while in others it may take a few business days. During this period, you may have limited access to certain features of the digital wallet.

5. Privacy and Security: It is important to choose a reputable digital wallet provider that has stringent privacy and security measures in place to protect your personal information. Look for providers that adhere to strict data protection regulations and encryption standards.

Verifying your identity is a crucial step to ensure the security of your digital wallet account and transactions. It helps in maintaining the integrity of the platform and provides an additional layer of protection for both you and the digital wallet provider.

Once your identity has been successfully verified, you can proceed with confidence in using your digital wallet for various transactions, such as adding funds, making payments, and sending or receiving money securely.

Adding Funds to Your Digital Wallet

Once you have set up your digital wallet and verified your identity, the next step is to add funds to your wallet. Here’s how you can do it:

1. Link a Bank Account or Credit Card: Most digital wallet apps allow you to link your bank account or credit card to add funds. Navigate to the “Settings” or “Profile” section of the app and look for the option to add a payment method. Follow the prompts to securely link your preferred payment method to your wallet.

2. Direct Deposit: Some digital wallet providers offer the option of direct deposit, allowing you to transfer funds from your bank account directly to your digital wallet. Look for the option to set up direct deposit in the app or on the provider’s website. Follow the instructions to complete the setup and initiate the transfer of funds.

3. Scan QR Code: In certain cases, you may come across merchants or individuals who accept payments via a QR code. To add funds to your digital wallet using a QR code, navigate to the “Add Funds” or “Top Up” section of your wallet app and select the option to scan a QR code. Scan the QR code provided by the merchant or individual, enter the desired amount, and confirm the transaction.

4. Receive Funds: If you’re expecting someone to send you funds, provide them with your digital wallet’s unique identifier, such as your wallet address or registered phone number or email. Once the sender initiates the transfer, the funds will be deposited into your digital wallet. You may receive a notification or see the transaction reflected in your wallet’s transaction history.

5. In-App Purchases: Some digital wallets allow you to make purchases directly within the app. This is especially common for digital wallets that offer a wide range of services or have partnerships with merchants. Look for the “Shop” or “Buy” section within your digital wallet app to explore available products or services for purchase.

When adding funds to your digital wallet, it’s important to be aware of any fees or transaction limits that may apply. Some providers may charge a small fee for certain types of transactions or impose limits on the amount you can add at once. Familiarize yourself with the terms and conditions of your digital wallet to ensure a smooth and hassle-free experience.

By adding funds to your digital wallet, you’ll have the necessary resources to make quick and convenient payments wherever the digital wallet is accepted.

Linking Your Bank Account or Credit Card

Linking your bank account or credit card to your digital wallet is an essential step that allows you to seamlessly add funds and make transactions. Here’s how you can link your bank account or credit card:

1. Open your digital wallet app and navigate to the “Settings” or “Profile” section.

2. Look for the option to link a payment method, which may be labeled as “Link Bank Account,” “Link Credit Card,” or similar.

3. Select the type of payment method you want to link, bank account or credit card.

4. Follow the prompts to enter the required information. This typically includes providing your account or card details, such as the account number, routing number, or card number, as well as the card’s expiration date and security code.

5. Once you’ve entered the necessary information, review it carefully to ensure accuracy. A small error in the details can cause issues with linking your account or card.

6. In some cases, the digital wallet app may initiate a verification process to confirm ownership of the linked account or card. This may involve a small authorization charge or a temporary hold on your account, which is refunded or released once the verification is complete.

7. After successfully linking your bank account or credit card, you will typically see a confirmation message or a notification indicating that the process was successful. You can then proceed to add funds to your digital wallet or make transactions using the linked payment method.

It’s important to keep in mind that the availability of linking options may vary depending on your region and the digital wallet provider. Some providers may also have specific requirements or restrictions when it comes to linking payment methods.

Ensure that you are linking a bank account or credit card that belongs to you and that you have ownership or authorized access to. Linking unauthorized or third-party accounts may violate the terms of service and result in account suspension or closure.

By linking your bank account or credit card, you’ll have the convenience of easily adding funds to your digital wallet and making seamless transactions whenever you need to.

Setting Up Two-Factor Authentication

Two-factor authentication (2FA) is an additional layer of security that provides an extra level of protection for your digital wallet. By enabling 2FA, you add an extra step to the login process, making it more difficult for unauthorized individuals to access your account. Here’s how you can set up 2FA:

1. Open your digital wallet app and navigate to the “Settings” or “Security” section.

2. Look for the option to enable two-factor authentication or 2FA. It may be labeled as “Security Settings,” “Two-Step Verification,” or similar.

3. Select the 2FA method you prefer. Some common methods include:

- SMS Authentication: This method involves receiving a verification code via SMS to your registered phone number. Enter the code into the app to complete the authentication process.

- Authenticator App: Download and install a trusted authenticator app, such as Google Authenticator or Authy, on your smartphone. Follow the prompts to scan the QR code displayed in the digital wallet app and set up the app as your authenticator. The authenticator app will generate time-based verification codes that you will need to enter during the login process.

- Biometric Authentication: If your device supports it, you can enable biometric authentication, such as fingerprint or facial recognition, as a form of 2FA. This adds an extra layer of security by requiring a biometric scan in addition to your regular login credentials.

4. Follow the setup instructions provided by your digital wallet app or authenticator app to complete the configuration process for 2FA.

5. Once 2FA is enabled, you will be prompted to provide the second factor, such as the generated verification code or biometric scan, during the login process. This ensures that even if someone obtains your login credentials, they would still need the additional factor to gain access to your account.

Enabling 2FA adds an extra layer of security to your digital wallet account by requiring both something you know (your password) and something you have (your phone or biometric authentication) to log in successfully. It significantly reduces the risk of unauthorized access even if your password is compromised.

Make sure to keep your registered phone number or biometric information secure and up to date, as they are crucial for the 2FA process. Regularly review and update your 2FA settings to ensure the highest level of security for your digital wallet.

By setting up two-factor authentication, you can enhance the overall security of your digital wallet and have peace of mind knowing that your account is protected from unauthorized access.

Exploring Additional Security Features

In addition to two-factor authentication, many digital wallet apps offer a range of additional security features to further protect your account and transactions. Here are some common security features worth exploring:

- Biometric Authentication: Some digital wallet apps support biometric authentication, such as fingerprint or facial recognition. Enabling this feature adds an extra layer of security by requiring a unique biological characteristic to access your account.

- Device Authorization: Digital wallet apps may provide the option to authorize specific devices for access. By linking your account to trusted devices, you can prevent unauthorized access from unrecognized devices.

- Transaction Notifications: Opt to receive real-time notifications for all transactions made with your digital wallet. These notifications can help you identify and report any unauthorized or suspicious activities promptly.

- Account Activity Monitoring: Some digital wallet apps allow you to monitor the activity history of your account. Regularly review your transaction history and account details to quickly spot any unusual behavior or unauthorized transactions.

- Remote Device Wiping: In the event that your smartphone or device is lost or stolen, certain digital wallet apps offer remote wiping features. This allows you to erase all the stored data on your lost device, including your digital wallet information.

- Additional Authentication Methods: Consider enabling other authentication methods, such as a PIN or pattern lock, to secure your digital wallet app itself. This adds an extra layer of protection in case your device is unlocked or falls into the wrong hands.

- Auto-Lock and Timeout: Ensure that your digital wallet app has an auto-lock feature that locks the app after a certain period of inactivity. This prevents unauthorized access if you accidentally leave your app open or your device unattended.

- Secure Password Management: Use unique and strong passwords for your digital wallet account. Consider using a reputable password manager to generate and store your passwords securely.

- Security Alerts and Updates: Stay informed about any security alerts or updates from your digital wallet provider. Keep your app up to date to benefit from the latest security patches and enhancements.

It’s important to explore and understand the available security features within your chosen digital wallet app. By taking advantage of these features, you can significantly reduce the risk of unauthorized access, identity theft, or fraudulent activities associated with your digital wallet account.

Always prioritize your account’s security and regularly review and update your settings to stay protected in the ever-evolving digital landscape.

Understanding Transaction Limits and Fees

As you use your digital wallet for various transactions, it’s important to have a clear understanding of the transaction limits and fees associated with your account. Here’s what you need to know:

Transaction Limits: Digital wallets often have transaction limits in place to ensure the security and integrity of the platform. These limits can vary depending on factors such as your account status, verification level, and the type of transaction. Common types of transaction limits include daily, weekly, or monthly limits on the amount of money you can send, receive, or withdraw from your digital wallet.

Make sure to familiarize yourself with the transaction limits set by your digital wallet provider. These limits may be adjustable based on your usage and can often be increased by submitting additional verification documents or by contacting customer support.

Transaction Fees: Depending on the digital wallet provider and specific transactions you perform, there may be fees associated with certain actions. These fees can include charges for adding funds to your wallet, sending money to other individuals or merchants, or converting between different currencies.

Review the fee structure provided by your digital wallet app to understand the specific charges that may apply to your transactions. It’s important to note that fee structures can vary, so be sure to compare the fees across different digital wallet providers if you have multiple options available to you.

Keep in mind that fees can also be influenced by factors such as the payment method used, geographical location, and the recipient’s country or region. Always check the latest fee information and be aware of any changes or updates to the fee structure.

Fee Avoidance: Some digital wallet providers offer fee avoidance strategies, such as lower fees for certain types of transactions or fee waivers for specific account levels or usage thresholds. Familiarize yourself with these options to maximize the value of your digital wallet and minimize fees whenever possible.

Understanding transaction limits and fees associated with your digital wallet is essential for managing your finances effectively. By staying informed about these details, you can plan and execute your transactions in a way that suits your needs and minimizes any associated costs.

If you have any questions or concerns about the transaction limits or fees, reach out to the customer support provided by your digital wallet app for clarification and assistance.

Sending and Receiving Money with Your Digital Wallet

One of the primary purposes of a digital wallet is to facilitate seamless and convenient money transfers. Whether you need to send funds to family or friends, make a purchase from an online store, or receive payments from clients or customers, your digital wallet allows you to do so with ease. Here’s how you can send and receive money using your digital wallet:

Sending Money:

- Launch your digital wallet app and ensure that you have sufficient funds available or a linked payment method from which you can send money.

- Look for the “Send Money” or “Make a Payment” option within the app.

- Select the recipient of the funds by entering their email address, phone number, or wallet address. Some digital wallet apps also allow you to scan a QR code for quick recipient identification.

- Enter the amount you wish to send and review the transaction details to ensure accuracy.

- Review any applicable fees or transaction limits that may be associated with the transfer.

- Confirm the transaction and verify any additional security factors, such as entering a verification code or using biometric authentication.

- Once the transaction is confirmed, the funds will be transferred to the recipient’s digital wallet. The recipient will usually receive a notification of the incoming funds.

Receiving Money:

- Provide the sender with your digital wallet identifier, such as your wallet address, registered email address, or phone number.

- Wait for the sender to initiate the transfer from their digital wallet app.

- Once the sender confirms the transaction, you will receive the funds in your digital wallet. You may receive a notification or see the transaction reflected in your wallet’s transaction history.

It’s important to ensure the accuracy of the recipient’s information when sending money, as transactions made to the wrong recipient cannot be reversed. Double-check the recipient’s details before confirming the transfer.

Remember that some transactions may be subject to transaction fees or limitations, depending on your digital wallet provider and the specific transaction type. Be mindful of these fees and limits to avoid any unexpected charges or restrictions.

Whether you’re sending money to friends, family, or business associates, or receiving payments for products or services, utilizing your digital wallet for money transfers provides a secure and convenient way to manage your finances.

Making Mobile Payments

One of the key features of a digital wallet is the ability to make mobile payments, allowing you to conveniently and securely make purchases in various settings. Here’s how you can utilize your digital wallet for making mobile payments:

1. In-Store Purchases:

Many digital wallet apps offer contactless payment options, allowing you to make purchases directly at participating physical stores. To make an in-store payment:

- Ensure that the store’s payment terminal supports contactless payments.

- Unlock your smartphone and open your digital wallet app.

- Select the payment method you want to use, such as a linked credit card or a specific payment balance within your wallet.

- Hold your smartphone near the payment terminal or tap it against the contactless reader, depending on the specific technology used.

- Wait for the transaction to be processed and approved. You may be prompted to verify the payment using biometric authentication or by entering a PIN.

- Once the payment is successful, you’ll receive a confirmation message or receipt, both on your smartphone and from the store.

2. Online Shopping:

When shopping online, you can use your digital wallet to make secure and convenient payments. Here’s how:

- Add items to your online shopping cart as usual.

- During the checkout process, look for the digital wallet payment option, such as “Pay with [Digital Wallet Name].” Select it.

- You’ll be redirected to your digital wallet app or asked to authenticate the payment using biometric authentication.

- Review the transaction details and confirm the payment.

- Once the payment is authorized, you’ll receive a confirmation message from both the digital wallet app and the online merchant.

3. Peer-to-Peer (P2P) Payments:

Your digital wallet enables you to make peer-to-peer payments to friends, family, or colleagues with ease. Here’s how:

- Open your digital wallet app and navigate to the P2P payment section.

- Select the recipient by their username, phone number, email, or by scanning their QR code.

- Enter the amount you wish to send and review the transaction details.

- Confirm the payment and provide any additional security verification if required.

- After confirming the payment, the recipient will receive the funds directly into their digital wallet.

Be mindful of any transaction fees or limits that may apply to mobile payments. Some digital wallet providers may charge nominal fees for certain types of transactions or impose limits on the amount you can spend in a single transaction or within a specific timeframe.

Making mobile payments with your digital wallet offers convenience, security, and flexibility, whether you’re shopping in-store, online, or sending money to friends or family. Remember to keep your digital wallet app updated, review your transaction history regularly, and stay alert for any suspicious activities to ensure a safe and seamless mobile payment experience.

Managing Your Digital Wallet

Effective management of your digital wallet is essential for maintaining security, organizing your finances, and maximizing the utility of your wallet. Here are some key aspects to consider when managing your digital wallet:

1. Updating Your Profile Information:

Keep your profile information up to date. This includes your name, contact details, and any other relevant information required by the digital wallet provider. Regularly review and update your profile to ensure the accuracy of your personal information.

2. Monitoring Your Transactions:

Regularly review your transaction history within your digital wallet app. This allows you to keep track of your spending, verify the accuracy of transactions, and quickly identify any unauthorized activity.

3. Adding or Withdrawing Funds:

Manage your funds by adding or withdrawing money from your digital wallet as needed. Be conscious of any fees or transaction limits that may apply to such actions, and ensure you have an appropriate balance for your intended usage.

4. Linking and Managing Payment Methods:

Ensure that your linked payment methods, such as bank accounts or credit cards, are up to date. Manage them within your digital wallet app, adding or removing accounts as necessary, to ensure smooth and secure financial transactions.

5. Setting Budgets and Spending Limits:

Consider setting budgets or spending limits within your digital wallet app. This can help you track and control your expenses, ensuring that you don’t overspend or exceed your financial limits.

6. Updating Security Settings:

Regularly review and update your security settings within your digital wallet app. This includes enabling two-factor authentication, reviewing authorized devices, and adjusting privacy preferences to ensure the highest level of account security.

7. Keeping Your App Updated:

Ensure that your digital wallet app is always up to date. App updates often contain important security fixes, feature enhancements, and bug fixes. Keeping your app updated helps to maintain the stability and security of your digital wallet.

8. Contacting Customer Support:

If you encounter any issues, have questions, or need assistance, reach out to the customer support provided by your digital wallet app. They can help address any concerns or provide guidance on managing your wallet effectively.

By effectively managing your digital wallet, you can ensure a smooth and secure experience while maximizing the benefits and features of your chosen wallet. Stay organized, stay informed, and take advantage of the tools and resources available to you through your digital wallet app.

Updating Your Profile Information

Updating your profile information is an important aspect of managing your digital wallet. By keeping your profile information accurate and up to date, you can ensure smooth transactions, maintain account security, and receive relevant notifications. Here’s what you need to know about updating your profile:

1. Personal Details:

Start by reviewing and updating your personal details within your digital wallet app. This includes your full name, date of birth, and contact information such as your phone number and email address. Make sure that this information is current and accurate to ensure seamless communication and verification.

2. Address and Location:

Check if your digital wallet app requires you to provide your residential address or location. If so, update this information whenever there are changes, such as moving to a new address. Accurate address information is important for proper verification and can be useful for certain transactions or features within the app.

3. Communication Preferences:

Take the time to review and update your communication preferences within the digital wallet app. You may have options to choose how you want to receive notifications, alerts, and promotional communications. Select the appropriate settings that align with your preferences and ensure that you receive important information in a timely manner.

4. Identification Documents:

In some cases, your digital wallet app may require you to provide identification documents to verify your identity. This can include documents such as a passport, driver’s license, or national ID card. If your app allows you to upload or update identification documents, make sure to provide accurate and up-to-date information as required.

5. Security Questions and Answers:

Check if your digital wallet app allows you to set up security questions and answers. These questions serve as an additional layer of protection for account recovery or access in case you forget your login credentials. Ensure that your security questions are meaningful and set up answers that you can remember easily.

6. Privacy Settings:

Explore the privacy settings available in your digital wallet app. Depending on the app, you may have options to control the visibility of your personal information to other users or manage data sharing preferences. Review these settings and adjust them based on your comfort level and privacy preferences.

7. Regular Updates:

Make it a habit to periodically review and update your profile information within your digital wallet app. Changes such as a new email address, updated contact number, or change in residence should be promptly reflected in your profile. Keeping this information current ensures that you can be reached when needed and that your account remains secure.

Remember to exercise caution when updating your profile and ensure that you are using a secure internet connection and trusted devices. Take the time to review the changes you’ve made before saving them to avoid any errors or discrepancies.

By regularly updating your profile information, you can ensure that your digital wallet account remains accurate, secure, and up to date. It allows for smooth transactions, enhances account security, and ensures that you receive relevant communications and notifications from your digital wallet provider.

Troubleshooting Common Issues

While using a digital wallet can bring convenience and efficiency to your financial transactions, you may encounter some common issues along the way. Understanding how to troubleshoot these issues can help you resolve them quickly and get back to using your digital wallet smoothly. Here are some common issues you may encounter and potential solutions:

1. Login Problems:

If you’re having trouble logging into your digital wallet app, double-check that you’re entering the correct login credentials. Ensure that your internet connection is stable and try restarting the app or your device. If the issue persists, use the app’s password recovery or account recovery options, which may involve email verification or answering security questions, to regain access to your account.

2. Payment Failures:

If a payment you’re making with your digital wallet fails, make sure you have sufficient funds in your wallet or that your linked payment method has enough available credit. Verify that you’ve entered the correct payment details, such as the recipient’s information or payment amount. If the problem continues, contact customer support for assistance, as it could be related to technical issues or security checks.

3. Currency Conversion:

When making payments in a foreign currency, ensure that your digital wallet supports the currency you need. Check that your account has sufficient funds in the required currency or link a payment method that supports currency conversion. If you encounter issues with currency conversion rates or discrepancies, consult your digital wallet app’s support documentation or contact customer support for guidance.

4. Slow or Unresponsive App:

If your digital wallet app is running slowly or becoming unresponsive, check for any available app updates and install them. Close any unnecessary background apps or processes that might be affecting performance. Clear the cache and data of your app or try reinstalling it if the problem persists. Restarting your device can also resolve temporary glitches that may be impacting the app’s performance.

5. Unauthorized Transactions:

If you notice any unauthorized transactions on your digital wallet account, contact your digital wallet provider immediately. Report the issue and provide any relevant details, such as transaction timestamps and amounts. They will guide you through the necessary steps to resolve the issue, which may include freezing your account, investigating the transactions, and reversing any unauthorized charges.

6. Customer Support Assistance:

If you’re facing any other technical issues or challenges with your digital wallet app, reach out to the customer support provided by your digital wallet provider. They are equipped to assist with a wide range of issues, provide troubleshooting guidance, and address any concerns you may have. Refer to the app or the provider’s website for contact information or access to online support channels.

Remember to keep your digital wallet app updated with the latest version, maintain a secure and stable internet connection, and follow best practices for password security and device protection to minimize the occurrence of common issues. Taking a proactive approach to troubleshooting and reaching out to customer support when needed can help ensure a smooth and hassle-free experience with your digital wallet app.

Keeping Your Digital Wallet Secure

When it comes to using a digital wallet, prioritizing security is essential to protect your financial information and transactions. Here are important measures you can take to keep your digital wallet secure:

1. Strong and Unique Password:

Create a strong, unique password for your digital wallet account. Use a combination of alphanumeric characters, symbols, and a mix of upper and lowercase letters. Avoid using easily guessable passwords or reusing passwords from other accounts to prevent unauthorized access.

2. Enable Two-factor Authentication (2FA):

Enable two-factor authentication (2FA) in your digital wallet app. This provides an extra layer of security, requiring an additional verification step, such as a code sent to your registered phone number or a biometric scan, to log in to your account. 2FA significantly reduces the risk of unauthorized access even if your password is compromised.

3. Keep Your App Updated:

Regularly update your digital wallet app to the latest version. App updates often include crucial security patches, bug fixes, and new features that enhance the overall security of the app. Set your app to automatically update whenever possible.

4. Be Cautious of Phishing Attempts:

Be vigilant against phishing attempts. Avoid clicking on suspicious links or downloading attachments from unknown sources. Legitimate digital wallet providers will never ask for your password or sensitive information via email or other communication channels. When in doubt, go directly to the official app or website to log in or contact customer support.

5. Secure Your Device:

Ensure the security of the device you use for your digital wallet. Set up a secure lock screen with a PIN, password, fingerprint, or facial recognition. Install reputable security software and keep it up to date. Avoid downloading apps or files from untrusted sources that may contain malware or spyware.

6. Be Mindful of Public Wi-Fi:

Avoid conducting sensitive transactions or accessing your digital wallet app on public Wi-Fi networks. Public networks can be insecure and susceptible to hacking. Use a secure and private network or a trusted VPN (Virtual Private Network) to protect your data and transactions.

7. Regularly Review Transactions:

Monitor and review your digital wallet transactions regularly. Check for any unauthorized or suspicious activities. If you notice any discrepancies, contact your digital wallet provider immediately and report the issue.

8. Safeguard Personal Information:

Be cautious with your personal information. Avoid sharing sensitive details, such as your digital wallet login credentials or account information, with anyone. Keep your wallet address, phone number, and email address private to prevent unauthorized access or phishing attempts.

By following these security practices, you can significantly reduce the risk of unauthorized access, fraudulent activities, and financial loss. Remember, proactive security measures and staying informed about the latest threats are crucial for keeping your digital wallet and financial transactions secure.