What is the Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) is a financial metric used to assess the profitability of an investment or project. It represents the annualized rate of return at which the net present value (NPV) of the cash flows of the investment becomes zero.

IRR takes into account the time value of money, which means that it considers the fact that a dollar received in the future is worth less than a dollar received today due to inflation and the potential return that could be earned by investing that dollar elsewhere.

Essentially, IRR helps investors evaluate the attractiveness of an investment by calculating the rate at which their initial investment will grow over time. It allows them to compare different investment opportunities and determine which one has the highest potential for generating positive returns.

IRR is commonly used in various financial scenarios, such as capital budgeting, project evaluation, and investment analysis. It provides a clear measure of the profitability and efficiency of an investment, making it a valuable tool for decision-making.

It’s important to note that IRR is expressed as a percentage and represents an annualized return. A higher IRR indicates a more favorable investment opportunity, while a lower IRR may indicate a less attractive or riskier investment.

Why is IRR important?

The Internal Rate of Return (IRR) is an important metric in financial analysis and decision-making for several reasons.

Firstly, IRR allows investors to assess the potential profitability of an investment by calculating the rate at which their initial investment will grow over time. This helps them compare different investment opportunities and select the most attractive ones based on their return expectations.

Secondly, IRR takes into account the time value of money, providing a more accurate assessment of an investment’s profitability. By considering the future value of cash flows and discounting them back to their present value, IRR enables investors to evaluate the true worth of an investment.

Furthermore, IRR helps investors understand the risks associated with an investment. A higher IRR often indicates a higher return potential but may also reflect higher risks. By analyzing the IRR, investors can make informed decisions and balance the potential returns against the risks involved.

IRR is also useful in capital budgeting decisions, where companies need to evaluate different projects and select the ones that offer the highest returns. By considering the IRR of each project, companies can allocate resources effectively and choose investment opportunities that align with their financial goals.

In addition, IRR aids in the assessment of project feasibility. By comparing the IRR of a project with the desired minimum acceptable rate of return, investors can determine if the project is financially viable and meets their investment criteria.

Overall, IRR plays a crucial role in investment analysis and decision-making processes. It provides a standardized method for evaluating the profitability, efficiency, and risks associated with an investment or project. By considering the IRR, investors can make well-informed decisions that maximize their returns and contribute to their long-term financial success.

Understanding the Time Value of Money

The concept of the time value of money is a fundamental principle in finance and plays a vital role in understanding the Internal Rate of Return (IRR).

Essentially, the time value of money recognizes that the value of money is not constant over time. A dollar received today is worth more than the same dollar received in the future. This is because money can be invested, earning a return or interest over time.

There are two main reasons why the time value of money is important:

Firstly, inflation erodes the purchasing power of money over time. Prices tend to rise over the years, and therefore, a dollar today can buy more than a dollar in the future. By accounting for inflation, the time value of money helps to adjust the future cash flows to their equivalent present value.

Secondly, the time value of money recognizes the opportunity cost of holding money. By investing money, individuals and businesses can earn a return, whether it be through interest, dividends, or capital appreciation. Therefore, a dollar today is more valuable than a dollar in the future because it has the potential to generate additional wealth.

When calculating the IRR, the time value of money is considered by discounting future cash flows back to their present value using a discount rate. This discount rate reflects the rate of return that could be earned by investing the money elsewhere.

Understanding the time value of money is crucial for making informed financial decisions. It helps investors evaluate the true worth of an investment and compare different investment opportunities. By considering the time value of money, investors can make realistic projections and determine the profitability and feasibility of an investment.

The Formula for IRR Calculation

The Internal Rate of Return (IRR) is calculated using the formula that equates the present value of cash inflows with the present value of cash outflows. The IRR is the discount rate at which the net present value (NPV) of an investment becomes zero.

The general formula for calculating IRR is as follows:

0 = CF0 + CF1/(1+IRR) + CF2/(1+IRR)2 + … + CFn/(1+IRR)n

Where:

- CF0 is the initial cash outflow or investment

- CF1, CF2, …, CFn are the expected cash inflows received at different periods

- IRR is the discount rate that makes the NPV equal to zero

To calculate the IRR, you can use various methods, including trial and error, interpolation, or financial software and calculators. The most efficient way is to use software like Microsoft Excel, which provides a built-in function to calculate the IRR.

The IRR formula can be complex to solve manually, especially when cash flows are uneven or occur at irregular intervals. In such cases, using Excel or other financial software simplifies the calculation process and allows for accurate results.

It’s important to note that the IRR formula assumes that cash inflows generated by the investment will be reinvested at the same IRR. This assumption is known as the reinvestment rate assumption.

By using the formula for IRR calculation, investors can determine the rate of return at which an investment becomes profitable and compare it against their required rate of return or expected return to assess the viability of the investment.

Entering Cash Flows in Excel

Microsoft Excel provides a convenient and efficient way to calculate the Internal Rate of Return (IRR) by entering cash flows into a spreadsheet. Here’s how to enter cash flows in Excel for IRR calculation:

- Create a new Excel spreadsheet or open an existing one.

- Label one column as “Period” to represent the time period in which the cash flow occurs.

- Label the next column as “Cash Flow” to enter the corresponding cash flow values.

- Enter the period numbers in ascending order in the “Period” column, starting from 0 for the initial investment.

- Enter the corresponding cash flow values in the “Cash Flow” column. Positive values indicate cash inflows, while negative values represent cash outflows.

- Make sure to include all relevant cash flows, including the initial investment in period 0 and any future cash inflows or outflows.

- Once you have entered all the cash flows, select an empty cell where you want to display the IRR calculation result.

- Use the IRR function in Excel to calculate the IRR. Type “=IRR(” without the quotation marks, and then select the range of cash flows in the parentheses. For example, “=IRR(A2:A10)”.

- Press Enter, and Excel will calculate and display the IRR as a percentage.

Using Excel to enter cash flows for IRR calculation offers several advantages. It allows for easy organization and manipulation of data, as well as quick updates or changes to cash flows. Additionally, Excel’s built-in IRR function simplifies the calculation process and provides accurate results.

By correctly entering cash flows in Excel, investors and financial analysts can leverage the power of IRR calculation to evaluate investment opportunities, make informed decisions, and optimize their financial strategies.

Using the IRR Function in Excel

Microsoft Excel provides a built-in function called IRR, which allows users to easily calculate the Internal Rate of Return (IRR) for a set of cash flows. The IRR function eliminates the need for manual calculations and provides quick and accurate results. Here’s how to use the IRR function in Excel:

- Open an Excel spreadsheet or create a new one.

- In one column, enter the cash flows in the order they occur, starting with the initial investment in period 0.

- Select an empty cell where you want to display the IRR calculation result.

- Type “=IRR(” without the quotation marks.

- Select the range of cash flows, excluding any labels or headers. For example, if the cash flows are in cells A2 to A10, enter “=IRR(A2:A10)”.

- Close the parentheses and press Enter.

Excel will calculate and display the IRR as a percentage. The IRR function automatically considers the time value of money and finds the discount rate at which the net present value of the cash flows becomes zero.

It’s important to note that the IRR function assumes that the cash flows occur at regular intervals and that there is at least one positive and one negative cash flow. In cases where the cash flows are irregular or there are multiple changes in cash flow direction, the IRR function may give inaccurate results.

Additionally, the IRR function may result in an error if there is no real solution or convergence. This can happen if the cash flows have conflicting signs or if the investment is not expected to generate positive returns.

By utilizing the IRR function in Excel, individuals and businesses can streamline the process of calculating the Internal Rate of Return. This allows for efficient financial analysis, investment evaluation, and decision-making.

IRR Calculation Example

Let’s walk through an example of calculating the Internal Rate of Return (IRR) using a simple cash flow scenario in Excel. Suppose you are considering an investment that requires an initial outlay of $10,000 and is expected to generate cash inflows of $3,000 in Year 1, $4,000 in Year 2, and $6,000 in Year 3.

- Create a new Excel spreadsheet and label Column A as “Period” and Column B as “Cash Flow”.

- In Column A, enter the periods as follows: 0 for the initial investment, 1 for Year 1, 2 for Year 2, and 3 for Year 3.

- In Column B, enter the corresponding cash flows: -10,000 for Period 0, 3,000 for Period 1, 4,000 for Period 2, and 6,000 for Period 3.

- Select an empty cell where you want to display the IRR calculation result.

- Type “=IRR(” without the quotation marks.

- Select the range of cash flows, excluding any labels or headers. In this case, it would be “=IRR(B1:B4)”.

- Close the parentheses and press Enter.

Excel will calculate the IRR and display it as a percentage. In this example, the calculated IRR is approximately 16.6%.

The calculated IRR represents the annualized rate of return at which the investment’s net present value becomes zero. In other words, it is the rate at which the future cash inflows offset the initial cash outlay.

In this scenario, an IRR of 16.6% indicates that the investment is expected to generate a return higher than the minimum required return. The higher the IRR, the more attractive the investment opportunity becomes.

It’s important to note that the IRR does not consider factors such as the risk associated with the investment or the specific time frame for achieving the cash flows. Therefore, it is crucial to evaluate the IRR result in conjunction with other investment criteria and objectives.

By using the IRR calculation example, you can apply this methodology to different investment scenarios and gain insights into the expected profitability and viability of your investment decisions.

Evaluating the IRR Result

Once you have calculated the Internal Rate of Return (IRR) for an investment or project, it is essential to evaluate the result to make informed decisions. Evaluating the IRR involves considering various factors and comparing the calculated IRR with other investment criteria and objectives. Here are some key points to consider when evaluating the IRR result:

1. Required Rate of Return: Compare the calculated IRR with the minimum or required rate of return for the investment. If the IRR is higher than the required rate of return, it indicates that the investment is attractive and meets the desired return expectations.

2. Risk Assessment: Assess the risk associated with the investment. A higher IRR often indicates a higher return potential but may also reflect higher risks. Consider the level of risk tolerance and evaluate if the potential return justifies the associated risks.

3. Market Comparisons: Compare the IRR with the rates of return offered by alternative investments or projects in the market. This allows you to evaluate the relative attractiveness of the investment compared to other available opportunities.

4. Payback Period: Consider the payback period, which is the time it takes for the investment’s cash flows to recoup the initial investment. A shorter payback period indicates a quicker return of funds, providing liquidity and minimizing the risk of tying up capital for an extended period.

5. Project Feasibility: Evaluate the feasibility of the project by considering the IRR alongside other financial metrics, such as net present value (NPV), profitability index (PI), or return on investment (ROI). Analyze these metrics collectively to gain a comprehensive understanding of the project’s financial viability.

6. Strategic Alignment: Ensure that the investment aligns with your long-term strategic goals and objectives. Consider how the investment fits within your overall investment portfolio and whether it contributes to diversification, growth, or other strategic priorities.

7. Sensitivity Analysis: Conduct sensitivity analysis by adjusting key assumptions, such as cash flows, discount rates, or project timelines. This analysis helps assess how changes in these variables impact the IRR, providing insights into the robustness and reliability of the investment’s potential returns.

Evaluating the IRR result is a crucial step in the decision-making process. By carefully considering the factors mentioned above and comparing the calculated IRR with investment criteria, risk tolerance, and market conditions, you can make well-informed investment decisions that align with your financial goals.

Considering the Limitations of IRR

While the Internal Rate of Return (IRR) is a popular and valuable financial metric, it is important to acknowledge its limitations and consider them when evaluating investment opportunities. Here are some limitations to keep in mind:

1. Single Rate of Return: The IRR assumes a single rate of return over the investment’s lifetime. However, in reality, returns may fluctuate or vary over time. The IRR does not capture these variations, potentially leading to an inaccurate representation of the investment’s profitability.

2. Cash Flow Reinvestment Assumption: The IRR assumes that cash inflows generated by the investment will be reinvested at the same IRR. This assumption may not be realistic, as it assumes consistent and predictable reinvestment opportunities. In practice, finding investment opportunities with the same rate of return may be challenging.

3. Ambiguity with Multiple IRRs: In some cases, investments with unconventional cash flow patterns may yield multiple IRRs or even no real solution. This situation arises when the cash flows change direction multiple times over the investment period. When facing this ambiguity, the IRR becomes less useful and alternative evaluation methods may be required.

4. Ignoring Cash Flow Magnitudes: The IRR considers the timing and sign of cash flows but does not account for their magnitude. This means that the IRR treats a cash flow of $1,000 in the same way as a cash flow of $10,000, even though the latter may have a more significant impact on the investment’s overall return.

5. Failure to Account for Risk: The IRR solely focuses on the financial return of an investment and does not consider the associated risks. It is essential to assess risks separately and align them with return expectations to make well-informed investment decisions.

6. Sensitivity to Discount Rates: The IRR’s output is sensitive to the discount rate used in the calculation. Small changes in the discount rate can lead to significantly different IRR results. Therefore, it is crucial to conduct sensitivity analysis by adjusting the discount rate to evaluate the robustness of the investment’s return potential.

7. Lack of Consideration for Project Size: The IRR does not consider the scale or size of an investment. It treats all cash flows on a percentage basis, which may not provide a clear understanding of the investment’s actual value or impact on overall financial performance.

Understanding the limitations of IRR helps investors make more nuanced evaluations of investment opportunities. By recognizing these constraints and considering them alongside other financial metrics and risk assessments, investors can gain a more comprehensive understanding of an investment’s profitability and suitability.

Using IRR for Investment Decision-making

The Internal Rate of Return (IRR) is a powerful tool that can be used for investment decision-making. Here are some key ways in which IRR can assist in the decision-making process:

1. Comparing Investment Opportunities: IRR enables investors to compare multiple investment opportunities and determine which one has the highest potential for generating positive returns. By calculating and comparing the IRR of different investments, investors can make more informed decisions about where to allocate their resources.

2. Assessing Profitability: The IRR assesses the profitability of an investment by calculating the rate of return at which the net present value (NPV) becomes zero. A higher IRR indicates a more profitable investment, giving investors a clear metric to evaluate the potential returns.

3. Factoring in the Time Value of Money: IRR takes the time value of money into account by considering the discount rate at which the cash flows are discounted. This ensures that future cash flows are appropriately valued, giving a more accurate assessment of an investment’s profitability.

4. Setting Investment Criteria: IRR can be used as a benchmark for setting investment criteria. By establishing a minimum required IRR, investors can filter out investment opportunities that do not meet their desired return objectives, helping them focus on investments with higher potential returns.

5. Assessing Project Feasibility: IRR is a crucial factor in evaluating the feasibility of a project. If the calculated IRR exceeds the desired minimum rate of return, it indicates that the project is financially viable. On the other hand, a lower IRR may indicate a riskier or less attractive project.

6. Optimizing Capital Budgeting Decisions: IRR is commonly utilized in capital budgeting decisions, where companies have limited capital and need to allocate it among competing investment opportunities. By evaluating the IRR of each project, companies can prioritize investments with higher IRRs, maximizing their overall returns.

7. Monitoring Investment Performance: IRR can also be used to monitor the performance of an investment over time. By periodically recalculating the IRR and comparing it with the expected return, investors can assess whether the investment is meeting their expectations and make any necessary adjustments.

It is important to note that while IRR is a helpful tool in investment decision-making, it should not be the sole factor considered. Additional considerations, such as risk analysis, market conditions, competition, and strategic fit, should also be taken into account to make well-rounded investment decisions.

By utilizing IRR alongside other financial metrics and evaluation techniques, investors can enhance their decision-making process and increase the likelihood of selecting investments that align with their financial goals and objectives.

Other Applications of IRR Calculation

While the Internal Rate of Return (IRR) is widely used for investment decision-making, it also has various other applications in finance and business. Here are some additional ways in which IRR calculation is applied:

1. Project Evaluation: IRR is an essential tool for evaluating the financial feasibility of projects, such as infrastructure development, research and development initiatives, or new product launches. By calculating the IRR, organizations can assess the potential profitability of the project and determine whether it aligns with their strategic objectives.

2. Merger and Acquisition (M&A) Analysis: IRR is utilized in M&A transactions to evaluate the financial impact of the deal. By calculating the IRR of the combined entity and comparing it with the company’s minimum required rate of return, organizations can assess the viability and potential returns of the merger or acquisition.

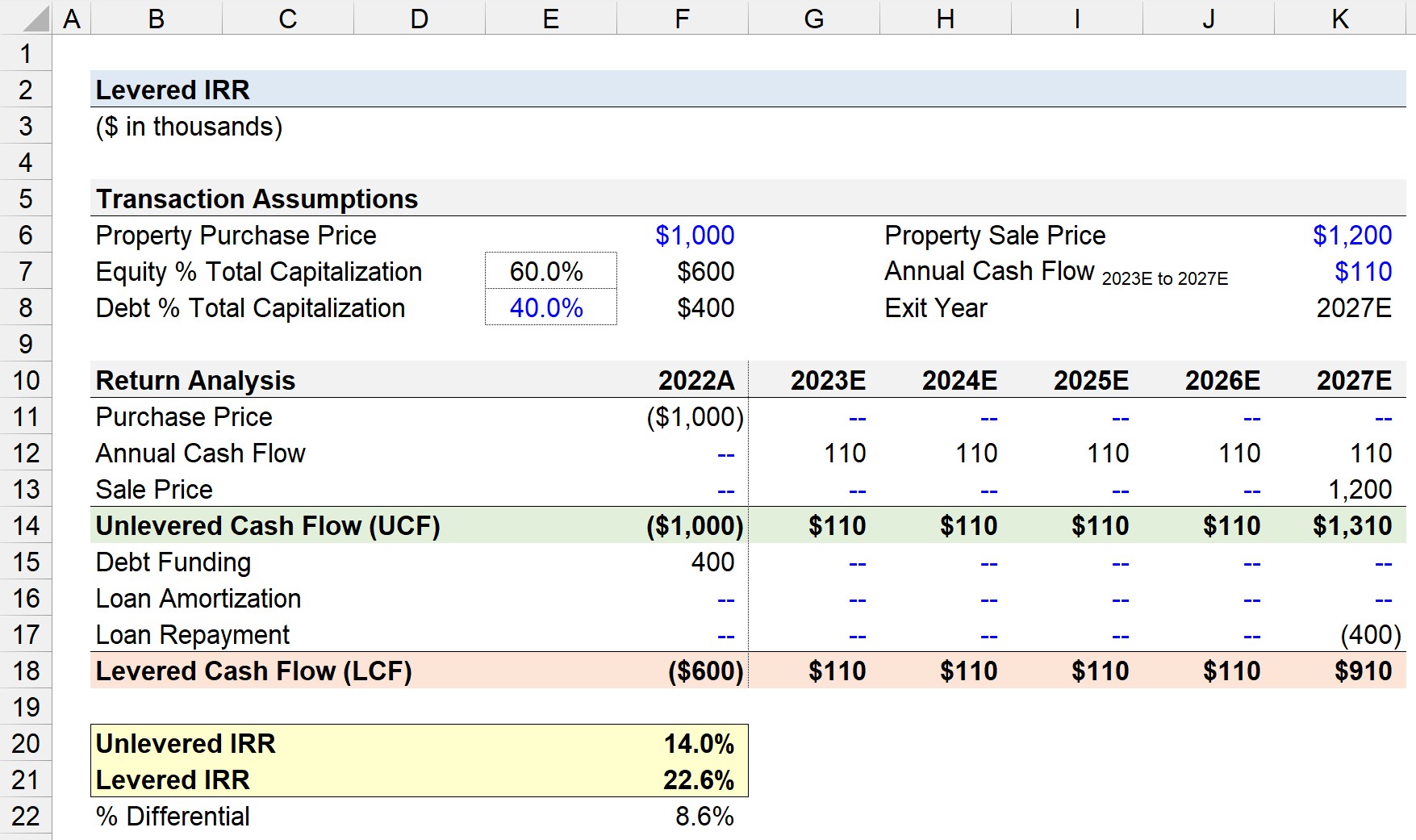

3. Real Estate Investment Analysis: IRR is commonly used in real estate investment analysis to evaluate the profitability of property investments. Real estate investors calculate the IRR to assess the potential return on investment, taking into account factors such as rental income, property appreciation, and financing costs.

4. Capital Rationing: IRR is valuable in situations where organizations have limited capital and need to allocate it among multiple investment opportunities. By comparing the IRRs of different projects, organizations can prioritize investments to maximize their overall return, considering the capital budget constraints.

5. Cost of Capital Estimation: IRR is used in estimating a company’s cost of capital. By calculating the IRR, organizations can determine the rate of return required to generate positive net present value (NPV) for their investments. This information is crucial in setting appropriate discount rates for project evaluation and capital budgeting decisions.

6. Business Valuation: IRR plays a role in estimating the value of a business. By discounting the expected cash flows of a business at an appropriate IRR, financial analysts can determine its present value and ultimately assess its worth in the market.

7. Performance Measurement: IRR is used as a performance measurement tool, particularly in portfolio management and mutual funds. It helps assess the performance of investment portfolios, comparing the realized rates of return with the expected returns or benchmark indices.

These applications highlight the versatility and practicality of IRR calculations in various financial and business contexts. By employing IRR analysis, organizations can make informed decisions, allocate resources effectively, and assess the financial viability of investment opportunities in different domains.

Tips and Tricks for Using IRR in Excel

Microsoft Excel provides a convenient and efficient way to calculate the Internal Rate of Return (IRR) for investment analysis. Here are some useful tips and tricks for using IRR in Excel:

1. Properly Organize Cash Flows: Ensure that the cash flows are correctly organized in a column, with the initial investment listed as Period 0 and subsequent cash inflows/outflows in the appropriate periods. Proper organization facilitates accurate IRR calculations.

2. Exclude Non-Relevant Cells: When selecting the range of cash flows for the IRR function, exclude any non-relevant cells, such as headers or labels. Including non-relevant cells can lead to errors or incorrect results.

3. Check for Convergence: In complex cash flow scenarios, IRR calculations may not always converge to a result, leading to a #NUM! error. In such cases, consider adjusting assumptions or consult with financial professionals to resolve the issue.

4. Sensitivity Analysis: Conduct sensitivity analysis by changing cash flow values or discount rates to understand how variations impact the IRR. This analysis helps assess the robustness and reliability of the investment’s return potential.

5. Using Custom Dates: Excel allows the use of custom dates for cash flow periods. Instead of using numerical periods, you can use specific dates in the “Period” column to align the cash flows with the actual time periods they correspond to.

6. Consider Additional Factors: While IRR is a valuable metric, it should not be the sole factor in decision-making. Consider other financial metrics, risk analysis, business objectives, and market conditions to make well-informed investment decisions.

7. Utilize Built-in IRR Function: Excel provides a built-in IRR function that simplifies the calculation process. Utilize this function rather than manually calculating IRR, as it ensures accuracy and saves time.

8. Refer to Excel Help and Resources: Excel offers extensive help resources, tutorials, and community forums where you can find solutions, tips, and additional guidance on using IRR effectively. Take advantage of these resources to enhance your understanding and proficiency in Excel.

By applying these tips and tricks, you can effectively use Excel’s IRR function to calculate and analyze the Internal Rate of Return for different investment scenarios. Excel’s flexibility, combined with thoughtful considerations and adjustments, makes IRR calculations more accurate and insightful.