Nothing beats the feeling of holding your first paycheck after landing your first job. However, seeing a breakdown of unfamiliar financial terms is rather confusing. What is gross income? What is net income? How does my adjusted gross income affect my tax return? What do all these taxes mean?

To a finance industry novice like many of us, or for those just learning how to save money, all the financial jargon can be pretty daunting.

But it doesn’t have to be. In this article, we attempt to simplify gross income. How it differs from other related accounting terms – such as net income – how to calculate your gross annual and monthly income. And why understanding it is important. We will also take a look at adjusted gross income, how to calculate it, and how it affects your tax bill.

What is Gross Income?

The simplest definition of gross income is the total earnings over a set period before any deductions are applied.

Understanding this concept lets you assess your financial health and, ultimately, formulate financial strategies based on your actual calculations. Not only will it help you determine your state and federal income tax rates, but it is also a key factor when companies, banks, and investors are assessing your eligibility to apply for credit cards – like a Home Depot credit card – or loans.

Note that the implications of gross incomes can slightly differ for a business and an individual. Besides their gross pay from job salaries, individuals need to include other gains when calculating their total gross income. This includes the dividend payouts from stocks and savings account interests, commissions, and income from selling or renting goods. Meanwhile, for business owners, your gross income referred to as gross profit or margin, will be the total revenue generated from sales minus the overall direct costs of goods that you sold.

How to Calculate Gross Income

You don’t need a fancy salary calculator to determine your gross income. Simply add up all your earnings from wages and salaries. On the other hand, business owners need to subtract the cost of goods sold from their sales revenue in order to get their gross margin. For example, if you have a cupcake business making a total of $1,000 in sales, and the cost of baking the cupcakes is $400, this means that your business’ gross profit is $600.

The gross margin of your business can communicate profitability and can either attract or discourage potential investors. You can also calculate it over a specified time frame — this can be annual (gross annual income), monthly (gross monthly income), or even, weekly.

Once you apply the necessary deductions to this, you get the net income.

What is Gross Annual Income?

An individual’s gross annual income is the sum total of all their earnings for one year, which can be based on a calendar year. This is from the first day of January to the last day of December of the same year. Alternatively, it can also be based on the fiscal year, which is the accounting period designated by the United States Federal Government. This starts on the first day of October of the previous year and ends on the last day of September of the next year. For example, October 1, 2021, to September 30, 2022, is one fiscal year. However, a company can still set its own non-calendar fiscal year — that is any consecutive 12-month period — based on the nature of the business.

It is important to define the period when calculating the gross annual income, especially when submitting annual income statements for audit, taxation, and other financial purposes. Typically, though, most businesses follow the fiscal year when calculating this financial information.

How To Calculate Gross Annual Income?

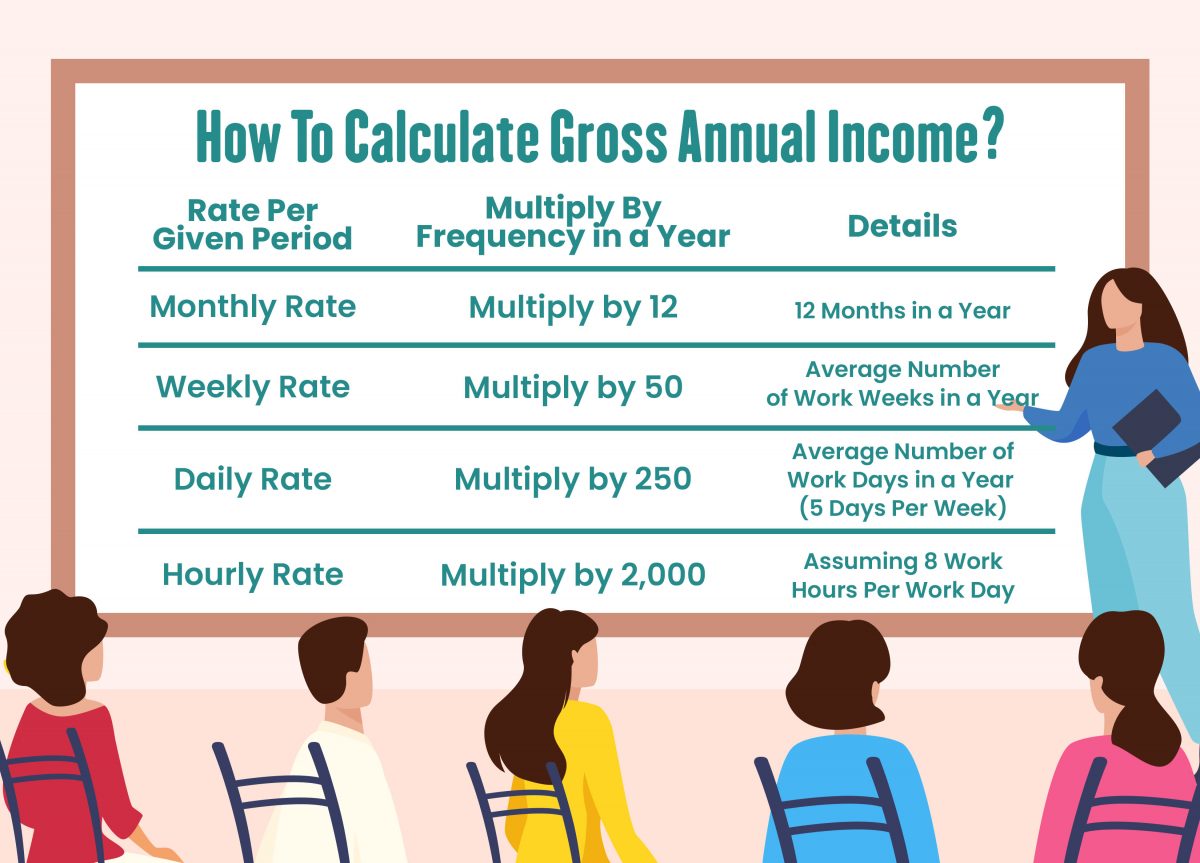

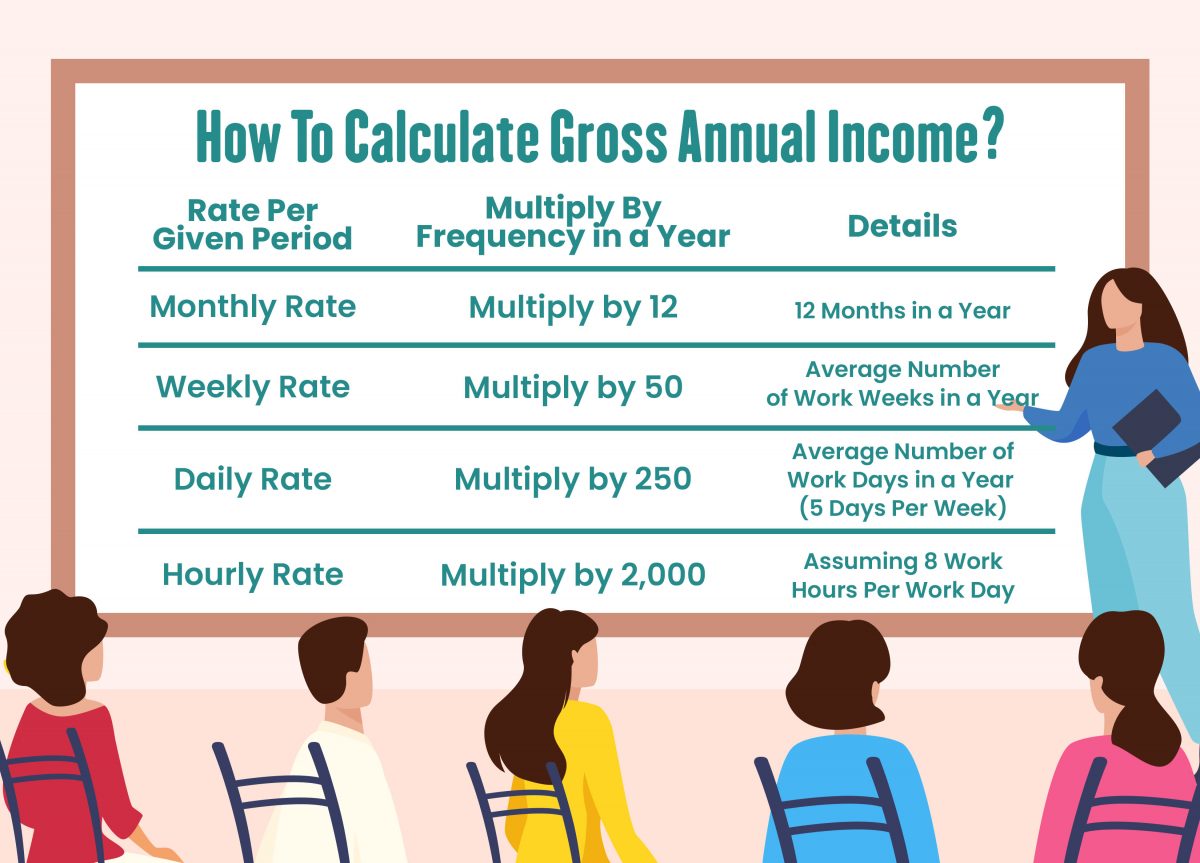

If you are a salaried employee, you might be wondering how to calculate your gross annual income. To do so, start with converting any of your hourly, daily, weekly, or monthly rates using the following applicable formula:

To calculate, simply convert your applicable rate by using the formulas mentioned above. The figures are based on the average number per year through an accounting process called calendarization. This process allows a standardized period when reporting income or any financial information.

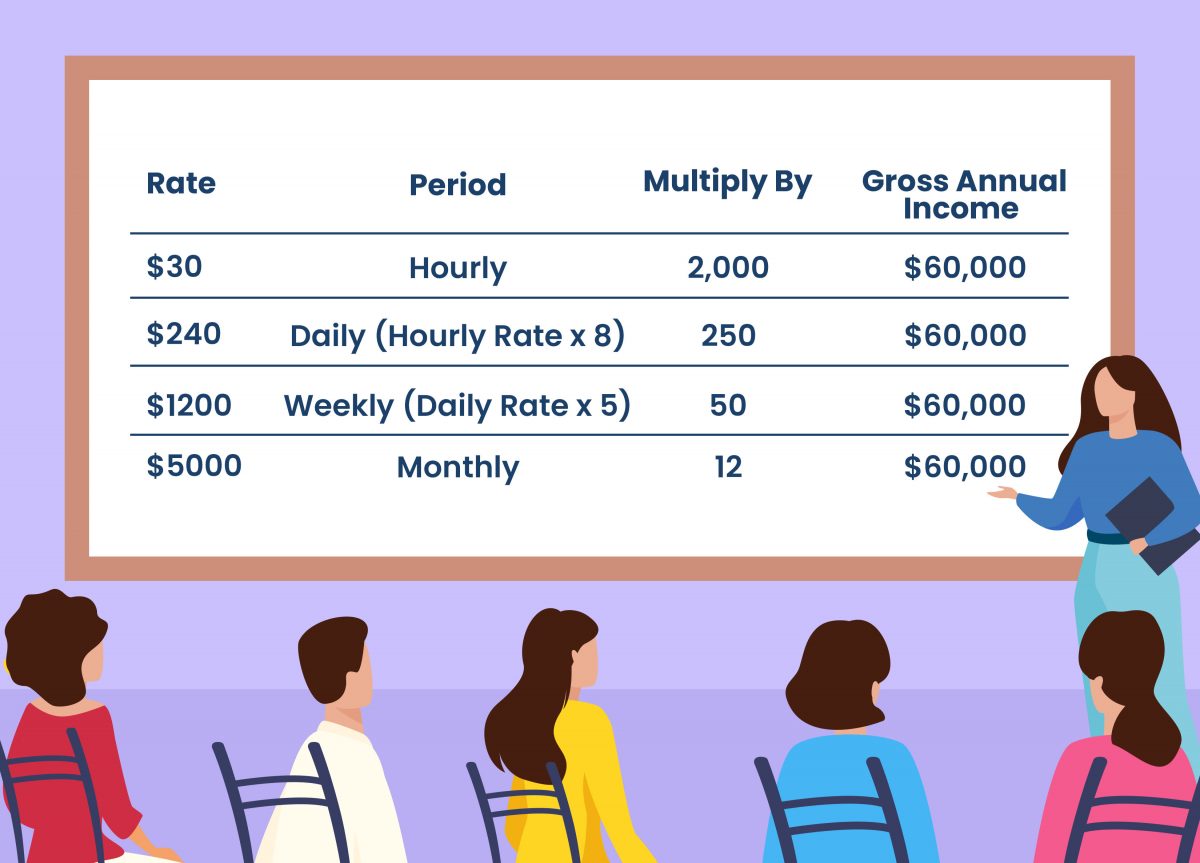

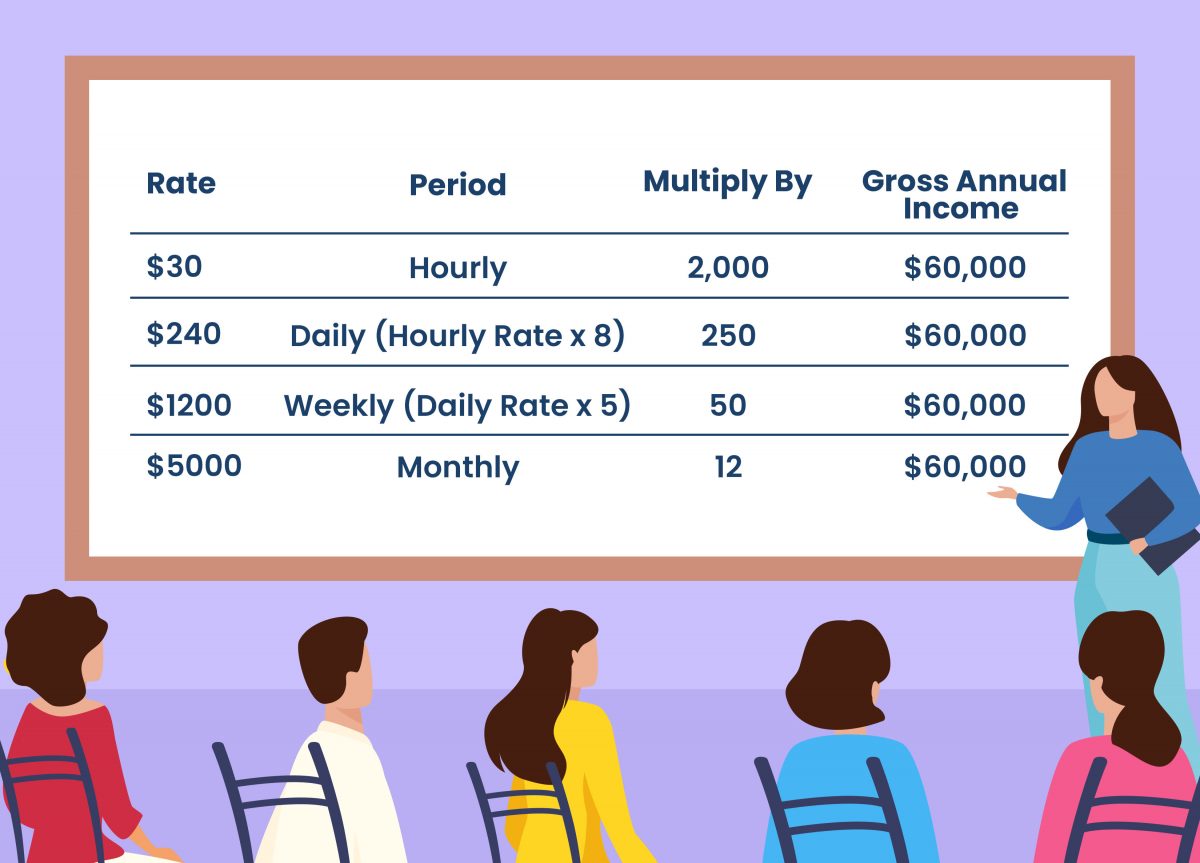

For example, let’s say you have an hourly wage of $30. You work a regular eight-hour workday, on all the work weekdays. You can calculate your gross annual income as follows:

This means that at your current hourly rate with the required number of working hours, you have a gross annual income of $60,000.

How to Calculate Gross Monthly Income

As with gross annual income, the same principles apply when calculating your gross monthly income, although it might differ a bit depending on the conditions of your pay.

If you are a salaried employee and are paid annually, and you have your gross annual income information, simply divide that number by 12 — corresponding to the number of months in a year.

For example, if you have an annual gross salary of $60,000, dividing that amount by 12, you will get a gross monthly income amount of $5,000.

Calculating When Paid Hourly

On the other hand, if you are paid on an hourly basis, you can perform the following calculations. First, identify how many hours on average you work in a week, multiply that number by 52 — which is the number of weeks in a year — then finally, divide it by 12. This is simplified through the following formula:

| Gross Monthly Income = ([Hourly Rate] x [Number of Hours Weekly] x [52]) / 12 |

Consider yourself an hourly paid employee earning $35 per hour working 40 hours per week. To determine your gross monthly income, take your hourly rate, and multiply it by 40 (number of hours in a week) and 52 (number of weeks in a year). In digits, that would be $35 x 40 hours per week, which is equal to $1,400. After multiplying this amount by 52, you will get your gross annual income amount of $72,800. Divide this by 12 to get the gross monthly income.

This means that you are earning a gross monthly income of $6,066.67.

The examples above only factored in salaries. In reality, you may have multiple sources of income and profit. When calculating, either on an annual or monthly basis, it is important to account for all profit sources.

Now you may be living with your family or spouse, or other housemates. In such scenarios, it might also be useful to calculate the household salaries, since it accounts for the total gross income of all the earning household members who are 15 years or older. Household earnings are usually calculated to gauge the economic context of a region. It is also useful for household members in cases of loan applications.

Net vs Gross Income

With all that said, what, then, is a net income? And why is it lower than your gross income? Essentially, your net income is the total earnings after subtracting expenses and taxes, such as withholding tax, payroll tax, and property tax. Other necessary deductions you need to subtract include payment or contributions to health savings accounts, loans, insurance policies, and retirement plans.

For a business, these deductions can include depreciation, administrative expenses, and other costs of operations. This can include the likes of business insurances, as well as professional and legal fees. Tracking the net income of the business means tracking its profitability and financial health. It provides insight into its overall business performance.

You can usually find the net income information in the company’s income statements. The income statement details the total revenue of a company over a period of time. It also breaks down the overall expenses and losses to show how the net income figures were calculated. This is why the income statement is one of the primary bases for business analysts and accountants to measure the financial soundness of the company.

Why is Knowing My Net Income Important?

In terms of salaries, the net income is the take-home pay or the amount from the salary available to you after all the deductions have been taken. This includes the likes of tax deductions and other contributions, like Social Security and Medicare. Your net income is the amount highlighted in your paycheck that you can withdraw or transfer to a bank account.

The net income formula is fairly straightforward. For example, you are earning a gross monthly income of $1,000. You will still have to subtract a total of about $400 for taxes, contributions, and other deductions. This would translate to a net income of $600 for that specific time frame. For better accuracy, an income tax calculator can be used to help determine how deductions will impact your overall tax return.

Knowing your net income allows you to create monthly budgets, and overall manage your finances more effectively. When creating budget plans, your starting amount will be your take-home pay. This means that being mindful of your net income will enable you to efficiently allot a budget for your expenses.

That’s not all. You can even allocate money for both your short-term and long-term financial goals. This can be for your savings, emergency and retirement funds, or investments.

Gross Income VS Adjusted Gross Income

What is adjusted gross income? There are specific adjustments that you can apply when calculating your actual taxable profit. This directly affects the amount of tax you will be liable to pay.

Adjusted gross income (AGI) is the amount that remains once certain necessary deductions are subtracted from your gross income. These adjustments are referred to as ‘above-the-line’ deductions or items. These include deductions on Social Security benefits, student loan payments, retirement plan contributions, and educator expenses, among others.

You might be wondering – what does adjusted gross income mean to me? Once applied or adjusted, it reduces your gross income, which consequently reduces your taxable income. In principle, after factoring in deductions and credits, the lesser your AGI, the lesser your income tax liability will be.

In addition, if you are filing your federal tax return online using the IRS Free File Program, you can use your AGI to verify your identity.

How to Calculate Adjusted Gross Income

To calculate your AGI, start first by calculating your gross income, which as mentioned above is the sum of all your financial sources. After which, subtract all applicable deductions. Some of the most common adjustments include:

- Retirement Contributions: Individuals with contributions to eligible retirement plans, like Individual Retirement Arrangements (IRAs) and Simplified Employee Pension Plan (SEP IRAs), are also qualified for deductions.

- Alimony and Separate Maintenance: Alimony payments may be tax-deductible for the paying spouse.

- Student Loan Interest Deduction: Eligible students, parents, or spouses can avail of a tax break for qualified student loan interest payments.

- Educator Expense Deduction: Qualified educators can deduct out-of-pocket and unreimbursed expenses incurred for education purposes, such as classroom materials, from their gross incomes.

- Moving Expenses for Members of the Armed Forces: Active-duty Armed Forces members who have moved or have to move due to official orders are qualified to get a tax break for the expenses incurred during moving.

After factoring in the applicable deductions, you will get your AGI, which also determines your income tax bill.

Modified Adjusted Gross Income

There are scenarios in which some adjustments, such as tax-exempt interests, are added back to your AGI. This is referred to as the modified adjusted gross income (MAGI). Some of the usual items adjusted back to your gross income include education-related expenses and retirement plan contributions.

If you have retirement plan coverage at work, your deductions will also affect your MAGI. For example, if you are single with a MAGI between $66,000 to $76,000, you will be qualified for a partial deduction.

It will also help in identifying your eligibility for certain credits, and deductions, as well as allow you to take full benefit of specific tax perks.

Moreover, if you’re looking to qualify for advance tax credits, your eligibility will be determined using your MAGI. You may be eligible for more credit, the lower your MAGI, as well. What’s more, under the Affordable Care Act (ACA), if your MAGI is below a certain threshold, it can be the basis for you and your household to qualify for coverage on subsidized health insurance programs like Medicaid.

Getting a better understanding of the concept of AGI and its different conditions and requirements will enable you to identify different areas where you can qualify for tax breaks and tax credits. All of these can translate to better long-term financial gains, reduced tax liabilities, and greater opportunities for savings.

The Importance of Knowing All About Gross Incomes

We’ve heard it before, and for sure, this won’t be the last time we’ll hear of it, “Knowledge is Power.”

Ultimately, being equipped with the basic knowledge of gross income and how it works allows you to become more strategic when budgeting your life expenses. Coupled with the awareness of other related financial concepts and how they’re interconnected, it will help you manage and grow your finances.

Whether you’re a business owner looking to grow your company or an employee looking to be smarter with your money by saving and investing even with little cash, it all starts with awareness of what you currently have. As such, knowing your gross income should be your starting point.