What is Net Salary?

Net salary refers to the amount of money an employee takes home after deductions and withholdings are subtracted from their gross salary. It is the actual amount that an employee receives in their bank account or paycheck.

Gross salary, on the other hand, is the total amount of money that an employee earns before any deductions are made. Deductions can include taxes, social security contributions, health insurance premiums, retirement contributions, and other withholdings mandated by the government or employer.

Net salary is an essential measure for employees as it represents their actual take-home pay, which they use for their monthly expenses, savings, and other financial obligations. It is crucial for employees to know their net salary as it helps them budget and make informed financial decisions based on their actual income.

Employers also calculate net salary to ensure that they are in compliance with labor laws and accurately compensate their employees. By deducting the required withholdings and deductions, employers can ascertain that they are providing the correct net salary to their employees.

The calculation of net salary may differ based on country, state, and local regulations, as well as employee-specific factors such as tax exemptions and additional benefits. However, the basic principle remains the same: deducting specific amounts from the gross salary to determine the net amount.

Overall, net salary is an integral part of both the employer-employee relationship and personal financial management. It allows employees to understand their true earnings and employers to fulfill their responsibility of ensuring accurate compensation. Properly calculating and understanding net salary is essential for effective financial planning and to maintain a healthy balance between income and expenses.

Why It Is Important to Calculate Net Salary

Calculating net salary is of utmost importance for both employees and employers. It not only provides a clear understanding of the actual income an employee will receive but also ensures accurate compensation and adherence to legal requirements. Here are several reasons why calculating net salary is essential:

1. Financial Planning: Knowing the net salary allows employees to plan their finances effectively. They can budget their expenses, savings, and investments based on their actual take-home pay. This helps in avoiding overspending and ensuring financial stability.

2. Employee Satisfaction: Employees want to know how much they will take home at the end of the day. Calculating the net salary provides transparency and helps build trust between the employee and employer. When employees are aware of their true earnings, it improves job satisfaction and motivation.

3. Compliance with Legal Requirements: Employers have a legal responsibility to accurately calculate and provide the net salary to their employees. By properly deducting taxes, social security contributions, and other statutory withholdings, employers can ensure compliance with labor laws and avoid penalties.

4. Accurate Compensation: Calculating net salary ensures that employees are paid accurately for their services. By deducting relevant withholdings, such as taxes and insurance premiums, the net salary reflects the appropriate amount that an employee should receive based on their gross salary.

5. Tax Planning: Accurate calculation of net salary plays a crucial role in tax planning for both employees and employers. It helps employees determine their tax liabilities and plan their tax-saving investments accordingly. Employers can also calculate and withhold the correct amount of taxes from employee salaries to meet their tax obligations.

6. Payroll Management: When employers calculate net salary, they have a clear understanding of their payroll expenses. This enables them to manage their finances effectively and allocate resources appropriately.

7. Legal Compliance: Various government regulations determine the deductions to be made from an employee’s salary. By calculating the net salary correctly, employers can ensure compliance with these regulations, such as tax laws, social security contributions, and other statutory obligations.

Overall, calculating net salary is vital for both employees and employers. It provides financial clarity, promotes transparency, ensures compliance with legal requirements, and facilitates effective financial planning. By accurately calculating net salary, both parties can enjoy a harmonious working relationship, leading to a more satisfied and productive workforce.

Required Information to Calculate Net Salary

Calculating net salary requires several pieces of information to ensure accuracy and compliance with relevant regulations. Here are the key details that are typically needed:

1. Gross Salary: The gross salary is the starting point for calculating net salary. It is the total amount of money earned by the employee before any deductions or withholdings are made. This can include base salary, overtime pay, bonuses, commissions, and other forms of compensation.

2. Tax Information: The employee’s tax information is crucial for accurate net salary calculation. This includes the tax code, tax rates, and any tax exemptions or deductions applicable to the employee. This information helps determine the amount of income tax that needs to be withheld from the gross salary.

3. Social Security Contributions: Depending on the country and specific regulations, employees may be required to contribute a portion of their salary towards social security programs. The employee’s social security number or identification, along with the applicable contribution rates, are necessary for calculating these deductions.

4. Insurance Premiums: If the employee has health insurance coverage or other insurance policies offered through the employer, the premium amount needs to be considered in the net salary calculation. This includes medical insurance, life insurance, disability insurance, and any other relevant policies.

5. Retirement Contributions: If the employee participates in a retirement savings plan, such as a 401(k) or pension scheme, the contribution amount should be taken into account. This deduction helps in determining the net salary by reducing the taxable income for the employee.

6. Other Withholdings: Additional deductions may apply based on specific circumstances and employer policies. These can include union dues, loan repayments, childcare expenses, or any other authorized withholdings as per the employment agreement.

7. Allowances and Reimbursements: Certain allowances and reimbursements, such as transportation or meal allowances, can affect the net salary calculation. These amounts should be considered to accurately determine the take-home pay of the employee.

It is important to note that the required information to calculate net salary may vary based on country-specific laws, employment agreements, and individual circumstances. Employers should ensure they have access to the necessary data and resources to carry out accurate calculations and stay compliant with legal requirements.

By having access to all the relevant information, employers can provide accurate net salary figures to their employees, ensuring transparency and building trust in the employment relationship. Employees can also be aware of the deductions made and understand the factors that impact their take-home pay.

Basic Calculation of Net Salary in Excel

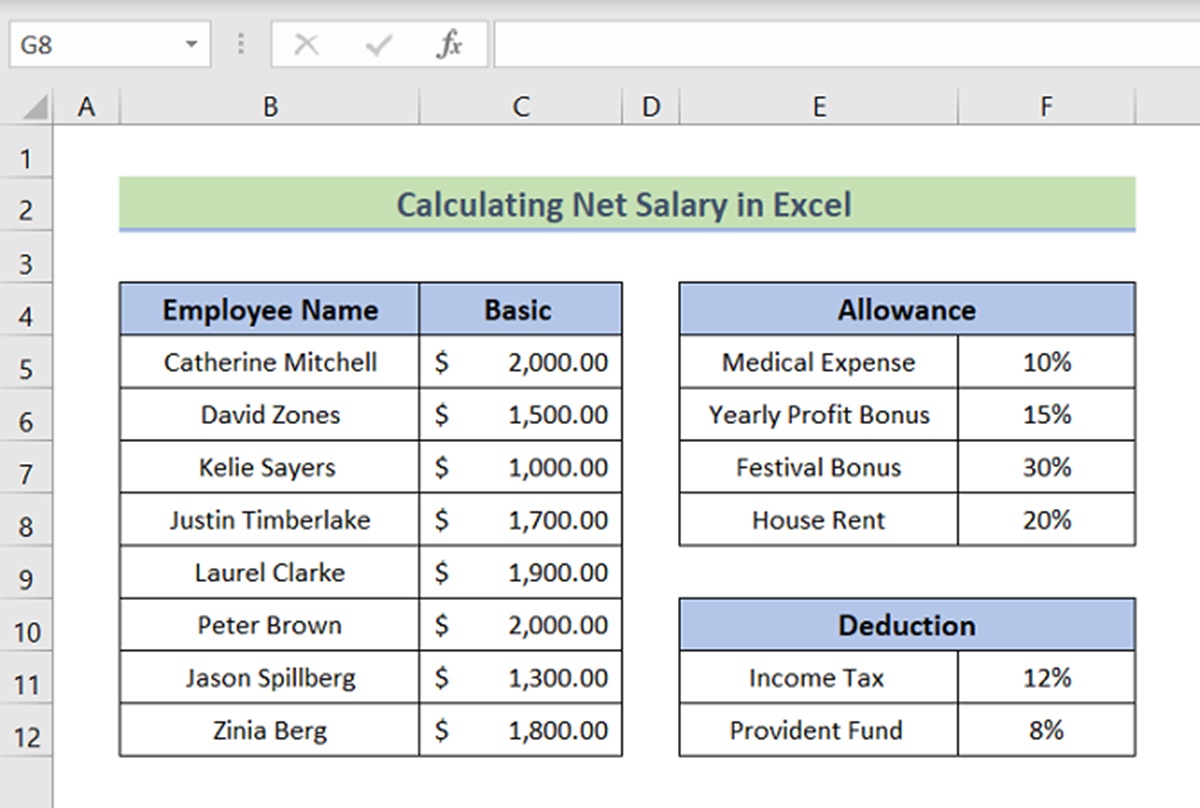

Excel is a powerful tool that can be used to calculate net salary efficiently and accurately. Here’s a step-by-step guide on performing the basic calculation of net salary using Excel:

Step 1: Set Up the Spreadsheet: Open a new Excel spreadsheet and create columns for the required information, such as employee name, gross salary, tax deductions, social security contributions, insurance premiums, and any other relevant deductions. Label each column appropriately.

Step 2: Input Employee Information: Enter the employee’s name and the corresponding values for their gross salary and applicable deductions in the appropriate cells.

Step 3: Calculate Tax Deductions: Assuming you have the tax rates and brackets available, use Excel’s formulas to calculate the amount of income tax to be deducted from the gross salary. You can use functions like VLOOKUP or IF statements to determine the tax amount based on the employee’s taxable income.

Step 4: Determine Social Security Contributions: If applicable, calculate the employee’s social security contributions based on the contribution rates. Multiply the gross salary by the contribution rate to obtain the social security deduction amount.

Step 5: Consider Insurance Premiums: If the employee has insurance coverage, account for the premium amount. Deduct the insurance premium from the remaining salary after tax and social security deductions.

Step 6: Subtract Other Deductions: If there are any additional deductions, such as retirement contributions or other withholdings, subtract them from the remaining salary to arrive at the net salary.

Step 7: Perform Net Salary Calculation: Subtract all the deductions from the gross salary to calculate the net salary. You can use the SUM function in Excel to add up the deductions and subtract them from the gross salary value.

Step 8: Format and Verify Results: Once the net salary is calculated, format the cell appropriately to display the final figure. Double-check the calculations to ensure accuracy.

Using Excel for net salary calculations offers several advantages, such as automation, accuracy, and scalability. Once the spreadsheet is set up, you can easily input the employee’s information and let Excel handle the calculations. Any changes or updates required in the future can be made swiftly, saving time and effort compared to manual calculations.

Remember to save the file and keep it securely for payroll purposes. Regularly review and update the calculations to reflect any changes in tax rates, contribution percentages, or employee-specific information to ensure accurate net salary calculations.

By utilizing Excel’s powerful features, employers can streamline the process of calculating net salaries and ensure compliance with legal requirements for accurate and transparent compensation of employees.

Advanced Calculation Options in Excel

Excel provides advanced features and functions that can enhance the calculation of net salary and make the process even more efficient. Here are some advanced calculation options in Excel:

1. Nested Formulas: Excel allows you to nest formulas, which means you can use one formula within another formula. This feature is especially useful when calculating multiple deductions. For example, you can nest the tax calculation formula within the net salary calculation formula to streamline the process and reduce errors.

2. Lookup Functions: Excel offers various lookup functions, such as VLOOKUP and HLOOKUP, that can be used to retrieve specific values based on certain criteria. This can be helpful when determining tax rates based on income brackets or looking up contribution percentages for social security or retirement plans.

3. IF Statements: The IF function in Excel allows you to perform conditional calculations. You can use this function to apply different formulas or calculations based on specific conditions. For example, you can use an IF statement to apply different tax calculations for employees based on their marital status or other qualifying factors.

4. Data Validation: Excel’s data validation feature allows you to set specific criteria for data entry. This can help ensure that the input values for employee information, such as gross salary or deduction percentages, are within acceptable ranges. By adding data validation rules, you reduce the risk of errors or inconsistencies in calculations.

5. Custom Functions: Excel also allows you to create custom functions using Visual Basic for Applications (VBA). This enables you to create personalized functions specific to your net salary calculation needs. Custom functions can automate complex calculations and streamline the process further.

6. PivotTables: PivotTables in Excel offer powerful data analysis and summarization features. You can use them to analyze salary data, group information by different categories like department or job position, and calculate net salaries for specific groups of employees. PivotTables provide a dynamic and flexible way to dissect and analyze salary data in various ways.

7. Data Tables: Excel’s data table feature allows you to perform “what-if” scenarios by creating multiple variations of the same net salary calculation. You can change input values, such as gross salary or deduction rates, and instantly see how the net salary changes. This feature helps in understanding the impact of different variables on the final net salary.

By utilizing these advanced calculation options in Excel, employers can further streamline net salary calculations and gain deeper insights into employee remuneration. These features help reduce errors, automate complex calculations, and provide a more comprehensive analysis of salary data.

Note that the use of advanced features in Excel may require a higher level of proficiency or training. It is recommended to familiarize yourself with these features or seek assistance from experts or online resources to fully leverage the capabilities of Excel for advanced net salary calculations.

Adding Deductions and Allowances to Net Salary Calculation

When calculating net salary, it’s important to consider both deductions and allowances to accurately reflect the employee’s take-home pay. Deductions reduce the gross salary, while allowances add to it. Here’s how to incorporate deductions and allowances into the net salary calculation:

1. Deductions: Deductions are amounts that are subtracted from the gross salary. Common deductions include income tax, social security contributions, health insurance premiums, and retirement contributions. To calculate the net salary, subtract these deductions from the gross salary.

2. Income Tax: Determine the tax rate applicable to the employee based on their income bracket. Multiply the gross salary by the tax rate to calculate the amount of income tax to be deducted. This helps in ensuring compliance with tax regulations and accurately reflecting the employee’s net income.

3. Social Security Contributions: Calculate the employee’s social security contribution rate, which is often a fixed percentage of the gross salary. Multiply the gross salary by the contribution rate to determine the deduction amount. Social security contributions are typically mandated by law and go towards retirement benefits and other social security programs.

4. Health Insurance Premiums: If the employee participates in a health insurance plan offered by the employer, consider the premium amount deducted from the gross salary. Subtract the health insurance premium from the remaining salary after tax and social security deductions.

5. Retirement Contributions: If the employee contributes to a retirement savings plan, such as a 401(k) or pension scheme, deduct the contribution amount from the remaining salary. This deduction helps in reducing the taxable income and ensuring accurate net salary calculations.

6. Other Deductions: Additional deductions, such as union dues, loan repayments, or childcare expenses, should be taken into account. Subtract these deductions from the remaining salary after tax, social security, health insurance, and retirement deductions to obtain the final net salary.

7. Allowances: Allowances are amounts that are added to the gross salary. Common allowances include transportation allowances, housing allowances, and meal allowances. These allowances increase the employee’s net salary and are typically provided as part of the employment agreement or local regulations.

8. Including Allowances: Add the allowances to the remaining salary after deducting taxes, social security contributions, health insurance premiums, and other deductions. This results in a more accurate net salary calculation that reflects any additional income provided through allowances.

By incorporating both deductions and allowances into the net salary calculation, employers can provide a more comprehensive and accurate representation of an employee’s take-home pay. This ensures transparency and compliance with legal requirements while accounting for any additional benefits or expenses that may affect the overall net salary received by the employee.

Using Excel Formulas for Complex Salary Calculations

Excel offers a wide range of formulas and functions that can handle complex salary calculations with ease. These formulas provide flexibility and accuracy, making it ideal for handling various scenarios. Here are some commonly used Excel formulas for complex salary calculations:

1. SUM Function: The SUM function is a fundamental Excel formula that adds up a range of cells. It can be used to calculate the total of different components of the salary, such as allowances, overtime pay, or bonuses.

2. IF Function: The IF function allows for conditional calculations based on specific criteria. It is particularly useful for applying different calculations for different employees, such as calculating different tax rates for employees in various income brackets.

3. VLOOKUP Function: The VLOOKUP function is used for retrieving specific data from a table based on a given value. It can be used to fetch tax rates, contribution percentages, or other relevant information from a lookup table based on the employee’s taxable income or other criteria.

4. DATE Function: The DATE function is helpful for calculating dates related to salary calculations, such as the start or end date of an employee’s pay period or the payment date of allowances or bonuses.

5. ROUND Function: The ROUND function allows you to round the calculated salary value to a specified number of decimal places. This helps in presenting the net salary in a concise and readable format.

6. TEXT Function: The TEXT function is useful for formatting the salary amount in a desired format, such as currency symbols, decimal separators, or leading zeros. It enhances the visual presentation of the net salary value.

7. AVERAGE Function: The AVERAGE function calculates the average of a range of numbers. It can be used, for example, to determine the average monthly overtime pay earned by an employee over a specific period.

8. CONCATENATE Function: The CONCATENATE function allows you to join or concatenate multiple text strings together. It is helpful for combining different components of the salary, such as adding a currency symbol to the net salary amount.

By utilizing these Excel formulas, employers can handle complex calculations efficiently and accurately. These formulas enable calculations based on various factors, such as income brackets, allowances, percentages, and other employee-specific information.

It’s important to have a solid understanding of these formulas and their usage to ensure accurate salary calculations. Proper organization of data and consistency in formula application will enhance efficiency and reduce errors.

Additionally, employers should regularly review and update the formulas and formulas as per the changes in tax regulations, company policies, or employee information to maintain accuracy and compliance.

Excel’s formulas can simplify complex salary calculations and provide a reliable and versatile solution for accurately determining net salaries based on various factors and scenarios.

Tips and Tricks for Efficient Salary Calculations in Excel

Excel offers numerous features and techniques that can streamline and simplify salary calculations. Here are some tips and tricks for efficient salary calculations in Excel:

1. Use Named Ranges: Instead of referring to specific cell references, assign names to important ranges or cells. This makes it easier to understand formulas and enhances readability. For example, you can name the cell containing the gross salary as “GrossSalary” and refer to it in formulas as “GrossSalary” instead of a cell reference.

2. Utilize AutoFill: Take advantage of Excel’s AutoFill feature to quickly populate formulas across a range of cells. Enter the formula in one cell, then position the cursor on the bottom right corner of the cell until it changes to a plus sign, and drag it down or across to populate the formula to adjacent cells automatically.

3. Protect Formulas: To prevent accidental changes to formulas, you can protect specific cells or worksheets that contain salary calculations. This ensures the integrity and accuracy of the calculations.

4. Conditional Formatting: Apply conditional formatting to highlight cells that meet specific criteria. For example, you can use conditional formatting to highlight cells where the net salary falls below a certain threshold or to visually distinguish between different components of the salary calculation.

5. Data Validation: Use data validation to restrict input values in specific cells. This helps prevent errors by ensuring that only valid data is entered. For example, you can set data validation rules to allow only numeric values for salary figures.

6. Test with Sample Data: Before finalizing the salary calculations, use sample data to test the formulas and ensure they are working correctly. This helps identify any errors or inconsistencies and allows for necessary adjustments before applying the formulas to actual employee data.

7. Document the Formulas: Keep a record of the formulas used in the salary calculations. Include detailed explanations or comments within the spreadsheet to document the purpose and logic behind each formula. This makes it easier to understand and maintain the calculations in the future.

8. Regularly Update and Review: Keep track of changes in tax rates, contribution percentages, or any other factors that may affect salary calculations. Regularly update and review the formulas to ensure they reflect the most up-to-date information and comply with current regulations.

By incorporating these tips and tricks, employers can efficiently perform salary calculations in Excel, reducing potential errors and improving productivity. Excel’s flexibility and functionality make it a valuable tool for accurate and effective salary management.

Common Mistakes to Avoid When Calculating Net Salary in Excel

While Excel is a powerful tool for calculating net salary, there are some common mistakes that can occur if proper precautions are not taken. By being aware of these mistakes, you can avoid errors and ensure accurate salary calculations. Here are some common mistakes to avoid when calculating net salary in Excel:

1. Incorrect Cell References: One of the most common mistakes is using incorrect cell references in formulas. Double-check that formulas refer to the correct cells, especially when copying and pasting formulas to other cells. An incorrect cell reference can lead to inaccurate salary calculations.

2. Forgetting to Lock Formulas: If you are using formulas to calculate net salary, ensure that they are locked after entering them in the designated cells. Failure to lock formulas can result in accidental changes when entering data or applying other calculations, leading to incorrect net salary calculations.

3. Mixing Up Gross and Net Salary: It is important to clearly differentiate between the gross and net salary values. Confusing the two can lead to significant errors in calculations and misrepresentation of the employee’s actual take-home pay.

4. Inconsistent Data Input: Inconsistencies in data input can cause discrepancies in salary calculations. Ensure consistency in formatting, decimal points, and use of currency symbols throughout the spreadsheet. This helps maintain accuracy and uniformity in the calculations.

5. Wrong Usage of Formulas: Misusing formulas or using incorrect formulas can result in incorrect net salary calculations. Be familiar with the proper usage of Excel formulas and ensure they are applied correctly based on the specific salary components and calculations involved.

6. Lack of Validation and Error Checking: Failure to validate data or perform error checks can lead to miscalculations. Use data validation to ensure accurate data entry and implement error checks to flag any inconsistencies or errors in the salary calculations.

7. Ignoring Currency Conversions: If dealing with multiple currencies, it’s crucial to consider currency conversions properly. Incorrectly converting currency values can lead to inaccurate net salary calculations and potentially impact employees’ earnings.

8. Failure to Update Tax Rates and Allowances: Tax rates, contribution percentages, and other allowances can change over time. Failing to update this information in your salary calculations can result in inaccurate net salary figures. Stay updated with the latest tax rates and allowances and make necessary adjustments accordingly.

By being mindful of these common mistakes and taking proper precautions, employers can ensure accurate net salary calculations in Excel. Regularly reviewing and double-checking the formulas and data input will help maintain the integrity of the calculations and avoid potentially costly errors.

Exporting and Saving Salary Calculations in Excel

Once you have completed the salary calculations in Excel, it’s important to properly export and save the file to ensure data integrity and ease of access. Here are some important considerations when exporting and saving salary calculations in Excel:

1. Choose the Right File Format: When saving the Excel file, select a file format that is widely supported and known for maintaining data integrity. The most common formats include .xlsx (default Excel format), .csv (comma-separated values), or .pdf (portable document format) for read-only purposes.

2. Rename the File: Save the file with a meaningful and descriptive name that reflects its purpose. This makes it easier to identify and locate the salary calculations file when needed.

3. Consider Data Security: If the salary calculations contain sensitive employee information, such as social security numbers or salary details, consider adding password protection to the file. This helps safeguard the data and restricts access only to authorized individuals.

4. Maintain a Backup Copy: Create a backup copy of the salary calculations file and save it separately. This ensures that you have a duplicate copy in case of accidental data loss, corruption, or any other unforeseen circumstances.

5. Include Documentation: Along with the Excel file, consider providing documentation that outlines the calculations, formulas used, and any other relevant details. This documentation can be helpful for future reference or when sharing the file with other team members or auditors.

6. Save Regularly: Save your work frequently as you make progress with the salary calculations. This helps protect against any unexpected computer or software issues that may lead to data loss.

7. Store in a Secure Location: Choose a secure location to store the saved file, such as a dedicated folder on your computer or a secure cloud storage service. Ensure that the location is easily accessible to authorized individuals and has appropriate access controls in place to protect the integrity of the data.

8. Version Control: If multiple versions of the salary calculations file are created over time, implement a version control system to track changes and maintain an organized record of each iteration. This helps avoid confusion and allows for easier tracking of changes made during the salary calculation process.

By following these steps for exporting and saving salary calculations in Excel, employers can ensure the security, accessibility, and accuracy of the data. Proper file management practices contribute to efficient record-keeping and facilitate easy retrieval of salary calculations when needed for future reference or auditing purposes.

Frequently Asked Questions about Using Excel to Calculate Net Salary

Q: Can I use Excel to calculate net salary for multiple employees?

A: Yes, Excel is capable of handling salary calculations for multiple employees. You can create a spreadsheet with a separate row for each employee and use Excel’s formulas and functions to calculate the net salary for each individual based on the provided information.

Q: Can Excel handle complex salary structures with various deductions and allowances?

A: Absolutely. Excel provides advanced formulas and functions that can handle complex salary calculations. You can incorporate nested formulas, lookup functions, and conditional statements to accommodate various deductions, allowances, and other factors that impact net salary calculations.

Q: How often should I update the salary calculations in Excel?

A: Salary calculations should be updated whenever there are changes in tax rates, contribution percentages, or any other factors that affect the net salary. It’s important to stay current with relevant regulations and update the calculations accordingly to ensure accuracy.

Q: Can I automate the salary calculations in Excel?

A: Yes, Excel allows for automation through the use of formulas, functions, and macros. By setting up proper formulas and using Excel’s features like AutoFill, you can automate salary calculations to save time and reduce errors.

Q: How can I protect sensitive salary data in Excel?

A: Excel provides options for protecting sensitive salary data. You can password-protect the file, restrict access to specific individuals, or encrypt the file to enhance data security. Be sure to follow best practices for data protection and comply with any relevant privacy regulations.

Q: Can I generate reports or statements based on the salary calculations in Excel?

A: Yes, Excel can be used to generate reports or statements based on the salary calculations. You can create custom templates, utilize Excel’s data analysis features like PivotTables, and format the data to create visually appealing and informative reports.

Q: How do I handle currency conversions in Excel for international salary calculations?

A: To handle currency conversions, you can utilize Excel’s built-in currency conversion functions or utilize external sources for up-to-date exchange rates. Convert the salary amounts to a standard currency using the appropriate conversion rates before performing the net salary calculations.

Q: Can I use Excel to track historical salary data and compare changes over time?

A: Yes, Excel is an effective tool for tracking and comparing historical salary data. You can create separate worksheets or utilize different columns to store information for different time periods. This allows you to analyze trends, compare salaries, and evaluate changes in compensation over time.

Q: Is it necessary to back up the Excel file containing salary calculations?

A: Yes, backing up the Excel file is highly recommended. It ensures that you have a copy of the salary calculations in case of unforeseen issues like data loss, corruption, or accidental deletion. Regularly create backups and store them securely to safeguard your salary data.

By addressing these frequently asked questions, employers can gain a clearer understanding of using Excel to calculate net salary. Excel’s versatility and capabilities make it a valuable tool for accurate and efficient salary calculations in diverse scenarios.