A Home Depot credit card can be very beneficial for anyone to have. It’s especially helpful when you have some home improvement plans in the works. This card is a great asset for when you have a small renovation or even a larger project to undertake. Here’s what you need to know about the Home Depot credit cards, from their rewards to how you can benefit from having one of your own.

What Are Home Depot Credit Cards?

Home Depot credit cards are store-issued cards that offer different financing options to customers of Home Depot. There are different variants to these cards, with benefits differing between each. The Home Depot credit card that primarily targets general customers of Home Depot is the Home Depot Consumer Credit Card.

What Are The Different Home Depot Credit Cards?

Home Depot Consumer Credit Card

The Home Depot Consumer Credit Card is the most basic Home Depot credit card that customers can avail of. It functions similarly to a regular credit card in that it offers cardholders credit for shopping at Home Depot.

Purchases of $299 or more allow cardholders to avail of 0% interest for six months. Take note, however, that there are conditions that need to be met in order to enjoy the 0% interest perk. Cardholders will need to pay their balance in full within six months for the 0% interest. Missing even one day after the six-month limit will charge cardholders with a full interest rate for the six months as consequence.

There are also other special offers that are available for limited periods. These include 12 months special financing on appliances and other house installations at certain prices. However, conditions still apply with regards to paying off your balance within the allotted time frame, else you have to deal with deferred interest.

Though this card does not offer a rewards program, it at least waives an annual fee. Furthermore, Home Depot Consumer Credit Card holders can enjoy an additional perk of returning items up to one year after purchase.

Home Depot Project Loan Card

The Home Depot Project Loan Card operates a little differently than the Consumer Credit Card. As its name suggests, this card allows you to apply for loans that can be used at Home Depot. Cardholders are permitted to apply for a credit line of up to $55,000.

Upon approval of your loan application, you will be provided with an 84-month schedule to pay back your loan. How much you pay will depend on how much you request on top of the card’s fixed 7.99% annual percentage rate (APR).

Much like the Home Depot Consumer Credit Card, the Project Loan Card does not require any annual fees. On the other hand, it does not come with a rewards program either. Also take note that upon being approved for a Project Loan Card, you will have a six-month timeframe to purchase any products or installation services from Home Depot.

Home Depot Commercial Revolving Charge Card

Whereas the Consumer Credit Card and Project Loan Card are primarily for typical consumers, the Home Depot Commercial Revolving Charge Card caters more to businesses and professionals. Though it is called a “charge card,” it functions a little differently next to other regular charge cards.

Unlike most charge cards, Home Depot’s Commercial Revolving Charge Card allows you to make payments in increments. On the other hand, the Home Depot Commercial Revolving Charge Card also incurs an APR if you take extra time to pay off your balance.

An additional perk to the Home Depot Commercial Revolving Charge Card is its basic fuel rewards program. Cardholders can benefit from savings of $0.10 per gallon when they fuel up at select gas stations. This is for every $100 that cardholders spend on Home Depot purchases.

Home Depot Commercial Account Credit Card

Interestingly, Home Depot’s Commercial Account Credit Card works like a regular charge card. This means that it does not have an APR, as cardholders are required to make payments in full for every billing period. But, cardholders can also opt to set payment periods to either 30 days or 60 days.

The Home Depot Commercial Account Credit Card does not charge an annual fee. Plus, much like the Revolving Charge Card, the Commercial Account Credit Card also comes with the same fuel rewards program.

How To Apply For Home Depot Credit Cards

You can apply for Home Depot credit cards online or in person. After the application, you will receive your card within 14 days. However, if Home Depot does not provide an instant credit decision, you will be notified via U.S. mail within 30 days to advise you of your application status. Also take note that you must be a resident of the United States to qualify for any of Home Depot’s cards.

To correctly apply for a Home Depot card, follow these steps below:

Apply Online

Step 1: Visit Home Depot’s online credit center and take a look at the Home Depot Consumer Credit Card offers.

Step 2: Then, click the orange “Apply Now” button to access the online credit card application.

Step 3: Fill out the online application. The application will require you to provide your full name, phone number, financial information, Social Security number, email address, street address, and date of birth.

Step 4: Read through the account terms and details. Check the agreement box.

Step 5: Click the orange “Submit Application” button to process your application.

Step 6: You will receive an online confirmation noting your credit limit as soon as you get approved.

Step 7: The last step is to take the confirmation to the nearest Home Depot store to receive your temporary card information. You will also receive a $25 coupon, which will be valid for 30 days upon issuance.

Applying In Person

Step 1: Locate any local Home Depot store, preferably one close to you. Go to the Special Services desk.

Step 2: Inform the personnel there that you want to apply for a Home Depot Consumer Credit Card.

Step 3: You will be issued an application form. Proceed to fill it out with your full name, date of birth, email address, street address, phone number, financial information, and Social Security number. Then, wait for your approval.

Step 4: After approval, you will receive your temporary credit card account information. You will also receive a $25 coupon upon approval. Purchases can now be charged to your account.

How To Improve Your Chances Of Being Approved For A Home Depot Card

It should be noted that even if you’re pre-qualified, your approval for any credit card is not guaranteed. This is because other factors, such as your income, are evaluated before final approval. Nevertheless, there are steps to take to improve your chances on how to get a Home Depot credit card without much challenge.

The steps are as follows:

- Try as much as possible to get your copy of your credit report and make sure there are no errors.

- Then, contact the credit bureau to dispute any errors and re-check your credit report before reapplying.

- If you still do not receive approval, then apply for a secured credit card. This will require a deposit to build a positive credit history.

- Once your report reflects positive credit history, then you can re-apply for the Home Depot card.

Ultimately, even if your credit card is rejected, it does not mean you will never be approved for a Home Depot card. There may be other factors in your credit history or finances that could hinder your chances of approval with Home Depot. Make a thorough review of your finances and credit report to figure out how you can improve your chances with your card application.

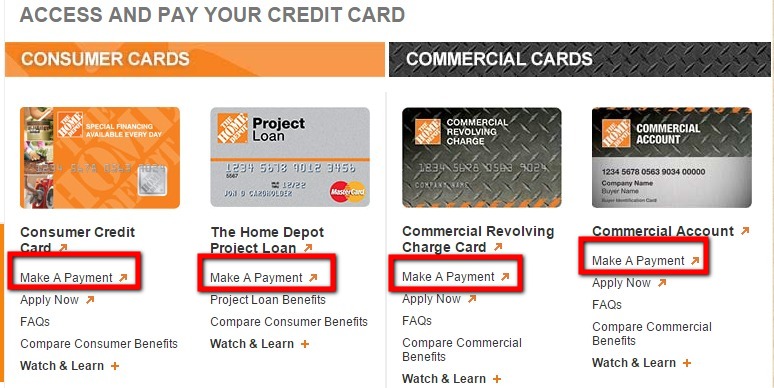

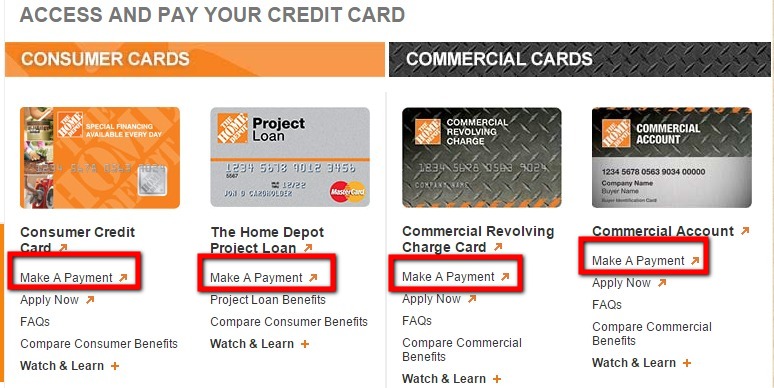

How To Make Payments

When using your credit card, you can make payments either online or through mail. Here’s how you can make payments for your Home Depot Credit Card.

Home Depot Credit Card Payment By Mail

You can use the return envelope and the payment coupon attached to the monthly statement to send payment via mail. However, if you lose your return envelope, there are two alternatives to mail back your payment:

1). Log in to your Home Depot Account online and click on the “Statements” tab from the “Account Activity” menu. You will then be granted access to your statement in PDF format. Print out the PDF file to include the necessary information in your mail.

2). You can also put your payment check in an envelope and write your account number in the memo section. This is so Home Depot knows which account to credit. Mail the envelop to this address: The Home Depot Consumer Credit Card Payments, Home Depot Credit Services, P.O. Box 9001010, Louisville, KY 40290-1010.

Online Home Depot Credit Card Payment

Use your Home Depot login to access your Home Depot credit card account online and make an electronic payment. After logging in to your account, select “Make a Payment” from the “Payments” menu. If you plan to use your savings account or checking account to pay your bill, then you will need to supply your bank account number and an ABA route number. Also, your Home Depot card can be used online to track your account activity, receive exclusive offers, and activate account alerts.

Why Should You Apply For A Home Depot Credit Card?

What are the perks that come with a Home Depot card? Why choose a Home Depot credit card over other special store-issued cards? Here are some reasons that may compel you to get a Home Depot card of your own.

It Offers Special Financing Options

Home Depot provides cardholders with special financing offers for limited periods of time. Some offers you might encounter as a cardholder may include:

- 12 months special funding for on appliances for $299+

- 12 months special funding for installed fences $2,999+

- 12 months special funding for an installed roofs, sidings, windows, insulation, gutters, and sheet protection $5,000+

- 24 months special financing by special order and installed blinds, or shades

- 12 months special funding for riding mowers $899+

You Can Enjoy Exclusive Offers And An Extended Return Period

If you’re a frequent Home Depot shopper, then you can take advantage of the fact that hassle-free returns are offered for one year with the card. This is four times longer than the usual return period for Home Depot purchases. Cardholders can also enjoy exclusive offers, such as a 10% Home Depot discount on a particular brand for a limited period, or 24-month funding offers during special promotions.

Bigger Projects Or Renovations Are Now More Attainable

With a Home Depot Project Loan Card, you can borrow up to $55,000 for major improvement projects at a relatively low APR (7.99% as of July 2019) for up to seven years. Home Depot Project Loan Cards are for financing larger projects, such as kitchen or bathroom remodeling. As such, it can appeal to consumers who do not have access to loans with a lower APR, such as a home equity loan.

New Cardholders Enjoy A Modest Home Depot Discount

As a new Home Depot cardholder, you will receive $25 off your first purchase if you spend up to $999. Similarly, you can enjoy a $100 discount if you spend $1,000 or more when you first receive your card. Additionally, Home Depot regularly runs promotions to encourage cardholders to fund purchases with the card.

Drawbacks

With advantages come some disadvantages to the Home Depot card. Take note of these drawbacks to determine whether or not Home Depot’s credit card is something for you.

Penalties

If you fail to pay your balance before the end of the six-month interest period, you will have to pay all the interest accrued during that time on the entire initial balance. This means that you will pay interest even on the part of your debt that you have already paid.

The limitations for the promotional period are different from regular credit cards, which offer 0% APR for several months. If you still have a balance after the end of these introductory periods, you only pay interest on your outstanding balance.

High Interest Rates

The Home Depot Credit Card interest rate is a range between 17.99% and 26.99% depending on your creditworthiness. But, three of the four levels are over 21% (21.99%, 25.99%, 26.99%). This is towards the high end of the typical spectrum of interest rates for credit cards.

Additionally, its offer of 0% can be a little misleading for some. Do take note that although Home Depot offers 0% interest for its credit cards, it is, essentially, conditional. You can enjoy 0% interest only if you manage to make your payment within the six-month period. Failure to do so will result in paying the full interest rate.

Lack Of Flexibility

As it is only a store card, the Home Depot Credit Card can only be used in Home Depot. Remember that it is not like your regular credit cards despite having similar functions to such cards.

Frequently Asked Questions

What Bank Issues The Card?

Citibank issues out Home Depot’s credit card.

Can You Use Home Depot Credit Cards Anywhere?

The answer is no. As mentioned, Home Depot cards can only be used at Home Depot. Thus, you cannot use it anywhere else. However, Home Depot cards are not limited to physical purchases. You can also use your card on Home Depot’s website, as well as when making purchases from Home Services and Home Depot’s Home Decorators Collection.

Does The Credit Card Come With Discounts?

There may be certain periods during the year when Home Depot gives special discounts on specific goods to cardholders. However, these offers are not guaranteed and are only available for a limited time.

Which Home Depot Credit Card Is Best?

Determining which card is the best depends on what you’re looking for. If you need to make general home purchases, then you might want to go for the Home Depot Consumer Credit Card. It’s the best option for when you are a frequent patron of Home Depot.

Meanwhile, if you are embarking on a large project — like building a new house or pursuing a home renovation — then the Home Depot Project Loan Card will suit you best. It’s good for when you need a card that will help you bring your remodeling projects into fruition.

Simply put, the best Home Depot credit card is whichever one is caters to your needs the most. By figuring out what you need, you will be able to determine which card to apply for.

Does The Home Depot Credit Card Include An Annual Fee?

No. The Home Depot credit cards come with no annual fee.

Can You Pay For Your Card At A Home Depot Store?

No. Your Home Depot card balance payments are not made in-store. Instead, you can make payments online, by mail, or by phone.

For Home Depot Consumer Card

Online: https://citiretailservices.citibankonline.com/

Via mail: The Home Depot® Consumer Credit Card Payments, Home Depot Credit Services, P.O. Box 9001010, Louisville, KY 40290-1010

By phone: 1-866-875-5488

For Home Depot Project Loan Card

By mail: Home Depot Loan Services, P.O. Box 933614, Atlanta, GA 31193-3614

By phone: 1-877-476-3860

What Is The Credit Limit On A Home Depot Card?

The credit limit of a Home Depot credit card is at least $500. Interestingly, maintaining a good credit score with a Home Depot card can also help you with future credit card applications. Though the Home Depot cards slightly differ from typical credit cards, they can still help you build a good credit score in the long run.

What Is The Home Depot Gift Card?

Whereas Home Depot’s credit cards function like credit cards, the Home Depot gift card differs in that it is simply as its name suggests: a gift card. It is a plastic or digital gift card with monetary value. Thus, it can only be used once. You can use these gift cards to make purchases at Home Depot, whether it be at the actual store or online.

Additionally, Home Depot ships gift cards to anyone with a valid street address residing in the United States. Note that the shipping time is dependent on the delivery method that Home Depot uses. It should also be noted that the Home Depot gift card, Mobile Home Depot cards, eGift card, or store credit cannot be used to buy third-party gift cards.

Conclusion

If you are a loyal customer of Home Depot, then consider getting yourself a Home Depot credit card. As a consistent patron, you can benefit from having one of Home Depot’s credit cards, as they can help with some of your many purchases. Think of them as exclusive credit cards that understand you and your home’s needs. They may not be a necessity, but they can definitely be a great asset, especially if you find yourself spending cash at Home Depot more often than not.