Got your first checking account and need to issue a check? There are so many ways that could go wrong when it’s your first time writing a check. Now you’re wondering how to write a check the proper way? Before we get on to the guide on how you can do this error-free, let’s first discuss what a check is, and the different types of checks.

What is a Check?

A check is an official document from a financial institution that mandates a bank to pay a sum of money (indicated on the check) to the payee. The payee’s name is spelled out on the check, and the money is paid by the bank of the payer giving out the check.

There are three principal figures in the transaction: the payee, payer, and the bank. The payee is the beneficiary, receiving the money stated in the transaction. It can either be via cash or deposit to the account of the receiver. The payer is the issuer of the check, and the bank is the financial institution that pays out the required amount. This article discusses how to write a check, but before then, we must explore the types of checks.

Types of Checks

There are various types of bank checks, and we will consider the common types below:

Bearer Check

The bearer of this check is written on the right side of the check. The bearer, however, is not canceled or marked. Bearer in this context means anyone with the check can withdraw it. This factor makes bearer check risky because anyone who finds it can cash it should it be misplaced. Bearer check should be handled with care since banks do not verify the identity of the bearer

Order Check

If the bearer on the check is marked or canceled as opposed to the bearer check, it is known as an order check. Such a check can be encashed by whoever has their name on the check. There are circumstances where another person selected by the payee can encash the check.

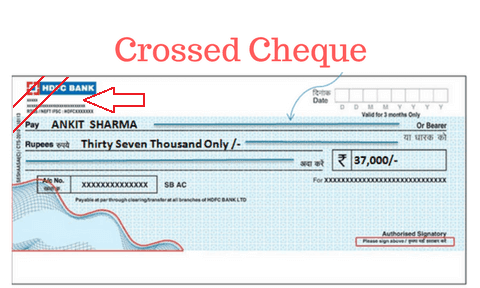

Crossed Check

Checks that have two parallel lines drawn either on the top right or left corner is called a crossed check. Alongside the two parallel lines, words like “Not Negotiable” or “Account Payee” could be written along the parallel lines. This type of check cannot be cashed on the counter.

This is the safest type of check as the amount is usually deposited to the payee’s account. As a result, to encash such a check, the payee must have an account.

Open Check

Also called “uncrossed check”, there are no two parallel lines drawn on it. It can be an order or bearer check and can be encashed on the counter.

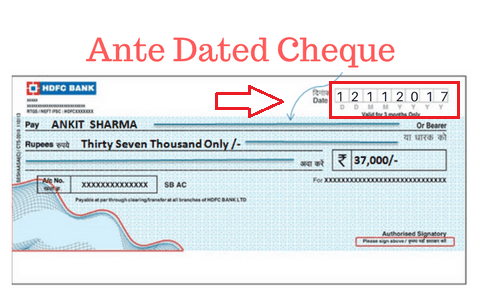

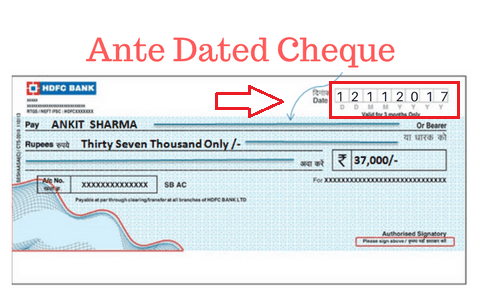

Anti-dated Check

An anti-dated check has an earlier date inscribed on the check than when it was brought to the bank. Such checks are valid for three months, and after that, it becomes invalid. When writing a check, it is vital to have the right date on the check and be sure to cash it before the three-month duration.

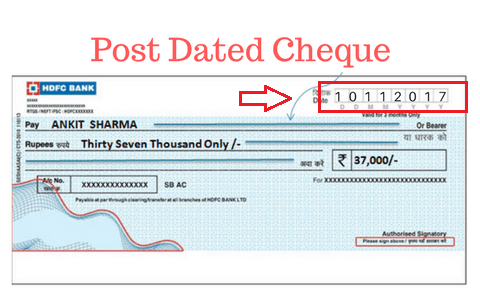

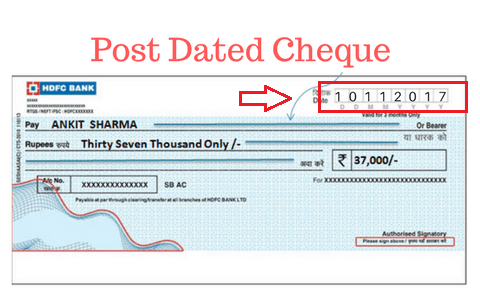

Post Dated Checks

You have a postdated check when there is a future date written on the check. Such a check is created on a mutual agreement between the payer and payee. However, such checks cannot be paid before the date on the check. They become valid only on the date (with a three-month duration) written on the check.

How to Write a Check: Step by Step Guide

The entire process of filling out a check is pretty simple. It is, however, important to get some things right before getting started. This section will help you if you need a guide to take you through writing a check.

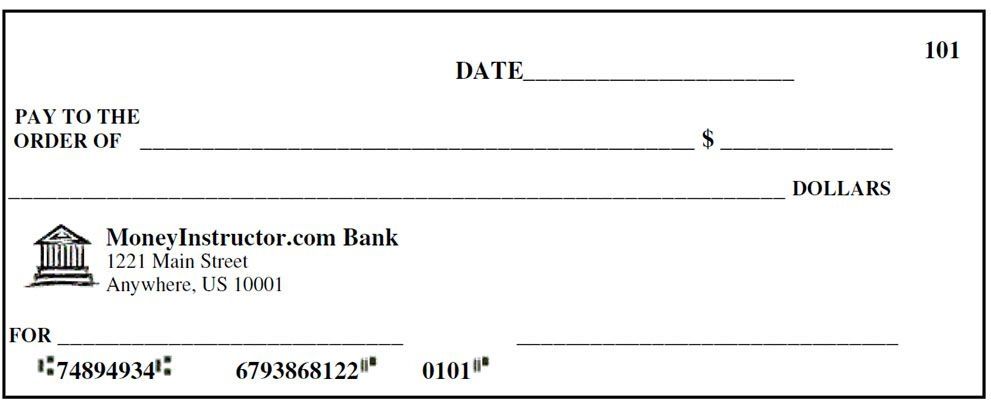

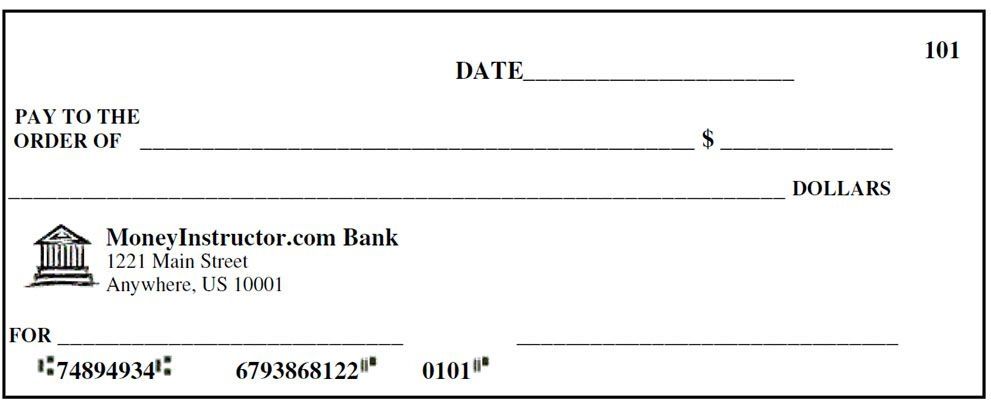

Date

Located near the check number, it is located at the top right corner. This is the portion of the date which should follow this format (DD/MM/YYYY) to avoid confusion.

Many at times, the date of writing the check is what you need. You can, however, post date a check if you are not ready to release the funds. For instance, if you will be with your grandma when your rent is due, a postdated check will come in handy for your house agent or landlord.

Recipient

There is the field marked “Pay to the order of.” This is the portion for the name of the check recipient. It will include both the first name and last name, should it be an individual. For business or organization, the formal name is ideal.

It is important to be careful if you do not know who will cash the check because some people advise writing “cash” in the field. This makes it totally unsafe as whoever gets the check can cash it.

Payment Amount

There are two separate fields that you will have to enter the payment amount. There is an enclosed boxed near the recipient line. This requires the payment amount in numerals. This section requires both dollar and cents amounts.

The line following will also contain the payment amount. You will have to input the change amount numerically if your payment includes a change

Signature

Your signature is one of the most important parts of your check. You will have your signature on the bottom right corner on the right.

How to Sign a Check

Make sure that your signature is legible. Also, your signature should be what you have on record at the bank. This is essential to validate a check. As we grow old, our signature could change gradually. Watch out for this.

Memo (optional)

Though optional, writing on the memo section is a good idea for record purposes. When paying workers via check, for instance, the month you are paying for should be clear on the memo. This avoids confusion. If you have a check for IRS, you need to input the tax year you are paying. This is important for accurate record keeping.

How to Write a Check with Cents

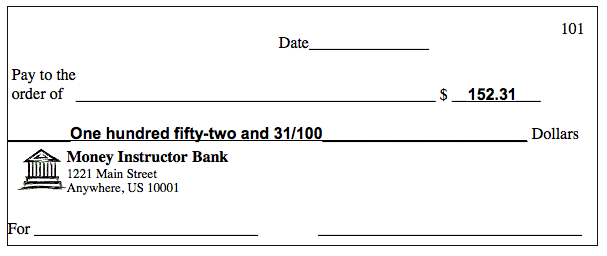

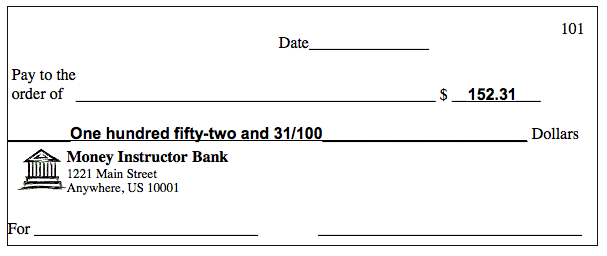

Let us assume you need to write a check of one hundred and fifty-two dollars and 31 cents, there are two steps.

We have the check sample above to explain this. There are two basic processes.

- Write the amount in numbers, the same way you want it (152.31)

- Write the amount in words, as shown above.

There is the dollar box located in the right side corner of the check. Next to the dollar sign, you will have input 152, followed by a decimal and 31.

You also have steps to write the check amount in words:

- Fill out the dollar amount.

- Include the word “and”

- Write out the number of cents.

Now, here is the tricky part, the number of cents which should be inputted in fraction format. You need simple mathematics here. All you will do is write the cents amount, follow by a slash and write 100. Still using the check format above, you will write (everything on the same line):

- One hundred and fifty-two dollars

- And

- 31/100

This is how to write a check with cents.

Some Precautions When Filling Out a Check

In filling out a check, it is essential to be careful. Writing a check seems like a simple process. There are, however, many things that could go wrong.

A costly mistake while filling out a check can cost you a lot of money. As a result, you need to be confident you know how to write a check before doing that. This section will explore important points to keep in mind while writing a check.

Avoid leaving Spaces Between Numbers and Words.

This is very important when filling the check. Whatever you will write on the check, be it name or amount, do not leave an excessive gap. This is to avoid anyone adding an extra number or alphabet, which could change the check entirely.

Imagine you have a check to PAUL JAMES. If you have too much space between PAUL and JAMES, it could look like this “PAUL JAMES.” This gives anyone the chance to have an extra A after Paul, changing the name to “PAULA JAMES or PAUL A JAMES.” This will be difficult if you have a single space between Paul and James.

Always Cross the Check With “A/C Payee”

In case you want to pay someone and it is important to you that the money goes into the person’s bank account, there should be a double-cross line on the left top corner. Also, write “Account Payee” or A/C Payee.” With this, the money only goes to the recipient’s bank account, not cashed at the counter.

Add a “dash or line” after the name and amount until the end.

A check is a pretty sensitive document. Fraudsters can take advantage of loopholes and cash checks if mishandled. This is a pretty important point you should take note when learning how to fill out a check. After writing your name and amount on the check, add a running dash like this “———————-.” Make it as long as possible, as the idea is to ensure that no one will add anything after the name or amount.

Cancel the Word “Bearer”

Looking closely at the check-in, the “Pay” section, you have the space for the name. On the right corner as well, there is the word “Or Bearer.” This authorizes either the person whose name appears on the check or anyone bearing the check (whose name is not necessarily on the check) to cash it.

For extra safety of your check, make sure you cancel out the “bearer.” You can, however, leave it if you do want it.

After the amount, add the sign “/-”

This is small and could be insignificant but still important. Writing a check this way, however, makes a lot of sense and could save you a lot. Consider these amounts: $4,500 and $4,500/-. You can add more numbers behind the first one depending on the space available, and there is nothing you can do with the second one. Take note!

Keep the Check details.

After writing a check, you should put down some important information for record purposes. Information like account name, check number, amount and the date issue, etc. This information is essential should you need to cancel the check.

How To Fill Out Your Check Register

Even if you know how to fill out a check, you should also properly understand the importance of a check register. For accountability purposes, you should know how to track your spending. This boils down to filling your check register.

Your check register shows a record of all the checks you have written. It gives you a record of the checks you have handed out, keeping a tab on the cleared ones, and your available balance. This way, you can keep a tab on your balance and also avoid expensive fees on your account.

Immediately after issuing a check, be sure to record the transaction in the register. This will help you avoid forgetting any detail.

How to Complete Your Check Register

It is not complete to learn how to write a check alone. You should also know how to complete a check register. We have the following step-by-step guide on how to complete a check register.

Step 1: The first line should include your starting balance. This is the same with your checking account balance. There are two boxes – a big one and a small one. Each one will have a dollar amount and the cent amount respectively.

Step 2: for the next line, input the check number

Step 3: input the date you post the check-in in the appropriate column alongside the recipient (person or company). This will go to the transaction description column. You should also have the check amount in the debit column.

Step 4: this is the point for creating a new balance in the balance column. You will subtract the check amount from the balance. This balance will not be the same as what you have on your account or via ATM. This is because you are yet to clear the check.

Make sure you repeat this process for every transaction, every check you issue, except it is a void check. With this, you can keep tabs on what is going on in your account.

Step 5: on getting your bank statement at the end of the month, take note of the checks and transactions that have been cleared from your account. In the checkmark column, add a mark.

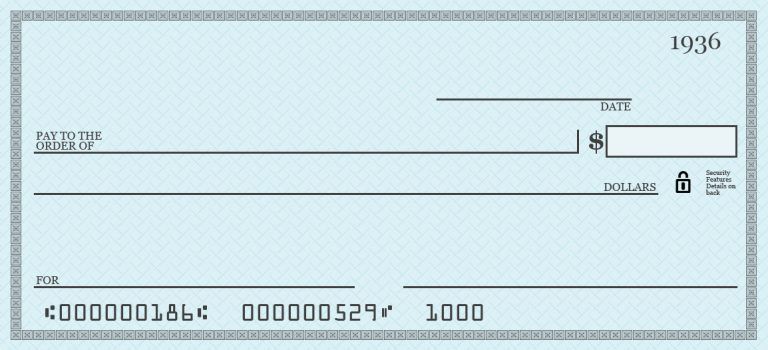

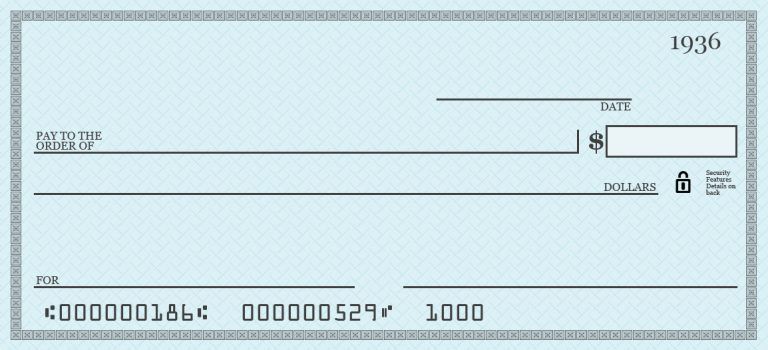

The Numbers Printed on Your Checks

There are some sets of numbers printed on every check. These numbers are present on every personal check, and some run along the bottom of the check. There are three numbers on the check:

Bank Routing Number: this is a nine-digit number that represents the exact bank in charge of your checking account. There are other information that can be revealed via the bank routing number. This is the first number on the check.

Account Number: This, most of the time, is the second number, which stands for the checking account number.

Check Number: this is the last number on the check. It must correspond to the check number inscribed on your check – the top right corner.

These numbers must be visible, clear, and intact when you send the check for payment. The numbers are essential to process the check. Banks have machines designed to read these numbers, so if any number is not clear, it will be rejected. If you tamper your check with staplers, tears, or holes, the bank will not be able to read the check. This could cause a bounced check.

How do you Write a Void Check?

There are times your employers might need a voided check. They need this to process direct deposits, automatic bill payments, and direct withdrawals. One of the advantages is to access the right account and also process the transaction without errors.

Writing a void check is not a complicated process. All you need to do is write “VOID” boldly in big amounts over the middle of the check. Also, you can write void as many times as possible in other parts of the check. This will help pass the message across that the check is invalid.

Common Mistakes When Filing a Check and What to Do

- There are times the written amount in a check will not match the amount in the figure. The bank can either accept only the written amount or return the check. Should the bank accept it, they will contact a customer to issue a change.

- There are times customers make a mistake with the date as well. The wrong date could be intended or unintentional. They usually return such checks.

- Also, if the signature on file does not match the one on the check, the bank might question the authenticity of the check.

- Checks that appeared to have been tampered with, altered, written with different colored ink, multiple handwriting styles, etc., will be returned.

Conclusion

If you need a detailed guide on how to write a check, we believe that this article has done justice to the topic. Check is a pretty sensitive document that must not get into the wrong hands. We have examined how to properly fill a check and block every loophole that fraudsters might want to take advantage of.