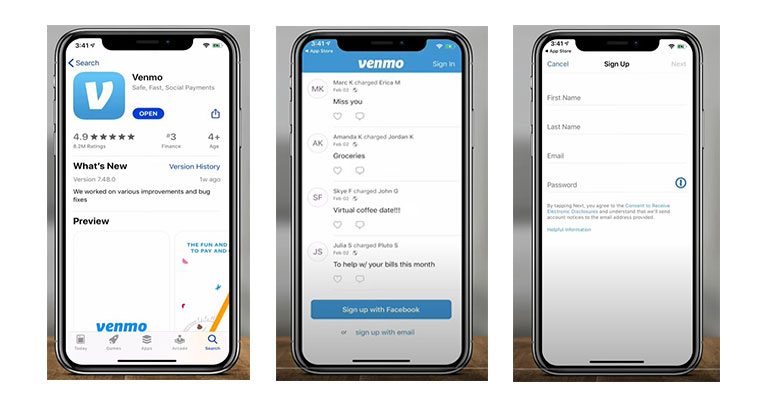

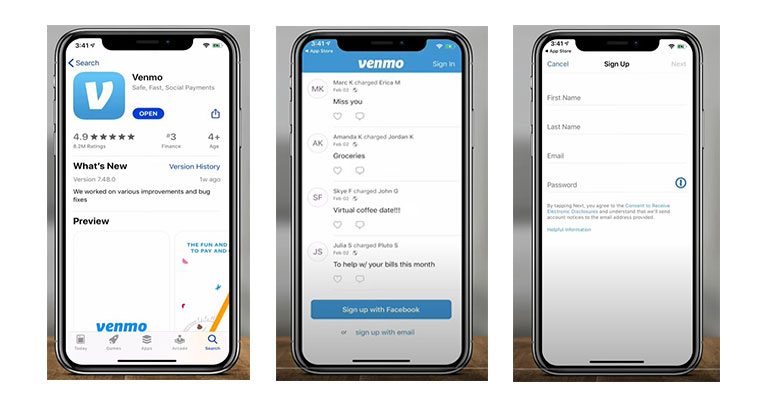

The evolution of technology has provided us with not just innovations, but a number of convenient alternatives in our daily lives as well. This is especially so when it comes to cashless transactions, thanks to mobile payment apps such as Venmo. Much like other typical payment apps, Venmo continues to be a go-to option when it comes to cashless payments.

If you’re unfamiliar with Venmo and how it works, then fret not. Read on to learn more about the app, from how it works to why you should try it out in the first place.

What is Venmo?

Venmo is one of the top existing digital wallets that allows you to share and make payments with other people. Its primary aim is to offer a more social method of settling payments, particularly if you prefer cashless transactions.

In other words, Venmo is a peer-to-peer payment app that’s accessible on Android phones and iPhones. It offers an effortless and fast direct exchange of money between you and other people. It’s especially beneficial today, when cashless payments have become more commonplace.

Why Go Cashless?

Going cashless offers a number of advantages. For starters, it provides convenience when making payments, as it eliminates the need for carrying physical money in the first place. That way, you have more security with your cash. This can additionally help you learn how to save money, as you won’t have to withdraw more than you actually need.

Furthermore, going cashless helps keep your finances more secure, as you won’t be physically bringing your money with you everywhere you go. Cashless payments are also more hygienic since it makes do without physically handling money. A number of businesses also make use of cashless payments, so it’s an excellent option for when you want to manage your payments with ease.

Is Venmo Safe?

The Venmo app makes use of bank-level data encryption and security to protect and guard your account against illegal transactions. User information is stored in secure servers to keep client payment information safe. For extra security, Venmo offers another option for you to create a touch ID and pin to log in to the app as an alternative as well.

Furthermore, users are provided with privacy settings that they can adjust in case they want to keep their transactions private from others to view. A user’s account can also be searched via email address or phone number. However, this can be toggled on or off depending on your preferences.

As is the case with most internet-connected applications, Venmo is not completely exempted from security breaches. In fact, Slate reported of previous security breaches and the criticism Venmo faced in light of how they handled the situation. Similarly, Venmo users are not immune to scams, either. Therefore, it is recommended that you only keep an adequate amount of funds in your account. Try to avoid keeping large quantities of money in your Venmo balance. After all, this is a money-sharing app, not an online bank account.

Nevertheless, don’t let these factors hinder you from using Venmo. No money exchanging app is perfect, but Venmo continues to be one of the top choices you can opt for today.

How Does Venmo Work?

As a mobile app, Venmo is simple to use. Users can link their bank account in order to use the app as a platform for making payment or transferring funds. Additionally, it allows users to to link their credit or debit card as well, in case they prefer this alternative.

When it comes to making transactions, there are no additional fees when it comes to transactions made via bank account, debit card, or Venmo balance. On the other hand, transactions made via credit card involve an additional 3% fee, which is the standard.

Adding funds to your account isn’t necessary when making transactions. However, if someone is sending you money via Venmo, then you will be required to request a withdrawal of those funds. Typically, the money transferred to your account reflects on the next business day. You need not worry about keeping your transactions safe, as Venmo uses encryption to keep all your app data secure.

Notably, the app’s straightforward and fast interface makes transactions smooth and easy to make. It also has another impressive feature that allows you to easily keep track of all your payments in a similar way to that of a mobile banking application.

One factor to take note of is accessibility. Venmo is only available in the US, which may be a significant drawback for international transactors.

How Does Venmo Make Money?

Venmo makes money through two particular fees:

Through Credit Card

As mentioned, you will not incur any additional fees if you make transactions with your Venmo balance, bank account, or debit card. However, if you send money with your credit card, your account will be charged 3% on the total transaction you make.

Merchant Fees

Because PayPal owns Venmo, it has the opportunity to make money via credit card transactions and merchant fees. Any merchant that receives credit via PayPal typically offers Venmo as a payment option as well. These merchants also pay the standard percentage of 2.9% with the fixed charges that would have been paid to PayPal. This combination is advantageous for merchants who use Venmo as a payment platform, as it allows them to use Venmo’s social media feature without any additional fee. Ultimately, this can become a great benefit for merchants, as having social media on their side can help bring their business to a much larger audience.

How to Use Venmo

In case you don’t have a Venmo card, there are other ways to go about adding funds to your account.

How to Add Funds to Your Account via Mobile App:

- Log into the Venmo app.

- Choose “Menu” at the top left corner.

- Click the “Manage Balance” option, which is next to your balance amount above the menu.

- Click “Add Money.”

- Type the desired amount you wish to add to your Venmo account. Then, click “Done.”

- Confirm the bank account you’ll be adding the money from, and then click “Next.”

- Crosscheck the transfer information provided. Finally, click “Add Money.”

Completion of funds transfer usually takes three to five business day.s Do take note that once you’ve confirmed and clicked on “Add Money,” the transaction is considered final and thus cannot be cancelled.

How to Add Funds to Your Account via Website:

- Visit the Venmo website.

- Log in with your account details.

- You will be sent a code to your mobile number. This is to confirm your identity upon accessing your account. Enter the sent code in the provided space. This will lead you to your homepage.

- Type in vemo.com/add funds into your search bar, then click enter. This will open a box labeled “Add funds from your bank account.”

- Inside that box, enter the amount you want to transfer. Then, if applicable, choose the bank account you wish to add the money from.

You should note that to add money successfully, you must first verify the bank account you want to use with Venmo. - After you have entered the amount, transfer and choose the account you want to add money from.

- Press “Transfer money into Venmo.” Next, you will need to confirm the transaction. After that, press “Confirm & Add Funds.”

You should be able to access the money added into your account after three to five business days.

It’s worth noting that there is a Venmo limit that determines the amount you can receive and send with each of the account types. You can make up to 30 transactions a day, and users have a sending limit of up to $2,999.99 per week on a rolling basis.

How to Cash Out From Your Account

Before you can successfully cash out Venmo funds and transfer them to your bank account, you will need to link your bank account to Venmo first and foremost.

To link a bank account to your Venmo account:

- Click the Link Bank Account button.

- Select the Bank from the list.

- Input your login credentials.

If your bank is not on the first list, select others from the bottom. If you select this option, you will need to add your account number and routing number.

From here, the next step is to confirm your bank account. Some banks are enabled to make instant process verification. If your bank is among them, simply input your bank details to confirm your account.

Instant Confirmation

If your bank does not confirm instantly, you can confirm by verifying micro-transfers. Just input your account details, then visit Venmo’s Bank Verification page to input the amount you want to transfer. After that, you will be allowed to transfer money into the bank you selected from your Venmo account.

If you have confirmed your identity, you can send up to $19,999 a week from Venmo. Transfers to a bank account usually take a full business day before they are reflected. Likewise, they normally show in your bank account as a deposit.

When you make a purchase, the app will use your Venmo balance at default unless otherwise specified. If the amount does not cover all your purchases, Venmo will cash-out the entire amount from the linked bank account.

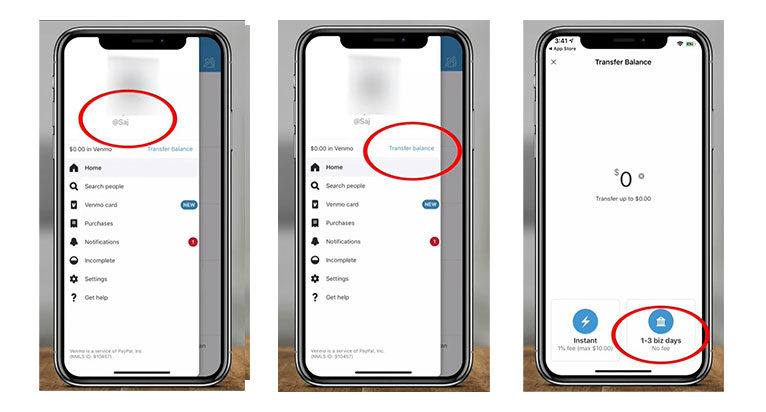

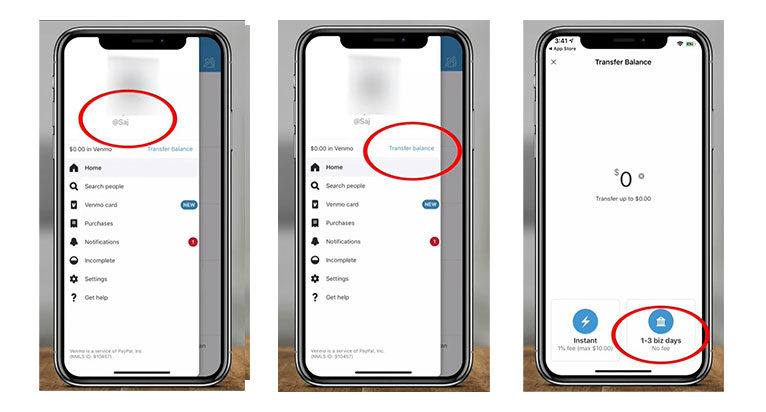

To transfer money from your Venmo account:

- Tap the icon at the top left corner. It will show up like this (☰).

- Select “Transfer to Bank” from the menu options.

- Select the amount you would like to transfer.

- Click the transfer button.

- When completed, choose the “Confirm Transfer to Bank” icon.

How to Pay Someone on Venmo

Before you can pay someone through Venmo or transfer funds with the app, your account must first have funds to begin with. When a Venmo user sends you money into your account, the funds will remain there until you cash out to a different source.

The cash in your Venmo account is referred to as your Venmo balance. Users can use it to pay a recognized merchant or make a payment to someone.

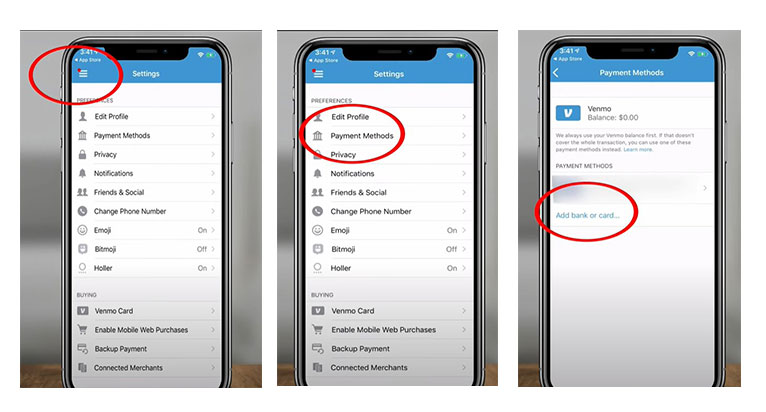

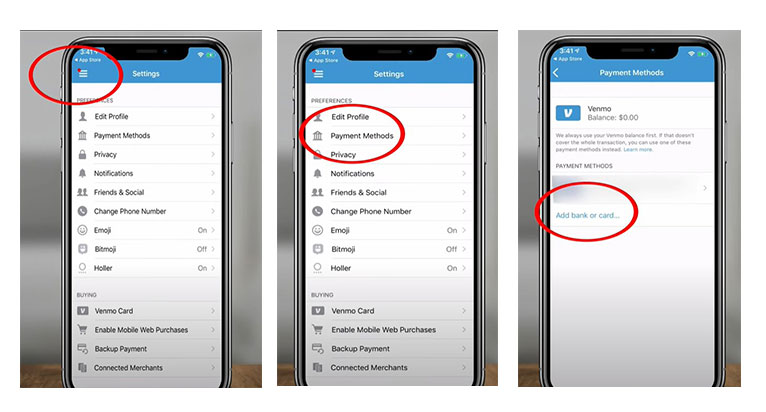

To make a payment to another source, you will need to add the source to your Venmo account. You can do so by following these steps:

- Log into your Venmo app.

- Select the icon at the top left-hand of the application

- Click “Settings.”

- Click the “Payment Methods” option under “Preferences.”

- Choose to add a bank or card under the payment methods.

About the Payment options:

Venmo offers you different options when it comes to making payments to friends and other online transactions. It allows users to set up their payment option of choice when they purchase or pay for the first time.

To select an automatic payment source from the app:

- Open the app on your smartphone.

- Select the icon at the top left-hand of the app.

- Click on “Settings.”

- Choose “Backup Payments.” You can also choose “Cards” or “Add Banks.”

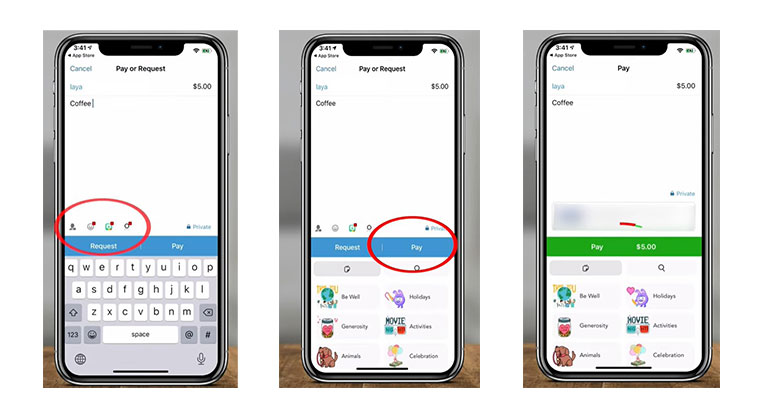

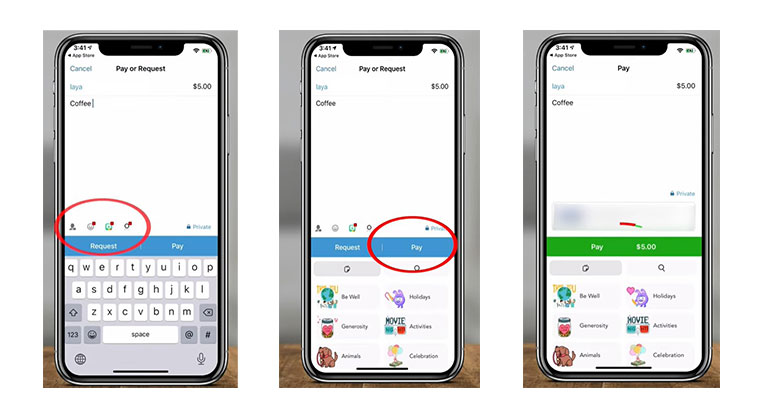

To pay through Venmo:

- Open the app on your smartphone.

- Select the payment option at the top right-hand corner.

- Choose the person you want to pay from your list of Venmo contacts, or add a recipient. You can add recipients by their Venmo phone number, username, or email. Alternatively, you can scan user’s QR code as well.

- Add the payment amount and you’re done.

Making Payments to Merchants

Before you can make payments to merchants, you must first opt-in on Venmo. Afterwards, making online purchases will be a breeze.

To opt-in:

- Open the Venmo app on your smartphone.

- Select the icon at the top left-hand of the app.

- Click “Settings.”

- Select “Connect Browsers.”

- Confirm your NATIVE smartphone. If you use iOS, it is Safari. On the other hand, if you use Android devices, it is Google Chrome.

To make the merchant purchase via smartphone, you will see a Venmo or PayPal button. Click on either one to settle your payment.

Venmo for Business

Venmo might not be for everyone, but there’s no denying that it is a convenient tool to have if you’re running a business yourself. Since it provides an easy way to transfer funds, it proves to be an asset when used in business transactions.

Interestingly, when transactions are made on Venmo, they are later reflected on a user’s feed as well as on the feeds of other parties involved in the transaction. This notification, however, will not appear if a user has deactivated this feature in their settings.

In any case, the showcase of business transactions via user feed is advantageous in that it shows how active your business is in that point in time. This alone can be a viable strategy in advertising your own business. As a result, you may be able to attract even more customers to your business.

Other benefits to using Venmo for business include:

- It’s a good platform for marketing your business.

- Payment processing is fast.

- You can connect with customers with ease and efficiency.

- It’s safe to use for your business.

In Conclusion

All in all, Venmo is a great tool to have, either as something for your business, or simply for everyday transactions. Cashless transactions are becoming more and more prominent. Thus, considering all the benefits, paying online and via apps should be a no-brainer by now. When it comes to quick and easy transactions between friends or even business contact, it’s clear that Venmo is the way to go.