Researching Xiaomi Company

Before delving into the world of stock trading, it's crucial to conduct thorough research on the company in which you plan to invest. Xiaomi, a prominent player in the technology industry, has garnered attention for its innovative products and rapid growth. To make informed decisions about purchasing Xiaomi shares, it's essential to gain a comprehensive understanding of the company's background, performance, and future prospects.

Begin by exploring Xiaomi's corporate history, including its founding, key milestones, and evolution within the tech sector. Understanding the company's journey can provide valuable insights into its resilience, adaptability, and potential for sustained success.

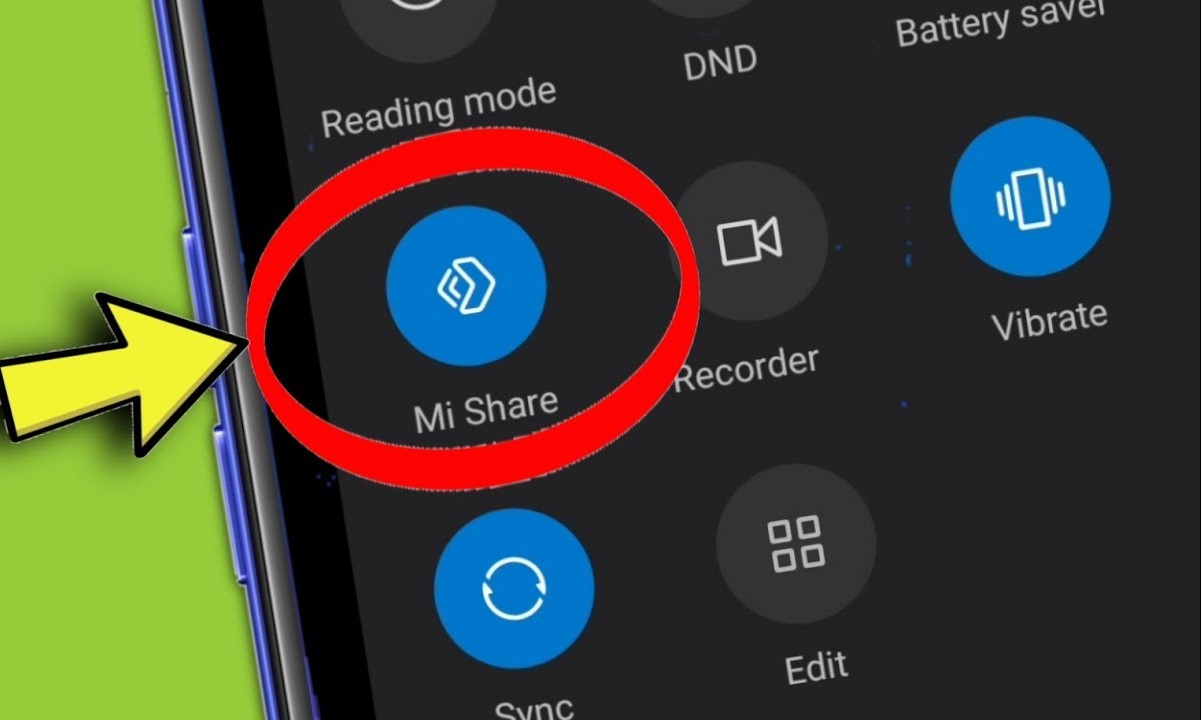

Next, delve into Xiaomi's product portfolio and industry positioning. Analyze its range of offerings, such as smartphones, smart home devices, and IoT solutions, to gauge the company's diversification and relevance in the market. By assessing Xiaomi's competitive advantages and market share, you can ascertain its ability to withstand industry dynamics and capitalize on emerging opportunities.

Furthermore, scrutinize Xiaomi's financial performance and growth trajectory. Evaluate key financial indicators, including revenue trends, profitability, and cash flow dynamics. By examining Xiaomi's financial health, you can gauge its capacity for sustained expansion and profitability, which are pivotal factors influencing stock valuation.

Additionally, stay abreast of Xiaomi's strategic initiatives and future prospects. Keep an eye on the company's R&D investments, partnerships, and expansion strategies, as these elements can offer insights into its long-term growth potential and competitive positioning within the tech landscape.

Moreover, it's advisable to monitor industry trends, market sentiment, and analyst recommendations related to Xiaomi. By assimilating diverse perspectives and market insights, you can refine your understanding of Xiaomi's standing in the tech sector and anticipate potential market shifts that could impact its stock performance.

In essence, researching Xiaomi comprehensively entails delving into its corporate journey, product landscape, financial performance, strategic direction, and broader market dynamics. By equipping yourself with a holistic view of Xiaomi, you can make well-informed decisions when considering the purchase of Xiaomi shares.

Understanding the Stock Market

Navigating the stock market is akin to embarking on a captivating journey filled with opportunities and risks. To venture into the realm of stock trading, it's imperative to comprehend the fundamental dynamics of the stock market and the factors that influence stock prices. This understanding forms the bedrock for making informed investment decisions, including the purchase of Xiaomi shares.

At its core, the stock market serves as a platform where individuals and institutions can buy and sell shares of publicly traded companies. This exchange of shares occurs through stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, which provide the infrastructure for trading securities. Understanding the mechanics of stock exchanges, including trading hours, order types, and regulatory frameworks, is essential for navigating the landscape of stock trading effectively.

Stock prices, the heartbeat of the market, are influenced by a myriad of factors, reflecting the dynamic interplay of supply and demand. Market participants, ranging from individual investors to institutional entities, collectively shape stock prices through their buying and selling activities. Factors such as company performance, economic indicators, geopolitical events, and investor sentiment contribute to the fluctuation of stock prices, underscoring the dynamic nature of the stock market.

Moreover, comprehending the different types of stocks is pivotal in formulating an investment strategy. Common stock, preferred stock, and growth stocks each exhibit distinct characteristics, risk profiles, and potential for returns. Understanding these variations empowers investors to align their investment objectives with the appropriate stock categories, thereby optimizing their portfolio composition.

Furthermore, delving into stock market indices, such as the S&P 500 and the Dow Jones Industrial Average, offers insights into broader market trends and performance. These indices serve as barometers of market health, reflecting the collective performance of constituent stocks and providing valuable benchmarks for evaluating investment returns and market movements.

In essence, understanding the stock market entails grasping the dynamics of stock exchanges, comprehending the factors influencing stock prices, discerning the nuances of stock types, and leveraging market indices for insights. Armed with this knowledge, investors can navigate the stock market with confidence and prudence as they contemplate the potential purchase of Xiaomi shares.

Choosing a Stockbroker

Selecting a stockbroker is a pivotal decision that profoundly influences your stock trading experience. A stockbroker serves as your gateway to the stock market, facilitating the execution of trades and providing essential guidance. When embarking on the journey of purchasing Xiaomi shares, the process of choosing a stockbroker warrants meticulous consideration and evaluation.

First and foremost, it's imperative to assess the range of services offered by different stockbrokers. Some brokers provide comprehensive platforms with robust research tools, educational resources, and personalized advisory services, catering to both novice and seasoned investors. Others may offer streamlined, no-frills platforms suitable for self-directed traders. By aligning your investment needs and preferences with the services offered, you can identify a stockbroker that complements your trading style and objectives.

Furthermore, evaluating the cost structure of stockbrokers is paramount. Factors such as commission fees, account maintenance charges, and inactivity fees can impact the overall cost of trading. For investors considering the purchase of Xiaomi shares, it's prudent to seek a stockbroker with competitive pricing and transparent fee structures, ensuring that trading costs remain conducive to your investment strategy.

In addition to cost considerations, the reliability and security of a stockbroker's trading platform and infrastructure are critical. Ensuring that the chosen stockbroker adheres to stringent security protocols, employs robust encryption measures, and provides seamless trade execution is essential for safeguarding your investment activities and sensitive financial information.

Moreover, the accessibility of customer support and the quality of service are pivotal factors in selecting a stockbroker. A responsive and knowledgeable support team can provide invaluable assistance in navigating trading platforms, addressing technical issues, and resolving inquiries promptly. Prioritizing stockbrokers renowned for their customer-centric approach can enhance your overall trading experience and instill confidence in your investment endeavors.

Lastly, evaluating the compatibility of a stockbroker's trading platform with your devices and operating systems is crucial. Whether you prefer web-based platforms, mobile apps, or desktop software, ensuring that the chosen stockbroker offers a seamless and intuitive trading interface aligns with your preferences and facilitates efficient trade execution.

In essence, choosing a stockbroker involves a comprehensive assessment of services, cost structures, platform reliability, customer support, and technological compatibility. By meticulously evaluating these factors, investors can identify a stockbroker that aligns with their trading needs and empowers them to pursue the purchase of Xiaomi shares with confidence and efficiency.

Opening a Trading Account

Opening a trading account marks a pivotal juncture in the journey of engaging with the stock market. This process serves as the gateway to executing trades, enabling investors to participate in the dynamic realm of stock trading. Whether you are considering the purchase of Xiaomi shares for the first time or expanding your existing investment portfolio, the process of opening a trading account entails several essential steps.

To commence this process, individuals typically engage with a brokerage firm or an online trading platform. These entities facilitate the establishment of trading accounts, offering diverse account types tailored to the unique needs and preferences of investors. Common account classifications include individual accounts, joint accounts, retirement accounts, and custodial accounts, each catering to specific investment objectives and regulatory requirements.

Upon selecting the preferred account type, prospective investors are required to furnish personal information and financial details for the account setup. This typically includes providing identification documents, such as a driver's license or passport, as well as proof of address and financial information. These measures are in place to comply with regulatory standards and ensure the integrity and security of the trading account.

Subsequently, investors are presented with the option to fund their trading accounts, enabling them to allocate capital for future investment activities. This funding process encompasses various methods, including bank transfers, wire transfers, and electronic fund transfers, allowing investors to deposit funds into their trading accounts seamlessly. By funding the trading account, investors position themselves to execute trades promptly and capitalize on market opportunities effectively.

Furthermore, the process of opening a trading account often involves the completion of account agreements and disclosures, which outline the terms and conditions governing the use of the trading platform and the execution of trades. These agreements encompass crucial aspects such as account maintenance, trading policies, and fee structures, providing investors with comprehensive insights into the operational parameters of their trading accounts.

In essence, opening a trading account embodies a pivotal milestone in the realm of stock trading, enabling investors to establish a foundational platform for executing trades and engaging with the stock market. By navigating the account setup process diligently and adhering to regulatory requirements, investors can position themselves to embark on the journey of purchasing Xiaomi shares with confidence and prudence.

Funding Your Trading Account

Funding your trading account is a pivotal step that empowers you to actively engage in the dynamic landscape of stock trading. By allocating capital to your trading account, you position yourself to seize market opportunities promptly and execute trades efficiently. Whether you are contemplating the purchase of Xiaomi shares or diversifying your investment portfolio, the process of funding your trading account encompasses essential considerations and practical steps.

Upon establishing your trading account, you gain access to a range of funding options tailored to your convenience and preferences. Bank transfers, a widely utilized method, enable seamless transfer of funds from your bank account to your trading account, facilitating swift availability of capital for investment activities. Similarly, electronic fund transfers offer a streamlined approach, allowing you to allocate funds electronically and expedite the funding process. Additionally, wire transfers present an alternative avenue for funding your trading account, providing a secure and reliable mechanism for transferring larger sums of capital.

As you contemplate funding your trading account, it's imperative to evaluate the timing and quantum of your capital allocation. Assessing your investment objectives, market conditions, and potential trading opportunities can inform your funding decisions, enabling you to optimize the allocation of capital based on prevailing market dynamics. By exercising prudence and strategic foresight in funding your trading account, you position yourself to capitalize on favorable market movements and navigate volatility effectively.

Furthermore, the process of funding your trading account necessitates a keen awareness of transaction fees, funding timelines, and deposit limits associated with your chosen brokerage firm or trading platform. Familiarizing yourself with these parameters empowers you to navigate the funding process with clarity and efficiency, ensuring that your capital allocation aligns with your investment strategy and trading objectives.

In essence, funding your trading account represents a pivotal stride in the realm of stock trading, enabling you to infuse your trading account with the capital necessary to execute trades and pursue investment opportunities. By leveraging diverse funding methods, exercising strategic foresight, and navigating funding considerations diligently, you position yourself to embark on the journey of purchasing Xiaomi shares and engaging with the stock market with confidence and prudence.

Placing an Order to Buy Xiaomi Shares

Once you have conducted thorough research on Xiaomi, gained a comprehensive understanding of the stock market, selected a suitable stockbroker, opened a trading account, and funded it, you are now poised to embark on the pivotal step of placing an order to buy Xiaomi shares. This process encapsulates the culmination of your preparatory efforts and marks the initiation of your investment journey in Xiaomi, a prominent player in the technology industry.

To initiate the purchase of Xiaomi shares, you will navigate the trading platform or interface provided by your chosen stockbroker. Within this platform, you will encounter the order placement module, which empowers you to specify the details of your purchase order. Here, you will be prompted to input essential parameters, including the stock symbol for Xiaomi, the quantity of shares you intend to purchase, and the type of order you wish to place.

When specifying the quantity of Xiaomi shares for purchase, it's imperative to align your decision with your investment objectives, risk tolerance, and available capital. Whether you opt for a modest position to initiate your investment in Xiaomi or seek a more substantial allocation to bolster your portfolio, exercising prudence in determining the quantity of shares is pivotal in aligning your investment strategy with your financial capacity and risk appetite.

Moreover, the type of order you select profoundly influences the execution of your purchase. Market orders, characterized by their immediacy and execution at prevailing market prices, enable swift acquisition of Xiaomi shares, albeit subject to potential price fluctuations. Conversely, limit orders afford you greater control over the purchase price, allowing you to specify a price threshold at which you are willing to buy Xiaomi shares, thereby facilitating precision in your purchase execution.

As you finalize the details of your purchase order, it's essential to review and confirm the accuracy of the input parameters, ensuring that your order aligns with your investment strategy and purchase intentions. This meticulous review process serves as a safeguard against inadvertent errors and reinforces the precision and integrity of your purchase order.

Upon confirmation, your purchase order is transmitted to the stock exchange or trading venue for execution, marking the culmination of your proactive decision to acquire Xiaomi shares. As your order traverses the execution process, you are positioned to become a shareholder in Xiaomi, aligning your investment portfolio with the innovative trajectory and growth potential of this esteemed technology company.

In essence, placing an order to buy Xiaomi shares embodies a pivotal juncture in your investment journey, encapsulating the culmination of your preparatory efforts and the initiation of your investment position in Xiaomi. By navigating the order placement process diligently and aligning your purchase decisions with your investment objectives, you position yourself to engage with the stock market confidently and embark on a compelling investment venture in Xiaomi.

Monitoring Your Investment

Monitoring your investment in Xiaomi shares is a dynamic and essential aspect of your engagement with the stock market. As you embark on this investment journey, vigilantly tracking the performance of your Xiaomi shares empowers you to make informed decisions, seize opportunities, and navigate market fluctuations effectively. This ongoing monitoring process encompasses several key elements that are integral to optimizing your investment experience and fostering a proactive approach to wealth management.

Tracking Stock Performance

Regularly tracking the performance of Xiaomi shares is fundamental to gauging the trajectory of your investment. By monitoring stock price movements, daily trading volumes, and overall market sentiment towards Xiaomi, you gain valuable insights into the dynamics shaping the value of your investment. Utilizing stock charts, price alerts, and market news, you can stay abreast of developments that impact Xiaomi shares, enabling you to respond promptly to market shifts and capitalize on favorable opportunities.

Assessing Company Developments

Staying informed about Xiaomi's corporate developments and strategic initiatives is pivotal in evaluating the long-term prospects of your investment. Monitoring quarterly earnings reports, product launches, and strategic partnerships provides visibility into Xiaomi's performance and growth trajectory. Additionally, analyzing industry trends, technological advancements, and competitive positioning within the tech sector equips you with a comprehensive understanding of the factors influencing Xiaomi's prospects and stock performance.

Rebalancing and Portfolio Optimization

As you monitor your investment in Xiaomi shares, it's essential to assess its impact on your overall investment portfolio. Evaluating the allocation of assets, diversification strategies, and risk exposure enables you to optimize your portfolio composition. Periodically rebalancing your portfolio, considering factors such as sectoral exposure and asset allocation, ensures that your investment in Xiaomi aligns with your broader wealth management objectives and risk tolerance.

Leveraging Research and Analysis

Engaging with research reports, analyst recommendations, and market insights offers valuable perspectives on Xiaomi's performance and growth potential. Leveraging fundamental and technical analysis enables you to refine your investment thesis, assess the intrinsic value of Xiaomi shares, and identify potential catalysts or risks that could influence your investment. By integrating diverse research sources into your monitoring process, you enhance your capacity to make informed decisions and adapt to evolving market conditions.

Adapting to Market Dynamics

In the dynamic landscape of the stock market, adaptability and responsiveness are paramount. Monitoring your investment in Xiaomi shares equips you to respond to market volatility, industry disruptions, and macroeconomic shifts effectively. By remaining attuned to market dynamics and proactively adjusting your investment strategy, you position yourself to navigate challenges and capitalize on opportunities, thereby enhancing the resilience and performance of your investment in Xiaomi.

In essence, monitoring your investment in Xiaomi shares embodies a proactive and iterative process that empowers you to optimize your investment experience, adapt to market dynamics, and make informed decisions. By integrating comprehensive monitoring practices into your investment journey, you cultivate a robust foundation for wealth management and position yourself to navigate the complexities of the stock market with confidence and agility.