Connecting Your Bank Account to PayPal

One of the first steps to withdrawing money from PayPal is to link your bank account to your PayPal account. This allows you to transfer funds between PayPal and your bank account seamlessly. Here’s how you can connect your bank account:

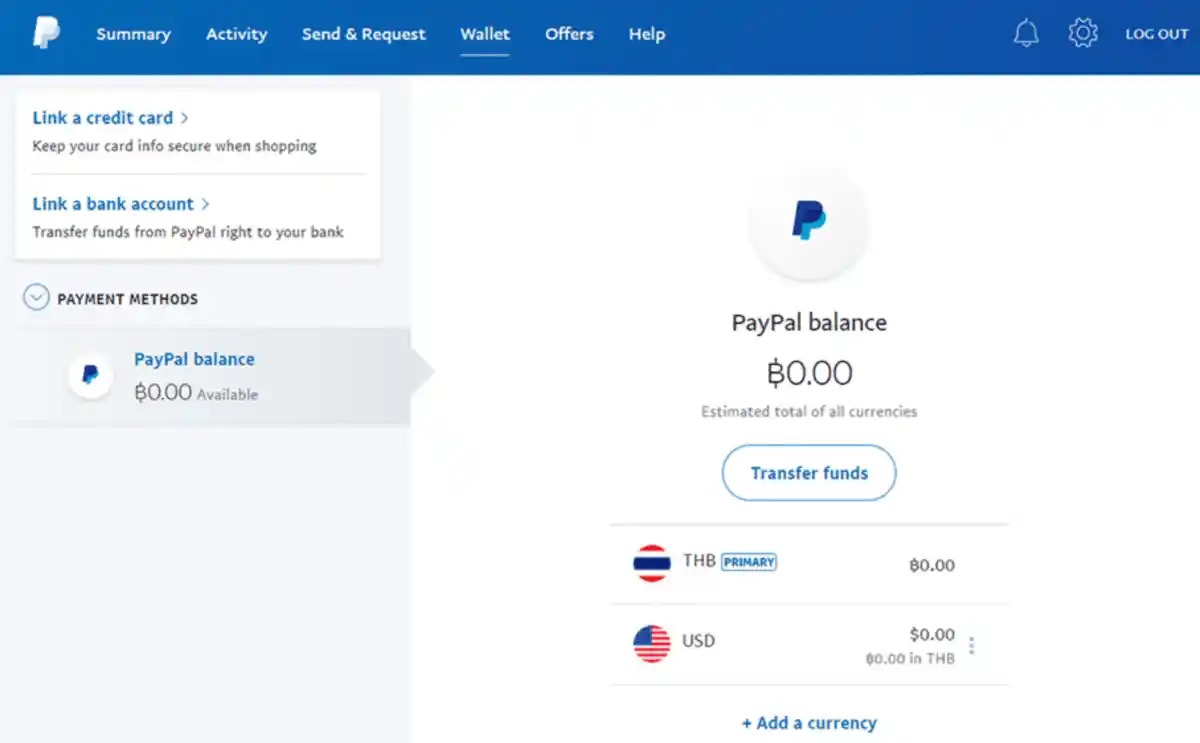

- Log in to your PayPal account and navigate to the “Wallet” section.

- Click on “Link a bank account” and choose your bank from the list or enter your bank details manually.

- Follow the on-screen instructions to complete the process. You may need to provide additional verification information to confirm your ownership of the bank account.

It’s important to note that PayPal supports a wide range of banks, making it convenient for users around the world. Once your bank account is connected, you can easily transfer money to and from your PayPal account.

By linking your bank account, you can also set up automatic transfers, enabling PayPal to directly withdraw funds from your bank account for purchases or other transactions. This makes managing your finances simpler and more efficient.

It’s worth mentioning that PayPal takes security seriously. They use encryption methods to protect your financial information and provide secure transactions. Nonetheless, it’s always a good practice to keep your password and account information confidential and regularly monitor your transactions for any suspicious activity.

Now that your bank account is connected and verified, you’re ready to initiate a withdrawal from PayPal to your bank account. In the following section, we’ll explore the process of withdrawing money from PayPal and discuss the different options available to you.

Verifying Your Bank Account

Once you have connected your bank account to your PayPal account, the next step is to verify the account. Verifying your bank account ensures that you have full access to the withdrawal functionality and increases the security of your transactions. Here’s how you can verify your bank account on PayPal:

- Log in to your PayPal account and go to the “Wallet” section.

- Under the “Bank Accounts” tab, find your connected bank account and click on “Confirm.”

- PayPal will deposit two small amounts into your bank account within a few business days.

- Check your bank statement or online banking to find the two small deposits made by PayPal.

- Return to your PayPal account, navigate to the “Wallet” section, and click on your bank account.

- Enter the exact amounts of the two deposits in the verification field provided.

- Click “Confirm” to complete the verification process.

Verifying your bank account not only confirms your ownership but also allows PayPal to lift certain withdrawal limits and provide you with a higher level of account security. It’s important to note that the verification process may vary depending on your country and bank. If you encounter any issues or need further assistance, PayPal’s customer support is always available to help you.

Once your bank account is verified, you’ll have access to various withdrawal options offered by PayPal. The ability to withdraw money from your PayPal account quickly and easily gives you the flexibility to manage your funds according to your needs.

In the next section, we’ll discuss PayPal withdrawal limits and what you need to know before initiating a withdrawal. Understanding these limits will help you plan your transactions accordingly and avoid any unnecessary delays or complications.

Understanding PayPal Withdrawal Limits

Before you initiate a withdrawal from your PayPal account, it’s important to understand the withdrawal limits imposed by PayPal. These limits ensure the security of your funds and help prevent unauthorized transactions. Here’s what you need to know about PayPal withdrawal limits:

1. Daily and Monthly Limits:

PayPal sets a default daily and monthly withdrawal limit for each user. The limits may vary depending on factors such as your account type, transaction history, and location. It’s recommended to check your account’s specific withdrawal limits to ensure you’re aware of the maximum amount you can withdraw within a given time period.

2. PayPal Withdrawal Fees:

PayPal may charge a fee for certain types of withdrawals. The fee structure can vary depending on factors such as the withdrawal method, currency conversion, and destination country. Be sure to review PayPal’s fee schedule to understand any applicable charges and factor them into your withdrawal planning.

3. Additional Verification:

In some cases, PayPal may require additional verification steps before you can access higher withdrawal limits. This could include providing additional identification documents or confirming your business account information. If you anticipate needing higher withdrawal limits, make sure to complete any necessary verification steps well in advance.

4. Transaction Holds:

Occasionally, PayPal may place a temporary hold on certain transactions for security purposes. These holds may affect your ability to withdraw funds from your account immediately. It’s recommended to review PayPal’s policies regarding transaction holds to understand any potential impacts on your withdrawal process.

By understanding the withdrawal limits and policies set by PayPal, you can plan your withdrawals effectively and avoid any unexpected surprises. Now that you have a clear understanding of the withdrawal limits, let’s explore the different methods available to withdraw money from your PayPal account in the next section.

Withdrawing Money to Your Bank Account

With PayPal, withdrawing money to your linked bank account is a straightforward process. By following a few simple steps, you can easily transfer funds from your PayPal balance to your bank account. Here’s how to withdraw money to your bank account:

- Log in to your PayPal account and navigate to the “Wallet” section.

- Select your linked bank account from the list of available options.

- Enter the amount you wish to withdraw or select from predefined options.

- Review the withdrawal details and click “Continue” to proceed.

- Confirm the transaction and click “Withdraw” to initiate the transfer.

Depending on your bank’s processing times, it may take a few business days for the funds to appear in your bank account. PayPal will provide you with an estimated arrival time during the withdrawal process. It’s essential to keep this in mind when planning your finances and withdrawals.

It’s worth noting that there may be certain withdrawal limits imposed by PayPal. These limits can vary based on factors such as account type, location, and transaction history. If you encounter any issues or have questions about your withdrawal limits, you can reach out to PayPal’s customer support for assistance.

Withdrawing money to your bank account is a reliable and secure way to access your PayPal funds. It allows you to utilize the money for various purposes, whether for personal expenses or business needs. Keep in mind that PayPal may charge a nominal fee for certain types of withdrawals, so be sure to review their fee schedule beforehand.

In the next section, we’ll explore another option for withdrawing money from PayPal, namely withdrawing money to your debit card. This option may be convenient for individuals who prefer to have immediate access to their funds without waiting for the bank transfer to complete.

Withdrawing Money to Your Debit Card

If you prefer to have immediate access to your PayPal funds, withdrawing money to your debit card is a convenient option. This allows you to make instant withdrawals from compatible ATMs or use your debit card to make purchases both online and offline. Here’s how you can withdraw money to your debit card:

- Log in to your PayPal account and navigate to the “Wallet” section.

- Select your linked debit card from the list of available options.

- Enter the amount you wish to withdraw or choose from predefined withdrawal options.

- Review the withdrawal details and click “Continue” to proceed.

- Confirm the transaction and click “Withdraw” to initiate the transfer.

Once the withdrawal is processed, the funds will be available on your linked debit card. You can confirm the successful withdrawal by checking your debit card balance or transaction history.

It’s important to note that while withdrawing money to your debit card offers instant access to your funds, there may be certain limits imposed by PayPal or your card issuer. These limits can vary based on factors such as account type, location, and transaction history. Make sure to review your account’s specific withdrawal limits to avoid any inconveniences.

Furthermore, it’s important to be aware of any applicable fees associated with debit card withdrawals. PayPal may charge a nominal fee for this service, so it’s recommended to review their fee schedule beforehand.

Withdrawing money to your debit card provides you with the flexibility to use your PayPal funds immediately, without the need to wait for bank transfers to complete. Whether you need cash or want to make a purchase, having instant access to your funds is beneficial.

In the following sections, we’ll explore additional options for instant withdrawals, including activating the PayPal Cash Card and using the PayPal app for quick and convenient access to your funds.

Activating the PayPal Cash Card for Instant Withdrawals

If you’re looking for a convenient way to access your PayPal funds instantly, activating the PayPal Cash Card is an excellent option. The PayPal Cash Card is a prepaid card that allows you to make purchases and withdraw cash from ATMs wherever Mastercard is accepted. Here’s how you can activate and use the PayPal Cash Card:

- Log in to your PayPal account and navigate to the “Wallet” section.

- Under the “PayPal Cash Card” section, click on “Activate Card”.

- Enter the required information, including your name, date of birth, and social security number.

- Agree to the terms and conditions.

- Once you’ve completed the activation process, your PayPal Cash Card will be linked to your PayPal account.

Once your PayPal Cash Card is activated, you can add funds from your PayPal balance to your card. This can be done through the PayPal website or mobile app. The transferred funds will be available on your PayPal Cash Card, and you can use it for purchases or withdraw cash instantly from ATMs.

It’s important to note that there may be daily withdrawal limits imposed by PayPal or the ATM owner. These limits can vary based on factors such as location, account type, and transaction history. Make sure to check the specific limits applicable to your PayPal Cash Card to ensure you have the necessary information.

Furthermore, using the PayPal Cash Card may incur certain fees, such as ATM withdrawal fees or foreign currency conversion fees. It’s recommended to review PayPal’s fee schedule to have a clear understanding of any applicable charges.

Activating the PayPal Cash Card provides you with a convenient and secure way to access your PayPal funds instantly. It eliminates the need for bank transfers or waiting times, allowing you to use your money whenever and wherever you need it.

In the next section, we’ll explore another method for quick withdrawals using the PayPal app, offering even more convenience and flexibility.

Using the PayPal App for Instant Withdrawals

The PayPal mobile app provides a convenient way to manage your PayPal account on the go, including instant withdrawals. With just a few taps on your smartphone, you can access your funds and make quick withdrawals directly to your linked bank account or eligible debit card. Here’s how you can use the PayPal app for instant withdrawals:

- Download and install the PayPal app from your device’s app store.

- Log in to your PayPal account using your credentials.

- Navigate to the “Wallet” section within the app.

- Select the bank account or eligible debit card you want to withdraw to.

- Enter the amount you wish to withdraw or choose from predefined options.

- Review the withdrawal details and tap on “Withdraw” to initiate the transfer.

Once the withdrawal request is processed, the funds will be deposited into your linked bank account or made available on your eligible debit card. Depending on the processing times of your financial institution, you can expect to see the funds within a few business days or instantly in the case of debit card withdrawals.

It’s important to note that while the PayPal app provides the convenience of instant withdrawals, there may be withdrawal limits and fees associated with these transactions. The specific limits and fees can vary depending on factors such as your account type, location, and transaction history. Make sure to review the details provided by PayPal to understand any applicable limits and fees.

The PayPal app also offers additional features such as tracking your transactions, sending and requesting money, managing your account settings, and receiving notifications for activity on your account. The app is designed to provide a seamless and user-friendly experience for managing your PayPal funds on the go.

If you encounter any issues or have questions regarding the PayPal app or its withdrawal features, you can reach out to PayPal’s customer support for assistance. They are available to provide guidance and help resolve any concerns you may have.

In the next section, we’ll address some common issues and provide troubleshooting tips to help you overcome any obstacles you may encounter during the PayPal withdrawal process.

Troubleshooting Common Issues with PayPal Withdrawals

While PayPal strives to provide a smooth and seamless withdrawal experience, occasionally, users may encounter issues or errors during the process. Here are some common problems you may come across with PayPal withdrawals and steps you can take to troubleshoot them:

1. Incorrect Bank Account Information:

Double-check that you have entered the correct bank account information, including the account number and routing number. Any errors in these details can result in failed or delayed withdrawals. If you notice any discrepancies, update the information in your PayPal account and attempt the withdrawal again.

2. Insufficient Funds:

Ensure that you have sufficient funds in your PayPal account to cover the withdrawal amount. If your balance is insufficient, you may need to transfer funds from a linked bank account or wait for a pending payment to clear before initiating the withdrawal.

3. Withdrawal Limit Exceeded:

If you encounter a message indicating that you have exceeded your withdrawal limit, check your account’s specific withdrawal limits. PayPal imposes these limits for security purposes. To increase your limits, you may need to go through additional verification steps or contact PayPal’s customer support for assistance.

4. Technical Issues:

In case you experience technical glitches or encounter errors during the withdrawal process, try clearing your browser cache or using a different web browser. If the problem persists, reach out to PayPal’s customer support, who can provide further guidance and troubleshoot technical issues.

5. Payment Holds or Account Restrictions:

In certain situations, PayPal may place a hold on your funds or restrict certain withdrawal permissions due to security concerns or suspicious activity. If you suspect this is the case, contact PayPal’s customer support to resolve any account restrictions or lift the payment holds.

Remember, PayPal’s customer support is available to assist you with any specific problems you may encounter during the withdrawal process. When seeking assistance, provide them with detailed information about the issue, including error messages, transaction IDs, and any steps you have already taken to troubleshoot the problem.

In the next section, we’ll explore some tips to help you improve the speed and efficiency of your PayPal withdrawals.

Tips for Faster PayPal Withdrawals

While PayPal withdrawals are generally efficient, there are some tips you can follow to ensure faster access to your funds. By implementing these suggestions, you can optimize the withdrawal process and minimize any delays. Here are some tips for faster PayPal withdrawals:

1. Link and Verify Your Bank Account:

Connecting and verifying your bank account in advance can expedite the withdrawal process. This helps PayPal confirm your ownership of the account and lifts certain withdrawal limits, allowing for smoother transactions.

2. Choose the Right Withdrawal Option:

If speed is of the essence, consider using instant withdrawal methods such as withdrawing to your debit card or activating the PayPal Cash Card. These options provide immediate access to your funds, eliminating the wait time associated with bank transfers.

3. Keep Your Account Information Up to Date:

Ensure that your contact information, including your email address and phone number, is accurate and up to date. This ensures that PayPal can communicate with you promptly if any issues arise during the withdrawal process.

4. Check Verification and Withdrawal Limits:

Verify your account and check your withdrawal limits. Completing any necessary verification steps in advance, such as providing identification documents, can help prevent delays. Additionally, understanding your withdrawal limits allows you to plan your transactions accordingly.

5. Consider Currency Conversion in Advance:

If you often deal with multiple currencies, it’s beneficial to consider currency conversion ahead of time. This allows you to be aware of any associated fees and factor them into your withdrawal planning, ensuring a smoother and faster process.

6. Keep Your Account in Good Standing:

Maintaining a positive account history, such as consistently verifying your transactions and resolving any issues promptly, can contribute to faster withdrawals. It also helps build trust with PayPal and reduces the likelihood of payment holds or account restrictions.

By following these tips, you can streamline the withdrawal process and expedite access to your PayPal funds. However, it’s important to note that some factors, such as processing times of financial institutions and unexpected circumstances, may still impact the overall speed of your withdrawals.

In the next section, we’ll explore alternative options to consider if you need to access your funds instantly and prefer alternatives to PayPal withdrawals.

Alternatives to Instant PayPal Withdrawals

While PayPal offers various methods for instant withdrawals, there may be situations where you need to explore alternative options. Here are a few alternatives to consider if you’re looking for alternative ways to access your funds instantly:

1. Peer-to-Peer Payment Apps:

Peer-to-peer payment apps like Venmo, Cash App, or Zelle allow you to send and receive money instantly between friends and family. These apps often have quick transfer times and can be a convenient option for accessing your funds immediately.

2. Digital Wallets:

Digital wallets such as Apple Pay, Google Pay, or Samsung Pay offer quick and secure transactions. They allow you to store your payment card information and make purchases or transfers with just a tap of your smartphone or smartwatch.

3. Prepaid Debit Cards:

Prepaid debit cards, available from various financial institutions, can provide instant access to your funds. You can load money onto the card and use it for purchases or ATM withdrawals, similar to a regular debit card.

4. Cryptocurrencies:

If you’re familiar with cryptocurrencies, platforms like Bitcoin, Ethereum, or Litecoin offer fast and secure transactions. However, it’s important to note that using cryptocurrency requires understanding the risks and the specific processes involved.

5. Mobile Banking Apps:

Many traditional banks offer mobile banking apps that allow you to manage your funds on the go. These apps often have features like person-to-person payments, mobile check deposits, and instant transfer capabilities.

Before opting for an alternative to PayPal withdrawals, carefully evaluate the options based on factors such as convenience, compatibility, and any associated fees. Keep in mind that transaction speeds and availability may vary depending on the service provider and your location.

While PayPal remains a popular and reliable platform for managing online transactions, exploring alternative options can provide additional flexibility when it comes to accessing your funds instantly.

Now that you’re aware of some alternatives to instant PayPal withdrawals, you can choose the option that best suits your needs and preferences. It’s always a good idea to research and understand the features, limitations, and security measures associated with any alternative method you choose.