Setting Up Zelle Account

Setting up a Zelle account is a simple and straightforward process that allows you to send and receive money quickly and securely. Whether you’re on your computer or mobile device, follow these steps to get started:

1. Download the Zelle app: Visit your device’s app store and search for the Zelle app. Download and install it on your device to begin the setup process.

2. Sign up for an account: Once you have the app installed, open it and click on the “Sign Up” button. You will be prompted to enter your email address or phone number, as well as some personal information to verify your identity.

3. Link your bank account: To send and receive money through Zelle, you need to link it to your bank account. The app will guide you through the process, and you’ll need to provide your bank’s name and login credentials to securely connect your account with Zelle.

4. Verify your email or phone number: Zelle will send you a verification code either through email or SMS. Enter the code in the app to confirm your email or phone number and complete the verification process.

5. Create a unique user ID: Choose a unique user ID that will be associated with your Zelle account. This ID will be visible to others when they send you money, ensuring that the funds go to the right recipient.

6. Agree to the terms and conditions: Read through the terms and conditions of using Zelle and agree to them. This step is essential to ensure that you understand the rules and guidelines governing the use of Zelle.

Once you’ve completed these steps, your Zelle account will be fully set up and ready to use. You can start sending and receiving money with ease, knowing that your transactions are protected by advanced security measures.

Linking Your Bank Account

To fully utilize the features of Zelle, you’ll need to link your bank account to your Zelle account. This will allow you to seamlessly transfer money between your bank and Zelle. Follow these steps to link your bank account:

1. Open the Zelle app: Launch the Zelle app on your device and log in to your Zelle account using your credentials.

2. Locate the bank linking option: In the app’s settings or profile section, you should find an option to link your bank account. Tap on this option to proceed.

3. Select your bank: Zelle supports a wide range of banks, so choose your bank from the list provided. If you don’t see your bank listed, it’s possible that it is not yet supported by Zelle.

4. Login to your bank account: To link your bank account, you’ll need to provide your online banking credentials. Zelle will securely connect to your bank’s server to establish a link between your bank account and Zelle.

5. Verify your account: Once Zelle establishes a connection with your bank, it may require additional verification. This typically involves sending a verification code to your registered email or phone number. Enter the code in the Zelle app to confirm and complete the linking process.

6. Link additional accounts (optional): If you have multiple accounts with the same bank, you may have the option to link them to Zelle as well. This can be useful if you want to transfer money between different accounts within the same bank.

By linking your bank account to Zelle, you’ll have the ability to easily send and receive money to and from your bank. It eliminates the need to manually initiate transfers from your bank’s website or app, streamlining the process and saving you time.

Verifying Your Email or Phone Number

Verifying your email or phone number is an important step in the Zelle account setup process. It helps ensure the security of your Zelle transactions and confirms that you are the rightful owner of the contact information associated with your Zelle account. Here’s how you can verify your email or phone number:

1. Open the Zelle app or website: Access the Zelle app on your mobile device or visit the Zelle website on your computer. Log in to your Zelle account using your credentials.

2. Navigate to the verification section: Look for the verification settings or profile options within the Zelle app or website. This is where you’ll find the steps to verify your email or phone number.

3. Enter your email or phone number: Depending on which method you chose when setting up your Zelle account, enter your email address or phone number in the designated field.

4. Check for a verification code: Zelle will send a verification code to the email address or phone number provided. Check your email inbox or messages for the code.

5. Enter the verification code: Once you receive the verification code, enter it in the appropriate field within the Zelle app or website. This code verifies that you have access to the email or phone number associated with your Zelle account.

6. Confirm the verification: After entering the verification code, submit the code within the Zelle app or website. Zelle will verify the code and confirm that your email or phone number is now fully verified.

7. Receiving a verification success message: Once your verification is complete, you’ll receive a confirmation message indicating that your email or phone number has been verified successfully.

Verifying your email or phone number is crucial for ensuring the accuracy of Zelle transactions and preventing unauthorized access to your account. It adds an extra layer of security to your Zelle account, allowing you to confidently send and receive money with peace of mind.

Adding Recipients

Adding recipients to your Zelle account makes it convenient and quick to send money to the people you frequently transfer funds to. Whether it’s friends, family members, or colleagues, here’s how you can add recipients in Zelle:

1. Open the Zelle app: Launch the Zelle app on your mobile device or access the Zelle website on your computer. Make sure you’re logged in to your Zelle account.

2. Navigate to the recipients section: Look for the “Recipients” or “Contacts” option within the Zelle app or website. This is where you can manage and add new recipients.

3. Click on “Add Recipient” or “Add Contact”: In the recipients section, you’ll find an option to add a new recipient. Click on it to begin adding a recipient to your Zelle account.

4. Enter the recipient’s information: Provide the necessary details for the recipient, such as their name, email address, or phone number. Ensure that the information is accurate to avoid any complications during the transfer process.

5. Save the recipient: After entering the recipient’s information, click on the “Save” or “Add” button to store their details in your Zelle account. This will make it easier to select them when sending money in the future.

6. Verify the recipient (if applicable): Depending on the recipient’s banking institution, they may need to verify their Zelle account to receive funds. In this case, Zelle will send them an email or SMS with instructions on how to complete the verification process.

7. Manage and edit recipients: Once you’ve added recipients, you can manage them within the Zelle app or website. This includes editing their details, deleting recipients who are no longer relevant, or organizing them into groups for easier access.

By adding recipients to your Zelle account, you can streamline the process of sending money to trusted individuals. This eliminates the need to manually enter their information each time, saving you time and effort.

Requesting Money

Zelle allows you to easily request money from friends, family, or anyone who owes you funds. By sending a request, you can ensure that you receive the money you’re owed in a convenient and straightforward manner. Here’s how you can request money using Zelle:

1. Open the Zelle app: Launch the Zelle app on your mobile device or access the Zelle website on your computer. Log in to your Zelle account using your credentials.

2. Select the recipient: Choose the person from whom you want to request money. You can select them from your list of recipients or manually enter their email address or phone number.

3. Enter the amount: Specify the exact amount you want to request. Make sure to double-check the amount to avoid any errors.

4. Add a message (optional): If you want to provide additional context or details about the money you’re requesting, you can include a brief message. This can be helpful if you’re requesting reimbursement for a specific expense or reminding someone about an outstanding payment.

5. Send the request: Once you’ve entered all the necessary details, click on the “Send” or “Request” button to initiate the request. Zelle will send a notification to the recipient, notifying them about the request.

6. Wait for the recipient’s response: The recipient will receive the request and can choose to accept or decline it. They may be prompted to enter their own Zelle account information if they haven’t already done so.

7. Monitor the request status: You can track the status of your request within the Zelle app or website. You’ll be notified when the recipient has responded, and you can check the payment status to see if the money has been successfully sent.

By utilizing the request money feature in Zelle, you can easily and politely ask others to fulfill their financial obligations. This eliminates any potential awkwardness or inconvenience associated with reminding someone about money owed.

Receiving Money

Receiving money through Zelle is a seamless and efficient process. Once someone sends you funds using Zelle, you can quickly access the money and use it for your needs. Here’s how you can receive money using Zelle:

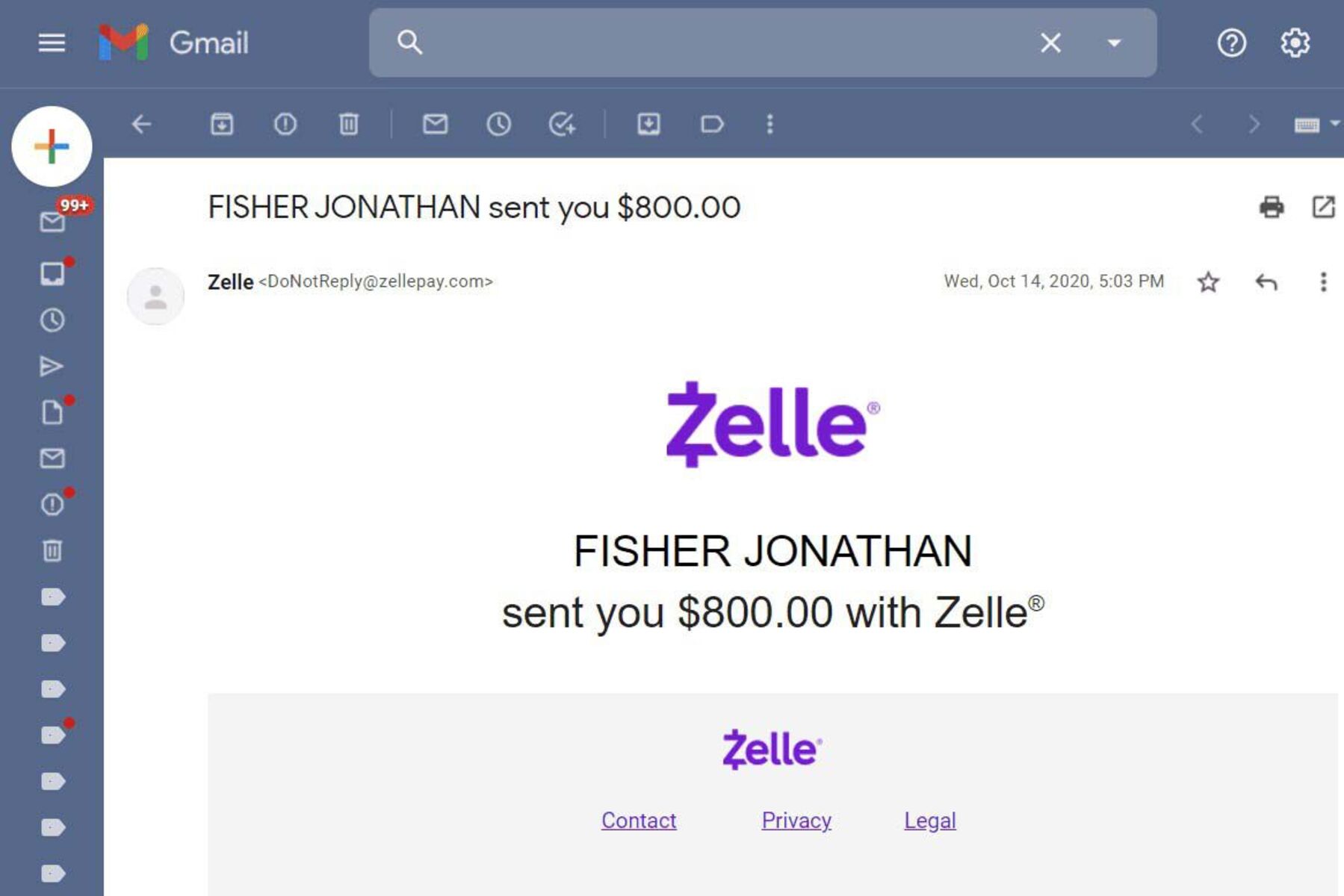

1. Check your notifications: Zelle will send you a notification via email or SMS once someone sends you money. Open the notification to view the details of the transaction.

2. Log in to your Zelle account: Open the Zelle app on your mobile device or access the Zelle website on your computer. Log in to your Zelle account using your credentials.

3. Verify the transaction: Upon logging in, you’ll see the pending transaction in your Zelle account. Review the details to ensure that the amount and sender’s information are accurate.

4. Accept the funds: If you’re satisfied with the transaction details, click on the “Accept” or “Claim” button to officially receive the funds. The money will be added to your available balance in the Zelle account.

5. Transfer to your bank account (optional): If you prefer to have the funds in your bank account, you can initiate a transfer from your Zelle account. Check if your bank account is already linked to Zelle, and if so, follow the instructions within the Zelle app or website to complete the transfer.

6. Check your bank account (if applicable): If you transferred the funds from your Zelle account to your bank account, check your bank account balance to ensure that the money has been successfully deposited.

7. Use the money as desired: Once the money is in your Zelle or bank account, you can use it as needed. Whether it’s for personal expenses, bills, or savings, the funds are now readily available for your use.

The process of receiving money through Zelle is quick and efficient, allowing you to access your funds with ease. It eliminates the need for physical checks or complicated money transfer processes, ensuring a hassle-free experience.

Notifications and Alerts

Zelle provides a robust system of notifications and alerts to keep you informed about important updates and transactions related to your account. These notifications help ensure that you stay up-to-date with your financial activities and can take immediate action when necessary. Here’s what you need to know about Zelle’s notifications and alerts:

1. Transaction notifications: Whenever you send or receive money through Zelle, you’ll receive a notification confirming the transaction. This notification will typically include details such as the amount, the sender’s or recipient’s information, and the date and time of the transaction. These notifications provide real-time updates on the status of your funds.

2. Security alerts: Zelle prioritizes the security of your account and will send security alerts if any suspicious or unauthorized activity is detected. These alerts serve as a warning and prompt you to take immediate action such as changing your password or contacting Zelle support. Be sure to monitor these alerts carefully and respond promptly if any security concerns arise.

3. Payment reminders: If you’ve sent a request for money and the recipient has not responded, Zelle may send payment reminders to both parties. These reminders serve as gentle prompts to ensure that the requested payment is addressed in a timely manner. It’s a helpful feature when you’re awaiting payment from someone.

4. Account balance updates: Zelle provides regular updates on your account balance, allowing you to keep track of the available funds in your Zelle account. This helps you plan your financial activities accordingly and ensures that you’re aware of the amount of money at your disposal.

5. Email and SMS notifications: Zelle sends notifications through both email and SMS, depending on the contact information associated with your account. Make sure to keep your email and phone number up to date to receive these notifications promptly.

6. Customizable notification settings: Zelle allows you to customize your notification preferences according to your needs. You can choose to enable or disable specific types of notifications, adjust the frequency of receiving notifications, or modify the channels through which you receive them. This customization ensures that you only receive the notifications that are most relevant to you.

By staying alert and responsive to Zelle’s notifications and alerts, you can actively manage your account and ensure a secure and efficient financial experience. Regularly check your notifications and take appropriate actions to stay on top of your Zelle transactions and account activities.

Transferring Money to Your Bank Account

Zelle provides a convenient option to transfer funds from your Zelle account to your linked bank account. This enables you to access and utilize your money outside of the Zelle ecosystem. Here’s how you can transfer money from Zelle to your bank account:

1. Log in to your Zelle account: Open the Zelle app on your mobile device or access the Zelle website on your computer. Enter your login credentials to access your Zelle account.

2. Navigate to the transfer section: Look for the “Transfer” or “Bank Transfer” option within the Zelle app or website. This is where you can initiate the process of transferring money to your bank account.

3. Select your bank account: If you have multiple bank accounts linked to your Zelle account, choose the one to which you want to transfer the funds. If you have only one bank account linked, this step may be skipped.

4. Enter the transfer amount: Specify the amount you wish to transfer from your Zelle account to your bank account. Double-check the amount to ensure accuracy.

5. Confirm the transfer: Review the transfer details, including the amount, bank account information, and any associated fees. Once you’re satisfied, click on the “Confirm” or “Transfer” button to initiate the transfer.

6. Wait for the transfer to complete: The transfer from your Zelle account to your linked bank account may take a few business days to complete. The exact duration depends on your bank’s processing times and may vary.

7. Monitor the transfer status: While the transfer is in progress, you can check your transfer status within the Zelle app or website. It will provide updates on whether the transfer is pending, processing, or completed.

8. Verify the funds in your bank account: Once the transfer is complete, check your bank account balance to ensure that the funds have been successfully deposited. This verifies that the transfer was successful and that the funds are readily available for your use.

Transferring money from your Zelle account to your bank account offers flexibility and convenience. It allows you to utilize your funds outside of the Zelle platform, giving you more options and control over your finances.

Understanding Transaction Limits

Every payment platform, including Zelle, comes with certain transaction limits to ensure the security and smooth operation of money transfers. Understanding these transaction limits is crucial to plan and manage your financial activities effectively. Here’s what you need to know about Zelle’s transaction limits:

1. Sending limits: Zelle imposes limits on the amount of money you can send in a single transaction, as well as the cumulative amount you can send within a specific timeframe. These limits vary based on several factors, such as your Zelle account status, the duration of your Zelle membership, and your relationship with your bank. You can check these limits within the Zelle app or website.

2. Receiving limits: Similar to sending limits, Zelle also sets limits on the amount of money you can receive in a single transaction and within a specified time period. These limits may vary depending on the status and history of your Zelle account, as well as your relationship with your bank. You can find this information in the Zelle app or website.

3. Business account limits: If you have a Zelle business account, separate transaction limits may apply. Business account limits are typically higher than those imposed on personal accounts, allowing for larger amounts of money to be sent and received. The specific limits will depend on the terms and conditions set by Zelle for business accounts.

4. Bank-specific limits: In addition to Zelle’s transaction limits, your bank may also have its own limits on the amount of money you can send or receive using Zelle. These limits can vary from one bank to another, so it’s important to be aware of the limits set by your specific bank.

5. Limits for new accounts: When you first set up a Zelle account, there may be initial limits placed on your transactions as a security measure. These limits are often temporary and may be increased as you establish a history of using Zelle and build trust with the platform.

It’s important to keep in mind that these transaction limits are in place to safeguard against unauthorized use and protect the overall security of Zelle. If you require higher transaction limits or have specific needs, it’s advisable to reach out to Zelle customer support or your bank to inquire about potential options or adjustments.

By understanding and adhering to Zelle’s transaction limits, you can ensure a seamless experience when sending and receiving money while prioritizing security and risk management.

Troubleshooting Common Issues

While Zelle offers a smooth and reliable platform for money transfers, occasional issues may arise that require troubleshooting. Understanding common issues and their solutions can help you navigate any challenges that may come up. Here are some common issues users may encounter with Zelle and how to troubleshoot them:

1. Incorrect recipient information: If you’ve sent money to the wrong recipient, reach out to Zelle customer support immediately. They can guide you through the process of resolving the issue and recovering the funds, if possible.

2. Failed or cancelled transactions: If a transaction fails or gets cancelled, check your bank account to ensure that the funds have not been deducted. If the funds have been deducted, contact Zelle customer support to report the issue and initiate a refund or resolution.

3. Delayed transfers: If you’re experiencing delays in the transfer of funds, first check Zelle’s estimated transfer timelines. If the transfer is taking longer than expected, reach out to Zelle customer support to investigate and rectify the issue.

4. Bank account linking issues: If you’re having trouble linking your bank account to Zelle, double-check that you’ve entered the correct bank information. If the problem persists, contact your bank for assistance or reach out to Zelle customer support for guidance.

5. Technical glitches or app malfunctions: If you encounter technical glitches or app malfunctions while using Zelle, try closing and reopening the app, or clearing the app cache. If the issue persists, uninstall and reinstall the Zelle app, ensuring you have the latest version. If the problem continues, reach out to Zelle customer support for further assistance.

6. Unresponsive recipients: If a recipient is not responding to your payment request or if the recipient claims they did not receive the funds, verify that you entered the correct contact information. If everything appears to be correct, contact Zelle customer support for guidance on how to resolve the issue and ensure the funds are properly transferred.

7. Security concerns: If you suspect any unauthorized activity or have concerns about the security of your Zelle account, change your password immediately. Additionally, contact Zelle customer support to report the issue and receive further guidance on securing your account.

For any other issues or queries not addressed here, it’s recommended to reach out to Zelle customer support for personalized assistance and resolution. They have the expertise to address specific issues and provide guidance based on your unique situation.

By troubleshooting common issues promptly and seeking assistance when needed, you can ensure a smooth and secure experience when using Zelle for your money transfers.