What is an electronic check?

An electronic check, also known as an e-check or digital check, is a digital version of a traditional paper check. It provides a secure and convenient method for electronic transactions by allowing funds to be transferred from one bank account to another electronically.

Unlike paper checks that require physical processing and transportation, electronic checks are processed through the Automated Clearing House (ACH) network. The ACH is an electronic banking network that facilitates the movement of funds between banks in the United States.

Electronic checks are commonly used for a variety of transactions, including paying bills, making online purchases, and receiving payments from clients or customers. By using electronic checks, individuals and businesses can save time and resources, eliminate the risk of lost or stolen checks, and reduce the need for manual paperwork.

When creating an electronic check, the payer provides their bank account information, including the routing number and account number, along with the payment amount. This information is securely transmitted to the payee’s bank, which verifies the account details and initiates the transfer of funds.

It is important to note that electronic checks are not the same as digital payment methods such as credit cards or mobile wallets. While digital payments rely on card networks or digital platforms, electronic checks rely on the ACH network and the banking system for processing.

Electronic checks offer an efficient and reliable way to electronically transfer funds between bank accounts. Their use has become increasingly common as more businesses and individuals embrace the convenience and security of digital transactions.

How does an electronic check work?

An electronic check, or e-check, works by leveraging the existing banking infrastructure to facilitate the transfer of funds between bank accounts. Here’s a step-by-step breakdown of how the process works:

- Authorization: The payer provides their bank account information, including the routing number and account number, to the payee. This information is necessary to initiate the electronic check.

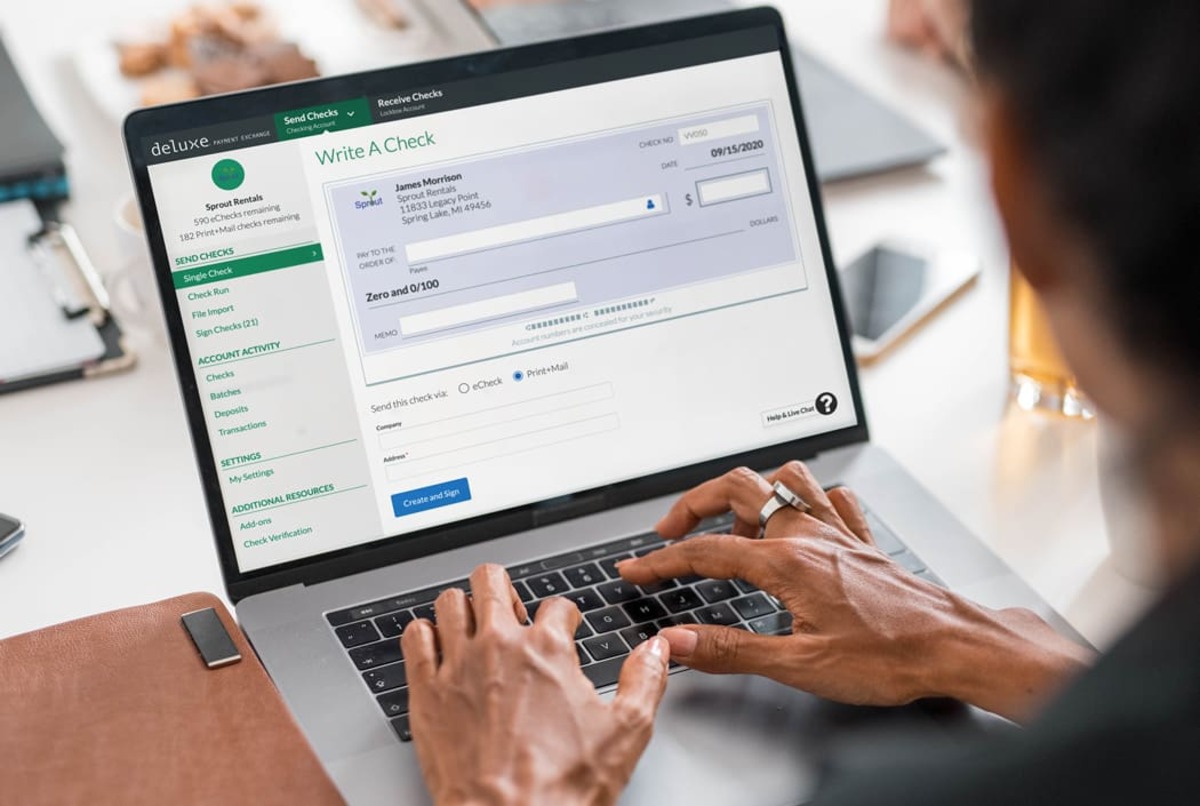

- Creation of the electronic check: The payee, typically a business or organization, creates an electronic check using specialized software or a payment gateway. The electronic check includes the payer’s account information, payment amount, and other relevant details.

- Transmission to the payer’s bank: The payee’s bank, also known as the originating depository financial institution (ODFI), transmits the electronic check to the payer’s bank, known as the receiving depository financial institution (RDFI), through the ACH network. This transmission is usually done overnight or in batches.

- Verification: The payer’s bank verifies the authenticity and sufficiency of funds in the payer’s account. This process involves confirming the payer’s account information, checking for sufficient funds, and ensuring that there are no holds or restrictions on the account.

- Funds transfer: Once the payer’s bank verifies the check, the funds are transferred from the payer’s account to the payee’s account. This transfer typically occurs within a few business days, although the exact timing may vary depending on the banks involved.

- Notification: After the funds have been transferred, both the payee and the payer receive notifications confirming the successful completion of the transaction. These notifications may be sent via email, text message, or through online banking platforms.

It’s important to note that the entire process is done electronically, without the need for physical checks or paper-based transactions. This not only saves time and resources but also reduces the risk of check fraud and ensures a more secure and efficient payment experience.

Overall, electronic checks provide a reliable and convenient method for transferring funds between bank accounts, offering an alternative to traditional paper checks that is more suitable for today’s digital age.

The processing time for an electronic check

The processing time for an electronic check refers to the duration it takes for the funds to be transferred from the payer’s account to the payee’s account. While electronic checks offer a faster alternative to traditional paper checks, the actual processing time can vary based on several factors:

1. Bank processing time: The time taken by the payer’s bank and the payee’s bank to process the electronic check can impact the overall processing time. Typically, banks aim to complete the processing within one to two business days, but it can take longer depending on the bank’s internal processes and the volume of transactions.

2. ACH network processing: The electronic check passes through the Automated Clearing House (ACH) network, which acts as the intermediary between banks. The ACH network processes transactions in batches and typically takes one to two business days to transfer the funds from the payer’s bank to the payee’s bank. However, larger or more complex transactions may take longer to process.

3. Cut-off times: Banks have specific cut-off times for processing transactions. If the e-check is initiated after the cut-off time, it may be processed on the next business day. It’s important for payers and payees to be aware of these cut-off times to avoid delays in processing.

4. Weekends and holidays: Weekends and bank holidays can impact the processing time for electronic checks. Since banks do not operate on these days, any e-check initiated during this period will be processed on the next business day. As a result, the processing time can be extended by a day or more.

5. Bank policies and procedures: Each bank has its own internal policies and procedures for processing electronic checks. These can vary depending on the bank’s efficiency and resources, which may impact the overall processing time. It’s advisable to check with the bank or refer to their website for specific information on their processing timelines.

Overall, the processing time for an electronic check is typically faster than a traditional paper check. However, it is important to consider the factors mentioned above to have realistic expectations regarding the time it takes for the funds to be transferred successfully.

Factors that can affect the processing time

While electronic checks offer a faster and more efficient way of transferring funds compared to traditional paper checks, there are several factors that can influence the processing time. Understanding these factors can help manage expectations and ensure a smooth payment experience. Here are some key factors that can affect the processing time for electronic checks:

1. Bank policies and processes: Different banks may have varying policies and processes in place for handling electronic checks. Some banks may have more streamlined systems and faster processing times, while others may take longer due to internal procedures or higher transaction volumes. It’s important to understand your bank’s specific policies and processes to anticipate potential delays.

2. Weekends and holidays: Banks typically do not process transactions on weekends and public holidays. Therefore, if an electronic check is initiated during these periods, it may not be processed until the next business day. This can result in a delay in the overall processing time. It’s important to factor in weekends and holidays when considering the expected processing time for an electronic check.

3. Cut-off times: Banks have specific cut-off times for processing transactions. If an electronic check is submitted after the cut-off time, it may not be processed until the next business day. It’s crucial to be aware of these cut-off times to ensure timely submission and processing of electronic checks.

4. ACH network processing: Electronic checks are processed through the Automated Clearing House (ACH) network, which facilitates the transfer of funds between banks. The ACH network operates in batches, and the timing of these batches can impact the processing time for electronic checks. While the ACH network is designed to expedite transactions, larger or more complex transactions may require additional processing time.

5. Payer and payee collaboration: The efficiency of the payment process also depends on the collaboration between the payer and the payee. If accurate and complete information is not provided when initiating the electronic check, it may result in additional processing time as the banks need to verify and rectify the details. It’s essential to double-check all account information and payment details before submitting an electronic check to minimize potential delays.

6. Other external factors: Occasionally, external factors such as technical issues, network outages, or unforeseen circumstances beyond the control of the banks can affect the processing time for electronic checks. These situations are rare but can cause delays in funds transfer.

By considering these factors and staying informed about the policies and processes of the involved banks, both payers and payees can manage expectations and ensure timely and efficient processing of electronic checks.

The role of the banks in the check clearing process

Banks play a crucial role in the check clearing process for electronic checks. They act as the intermediaries, facilitating the secure and efficient transfer of funds between the payer’s account and the payee’s account. Here’s an overview of the key roles banks play in the check clearing process:

1. Verification and authentication: When an electronic check is initiated, the payer’s bank plays a vital role in verifying and authenticating the check. This includes confirming the accuracy of the payer’s account information, ensuring sufficient funds, and checking for any holds or restrictions on the account. This verification process helps prevent fraud and ensures that the account is valid for the funds transfer.

2. Processing and routing: Once the payer’s bank has verified the electronic check, it transmits the payment instructions securely to the payee’s bank through the Automated Clearing House (ACH) network. The payer’s bank determines the routing and processing instructions for the payment, ensuring that it reaches the payee’s bank for further processing.

3. Fund transfer: The payer’s bank is responsible for initiating the transfer of funds from the payer’s account to the payee’s account. This involves debiting the funds from the payer’s account and securely transferring them to the payee’s bank. The payee’s bank then receives the funds and credits them to the appropriate account.

4. Security and risk management: Banks have robust security measures in place to ensure the safe and secure transfer of funds during the check clearing process. They employ encryption, authentication protocols, and other security technologies to protect the integrity of the electronic checks and prevent unauthorized access or tampering.

5. Settlement and reconciliation: After the funds transfer has taken place, both the payer’s bank and the payee’s bank reconcile their accounts to ensure that the transaction has been processed accurately. This involves confirming the payment details, verifying the funds’ availability, and reconciling any discrepancies. Banks ensure that the payment is settled properly and reflected in the respective accounts.

6. Communication and notifications: Throughout the check clearing process, banks play a crucial role in facilitating communication between the payer and the payee. They send notifications to both parties, confirming the status of the transaction, and providing updates on any issues or delays that may arise during the process.

By performing these roles effectively, banks ensure the smooth and secure processing of electronic checks, allowing individuals and businesses to carry out financial transactions efficiently and with peace of mind.

Can the processing time be expedited?

The processing time for electronic checks can vary depending on various factors, including bank processes, cut-off times, and the ACH network’s operation. However, in certain situations, it may be possible to expedite the processing time for electronic checks. Here are a few scenarios in which the processing time can be expedited:

1. Same-day ACH: In recent years, the ACH network has introduced a same-day ACH service, which allows for expedited processing of electronic checks. This service allows eligible transactions to be processed and settled on the same business day, as long as they are submitted before the specified cut-off time. Same-day ACH provides a faster alternative for time-sensitive payments.

2. Higher processing priority: Some banks offer expedited processing services for a fee. By paying an additional charge, individuals and businesses can request their electronic checks to be processed with a higher priority. This can result in faster fund transfer and a shorter overall processing time. It’s important to check with your bank to see if they offer expedited processing options and understand any associated fees.

3. Electronic check verification: Utilizing electronic check verification services can help minimize the processing time. These services involve checking the payer’s account information, authentication, and verification before initiating the electronic check. By ensuring the accurate and complete information upfront, it reduces the chances of delays or issues during the processing stage.

4. Proactive communication: If expediting the processing time is essential, proactive communication with the bank can help. Contacting the bank’s customer service, explaining the urgency of the transaction, and requesting expedited processing can sometimes lead to faster handling of the electronic check.

5. Timely submission: Submitting the electronic check well before the cut-off time can increase the chances of faster processing. It ensures that the bank has sufficient time to verify the check, initiate the fund transfer, and complete the necessary processes within the regular processing windows.

6. Using alternative payment methods: In cases where immediate funds transfer is essential, using alternative payment methods, such as wire transfers or instant payment apps, can be a viable option. These methods offer real-time or near-instantaneous fund transfer, eliminating the need for waiting for the processing time associated with electronic checks.

While these options may provide ways to expedite the processing time for electronic checks, it’s essential to remember that some scenarios may involve additional fees or conditions. It’s always recommended to consult with your bank or financial institution to understand the available options and any associated fees before attempting to expedite the processing time for electronic checks.

Tips for ensuring a faster electronic check clearing time

While the processing time for electronic checks is influenced by various factors beyond our control, there are several tips you can follow to help ensure a faster clearing time for your electronic checks. By implementing these strategies, you can expedite the processing and transfer of funds. Here are some tips to consider:

1. Provide accurate and complete information: Ensure that you provide accurate and complete account information, including the routing number and account number, when initiating an electronic check. Any errors or discrepancies in the provided information can result in delays or failed transactions. Double-check the details to avoid any unnecessary issues.

2. Submit the electronic check early in the day: Submitting the electronic check early in the business day allows for more time for processing. Banks typically process transactions in batches and have cut-off times for same-day processing. By submitting your electronic check earlier in the day, you increase the chances of it being processed on the same day, which can expedite the clearing time.

3. Be aware of cut-off times: Each bank has its own cut-off times for processing transactions. Make sure you are aware of your bank’s cut-off times and plan your electronic check submission accordingly. Submitting the check before the cut-off time ensures that it is processed within the same day and reduces the overall clearing time.

4. Utilize same-day ACH services: Check if your bank offers same-day ACH services. Same-day ACH allows for expedited processing and settlement of electronic checks. By opting for this service, you can ensure that your electronic check is processed and cleared on the same business day, providing a faster funds transfer.

5. Communicate with your bank: If you require a faster clearing time for a specific electronic check, it can be beneficial to communicate with your bank. Reach out to their customer service or visit a local branch to discuss your specific situation. Banks may be able to provide assistance, offer insights into any potential delays, or provide guidance on expediting the clearing process.

6. Monitor your account: Keep track of your bank account to stay updated on the status of your electronic check. Regularly check your account balance and transaction history to ensure that the funds have been transferred successfully. If you notice any discrepancies or delays, contact your bank promptly to address the issue.

7. Consider alternative payment methods for urgent transactions: If time is of the essence and you require an immediate funds transfer, consider using alternative payment methods that offer faster clearing times. Wire transfers, instant payment apps, and other real-time payment solutions can provide near-instantaneous fund transfers, eliminating the processing time associated with electronic checks.

By following these tips, you can increase the likelihood of a faster electronic check clearing time. However, it’s important to note that certain factors, such as weekends, holidays, and bank policies, may still affect the clearing time. It’s always recommended to consult with your bank or financial institution for specific information and guidance on expediting electronic check clearing.

How to track the status of an electronic check

Once you have initiated an electronic check, you may want to track its status to ensure that the payment has been successfully processed and funds have been transferred. Here are several methods you can use to track the status of an electronic check:

1. Online banking: Most banks provide online banking services that allow you to track the status of your transactions, including electronic checks. Log in to your online banking account and navigate to the transaction history or payment section. Look for the specific electronic check you wish to track to view its status and details, such as whether it has been processed or cleared.

2. Mobile banking apps: Many banks offer mobile banking apps that provide convenient access to your accounts on your smartphone or tablet. Open the app and navigate to the transaction history or payment section to find information about the electronic check you are tracking. Mobile banking apps often provide real-time updates on the status of your transactions.

3. Customer service: If you are unable to track the status of your electronic check through online banking or mobile banking apps, reaching out to your bank’s customer service can provide assistance. Contact their customer service department either by phone, email, or through their online chat service. Provide them with the details of the electronic check, including the date and amount, and they can provide you with the current status or any updates on its processing.

4. Automatic notifications: Some banks may send automatic notifications to customer email addresses or mobile numbers once the electronic check has been processed or cleared. These notifications provide real-time updates on the status of your payment and can help you track its progress without actively checking your account or contacting customer service. Ensure that your contact information is up to date to receive these notifications.

5. Check images and statements: You can also track the status of an electronic check by reviewing your bank statements or check images. These documents typically provide details of the transactions, including the date of the electronic check and whether it has been cleared or not. Check images can be retrieved through online banking or by contacting your bank directly.

6. ACH trace numbers: If you require more detailed information about the status of an electronic check, you can request the ACH trace number from your bank. The ACH trace number is a unique identifier assigned to each ACH transaction, including electronic checks. With the ACH trace number, you can contact the ACH operator or your bank to obtain specific information about the progress of the transaction.

By utilizing these methods, you can easily track the status of your electronic check and stay informed about its progress. Make sure to check with your bank for specific guidelines and resources available to track electronic check transactions.

Alternatives to electronic checks for faster transactions

While electronic checks offer a convenient and efficient method for fund transfers, there are other alternatives available that can expedite transactions even further. These alternatives provide faster clearing times and near-instantaneous funds transfer. Here are some alternatives to electronic checks for faster transactions:

1. Wire transfers: Wire transfers are a popular option for fast and secure funds transfer. They involve transferring funds directly from one bank account to another, typically on the same business day. Wire transfers are ideal for urgent or time-sensitive payments and are widely used for international transactions as well.

2. Instant payment apps: Instant payment apps, such as Venmo, PayPal, and Cash App, enable users to send and receive funds instantly. These apps link to your bank account or credit card and provide a seamless way to transfer money to friends, family, or businesses. Instant payment apps are ideal for quick, person-to-person transactions.

3. Mobile wallets: Mobile wallets, like Apple Pay, Google Pay, and Samsung Pay, allow users to make contactless payments using their smartphones or wearable devices. These wallets store credit card or bank account information securely, enabling users to make payments effortlessly and quickly at participating merchants.

4. Peer-to-peer (P2P) payment platforms: P2P payment platforms, such as Zelle, allow individuals to transfer funds directly to one another using their bank accounts. These platforms often provide near-instantaneous funds transfer between individuals who are connected on the platform. P2P payment platforms are commonly used for splitting bills, repaying friends, or making small, quick transactions.

5. Prepaid cards: Prepaid cards, such as prepaid debit cards or gift cards, offer a quick and convenient way to make payments without the need for bank account details. These cards can be loaded with funds and used for purchases anywhere the card network is accepted. Prepaid cards eliminate the need for transaction clearing since they are pre-loaded with funds.

6. Cryptocurrencies: Cryptocurrencies, such as Bitcoin or Ethereum, provide an alternative digital payment method. Transactions using cryptocurrencies can be highly efficient, with funds transferred directly between wallet addresses. However, it’s important to note that cryptocurrency adoption is still growing, and acceptance may be limited for certain transactions.

By utilizing these alternatives, individuals and businesses can benefit from faster transaction times, making it suitable for time-sensitive payments or when immediate funds are required. However, it is essential to weigh the pros and cons of each alternative and consider factors such as fees, availability, and security before selecting the most appropriate option for your specific needs.