Adding Credit or Debit Cards

Adding credit or debit cards to Apple Pay is a seamless process that empowers you to make secure and convenient transactions using your iPhone 12. Here's a step-by-step guide to help you set up Apple Pay with your preferred payment cards:

-

Open the Wallet App: To begin, locate and open the Wallet app on your iPhone 12. The Wallet app features a simple, intuitive interface designed to streamline the management of your payment cards and passes.

-

Tap the "+" Icon: Within the Wallet app, look for the "+" icon typically located in the top-right corner of the screen. Tapping this icon initiates the process of adding a new card to your Apple Pay account.

-

Select "Credit or Debit Card": Upon tapping the "+" icon, you'll be presented with various options for adding cards to Apple Pay. Choose the "Credit or Debit Card" option to proceed with adding your preferred payment card.

-

Position Your Card in the Frame: After selecting the "Credit or Debit Card" option, your iPhone 12's camera will activate, prompting you to position your physical credit or debit card within the frame displayed on the screen. Ensure that the card details are aligned within the frame for accurate scanning.

-

Manually Enter Card Details: In the event that your iPhone 12 is unable to scan your card, you can opt to manually enter the card details, including the card number, expiration date, and security code.

-

Verify Your Card: Following the entry of your card details, your card-issuing bank may require verification. This typically involves receiving a verification code via SMS, email, or through the bank's mobile app. Enter the verification code as prompted to authenticate and link your card to Apple Pay.

-

Agree to Terms and Conditions: Once your card is successfully verified, you may be prompted to agree to the terms and conditions for using the card with Apple Pay. Review and accept the terms to complete the setup process.

-

Start Using Apple Pay: With your credit or debit card successfully added to Apple Pay, you can now enjoy the convenience of making secure and contactless payments at participating merchants, both in-store and online.

By following these simple steps, you can effortlessly add your credit or debit cards to Apple Pay, enhancing the versatility and convenience of your iPhone 12 for everyday transactions.

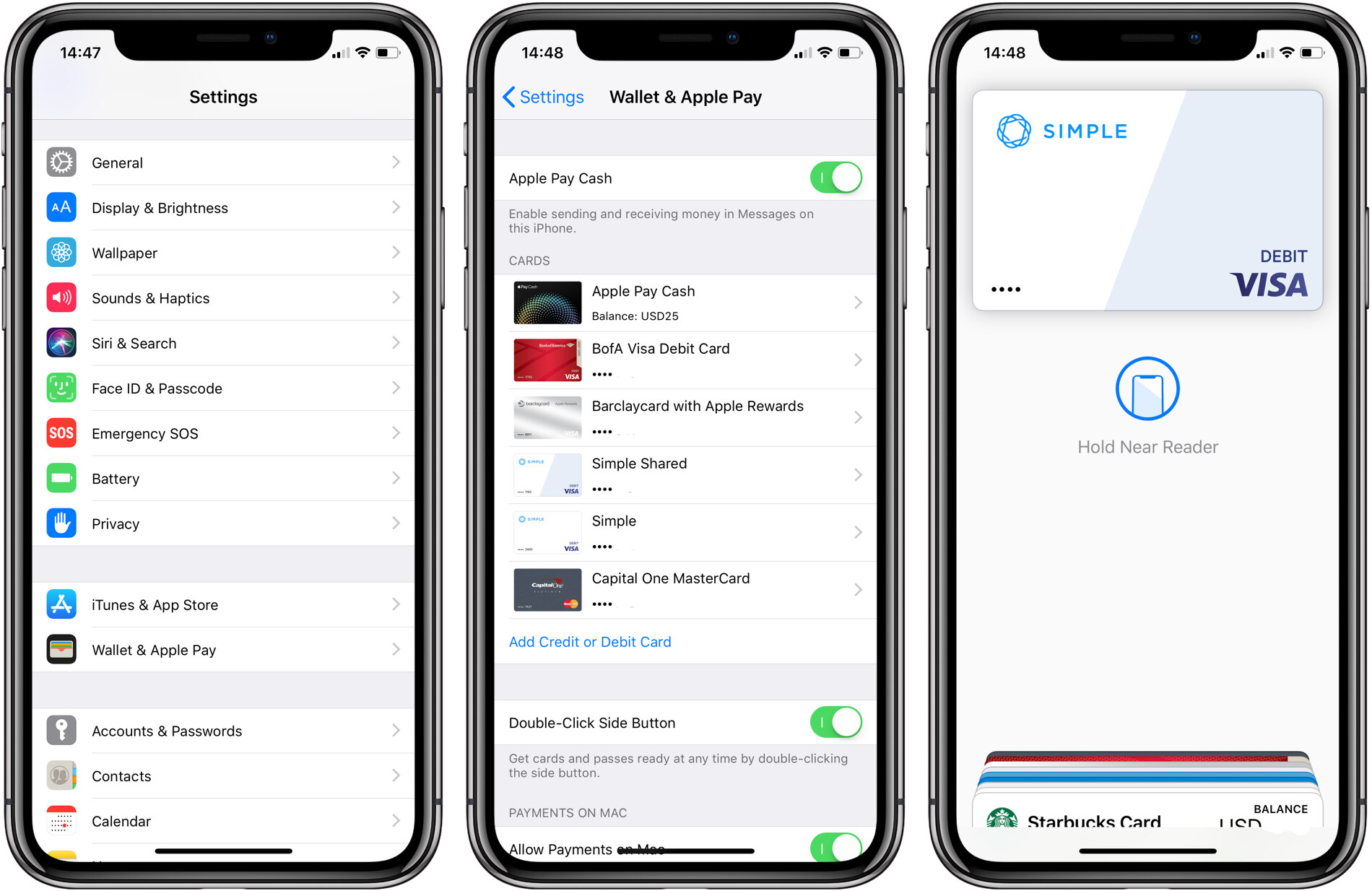

Setting Up Apple Pay

Setting up Apple Pay on your iPhone 12 is a straightforward process that elevates the convenience and security of your digital transactions. By seamlessly integrating your preferred payment cards with Apple Pay, you can enjoy the ease of making contactless payments in stores, within apps, and on websites. Here's a comprehensive guide to help you configure Apple Pay on your iPhone 12:

-

Access the Wallet App: Begin by locating and opening the Wallet app on your iPhone 12. The Wallet app serves as the central hub for managing your payment cards, boarding passes, and more, offering a user-friendly interface for a seamless setup process.

-

Initiate the Setup: Within the Wallet app, tap the "Add" button, typically denoted by a "+" sign, to initiate the setup process for Apple Pay. This action prompts your iPhone 12 to guide you through the necessary steps for adding and verifying your payment cards.

-

Add Your Payment Cards: You'll have the option to add credit or debit cards from participating banks and card issuers to your Apple Pay account. This can be done by either scanning your physical card using your iPhone's camera or manually entering the card details, including the card number, expiration date, and security code.

-

Verification Process: After adding your payment cards, your card-issuing bank may require verification to ensure the security of the transaction. This typically involves receiving a verification code via SMS, email, or through the bank's mobile app. Enter the verification code as prompted to authenticate and link your card to Apple Pay.

-

Agree to Terms and Conditions: Once your card is successfully verified, you may be prompted to review and accept the terms and conditions for using the card with Apple Pay. It's essential to carefully review the terms to ensure a clear understanding of the usage guidelines and responsibilities associated with using Apple Pay.

-

Set a Default Card: Within the Wallet app, you have the option to set a default card for Apple Pay transactions. This default card will be used for contactless payments unless you choose a different card during the transaction.

-

Enable Face ID or Touch ID: To enhance the security of your Apple Pay transactions, consider enabling Face ID or Touch ID authentication. This adds an extra layer of protection by requiring your facial recognition or fingerprint authentication before completing a payment.

-

Explore Additional Features: Once Apple Pay is set up, take the time to explore additional features such as managing your transaction history, setting up transaction notifications, and utilizing Apple Cash for person-to-person payments.

By following these steps, you can seamlessly set up Apple Pay on your iPhone 12, unlocking a world of secure and convenient payment options at your fingertips. With Apple Pay configured, you can confidently embrace the ease of making transactions in stores, within apps, and online, all while prioritizing security and efficiency.

Using Apple Pay for In-Store Purchases

Utilizing Apple Pay for in-store purchases revolutionizes the way you make transactions, offering a seamless and secure alternative to traditional payment methods. With your iPhone 12 equipped with Apple Pay, you can effortlessly complete purchases at a diverse range of merchants, from retail stores to restaurants, with just a tap of your device. Here's a detailed exploration of the process and benefits of using Apple Pay for in-store transactions:

Streamlined Checkout Process

When making in-store purchases, leveraging Apple Pay streamlines the checkout process, eliminating the need to fumble for physical payment cards or cash. Upon reaching the point of sale, simply hold your iPhone 12 near the contactless reader and authenticate the transaction using Face ID, Touch ID, or your device's passcode. This swift and contactless interaction expedites the payment process, reducing wait times and enhancing overall convenience.

Enhanced Security Measures

Apple Pay prioritizes security, safeguarding your payment information through tokenization and encryption. When you initiate an in-store transaction with Apple Pay, your actual card details are never shared with the merchant. Instead, a unique, encrypted code is generated for each transaction, adding an extra layer of protection against unauthorized access and fraudulent activities. This advanced security framework instills confidence in users, assuring them of a secure and reliable payment experience.

Wide Acceptance and Accessibility

One of the key advantages of using Apple Pay for in-store purchases is its widespread acceptance across various retailers, making it a versatile and accessible payment solution. Whether you're shopping at major department stores, grocery chains, or boutique establishments, the likelihood of encountering Apple Pay-compatible terminals is increasingly prevalent. This broad acceptance empowers users to seamlessly integrate Apple Pay into their daily shopping routines, fostering a consistent and convenient payment experience.

Contactless and Hygienic Transactions

In today's landscape, where health and hygiene are paramount, the contactless nature of Apple Pay transactions aligns with the evolving preferences of consumers. By minimizing physical contact with payment terminals and cash, Apple Pay contributes to a more hygienic shopping environment, reducing the potential transmission of germs and promoting a safer transactional experience for both customers and merchants.

Seamless Integration with Rewards and Loyalty Programs

Apple Pay seamlessly integrates with various rewards and loyalty programs offered by participating merchants, allowing users to conveniently accrue and redeem points, discounts, and special offers during in-store transactions. This integration streamlines the rewards process, eliminating the need for physical loyalty cards or additional steps at checkout. This added convenience enhances the overall shopping experience, incentivizing users to leverage Apple Pay for its integrated benefits.

In summary, using Apple Pay for in-store purchases presents a myriad of advantages, including a streamlined checkout process, enhanced security measures, wide acceptance, contactless transactions, and seamless integration with rewards programs. By embracing the convenience and security of Apple Pay, users can elevate their in-store shopping experiences while aligning with evolving trends in digital payments and consumer preferences.

Using Apple Pay for Online Purchases

Embracing the digital era, Apple Pay extends its seamless and secure payment capabilities to online transactions, revolutionizing the way users engage in e-commerce. With the integration of Apple Pay on your iPhone 12, you can navigate the virtual shopping landscape with enhanced convenience and confidence. Here's an in-depth exploration of the process and benefits of using Apple Pay for online purchases:

Effortless Checkout Experience

When making online purchases, Apple Pay streamlines the checkout process, eliminating the need to manually enter extensive payment and shipping details. Upon reaching the payment stage on a participating merchant's website or app, simply select the Apple Pay option and authenticate the transaction using Face ID, Touch ID, or your device's passcode. This frictionless interaction expedites the payment process, reducing potential barriers and enhancing overall convenience for users.

Advanced Security Protocols

Apple Pay prioritizes security, employing robust measures to safeguard users' payment information during online transactions. Through tokenization and encryption, Apple Pay ensures that sensitive card details are never shared with the merchant. Instead, a unique, encrypted code is generated for each transaction, mitigating the risk of unauthorized access and enhancing data protection. This advanced security framework instills trust and reassurance, positioning Apple Pay as a reliable and secure payment solution for online shopping endeavors.

Seamless Integration with Apps and Websites

One of the key advantages of using Apple Pay for online purchases is its seamless integration with a wide array of apps and websites. As an increasing number of merchants embrace Apple Pay, users can enjoy a consistent and streamlined payment experience across diverse online platforms. Whether you're shopping for apparel, electronics, or digital services, the integration of Apple Pay simplifies the checkout process, fostering a user-friendly and efficient transactional journey.

Enhanced Privacy and Anonymity

By leveraging Apple Pay for online purchases, users can benefit from enhanced privacy and anonymity. As the actual card details are not transmitted to the merchant, Apple Pay adds an extra layer of confidentiality to online transactions. This privacy-centric approach aligns with evolving consumer preferences for secure and discreet online interactions, contributing to a more trusted and personalized shopping experience.

Support for Contactless and Remote Transactions

In the current landscape, where remote interactions are increasingly prevalent, Apple Pay facilitates contactless and remote transactions for online purchases. Whether you're shopping from the comfort of your home or engaging in e-commerce while on the go, the seamless nature of Apple Pay transactions transcends physical boundaries, empowering users to navigate the digital marketplace with ease and efficiency.

In summary, using Apple Pay for online purchases offers a myriad of advantages, including an effortless checkout experience, advanced security protocols, seamless integration with apps and websites, enhanced privacy, and support for contactless and remote transactions. By embracing the convenience and security of Apple Pay in the online realm, users can elevate their e-commerce experiences while aligning with evolving trends in digital payments and consumer preferences.

Managing Apple Pay Cards

Managing your Apple Pay cards empowers you to maintain control over your digital payment methods, ensuring a seamless and personalized transactional experience. With the ability to add, remove, and organize your payment cards within the Wallet app on your iPhone 12, you can effortlessly tailor your Apple Pay account to suit your evolving financial needs. Here's an insightful exploration of the essential aspects of managing Apple Pay cards:

Adding and Removing Cards

The process of managing Apple Pay cards begins with the flexibility to add new cards and remove existing ones as needed. When adding a new card, whether it's a credit or debit card from a participating bank or an eligible transit card, the Wallet app guides you through a user-friendly interface, allowing you to seamlessly integrate additional payment methods into your Apple Pay account. Conversely, should the need arise to remove a card, the Wallet app provides straightforward options for decluttering your digital wallet, ensuring that your active cards align with your current preferences and usage patterns.

Setting Default Cards and Organizing Preferences

Within the Wallet app, you have the autonomy to designate a default card for Apple Pay transactions, streamlining the checkout process by pre-selecting a preferred payment method. This feature enhances convenience, especially for users with multiple cards linked to their Apple Pay account, as it simplifies the payment selection process during in-store and online transactions. Additionally, the ability to organize and prioritize your cards within the Wallet app allows for a personalized and intuitive management approach, enabling you to arrange your payment methods according to frequency of use or specific spending categories.

Managing Transaction History and Notifications

Apple Pay offers users the capability to monitor and manage their transaction history directly within the Wallet app, providing a comprehensive overview of their recent purchases and payments made using Apple Pay. This feature facilitates financial transparency and accountability, empowering users to track their expenditure and identify trends in their spending habits. Furthermore, the option to set up transaction notifications enhances security and awareness, as users can receive real-time alerts for their Apple Pay transactions, enabling them to promptly detect and address any unauthorized or suspicious activities.

Leveraging Apple Cash and Person-to-Person Payments

In addition to managing traditional payment cards, Apple Pay encompasses the integration of Apple Cash, a convenient and secure method for person-to-person payments. By managing Apple Cash within the Wallet app, users can effortlessly send and receive money from friends and family, further expanding the utility of their digital wallet. This seamless integration of person-to-person payments within the Apple Pay ecosystem enhances the versatility and practicality of managing financial transactions on the iPhone 12.

By actively managing your Apple Pay cards, you can optimize the functionality and security of your digital wallet, ensuring a tailored and efficient payment experience that aligns with your individual preferences and financial objectives. The intuitive features and capabilities offered within the Wallet app empower users to maintain a dynamic and personalized approach to managing their payment methods, ultimately enhancing their overall digital payment experience.