Introducing the top 15 superior bookkeeping software for 2023. In today's digital era, efficient bookkeeping plays a vital role in the success of businesses. As technology advances, so does the need for reliable software that simplifies financial management tasks. Whether you are a small business owner or a finance professional, having access to high-quality bookkeeping software can streamline your operations, improve accuracy, and save valuable time. In this article, we will explore the top 15 bookkeeping software options available in 2023, highlighting their features, user-friendliness, and overall effectiveness. Stay ahead of the competition by harnessing the power of these superior bookkeeping software solutions.

Overall Score: 6.5/10

Express Accounts Accounting Software Free is a user-friendly program that allows you to manage your business finances efficiently. It helps you keep track of payments, deposit transactions, and generate reports for monitoring your financial status. With this software, you can easily create and track quotes, invoices, and more. You can also connect to the app with secure web access, making it convenient to access your financial information anywhere. It is a great solution for small businesses looking for a simple and practical accounting software. However, some users have reported issues with bank account connectivity and a slow interface. Overall, Express Accounts Accounting Software Free offers value for money with its essential features.

Key Features

- Manage your payments and deposit transactions

- Check balances and generate reports to monitor your business finances

- Email and fax reports to your accountant

- Create and track quotes, invoices, and more

- Connect to the app with secure web access

Specifications

- N/A

Pros

- User-friendly and easy to use

- Convenient web access for remote usage

- Suitable for small businesses

- Value for money

Cons

- Issues with bank account connectivity

- Slow interface when switching tabs

Express Accounts Accounting Software Free is a reliable option for small businesses seeking a straightforward accounting solution. It offers essential features to manage payments, generate reports, and track invoices. The secure web access ensures convenience and accessibility. However, users have experienced problems with bank account connectivity and encountered a slow interface. Despite these drawbacks, the software provides good value for money. If you are looking for a practical and user-friendly accounting software without complicated features, Express Accounts Accounting Software Free is worth considering.

Overall Score: 7.2/10

Express Accounts is a user-friendly accounting software that simplifies bookkeeping. With features such as tracking payments, generating reports, and emailing reports directly to your accountant, Express Accounts streamlines your financial management. It is easy to use, with a quick setup process and intuitive interface. You can also provide secure logins for multiple users within your organization. While it lacks detailed specifications, Express Accounts is highly rated for its time-saving capabilities and comprehensive reporting. However, some users have encountered issues with downloads and customer support. Overall, Express Accounts is a reliable option for small businesses or individuals in need of basic accounting functions.

Key Features

- Easily track payments, deposits, quotes, invoices, and expenses

- View balance for all accounts and generate reports

- Email or fax reports directly to your accountant

- Quick and intuitive setup process

- Secure logins for multiple users within your organization

Specifications

Pros

- Saves time with comprehensive reports

- Intuitive and user-friendly interface

- Provides access for multiple users

Cons

- Issues with downloads and installation

- Limited customer support

- Lacks detailed product specifications

Express Accounts is a solid accounting software for small businesses or individuals in need of basic bookkeeping functions. Its time-saving features and intuitive interface make it an attractive option. However, it falls short in providing sufficient customer support and lacks detailed specifications. If you’re looking for a reliable accounting solution that is easy to use and offers comprehensive reporting, Express Accounts is worth considering. Just be aware of the potential issues with downloads and seek alternative support options if needed.

Overall Score: 7/10

Accounting and QuickBooks – 2 in 1: Learn How to Use Small Business Bookkeeping Software for Beginners is a comprehensive guide by Kevin Ellis that helps users understand and navigate both accounting and QuickBooks software. The book is written in a concise and informative manner, making it easy to grasp concepts even for those without a strong background in numbers. It covers the basics of accounting, financial and managerial accounting, and the distinction between accounting and bookkeeping. The QuickBooks section provides a step-by-step guide for beginners on how to use the software effectively. Overall, this book is a valuable resource for small business owners and professionals looking to enhance their understanding of accounting and QuickBooks.

Key Features

- Covers both accounting and Quick Books software

- Concise and informative writing style

- Separate sections for accounting and Quick Books

- Provides step-by-step instructions for beginners

Specifications

- Dimension: 5.00Lx0.61Wx8.00H

Pros

- Informative and easy-to-understand content

- Helpful guide for beginners in accounting and Quick Books

- Includes separate sections for accounting and Quick Books

Cons

- Poorly edited with some writing errors

- Lacks practical hands-on teaching approach

- May require additional resources for deeper learning

Accounting and QuickBooks – 2 in 1: Learn How to Use Small Business Bookkeeping Software for Beginners is an informative guide that simplifies the complex world of accounting and QuickBooks for small business owners and beginners. With its clear and concise writing style, it offers a valuable resource for those looking to gain a better understanding of financial management. While some editing issues and the lack of a hands-on approach can be drawbacks, the book covers the basics effectively and provides step-by-step instructions for using QuickBooks. Overall, it is a recommended resource for individuals starting their own business or seeking to improve their accounting knowledge.

Overall Score: 5/10

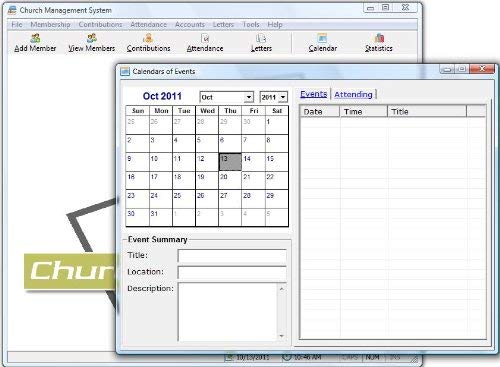

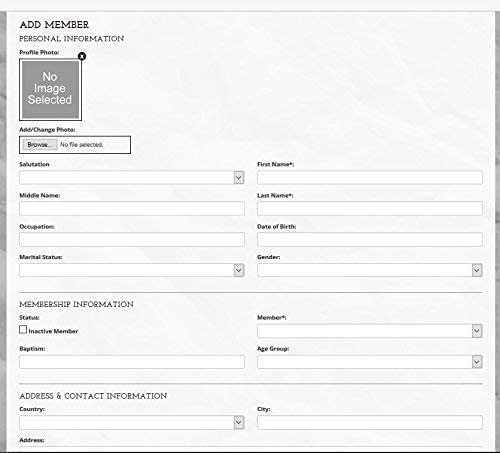

The Church Management Software Professional System is a comprehensive software designed to assist churches in managing their facilities, office tasks, bookkeeping, finances, and member administration. With the capability to handle details of over 100,000 members, including church events calendars and a general ledger, this software aims to streamline church management processes. It offers features such as church administration tools and financial management functionalities. However, customer reviews have been mixed, with complaints about the software's lack of detailed accounting system and incomplete CD contents. On the other hand, some users have found it easy to use and customize. Overall, the Church Management Software Professional System receives a customer rating of 2.5 out of 5.

Key Features

- Church management software

- Church administration software

- Handle details of over 100,000 members

- Includes general ledger

Specifications

Pros

- Easy to customize

- Easy to use

- Very straight forward

Cons

- No detailed accounting system

- Incomplete CD contents

- Lack of customer support

The Church Management Software Professional System offers a comprehensive solution for churches in managing various aspects of their operations. While it has some limitations, such as the lack of a detailed accounting system and incomplete CD contents, it still provides value with its user-friendly interface and customization options. The software’s ability to handle large member databases and financial management tasks can be beneficial for organizations with over 100,000 members. However, potential buyers should be aware of the mixed customer reviews and consider their specific needs before making a purchase decision.

Overall Score: 6.5/10

The Church Management Software Professional System is a powerful tool designed to assist churches in managing their facilities, office tasks, bookkeeping, and finances. With online access, it provides easy and convenient management solutions for Windows, Mac, and smartphones. Track and print various custom letters for church members, manage and print calendars with events, track and print multiple church bank accounts and transactions, and manage church finances effectively. It also allows tracking and printing of members' contributions, making it a comprehensive system for churches. Despite mixed reviews and concerns about online security, the software offers a range of features and functionalities tailored to meet the needs of church administration.

Key Features

- Track and print various custom letters for members

- Manage and print calendar with events

- Track and print multiple Church Bank Accounts and transactions

- Church Finances

- Church Event Calendars

- Track and print members' contributions

Specifications

Pros

- Useful and efficient

- Convenient tool for organizing a new church

- Offers comprehensive reports and accounting module

- Friendly and professional tech support

Cons

- Not secure software, potential data risk

- Misleading packaging, online download instead of CD

- Not a true church management product

- Lack of contact information on the website

The Church Management Software Professional System offers a range of functionalities to assist churches in effectively managing their operations. With features for letter tracking, event calendars, bank account management, and member contributions, it provides valuable tools for church administration. However, concerns over online security and misleading packaging raise doubts. Despite these issues, the software proves helpful to many users, streamlining their management tasks. Notably, the availability of detailed reports and a comprehensive accounting module, along with friendly and prompt tech support, adds value to the package. While improvements are needed, it remains a useful application for churches seeking digital solutions for their administrative needs.

Overall Score: 8.5/10

Mastering QuickBooks® 2023: The Ultimate Guide to Bookkeeping with QuickBooks®, 4th Edition is a comprehensive reference book and how-to guide for QuickBooks Online users. Written by Crystalynn Shelton, the book covers everything from basic topics to advanced features. With colorful screenshots, step-by-step instructions, and clear explanations, the book is easy to follow, making it a valuable resource for beginners and experienced users alike. The book also includes Pro Tips and links to helpful resources, aiding in a better understanding of the QuickBooks platform. Whether you are new to QuickBooks Online or looking to enhance your skills, Mastering QuickBooks® 2023 is a must-have companion.

Key Features

- Comprehensive guide for Quick Books Online users

- Colorful screenshots, step-by-step instructions, and clear explanations

- Pro Tips and links to helpful resources

Specifications

- N/A

Pros

- Well-organized and easy-to-understand

- Includes basic and advanced topics

- Useful for beginners and experienced users

- Helpful Pro Tips and links to additional resources

Cons

- Not suitable for Quick Books Desktop users

- Book damaged in packaging for some customers

- May not cover advanced features in depth

Mastering QuickBooks® 2023 is an excellent reference book and how-to guide for QuickBooks Online users. Crystalynn Shelton provides a comprehensive overview of the platform, from basic concepts to advanced features. The book is well-organized, with easy-to-understand language, colorful screenshots, and step-by-step instructions. It is a valuable resource for beginners who want to learn QuickBooks Online and experienced users who want to enhance their skills. The inclusion of Pro Tips and links to helpful resources further enhances the learning experience. However, it’s important to note that this book is specifically for QuickBooks Online and may not be suitable for QuickBooks Desktop users. Overall, Mastering QuickBooks® 2023 is a must-have companion for anyone looking to master bookkeeping with QuickBooks Online.

Overall Score: 9/10

NetWorth2b StoryBooks Accounting is a feature-rich and user-friendly double-entry accounting system. It provides an easy-to-use interface for managing receipts, disbursements, and journal entries. The software automatically calculates payroll taxes for each employee paycheck and generates a payroll summary report to simplify tax return preparation. With NetWorth2b StoryBooks Accounting, you can access essential financial statements such as income statement, balance sheet, trial balance, and general ledger. The software also offers bank reconciliation helper reports for detailed and summary transactions. It includes management reports that translate data into valuable information. Additionally, the software allows for built-in backup and restore options to the location of your choice. With one low price and no hidden costs or subscription fees, NetWorth2b StoryBooks Accounting can accommodate accounting needs for up to three separate companies.

Key Features

- Feature-Rich, Complete Double-entry Accounting System

- User-Friendly Interface for Receipts, Disbursements & Journal Entries

- Auto-Calculate Payroll Taxes for Each Employee Paycheck

- Payroll Summary Report to Simplify Payroll Tax Return Preparation

- Income Statement, Balance Sheet, Trial Balance, General Ledger, etc.

- Bank Reconciliation Helper Reports for Detail and Summary Transactions

- Management Reports that Translate Data into Information

- Built-in Back-up and Restore Option to the Location that You Choose

- One Low Price, No Hidden Costs, No Subscription Fees

- Accommodates Accounting for Three Separate Companies

Specifications

- N/A

Pros

- Feature-rich and comprehensive double-entry accounting solution

- User-friendly interface for easier receipt and journal management

- Automated payroll tax calculations save time and effort

- Payroll summary report simplifies tax return preparation

- Offers various essential financial statements and bank reconciliation reports

- Management reports convert data into valuable information

- Built-in backup and restore option for added data security

- Affordable price with no hidden costs or subscription fees

- Allows accounting for up to three separate companies

Cons

NetWorth2b StoryBooks Accounting is an excellent choice for small businesses and individuals looking for a comprehensive accounting software. With its user-friendly interface and feature-rich functionality, it simplifies financial management tasks and provides valuable insights through management reports. The automated payroll tax calculation and payroll summary report streamline tax return preparation. The software’s ability to accommodate accounting for three separate companies makes it versatile for different scenarios. Additionally, the built-in backup and restore option enhances data security. Overall, NetWorth2b StoryBooks Accounting offers a robust solution with no hidden costs or subscription fees, making it a cost-effective choice for efficient accounting operations.

Overall Score: 7.8/10

Nonprofit Bookkeeping and Accounting For Dummies is a helpful book aimed at individuals looking to start a nonprofit organization. It provides easy-to-understand explanations and examples, making it accessible for beginners. The book covers the basic principles and terminology of accounting, as well as offering guidance on using Quickbooks software. With chapters building upon each other, it provides a comprehensive overview of nonprofit bookkeeping. The book is praised for its simplicity and straight-to-the-point nature, making it valuable for small nonprofits and beginners. However, some reviewers note that certain key concepts are missing, and some pages may be out of order in used copies. Overall, it serves as an indispensable reference for those seeking to navigate nonprofit accounting.

Key Features

- Easy-to-understand explanations and examples

- Covers basic principles and terminology of accounting

- Provides guidance on using Quickbooks software

- Chapters build upon each other for a comprehensive overview

- Helpful for small nonprofits and beginners

Specifications

- N/A

Pros

- Easy to read and follow

- Valuable for starting a nonprofit organization

- Simple and straight-to-the-point

- Helps understand basic accounting principles

Cons

- Key nonprofit accounting concepts missing

- Pages may be out of order in used copies

- More direction may be needed for some readers

Nonprofit Bookkeeping and Accounting For Dummies serves as a valuable resource for individuals looking to establish a nonprofit organization. With its easy-to-understand explanations and examples, it simplifies complex accounting principles and provides guidance on using Quickbooks software. While some reviewers noted that key nonprofit accounting concepts were missing and that used copies may have pages out of order, the book overall is praised for its simplicity and its ability to provide useful information for small nonprofits and beginners. Whether you’re starting from ground zero or need a refresher, this book is a great investment for anyone seeking to navigate nonprofit accounting.

Overall Score: 8.5/10

Enhance your bookkeeping skills with this comprehensive guide filled with valuable tips and tricks. Whether you're a beginner or an experienced bookkeeper, this book offers practical advice and strategies to streamline your bookkeeping processes and improve accuracy. From managing accounts payable and receivable to creating financial reports and reconciling statements, you'll find step-by-step instructions and expert insights to help you become more efficient and effective in your role. With real-world examples and helpful illustrations, this book is a must-have resource for anyone involved in bookkeeping.

Key Features

- Practical tips and tricks to enhance bookkeeping skills

- Step-by-step instructions and expert insights

- Real-world examples and helpful illustrations

Specifications

- Dimension: 6.00Lx0.24Wx9.00H

Pros

- Comprehensive guide for beginner and experienced bookkeepers

- Practical advice to streamline bookkeeping processes

- Provides strategies to improve accuracy

- Includes real-world examples and helpful illustrations

Cons

- May not cover advanced bookkeeping topics

- Lacks interactive exercises for hands-on practice

Bookkeeping Tips And Tricks is a valuable resource for individuals seeking to enhance their bookkeeping skills. Whether you’re just starting out or have years of experience, this comprehensive guide offers practical advice and strategies that can greatly improve your efficiency and accuracy. The step-by-step instructions and expert insights are easy to follow, making it suitable for beginners. However, individuals looking for advanced bookkeeping topics may find it lacking. The inclusion of real-world examples and helpful illustrations enhances the learning experience. Overall, this book is highly recommended for anyone involved in bookkeeping looking to sharpen their skills and optimize their processes.

Overall Score: 6.4/10

Bookkeeper is an easy-to-use bookkeeping software that allows you to import product and contact data, reconcile bank statements, and track transactions. It offers a Start-up Wizard for quick setup and improved support for sending emails. With support for new W4 form fields in employee payroll calculations and the ability to include PayPal.Me link on invoices, Bookkeeper helps you manage your finances efficiently. While it is praised for its economical price and suitability for small businesses, some users have experienced difficulties with font size and account customization. Overall, Bookkeeper provides basic accounting functionality and can be a good option if you're looking for a budget-friendly solution.

Key Features

- Start-up Wizard for quick setup

- Import product and contact data

- Reconcile bank statements

- Track transactions

- Support for new W4 form fields in payroll calculations

- Include Pay Pal.Me link on invoices

- Improved email support

Specifications

- N/A

Pros

- Easy-to-use

- Economical price

- Suitable for small businesses

- Quick setup

Cons

- Font size may be too small for some

- Limited customization options for accounts

- No instructions provided

- Reports and printing options are limited

Bookkeeper is a basic accounting program that offers essential features for small businesses. While it may have limitations and lack advanced capabilities, its affordability makes it a viable option for those on a tight budget. However, if you require more flexibility in account customization and advanced reporting options, you may need to consider other alternatives. Overall, Bookkeeper provides value for money and can be a suitable choice for individuals or small businesses starting out in bookkeeping.

Overall Score: 8.2/10

The Church Management Software is a comprehensive tool designed to streamline and simplify the administrative tasks of running a church. This multi-user edition is suitable for churches with up to 100,000 members. With no monthly fees, the software offers a lifetime use, making it a cost-effective solution. It allows you to manage, track, and print member details and attendance, as well as schedule and calendar appointments. The platform includes features for bookkeeping, finances administration, and office management, providing an all-in-one solution for church management tasks. Available for Windows, Mac, and smartphones, this software ensures flexibility and accessibility for all users.

Key Features

- Church Facilities, Office, Bookkeeping, and Finances Administration

- One purchase equals lifetime use. NO monthly fees

- Manage, track, and print member details and attendance

- Scheduling and calendaring features for effective organization

Specifications

- Color: Church Management

Pros

- Comprehensive platform with scheduling, billing, and membership management tools

- Easy to use with a robust interface

- Flexible scheduling and calendar features

- Cost-effective solution with lifetime use and no monthly fees

Cons

- Some desired features may be missing

- Login issues reported by some users

The Church Management Software offers churches a powerful tool to streamline their administrative tasks. With its comprehensive features, intuitive interface, and flexible scheduling options, it provides an all-in-one solution for managing church facilities, office work, bookkeeping, and finances administration. The lifetime use and absence of monthly fees make it a cost-effective choice for churches of all sizes. While there may be some limitations reported by users, the overall feedback has been positive regarding its usefulness and value for the cost. Whether you are managing a small congregation or a large church community, this software can greatly simplify and enhance your church management processes.

Overall Score: 8/10

The Bookkeeping Practice Business Plan, Marketing Plan, How to Guide, and Funding Directory is a comprehensive package designed to assist individuals in starting and establishing their own bookkeeping practices. With a 9 chapter business plan, complete industry research, an 8 chapter marketing plan, and a 425+ page funding directory, this package provides all the necessary tools and resources for success. Additionally, it includes a How To guide that covers everything one needs to know about starting a bookkeeping practice. A PowerPoint presentation is also included, making it easy to present the business plan to potential investors or partners. Whether you are just starting out or looking to expand your bookkeeping practice, this package has everything you need.

Key Features

- 9 Chapter Business Plan (MS Word and Excel) – Full Industry Research

- 8 Chapter Marketing Plan (MS Word and Excel)

- 425+ Page Funding Directory!

- Everything you Need to Know About Starting a Bookkeeping Practice (How To Guide)

- Power Point Presentation Included!

Specifications

- N/A

Pros

Cons

The Bookkeeping Practice Business Plan, Marketing Plan, How to Guide, and Funding Directory is an excellent resource for individuals looking to start or expand their bookkeeping practices. With comprehensive business and marketing plans, a funding directory, and a detailed how-to guide, this package provides all the necessary tools and information for success. The inclusion of a PowerPoint presentation makes it easy to communicate the business plan effectively. The only downside is the lack of specific specifications provided. Nevertheless, this package offers great value and is highly recommended for those venturing into the world of bookkeeping.

Overall Score: 8.2/10

Bookkeeping For Dummies is a beginner's guide that simplifies the process of bookkeeping. With easy-to-understand language, it helps readers to learn accounting concepts and gain a solid foundation in bookkeeping. The book is well-written and provides clear information on terminology and common practices. However, some users have expressed disappointment with the UK edition not being clearly indicated beforehand. Overall, it is a helpful resource for beginners and offers valuable insights into bookkeeping for business owners. With a customer rating of 4.4/5, Bookkeeping For Dummies is a reliable choice for those looking to learn bookkeeping.

Key Features

- Simplified bookkeeping concepts

- Clear information on terminology

- Helpful for beginners

Specifications

- N/A

Pros

- Easy to read and understand

- Provides good clear information

- Helpful for learning technical accounting words

Cons

- UK edition not clearly indicated

- Some screenshots have small text

Bookkeeping For Dummies is a valuable resource for beginners looking to grasp the foundations of bookkeeping. It offers well-written content and clear explanations of accounting concepts. However, potential buyers should be aware of the UK edition, which may not be suitable for readers outside the UK. Overall, if you are just starting out with bookkeeping or want to understand basic accounting terminology, this book is a great choice.

Overall Score: 8.5/10

If you're looking to delve into the world of bookkeeping and accounting but feel overwhelmed, fear not! Bookkiping Fundamentals is here to guide beginners through the basics. This comprehensive guide offers step-by-step instructions and explanations, making it easy to understand even if you have no prior knowledge. With practical examples and exercises, you'll develop a solid foundation in bookkeeping principles and gain confidence in managing your business finances. Whether you're a small business owner or someone interested in pursuing a career in accounting, this beginner-friendly guide is a valuable resource to kickstart your journey.

Key Features

- Step-by-step instructions and explanations

- Practical examples and exercises

- Suitable for beginners with no prior knowledge

Specifications

- Dimension: [object Object]

Pros

- Clear and concise explanations

- Practical exercises reinforce learning

- Beginner-friendly approach

Cons

- May lack in-depth analysis for advanced users

- Limited focus on specific industries

Bookkiping Fundamentals: A Beginners Guide to Basic Bookkeeping and Accounting for Business is an excellent resource for those who want to understand the foundations of bookkeeping and accounting. It provides clear explanations, practical exercises, and a step-by-step approach that is perfect for beginners. While it may not offer deep analysis for advanced users or cater to specific industries, it serves its purpose of introducing basic concepts effectively. Whether you’re a small business owner or someone looking to start a career in accounting, this guide will give you the confidence you need to manage your business finances successfully.

Overall Score: 7/10

Quicken Home & Business is a powerful software that helps manage both personal and business finances. It offers features such as expense categorization, invoicing, tax preparation, portfolio analysis, custom budgeting, bill payment, loan tracking, and multi-device access. With Quicken, users can easily separate and track their personal and business expenses, generate custom invoices, analyze profit and loss, compare returns, create budgets, and conveniently manage bills. The software is designed to provide a comprehensive solution for individuals who need to manage both personal and business finances in one place. However, some users have reported issues with connectivity, importing files, and poor instructions. Quicken Home & Business requires a subscription membership for access.

Key Features

- Separate and categorize business and personal expenses

- E-mail custom invoices from Quicken with payment links

- Track business profit and loss and identify tax-deductible expenses

- Compare returns to market averages

- Improved portfolio analysis

- Create a customized budget

- Automatically categorize expenses

- Convenient bill access, download, and payment

- Track loan payments to save

- Access on multiple devices with free web and mobile app

Specifications

- N/A

Pros

- Comprehensive solution for personal and business finances

- Custom invoicing and expense tracking

- Improved portfolio analysis

- Convenient bill payment

- Multi-device access

Cons

- Connectivity issues with financial institutions

- Problems importing files

- Lack of clear instructions

- Membership subscription required

- Not compatible with Mac for Home&Business

Quicken Home & Business offers a range of powerful tools to manage personal and business finances in one place. It provides features like expense tracking, invoicing, tax preparation, portfolio analysis, and bill payment. However, some users have encountered issues with connectivity, file imports, and lack of instructions. The software requires a membership subscription for access and is not compatible with Mac for Home&Business. Overall, if you are looking for a comprehensive solution to streamline your personal and business finances, Quicken Home & Business can be a valuable tool.

BUYER'S GUIDE: BOOKKEEPING SOFTWARE

Benefits of Bookkeeping Software

- Efficiency: Bookkeeping software automates the process of recording transactions, saving you time and reducing the risk of errors.

- Accuracy: Software can perform complex calculations and generate accurate financial reports, ensuring your records are precise.

- Organization: Bookkeeping software allows you to keep all your financial data in one place, making it easy to access and analyze.

- Simplified Tax Filing: With built-in tax features, these tools make it simpler to prepare and file your tax returns accurately.

- Financial Insights: Advanced software often offers analytics and reporting capabilities, providing valuable insights into your business's financial health.

Factors to Consider When Choosing Bookkeeping Software

- Compatibility: Ensure the software is compatible with your operating system and can integrate with other tools you use.

- Usability: Look for an intuitive interface and user-friendly navigation to streamline your bookkeeping tasks.

- Features: Consider the specific features you require, such as invoicing, inventory management, budgeting, or payroll processing.

- Scalability: Choose software that can grow with your business, accommodating increasing transaction volumes and additional users.

- Data Security: Verify that the software offers robust security measures to protect your financial data from unauthorized access.

- Customer Support: Check if the software provider offers reliable customer support to assist you with any technical issues or questions.

Types of Bookkeeping Software

- Online Bookkeeping Software (Cloud-Based): These platforms store your financial data in the cloud, allowing access from anywhere with an internet connection.

- Desktop Bookkeeping Software: Installed locally on your computer, these programs offer offline access and can be more suitable for businesses without consistent internet availability.

- Mobile Bookkeeping Apps: Designed for smartphones and tablets, these apps provide on-the-go bookkeeping capabilities, ideal for freelancers or small business owners.

Popular Bookkeeping Software

- QuickBooks: A widely recognized and comprehensive software offering various versions for different business needs and sizes.

- Xero: Known for its user-friendly interface and extensive features, Xero is a popular choice among small and medium-sized businesses.

- Sage 50cloud: Offering robust accounting and bookkeeping features, Sage 50cloud is suitable for small to mid-sized businesses.

- FreshBooks: Known for its simplicity, FreshBooks is designed for small businesses and freelancers who need invoicing and expense tracking capabilities.

- Zoho Books: Zoho Books is a cloud-based accounting solution with a comprehensive feature set catered to businesses of all sizes.

Frequently Asked Questions about 15 Superior Bookkeeping Software for 2023

Bookkeeping software is a tool that helps individuals and businesses record, organize, and track financial transactions. It is especially beneficial if you want to streamline your bookkeeping process, improve accuracy, and gain deeper insights into your financials.

No, bookkeeping software can be useful for businesses of all sizes. Whether you are a freelancer, small business owner, or operate a larger organization, bookkeeping software can simplify your financial management tasks and enhance efficiency.

Yes, most bookkeeping software is capable of generating various financial reports, such as profit and loss statements, balance sheets, cash flow statements, and more. These reports provide critical insights into your business’s financial performance.

Yes, depending on the type of software you choose, cloud-based bookkeeping software and mobile apps allow you to access your financial data from multiple devices, including computers, smartphones, and tablets.

Reputable bookkeeping software providers prioritize data security. They implement measures such as data encryption, secure servers, and regular backups to protect your financial information from unauthorized access or loss.

The cost of bookkeeping software varies depending on the features, functionalities, and the provider. Prices can range from free for basic versions to several hundred dollars per month for advanced software suites. Consider your business needs and budget when choosing a suitable option.

Some bookkeeping software includes payroll processing capabilities, while others may integrate with dedicated payroll software or third-party services. Ensure the software you choose fits your specific payroll requirements.

Yes, many bookkeeping software tools offer tax-related features, such as tracking deductible expenses, generating tax reports, and even integrating with tax filing software. These capabilities can simplify the process of preparing and filing your taxes accurately.

Reliable bookkeeping software providers offer customer support through various channels such as email, phone, live chat, or help centers. Reach out to their support team for any assistance or troubleshooting you may require.

Most bookkeeping software allows some level of customization, such as adding company logos to invoices or tailoring financial reports to specific requirements. Explore the customization options available in the software you choose to align it with your business branding and reporting needs.

Yes, certain bookkeeping software offers built-in inventory management features. These tools enable you to track stock levels, manage purchase orders, and even integrate with e-commerce platforms, providing a comprehensive solution for inventory management alongside bookkeeping tasks.

Many bookkeeping software options allow you to import your existing financial data, such as bank transactions or data from previous accounting systems. This feature can save time during the initial setup process, ensuring a smooth transition to the new software.