Are you tired of the tedious and complex process of filing your income taxes? Look no further! In this article, we have compiled a list of the 10 Best Income Tax Software for 2023. These cutting-edge software programs have been carefully selected based on their user-friendly interface, accuracy, and efficiency. Whether you're an individual taxpayer, a freelancer, or a small business owner, these top-rated income tax software options will streamline the tax filing process and maximize your deductions. Say goodbye to stress and confusion and say hello to hassle-free tax preparation with the 10 Best Income Tax Software for 2023.

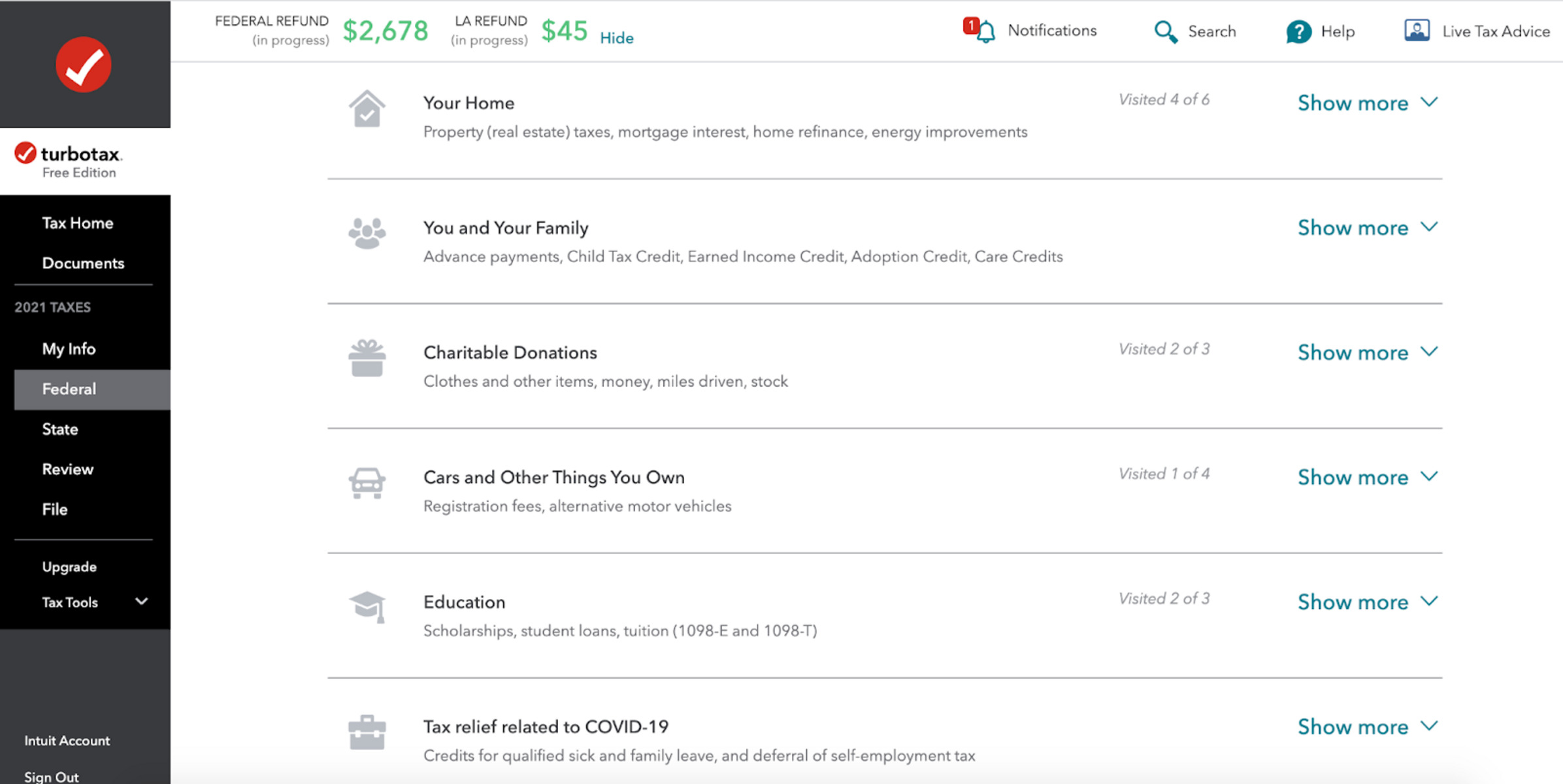

Overall Score: 7.5/10

H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer is a comprehensive tax software that helps individuals maximize their deductions and accurately file their taxes. With step-by-step guidance, users can easily import their tax documents, such as W-2s and 1099s, and swiftly complete their tax returns. The software also provides reporting assistance on various sources of income, including investments and stock options. Users can benefit from valuable features like accuracy review to minimize audit risks and the option to put their refund on an Amazon gift card with a bonus. However, some users have reported issues with bugs in the software and unexpected charges when filing state returns. Overall, H&R Block Tax Software Deluxe + State 2022 is a reliable option for straightforward tax returns.

Key Features

- Choose to put your refund on an Amazon gift card and get a 2.75% bonus

- One state program download included

- Reporting assistance for income from investments, stock options, home sales, and retirement

- Step-by-step Q&A and guidance

- Quick import of W-2, 1099, 1098, and last year's tax return

- Accuracy Review to check for issues and assess audit risk

- Five free federal e-files and unlimited federal preparation and printing

Specifications

- N/A

Pros

- Comprehensive and user-friendly tax software

- Ability to import tax documents from various sources

- Step-by-step guidance for easy filing

- Reporting assistance for different income sources

- Option to receive refund on an Amazon gift card with bonus

- Includes five free federal e-files

Cons

- Potential bugs in the software

- Unexpected charges when filing state returns

- Lack of clarity in instructions for certain features

H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer is a reliable tax software that offers comprehensive features and step-by-step guidance for individuals looking to file their taxes accurately. It stands out for its ability to import tax documents from various sources and its reporting assistance for different income sources. Users appreciate the option to receive their refund on an Amazon gift card with a bonus, adding extra value to their tax filing experience. However, some users have reported issues with bugs in the software and unexpected charges when filing state returns. Despite these drawbacks, H&R Block Tax Software Deluxe + State 2022 remains a solid choice for individuals with straightforward tax returns.

Overall Score: 8/10

TurboTax Deluxe 2022 Tax Software is the ultimate solution for homeowners, individuals with charitable donations, and high medical expenses. This software allows you to file both Federal and State Tax Returns, maximizing your deductions and credits for the maximum refund possible. With up-to-date knowledge of the latest tax laws, TurboTax Deluxe ensures accuracy and ease of use. As an Amazon exclusive offer, you also receive a 1-year subscription of Quicken Starter Edition, valued at $41.88, and save $10 off McAfee Total Protection 2023. While it does not include a detailed list of specifications, TurboTax Deluxe offers the necessary features and support for a hassle-free tax filing experience. Customer ratings average at 4.3/5, indicating high user satisfaction.

Key Features

- Recommended for homeowners and individuals with specific deductions

- Includes 5 Federal e-files and 1 State via download ($45 value)

- Maximizes 350+ deductions and credits

- Up-to-date with the latest tax laws

- 1-year subscription of Quicken Starter Edition included

- Save $10 off Mc Afee Total Protection 2023

Specifications

Pros

- Easy to use with accurate results

- Saves money compared to hiring a tax preparer

- Allows for adjustments and amended returns

- Includes free U.S.-based product support

- Comes with additional software and discount offers

Cons

- State filing requires an additional fee

- Download issues reported on certain devices

- Difficulty uninstalling bundled security application

TurboTax Deluxe 2022 Tax Software is a reliable and user-friendly solution for filing Federal and State Tax Returns. It offers a comprehensive set of features, up-to-date tax laws, and excellent support. The inclusion of Quicken Starter Edition and discount on McAfee Total Protection provides added value. While the requirement of an additional fee for state filing may disappoint some, TurboTax’s accuracy and ease of use make it a popular choice. However, users have reported occasional download issues, and some have faced difficulty uninstalling bundled security software. Overall, TurboTax Deluxe is a solid option for DIY tax filers, especially those with homeownership and specific deductions.

Overall Score: 8/10

TurboTax Home & Business 2022 Tax Software is a comprehensive tax preparation software designed for self-employed individuals, independent contractors, freelancers, small business owners, sole proprietors, and consultants. It helps users get their personal and self-employed taxes done right, maximize industry-specific small business tax deductions, and create W-2s and 1099 tax forms for employees and contractors. The software also includes exclusive offers such as a 1-Year Subscription of Quicken Starter Edition and a discount on McAfee Total Protection 2023. With free U.S.-based product support and electronic filing options, TurboTax Home & Business 2022 provides a reliable and user-friendly solution for tax preparation.

Key Features

- Recommended for self-employed and small business owners

- Includes 5 Federal e-files and 1 State via download

- Boosts bottom line with industry-specific tax deductions

- Creates W-2s and 1099 tax forms for employees & contractors

- Includes exclusive offers from Amazon

Specifications

Pros

- Comprehensive tax preparation for self-employed individuals

- Industry-specific small business tax deductions

- Free U.S.-based product support

Cons

- Requires downloading a new operating system each year

- Limited access to previous year's tax return details

TurboTax Home & Business 2022 Tax Software is a reliable and efficient tax preparation software. It offers a comprehensive solution for self-employed individuals and small business owners, helping them maximize their tax deductions and streamline the filing process. With its user-friendly interface, up-to-date information on tax laws, and free U.S.-based product support, TurboTax Home & Business 2022 ensures a stress-free and accurate tax filing experience. Although there are some drawbacks, such as the requirement to download a new operating system each year and limited access to previous year’s tax return details, the overall performance and features of TurboTax Home & Business 2022 make it a recommended choice for individuals in need of reliable tax software.

Overall Score: 8.5/10

TurboTax Premier 2022 Tax Software is the ideal choice for individuals who sold stock, employee stock, bonds or mutual funds, own rental property, or are trust beneficiaries. It allows you to maximize your IRA savings with retirement tax help and keeps you up-to-date with the latest tax laws. With 5 Federal e-files and 1 State via download, it offers convenience and efficiency. Plus, it comes with a 1-year subscription of Quicken Starter Edition and a $10 discount on McAfee Total Protection. The software has a user-friendly interface, offers online support, and handles your tax needs effectively. Its interview process is easy to follow, and it smoothly imports data from previous tax returns and investment accounts. While some features like backdoor Roth IRA contributions and handling ETFs categorized as trusts might be challenging, TurboTax Premier remains one of the best tax software options available.

Key Features

- Recommended for individuals who sold stock, bonds, etc.

- Includes 5 Federal e-files and 1 State via download

- Maximize IRA savings with retirement tax help

- Up-to-date with the latest tax laws

- 1-Year Subscription of Quicken Starter Edition included

- Save $10 off Mc Afee Total Protection

Specifications

Pros

- Well-designed and easy-to-use interface

- Handles investment and rental property income

- Active support forums for addressing tax-related questions

- Easy import of data from previous tax returns and investment accounts

Cons

- No easy process for backdoor Roth IRA contributions

- Difficulty in removing old form data from tax return

- Challenges in handling tax complications with ETFs categorized as trusts

TurboTax Premier 2022 Tax Software is a reliable and efficient option for individuals with complex tax situations. While it may not be the most affordable option, it offers a range of features and online support that make it worth the price. Its user-friendly interface, data import capabilities, and up-to-date tax laws ensure accurate and convenient tax filing. Although it may have some limitations in handling specific tax scenarios, TurboTax Premier remains the gold standard in tax software. Whether you’re a stock trader, rental property owner, or trust beneficiary, TurboTax Premier will simplify the process and help you maximize your tax savings. Overall, it’s a highly recommended solution for comprehensive tax preparation.

Overall Score: 8.5/10

Looking for a reliable solution to manage your taxes effectively? The TAX MANAGEMENT guide is here to assist you in navigating the complex world of tax management. With clear and concise instructions, this comprehensive guide helps individuals and businesses organize, understand, and optimize their tax processes. From tax planning to filing strategies, this resource covers all aspects of tax management. With step-by-step guidance and practical tips, you can ensure compliance with tax regulations and make informed financial decisions. Stay in control of your taxes and save time and money with this invaluable guide.

Key Features

- Comprehensive guide to tax management

- Clear and concise instructions

- Covers tax planning and filing strategies

- Step-by-step guidance and practical tips

Specifications

- N/A

Pros

- Provides comprehensive guidance for tax management

- Clear and concise instructions simplify tax processes

- Helps in tax planning and filing strategies

- Offers practical tips for compliance and financial decisions

Cons

- No specifications listed

- May not be suitable for advanced tax professionals

TAX MANAGEMENT: How to manage tax is a valuable resource that offers individuals and businesses a reliable solution for effective tax management. With its comprehensive guide and clear instructions, it simplifies the complex world of taxes. From planning to filing and making informed financial decisions, this guide provides step-by-step guidance and practical tips. While it may not cater to the needs of advanced tax professionals, it is an invaluable tool for individuals and businesses looking to stay in control of their taxes. Whether you’re looking to optimize your tax processes or ensure compliance, this guide is a must-have.

Overall Score: 8.4/10

The INCOME AND EXPENSE LOG BOOK is a small business ledger book perfect for bookkeeping and budgeting. With its floral cover and simple design, it serves as a daily bill budgeting planner and organizer. This tracker workbook journal helps you keep track of your income and expenses in an organized manner. Its compact size makes it convenient to carry around. The log book is ideal for small businesses, freelancers, and individuals looking to manage their finances efficiently. Measure your financial progress and stay on top of your expenses with this practical log book.

Key Features

- Small business ledger book with floral cover

- Simple design for bookkeeping and budgeting

- Daily bill budgeting planner and organizer

- Compact size for easy portability

Specifications

- Dimension: 8.50Lx0.28Wx11.00H

Pros

- Convenient and compact for on-the-go use

- Helps organize and manage income and expenses

- Durable and high-quality design

- Attractive floral cover adds a touch of style

Cons

- Limited space for extensive record-keeping

- Does not include additional financial tools or resources

The INCOME AND EXPENSE LOG BOOK is a practical tool for small business owners, freelancers, and individuals who want to effectively track their finances. Its compact size and durable design make it perfect for on-the-go use, ensuring that you can easily record your income and expenses wherever you are. The simple ledger layout helps keep your financial information organized, allowing you to analyze and manage your budget efficiently. Although the log book has limited space for extensive record-keeping, its attractive floral cover and high-quality construction add a touch of style to this essential financial tool.

Overall Score: 8/10

The Clever Fox Income & Expense Tracker is a highly functional accounting ledger book designed for small businesses. With its efficient and stress-free bookkeeping framework, you can easily organize your finances, record transactions, and analyze your business. This book comes with premium quality materials, including a vegan leather cover, no-bleed pages, and extra features like an elastic band and a ribbon bookmark. It also offers a hassle-free guarantee and returns policy. The Clever Fox Income & Expense Tracker is the perfect tool for small business owners looking to take control of their finances and succeed.

Key Features

- Perfect ledger book for small businesses

- Efficient and stress-free accounting

- Detailed record for analysis and financial statements

- Premium quality materials and extras

- Guarantee and returns policy

Specifications

- Color: Purple

- Size: A5 (5.8″ x 8.3″)

Pros

- High quality materials

- Efficient bookkeeping framework

- Detailed record for analysis

- Convenient size with useful extras

Cons

- Color may appear darker in certain lighting

- Columns not wide enough for required information

- Limited space for separating personal and work expenses

The Clever Fox Income & Expense Tracker is an excellent tool for small business owners who want to simplify their accounting processes. With its premium materials and useful extras, it offers a pleasant user experience. The detailed record of transactions and totals allows for easy analysis and accurate financial statements. However, some users may find limitations in space for certain information and separating personal and work expenses. Overall, this tracker provides great value and functionality, making it a worthy investment for small business owners.

Overall Score: 9.2/10

The LEGO Marvel Infinity Gauntlet Set 76191 is a collectible building set that features a LEGO brick recreation of the iconic Infinity Gauntlet with Infinity Stones. The set also includes a sturdy stand with a descriptive tablet. The golden Thanos glove captures the captivating style of Marvel Studios' Avengers: Infinity War and Avengers: Endgame movies. With movable fingers and vibrant colors, this LEGO set is a timeless display piece. It's perfect for decorating your office or home and is sure to be the center of attention. This LEGO building set makes a great Avengers gift for adults and teens, as well as a Christmas gift for Marvel fans or any model-making enthusiasts. Let your imagination run wild with this impressive LEGO set!

Key Features

- LEGO brick recreation of the Infinity Gauntlet with Infinity Stones

- Sturdy stand with a descriptive tablet

- Golden Thanos glove with movable fingers and vibrant colors

- Perfect for office or home decor

- Great Avengers gift idea for adults and teens

Specifications

- Color: Multicolor

- Dimension: 7.52Lx13.94Wx3.58H

- Size: Standard

Pros

- Impressive homage to Marvel

- Easy to follow instructions

- Vibrant colors and spot-on details

- Great collectible item for display

- Perfect gift for Marvel fans

Cons

- Missing critical piece in one pack

- Falls apart easily

- Box may arrive damaged

The LEGO Marvel Infinity Gauntlet Set 76191 is a must-have for any Marvel fans or building enthusiasts. With its impressive design, movable fingers, and vibrant colors, it serves as a perfect display piece for your office or home. The easy-to-follow instructions make it enjoyable to build, and the end result is truly satisfying. It may have a few minor cons, such as missing pieces or fragility, but overall, this LEGO set offers hours of fun and a great addition to any LEGO Marvel collection. Whether you’re buying it for yourself or as a gift, you won’t be disappointed with the LEGO Marvel Infinity Gauntlet Set 76191.

Overall Score: 8/10

TurboTax Business 2022 Tax Software is a comprehensive tax software for businesses and trusts. It is recommended for those who have a partnership, own an S or C Corp, Multi-Member LLC, manage a trust or estate, or need to file a separate tax return for their business. The software allows users to prepare and file their business or trust taxes with confidence, while also providing industry-specific tax deductions to boost the bottom line. It also includes features to create W-2 and 1099 tax forms for employees and contractors. With free U.S.-based product support, users can easily navigate the software. Overall, TurboTax Business 2022 Tax Software is a reliable and user-friendly solution for filing business and trust taxes.

Key Features

- Recommended if you have a partnership, own a S or C Corp, Multi-Member LLC, manage a trust or estate, or need to file a separate tax return for your business

- Includes 5 Federal e-files. Business State sold separately via download. Free U.S.-based product support (hours may vary).

- Prepare and file your business or trust taxes with confidence

- Boost your bottom line with industry-specific tax deductions

- Create W-2 and 1099 tax forms for employees and contractors

- Amazon Exclusive – Buy Turbo Tax and Save $10 off Mc Afee Total Protection 2023 | 5 Devices

Specifications

- N/A

Pros

- Comprehensive tax software for businesses and trusts

- User-friendly interface and easy to navigate

- Industry-specific tax deductions to boost bottom line

- Creates W-2 and 1099 tax forms for employees and contractors

- Includes 5 Federal e-files and free U.S.-based product support

- Amazon Exclusive offer to save $10 off Mc Afee Total Protection

Cons

- Significant price increase compared to previous years

- Compatibility issues with importing data from Quickbooks

- Difficulty in downloading the software from Amazon

TurboTax Business 2022 Tax Software is a reliable solution for businesses and trusts to prepare and file their taxes. It offers a user-friendly interface and provides industry-specific tax deductions to optimize the bottom line. The software helps to easily create W-2 and 1099 tax forms for employees and contractors, simplifying the tax filing process. However, some users have reported a significant price increase compared to previous years, as well as compatibility issues when importing data from Quickbooks. Despite these shortcomings, TurboTax remains a popular choice for individuals who prefer to handle their business taxes independently. Overall, TurboTax Business 2022 Tax Software is a valuable tool for businesses and trusts to confidently manage their tax obligations.

Overall Score: 7.5/10

Adobe Photoshop Elements 2023 is a photo editing software designed for Windows PC. It utilizes Adobe Sensei AI technology to automate tasks and allow users to focus on creative enhancements. With 61 guided edits, users can create depth, perfect landscapes, replace backgrounds, and make modern duotones. The software also offers personalized creations through collage and slideshow templates and updated creative content. Additionally, it provides web and mobile companion apps for photo editing on the go. While some users find it lacking compared to the full version of Photoshop, it is praised for its affordability and accessibility for beginners. With a customer rating of 3.8/5, Adobe Photoshop Elements 2023 offers a capable option for basic photo editing needs.

Key Features

- Adobe sensei ai technology

- 61 Guided edits

- Craft personalized creations

- Go beyond your desktop

Specifications

- N/A

Pros

- Affordable one-time purchase

- Suitable for beginners with manageable learning curve

- Includes basic features of Photoshop

- Access and edit photos on web and mobile

Cons

- Lacks advanced functionality of full Photoshop version

- May not meet the needs of experienced users

Adobe Photoshop Elements 2023 is a reliable and reasonably priced option for users seeking basic photo editing capabilities. While it may not offer the extensive features of the full Photoshop version, it provides automated options through Adobe Sensei AI technology and various guided edits for creative enhancements. The software allows users to create depth, perfect landscapes, replace backgrounds, and more. It also offers personalized creations, including collage and slideshow templates. With the added convenience of web and mobile companion apps, users can edit their photos beyond their desktop. However, advanced users may find the software lacking in terms of advanced functionality. Overall, Adobe Photoshop Elements 2023 is a solid choice for beginners and casual users.

Buyer's Guide: Income Tax Software

Finding the right income tax software to help you navigate the complex world of taxes can be overwhelming. Here is a comprehensive buyer's guide to assist you in making an informed decision.

Key Factors to Consider

- Price: Determine your budget and look for software that fits within your financial constraints.

- Ease of Use: Look for software with a user-friendly interface to simplify the tax filing process.

- Compatibility: Ensure the software is compatible with your operating system and devices.

- Features: Consider the features provided by the software, such as import options, tax calculators, and error-checking capabilities.

- Security: Prioritize software that offers robust security measures to protect your sensitive financial information.

Types of Income Tax Software

- Digital Downloads: These software programs are installed directly onto your computer for offline use.

- Web-Based Services: These online solutions allow you to access your tax files from any device with an internet connection.

- Mobile Applications: These apps provide a quick and convenient way to file your taxes on the go using your smartphone or tablet.

Choosing the Right Software

- Free Options: If you have a simple tax situation, consider free software options available from government agencies or reputable tax preparation companies.

- Basic Packages: Basic software packages are suitable for individuals with straightforward tax requirements and limited deductions.

- Deluxe Packages: For individuals with more complex tax situations, deluxe versions often offer advanced features, including additional forms and expert guidance.

- Premium Packages: Premium software typically caters to self-employed individuals, small business owners, and investors who require advanced tax preparation capabilities.

Pros and Cons of Income Tax Software

Pros:

- Provides step-by-step guidance, reducing the chances of costly errors.

- Automates calculations, saving time and minimizing the risk of mathematical mistakes.

- Offers electronic filing options for quicker refunds.

- Helps identify potential deductions and credits to maximize your tax savings.

- Generally more affordable than hiring a professional tax preparer.

Cons:

- Software is not infallible; mistakes can still occur.

- May not be suitable for individuals with very complex tax situations.

- Requires a certain level of computer literacy.

- Lack of personalized assistance or face-to-face interaction.

Frequently Asked Questions about 10 Best Income Tax Software for 2023

If you are required to file income taxes and want to simplify the process, income tax software can be a valuable tool. It can help ensure accurate calculations, identify potential deductions, and simplify electronic filing.

It is difficult to determine the “best” software as the ideal choice varies depending on individual needs. Consider factors such as price, ease of use, compatibility, features, and security before making a decision.

While income tax software can handle a wide range of tax situations, it may not be suitable for extremely complex scenarios. In such cases, it is advisable to consult with a professional tax preparer.

Reputable income tax software employs advanced security measures to protect your information. However, it is essential to follow best practices, such as using secure internet connections and keeping your computer up to date with the latest security patches.

Yes, income tax software can assist in maximizing your refund by identifying eligible deductions and credits that you may have missed. However, the size of your refund ultimately depends on your individual circumstances and the accuracy of the information provided.

It is advisable to keep paper copies of important tax documents for your records. While software can securely store your information electronically, it is wise to have physical copies as a backup.

Yes, many tax software providers offer mobile applications that enable you to file your taxes conveniently using your smartphone or tablet.

If you make a mistake, most income tax software provides error-checking capabilities to help identify and rectify errors before submission. However, it is crucial to review your tax return carefully to ensure accuracy.

Many income tax software programs can handle multiple state tax filings; however, some may charge an additional fee for each additional state return. Check the software’s specifications or contact customer support for clarity.

Reputable income tax software providers typically offer customer support via hotline, email, or live chat during tax season. Check the level of customer support provided before purchasing the software.