Trading and investing are more accessible now than ever before. Once the preserve of those with connections, insider knowledge and plenty of cash, these days, almost anybody can become an ‘armchair investor’. But before you start investing, you must first understand something about how the markets work and how to identify investment patterns that will help guide your trading decisions.

Getting started

All you need to start your investing journey are:

- A few hundred dollars

- An internet connection

- A plan

That third item is the most important. Plenty of people have leapt into amateur trading with no clear idea of what they want or how they intend to structure their trades. And some of them have lost their investment in no more than a few hours.

The other key factor to determine is your attitude to risk and reward. Whilst it’s advisable to trade with a diverse portfolio, some investors prefer to play safe by avoiding those trades that have the highest potential returns but also come with the highest risk.

The most important thing to remember, though, is that you should never invest more than you can afford to lose.

Don’t expect to make millions overnight

The internet is rife with courses, videos and ebooks that promise they’ll make you rich. Which begs the question, why are these people creating those tools rather than just investing money and making millions? Successful trading is about practice and knowledge.

Expect more than half of your investments to fail

That may sound like a lot, but it’s the reality for most professional and amateur traders. And it’s why having a long-term strategy is so important. You can’t get carried away with every success or too downhearted each time you lose. A diverse portfolio based on good analysis should be your goal, not following fads.

Stock analysis is crucial for trading success

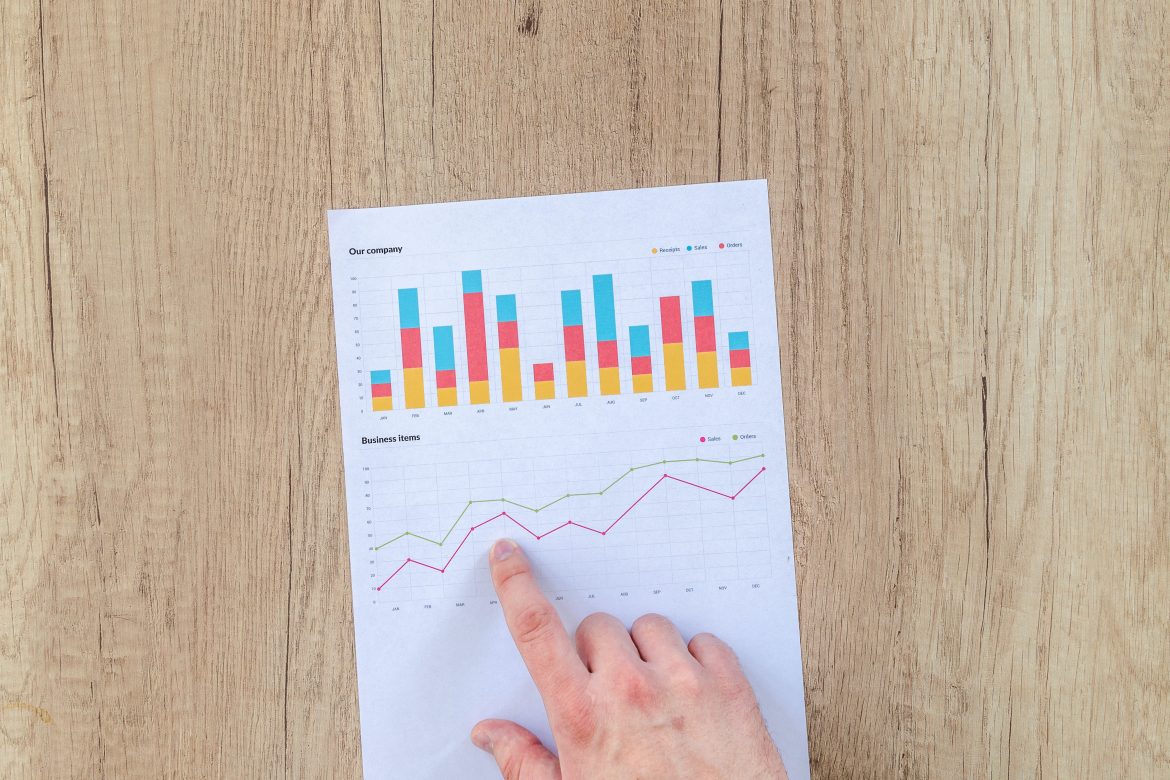

Stock analysis is a way of gaining knowledge of the markets to help inform your decisions. There are two types of stock analysis:

- Fundamental analysis: Analyzing the accounts of a company, current media and expert opinion on it, and the overall state of the economy.

- Technical analysis: Taking information from charts and graphs and trying to identify patterns that help predict how an asset will perform in the short and long term.

Typically, traders use both types of stock analysis along with other investment tools such as the economic calendar. By looking at any investment from the perspective of each of these, traders can take a well-rounded view before investing.

On-balance volume for identifying promising trades

The on-balance volume (OBV) indicates the running total of up volume (the amount of volume on a day when the price has rallied) minus down volume (the amount of volume on a day when the price has fallen).

If the OBV is increasing, this is an indication that demand is up, and the price may rise. If the OBV is in decline, supply is outstripping demand, and the price is likely to fall.

OBV can be used to identify what traders call ‘divergence’. This is when the OBV and the price of the asset are moving in different directions, suggesting the current trend is due to reverse. This can be a good time to buy or sell.

This tool is typically used in conjunction with moving average convergence divergence (MACD) which gives a greater indication of the strength of a trend than using the OBV in isolation.

Use automated orders

With automated orders, you don’t need to stay awake 24/7 to keep an eye on market movements. Instead, you can set a trade to execute during specific conditions. This is a great tool, but it can only be trusted if you’ve done your research, identified a clear plan and have a strategy for the optimum moment to buy or sell according to your data analysis and knowledge of the market.

Make use of online forums

It’s important to avoid getting dragged into following somebody else’s ‘hot tip’ without first conducting your own research. But it’s always worth checking in with other traders to talk about promising trades and new online investment tools or to just learn about how others approach the markets. After all, the more knowledge you have, the more efficient your trading strategy will become.

One cannot overstate the importance of performance analytics in trading. Neither can the need to know what is happening in the markets. Once you have these fundamentals nailed, it’s time to consider your attitude to risk and reward.

Key takeaways

There is no quick-fix investment strategy that guarantees immediate results. Expect trial and error in trading, and certainly, in the early stages, it’s advisable to make small investments while you grasp new terminologies and understand how the markets work.

Regardless of how well or badly any trade performs, it’s essential that you analyze it and find out what factors influence it. The more you do this, the more you’ll learn. As you begin to eradicate mistakes, employ better trading strategies and trust your analysis, you’re trading (and therefore your returns) should improve.