Are you ready for tax season? Look no further! In this article, we will delve into the world of tax software and introduce you to the 9 unbelievable 2018 Tax Software Federal & State for 2023. These software programs are designed to streamline the tax filing process, making it easier than ever for individuals and businesses alike to navigate the complex world of taxes. Whether you're a first-time filer or a seasoned pro, these software options offer a range of features and benefits to help maximize your refund and minimize your stress. So let's dive in and discover the top tax software options for 2023!

Overall Score: 8/10

Turbotax 2018 Deluxe Federal Plus State Tax Software CD is an old version of the software designed to simplify filing federal and state taxes for PC and Mac users. With a customer rating of 4.2/5, it offers a range of features that make the tax filing process easier. The dimensions of the CD are 7.50Lx5.50Wx0.60H.

Key Features

- Easy to use interface

- Supports both PC and Mac

- Includes federal and state tax forms

- Provides guidance and error checks

- Imports data from previous years

- Offers audit risk detection

Specifications

- Dimension: 7.50Lx5.50Wx0.60H

Pros

- User-friendly interface

- Support for PC and Mac

- Comprehensive tax forms included

- Helpful guidance and error checks

- Import data from previous years

Cons

- Old version of the software

- Deceiving product description for online filing of prior returns

Turbotax 2018 Deluxe Federal Plus State Tax Software CD is a reliable choice for individuals looking to simplify their tax filing process. It offers a user-friendly interface, support for both PC and Mac, and a wide range of tax forms. The software provides helpful guidance and error checks, and even allows users to import data from previous years. However, as an old version, it may lack some of the latest features and updates. Additionally, the product description can be deceiving when it comes to online filing of prior returns. Overall, it remains a solid option, especially for those who prefer a CD-based software solution.

Overall Score: 6/10

The H&R BLOCK Tax Software Deluxe + State 2018 is a reliable and easy-to-use tax program designed for your filing needs. With its 2018 version, it offers a range of features and capabilities to help you accurately complete your taxes. This software comes with an audit risk check, ensuring that your data is error-free. It is popular for its simplicity and user-friendly interface. However, it is important to note that this version is not the most current one available. If you have more complex tax situations or require forms for additional deductions, this software may not be ideal. Overall, the H&R BLOCK Tax Software Deluxe + State 2018 is a suitable option for individuals looking for a straightforward and affordable tax filing solution.

Key Features

- 2018 version not current version

Specifications

- N/A

Pros

- Simple and easy to use

- Affordable price

- Accurate returns with audit risk check

Cons

- Not suitable for more complicated returns

- Outdated for recent tax code changes

The H&R BLOCK Tax Software Deluxe + State 2018 is a budget-friendly option for individuals with straightforward tax situations. Its user-friendly interface and accurate return calculations make it a reliable choice. However, it is important to double-check that you are purchasing the correct version for your specific tax year, as this software is intended for 2018 taxes. If you have more complex deductions or if you require the most up-to-date tax code information, you may need to explore other options. Overall, this software provides a convenient and cost-effective solution for those seeking a simple and hassle-free tax preparation experience.

Overall Score: 8/10

TurboTax Deluxe 2022 Tax Software is the ultimate solution for homeowners, individuals with charitable donations, and high medical expenses. This software allows you to file both Federal and State Tax Returns, maximizing your deductions and credits for the maximum refund possible. With up-to-date knowledge of the latest tax laws, TurboTax Deluxe ensures accuracy and ease of use. As an Amazon exclusive offer, you also receive a 1-year subscription of Quicken Starter Edition, valued at $41.88, and save $10 off McAfee Total Protection 2023. While it does not include a detailed list of specifications, TurboTax Deluxe offers the necessary features and support for a hassle-free tax filing experience. Customer ratings average at 4.3/5, indicating high user satisfaction.

Key Features

- Recommended for homeowners and individuals with specific deductions

- Includes 5 Federal e-files and 1 State via download ($45 value)

- Maximizes 350+ deductions and credits

- Up-to-date with the latest tax laws

- 1-year subscription of Quicken Starter Edition included

- Save $10 off Mc Afee Total Protection 2023

Specifications

Pros

- Easy to use with accurate results

- Saves money compared to hiring a tax preparer

- Allows for adjustments and amended returns

- Includes free U.S.-based product support

- Comes with additional software and discount offers

Cons

- State filing requires an additional fee

- Download issues reported on certain devices

- Difficulty uninstalling bundled security application

TurboTax Deluxe 2022 Tax Software is a reliable and user-friendly solution for filing Federal and State Tax Returns. It offers a comprehensive set of features, up-to-date tax laws, and excellent support. The inclusion of Quicken Starter Edition and discount on McAfee Total Protection provides added value. While the requirement of an additional fee for state filing may disappoint some, TurboTax’s accuracy and ease of use make it a popular choice. However, users have reported occasional download issues, and some have faced difficulty uninstalling bundled security software. Overall, TurboTax Deluxe is a solid option for DIY tax filers, especially those with homeownership and specific deductions.

Overall Score: 7.5/10

H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer is a comprehensive tax software that helps individuals maximize their deductions and accurately file their taxes. With step-by-step guidance, users can easily import their tax documents, such as W-2s and 1099s, and swiftly complete their tax returns. The software also provides reporting assistance on various sources of income, including investments and stock options. Users can benefit from valuable features like accuracy review to minimize audit risks and the option to put their refund on an Amazon gift card with a bonus. However, some users have reported issues with bugs in the software and unexpected charges when filing state returns. Overall, H&R Block Tax Software Deluxe + State 2022 is a reliable option for straightforward tax returns.

Key Features

- Choose to put your refund on an Amazon gift card and get a 2.75% bonus

- One state program download included

- Reporting assistance for income from investments, stock options, home sales, and retirement

- Step-by-step Q&A and guidance

- Quick import of W-2, 1099, 1098, and last year's tax return

- Accuracy Review to check for issues and assess audit risk

- Five free federal e-files and unlimited federal preparation and printing

Specifications

- N/A

Pros

- Comprehensive and user-friendly tax software

- Ability to import tax documents from various sources

- Step-by-step guidance for easy filing

- Reporting assistance for different income sources

- Option to receive refund on an Amazon gift card with bonus

- Includes five free federal e-files

Cons

- Potential bugs in the software

- Unexpected charges when filing state returns

- Lack of clarity in instructions for certain features

H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer is a reliable tax software that offers comprehensive features and step-by-step guidance for individuals looking to file their taxes accurately. It stands out for its ability to import tax documents from various sources and its reporting assistance for different income sources. Users appreciate the option to receive their refund on an Amazon gift card with a bonus, adding extra value to their tax filing experience. However, some users have reported issues with bugs in the software and unexpected charges when filing state returns. Despite these drawbacks, H&R Block Tax Software Deluxe + State 2022 remains a solid choice for individuals with straightforward tax returns.

Overall Score: 8/10

TurboTax Home & Business 2022 Tax Software is a comprehensive tax preparation software designed for self-employed individuals, independent contractors, freelancers, small business owners, sole proprietors, and consultants. It helps users get their personal and self-employed taxes done right, maximize industry-specific small business tax deductions, and create W-2s and 1099 tax forms for employees and contractors. The software also includes exclusive offers such as a 1-Year Subscription of Quicken Starter Edition and a discount on McAfee Total Protection 2023. With free U.S.-based product support and electronic filing options, TurboTax Home & Business 2022 provides a reliable and user-friendly solution for tax preparation.

Key Features

- Recommended for self-employed and small business owners

- Includes 5 Federal e-files and 1 State via download

- Boosts bottom line with industry-specific tax deductions

- Creates W-2s and 1099 tax forms for employees & contractors

- Includes exclusive offers from Amazon

Specifications

Pros

- Comprehensive tax preparation for self-employed individuals

- Industry-specific small business tax deductions

- Free U.S.-based product support

Cons

- Requires downloading a new operating system each year

- Limited access to previous year's tax return details

TurboTax Home & Business 2022 Tax Software is a reliable and efficient tax preparation software. It offers a comprehensive solution for self-employed individuals and small business owners, helping them maximize their tax deductions and streamline the filing process. With its user-friendly interface, up-to-date information on tax laws, and free U.S.-based product support, TurboTax Home & Business 2022 ensures a stress-free and accurate tax filing experience. Although there are some drawbacks, such as the requirement to download a new operating system each year and limited access to previous year’s tax return details, the overall performance and features of TurboTax Home & Business 2022 make it a recommended choice for individuals in need of reliable tax software.

Overall Score: 8.5/10

TurboTax Premier 2022 Tax Software is the ideal choice for individuals who sold stock, employee stock, bonds or mutual funds, own rental property, or are trust beneficiaries. It allows you to maximize your IRA savings with retirement tax help and keeps you up-to-date with the latest tax laws. With 5 Federal e-files and 1 State via download, it offers convenience and efficiency. Plus, it comes with a 1-year subscription of Quicken Starter Edition and a $10 discount on McAfee Total Protection. The software has a user-friendly interface, offers online support, and handles your tax needs effectively. Its interview process is easy to follow, and it smoothly imports data from previous tax returns and investment accounts. While some features like backdoor Roth IRA contributions and handling ETFs categorized as trusts might be challenging, TurboTax Premier remains one of the best tax software options available.

Key Features

- Recommended for individuals who sold stock, bonds, etc.

- Includes 5 Federal e-files and 1 State via download

- Maximize IRA savings with retirement tax help

- Up-to-date with the latest tax laws

- 1-Year Subscription of Quicken Starter Edition included

- Save $10 off Mc Afee Total Protection

Specifications

Pros

- Well-designed and easy-to-use interface

- Handles investment and rental property income

- Active support forums for addressing tax-related questions

- Easy import of data from previous tax returns and investment accounts

Cons

- No easy process for backdoor Roth IRA contributions

- Difficulty in removing old form data from tax return

- Challenges in handling tax complications with ETFs categorized as trusts

TurboTax Premier 2022 Tax Software is a reliable and efficient option for individuals with complex tax situations. While it may not be the most affordable option, it offers a range of features and online support that make it worth the price. Its user-friendly interface, data import capabilities, and up-to-date tax laws ensure accurate and convenient tax filing. Although it may have some limitations in handling specific tax scenarios, TurboTax Premier remains the gold standard in tax software. Whether you’re a stock trader, rental property owner, or trust beneficiary, TurboTax Premier will simplify the process and help you maximize your tax savings. Overall, it’s a highly recommended solution for comprehensive tax preparation.

Overall Score: 8/10

TurboTax Business 2022 Tax Software is a comprehensive tax software for businesses and trusts. It is recommended for those who have a partnership, own an S or C Corp, Multi-Member LLC, manage a trust or estate, or need to file a separate tax return for their business. The software allows users to prepare and file their business or trust taxes with confidence, while also providing industry-specific tax deductions to boost the bottom line. It also includes features to create W-2 and 1099 tax forms for employees and contractors. With free U.S.-based product support, users can easily navigate the software. Overall, TurboTax Business 2022 Tax Software is a reliable and user-friendly solution for filing business and trust taxes.

Key Features

- Recommended if you have a partnership, own a S or C Corp, Multi-Member LLC, manage a trust or estate, or need to file a separate tax return for your business

- Includes 5 Federal e-files. Business State sold separately via download. Free U.S.-based product support (hours may vary).

- Prepare and file your business or trust taxes with confidence

- Boost your bottom line with industry-specific tax deductions

- Create W-2 and 1099 tax forms for employees and contractors

- Amazon Exclusive – Buy Turbo Tax and Save $10 off Mc Afee Total Protection 2023 | 5 Devices

Specifications

- N/A

Pros

- Comprehensive tax software for businesses and trusts

- User-friendly interface and easy to navigate

- Industry-specific tax deductions to boost bottom line

- Creates W-2 and 1099 tax forms for employees and contractors

- Includes 5 Federal e-files and free U.S.-based product support

- Amazon Exclusive offer to save $10 off Mc Afee Total Protection

Cons

- Significant price increase compared to previous years

- Compatibility issues with importing data from Quickbooks

- Difficulty in downloading the software from Amazon

TurboTax Business 2022 Tax Software is a reliable solution for businesses and trusts to prepare and file their taxes. It offers a user-friendly interface and provides industry-specific tax deductions to optimize the bottom line. The software helps to easily create W-2 and 1099 tax forms for employees and contractors, simplifying the tax filing process. However, some users have reported a significant price increase compared to previous years, as well as compatibility issues when importing data from Quickbooks. Despite these shortcomings, TurboTax remains a popular choice for individuals who prefer to handle their business taxes independently. Overall, TurboTax Business 2022 Tax Software is a valuable tool for businesses and trusts to confidently manage their tax obligations.

Overall Score: 8/10

Norton 360 Deluxe 2023 is an antivirus software that provides ongoing protection and advanced security against malware threats. It includes a secure VPN for browsing anonymously and securely, dark web monitoring to keep your personal information safe, and a PC cloud backup to protect important files. With pre-paid subscription and auto-renewal, you won't have any service disruption. Norton 360 Deluxe 2023 has received positive reviews for its ease of installation, effectiveness in protecting devices, and long-standing reputation. However, some users have mentioned issues related to advertisement interruptions and customer support. Overall, it is considered a reliable security product by many customers.

Key Features

- ONGOING PROTECTION for up to 5 devices

- REAL-TIME THREAT PROTECTION against malware

- SECURE VPN for anonymous browsing

- DARK WEB MONITORING for personal information

- 50GB Secure pc cloud backup

- PRE-PAID SUBSCRIPTION with auto-renewal

- Easy installation and simple file scanning

- Trusted security software with a long-standing reputation

Specifications

Pros

- Provides ongoing protection for multiple devices

- Effective in protecting against malware threats

- Includes VPN for secure browsing

- Dark web monitoring adds an extra layer of security

- 50GB PC cloud backup helps prevent data loss

- Pre-paid subscription with auto-renewal ensures continuous service

Cons

- Advertisement interruptions in the software

- Issues with Norton customer support

- Login process can be challenging

- Lack of visibility for password errors

Norton 360 Deluxe 2023 is a reliable antivirus software that offers comprehensive protection for up to 5 devices. It has proven to be effective in safeguarding against malware threats, providing a secure VPN for anonymous browsing, and monitoring personal information on the dark web. The inclusion of a PC cloud backup adds an extra layer of protection against data loss. While some users have experienced issues with advertisement interruptions and customer support, the overall performance and reputation of Norton 360 Deluxe 2023 make it a popular choice among customers. If you are looking for a trusted security solution for your devices, Norton 360 Deluxe 2023 is worth considering.

Overall Score: 7/10

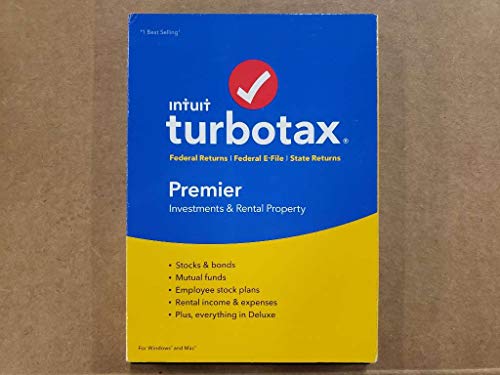

TurboTax Premier Federal + E-File + State 2018 is a brand new tax software that comes in a box with all the relevant accessories. It is regarded as the best and most user-friendly tax software. However, one drawback is the lack of support for Windows 7, while Windows 10 is still not stable. The software is reasonably priced and easily installable and usable. Its physical product receives a 5-star rating due to its great deal for less than $10. On the downside, the software is slower than other tax programs and lacks proper explanation for the results it provides. Despite its shortcomings, it is still highly recommended for those with simple tax situations.

Key Features

- Brand New in box

- The product ships with all relevant accessories

Specifications

- Dimension: 6.00Lx8.00Wx2.00H

Pros

- Best tax software

- Easy to install and use

- Reasonable price

Cons

- No support for Windows 7

- Slow software

- Lack of explanation for results

TurboTax Premier Federal + E-File + State 2018 is a reliable and user-friendly tax software that offers great value for its price. While the lack of support for Windows 7 and the software’s slowness are noticeable drawbacks, it is still a solid choice for individuals with simple tax situations. The software is easy to install and use, and its physical product has received positive reviews for its authenticity. It may not be the best option for those with complex tax scenarios, as the software lacks proper explanation for the results it produces. Overall, TurboTax Premier Federal + E-File + State 2018 is a solid choice for anyone seeking an affordable and accessible tax software solution.

BUYER'S GUIDE: 2018 TAX SOFTWARE FEDERAL & STATE*Please note: This buyer's guide aims to provide you with valuable information to help you make an informed decision when choosing tax software for your federal and state taxes. Please consult with a tax professional for specific advice regarding your individual circumstances.*

Benefits of Tax Software:

- Convenience: Tax software allows you to prepare and file your taxes from the comfort of your own home, eliminating the need for extensive paperwork and multiple visits to a tax professional.

- Accuracy: Modern tax software is equipped with robust error-checking mechanisms and up-to-date tax code knowledge, reducing the likelihood of errors in your tax return.

- Time-saving: With an intuitive user interface and streamlined data input, tax software saves you precious time by automating calculations and allowing quick access to previous year's returns.

- Cost-effective: Using tax software is often much more affordable than hiring a tax professional or purchasing physical tax forms.

- Security: Reputable tax software employs advanced encryption technologies to safeguard your personal and financial information, providing peace of mind during the tax filing process.

Features to Consider:

- Federal and State Compatibility: Ensure the tax software you select supports both federal and state tax filings. Some software packages offer separate state editions or require an additional purchase for state filing.

- Form Support: Different tax situations may require various forms and schedules to be completed. Verify that the software you choose supports the specific forms you need.

- Importing and Exporting: Look for software that allows you to import data from previous tax returns, making the filing process more efficient. Exporting capabilities can also be useful for maintaining records.

- Real-time Updates: Tax laws can change frequently, affecting your filing requirements. Opt for software that offers real-time updates to keep your tax return compliant with the latest regulations.

- Customer Support: Reliable customer support can be invaluable. Look for software providers that offer various support channels, such as phone, chat, or email, to address any questions or issues you may encounter.

Things to Keep in Mind:

- System Requirements: Check whether your computer or device meets the minimum system requirements for the tax software you intend to purchase. Inadequate hardware or software specifications may cause compatibility issues.

- Pricing Model: Tax software is available in different pricing models, including one-time purchases, annual subscriptions, or pay-per-return options. Consider your budget and frequency of tax filing when choosing the right pricing model for you.

- User Interface: The software's user interface should be intuitive and easy to navigate. A cluttered or complex interface could impede your progress and make the tax preparation process more frustrating.

- Data Security: Protecting your personal and financial information is essential. Research the software provider's measures for data security and their compliance with industry standards.

- Supported Operating Systems: Ensure that the tax software you choose is compatible with your operating system, whether it's Windows, macOS, or a mobile platform.

Frequently Asked Questions about 9 Unbelievable 2018 Tax Software Federal & State for 2023

Yes, reputable tax software undergoes rigorous testing to ensure accuracy in calculations. However, always review your return for potential errors and consult with a tax professional for complex situations.

It’s a good practice to keep physical copies of your tax documents for backup purposes. However, tax software typically allows you to save and access electronic copies of your returns for future reference.

Yes, tax software often includes features specifically designed for self-employed individuals, freelancers, and small business owners. Look for software that supports Schedule C and other relevant forms.

Yes, tax software usually includes tools to identify deductions and credits that may apply to your tax situation. However, it’s essential to review the suggestions and ensure they are accurate for your circumstances.

While tax software is generally safe and secure, there may be risks associated with online transmission and data breaches. Choose well-established software providers with proven track records of protecting user data.