Enhanced Customer Experience

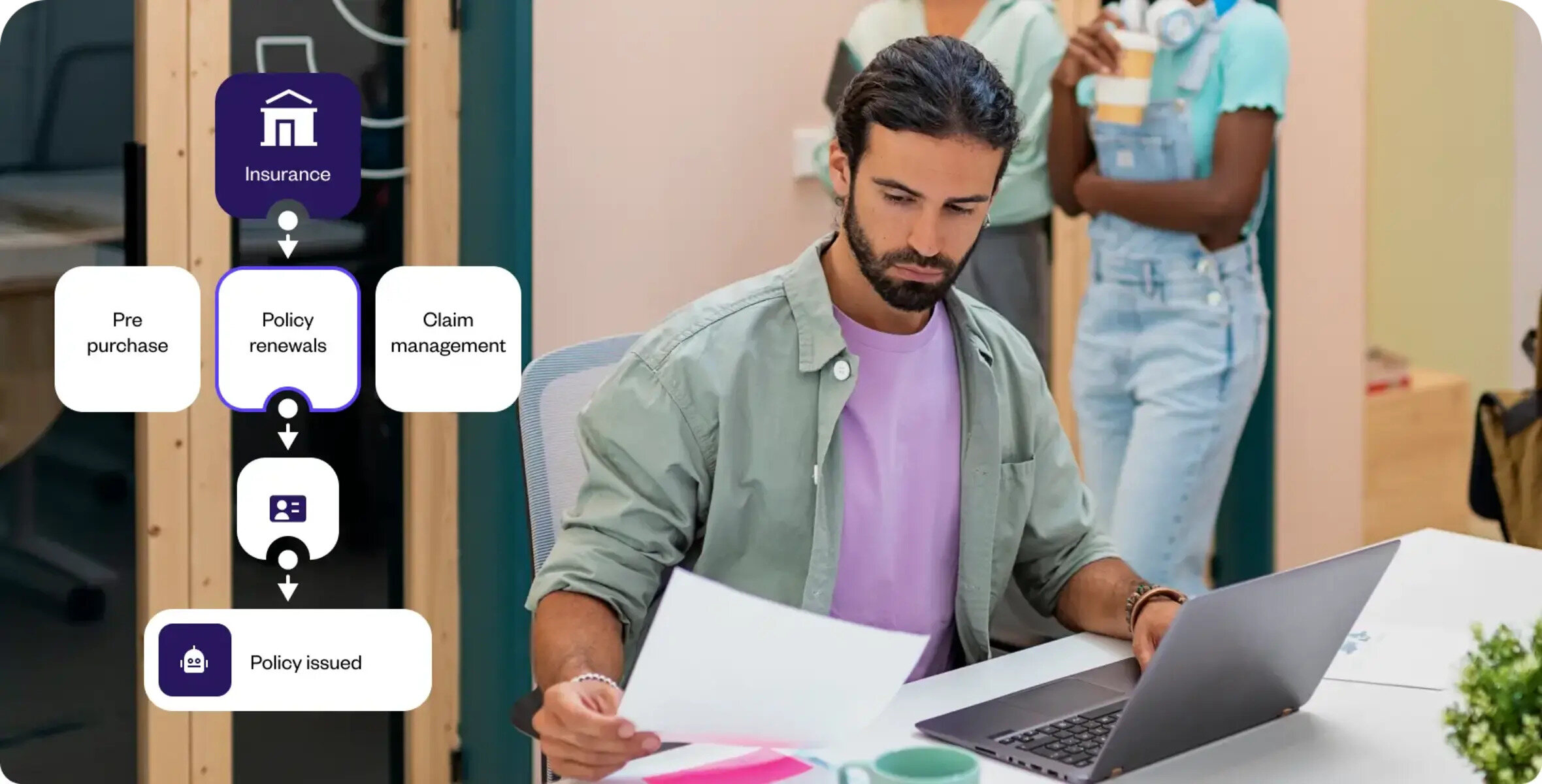

Chatbots have revolutionized the way customers interact with insurance companies, offering them an enhanced experience from start to finish. By integrating chatbots into their customer service strategy, insurance companies can provide immediate and personalized assistance to policyholders, ensuring their needs are met efficiently.

One of the key advantages of using chatbots in insurance is the 24/7 availability they offer. Unencumbered by time zones or working hours, chatbots are always accessible to customers, providing them with round-the-clock support. This eliminates the frustration of navigating through automated phone systems or waiting for a representative to become available.

Moreover, chatbots offer a quick response time. Customers no longer have to wait in long queues or endure lengthy call waiting times. Instead, they can simply chat with a bot and receive instant responses to their inquiries. This not only improves customer satisfaction but also saves valuable time for both customers and insurance providers.

Additionally, chatbots have the ability to provide personalized recommendations based on the customer’s unique situation. By analyzing customer data and understanding their preferences, chatbots can suggest the most suitable insurance plans or coverage options for individuals. This level of customization ensures that customers receive tailored recommendations that align with their specific needs and preferences.

Furthermore, chatbots streamline the claims processing experience. Customers can submit their claims through the chatbot interface, eliminating the need for cumbersome paperwork. The chatbot can also guide customers through the entire claims process, providing updates on the status of their claims and answering any questions they may have along the way. This results in a more efficient and hassle-free claims experience, reducing customer frustration and improving overall satisfaction.

Overall, the use of chatbots in insurance significantly enhances the customer experience. The 24/7 availability, quick response time, personalized recommendations, and streamlined claims processing all contribute to a more seamless and efficient customer journey. By leveraging the power of chatbots, insurance companies can prioritize customer satisfaction and build long-lasting relationships with their policyholders.

24/7 Availability

One of the key advantages of using chatbots in the insurance industry is the 24/7 availability they offer to customers. Unlike traditional customer service channels that operate during limited business hours, chatbots are accessible round-the-clock, providing immediate assistance regardless of the time of day or geographical location.

Gone are the days when policyholders had to wait until the next business day to get their insurance questions answered or issues resolved. With chatbots, customers can now interact with an automated system and receive real-time support whenever they need it. This level of availability is particularly beneficial for customers in different time zones or those with busy schedules that may not allow them to seek help during traditional office hours.

By leveraging chatbots’ 24/7 availability, insurance companies can cater to the needs of their customers at any time, providing a seamless and convenient experience. Whether a policyholder wants to inquire about policy details, request a quote, or report a claim, they can easily access the chatbot and receive immediate assistance without having to wait for a human representative to become available.

This accessibility also aligns with the changing customer expectations and preferences in a digital world. Customers today expect instant solutions and prompt responses, and the round-the-clock availability of chatbots meets these demands effectively. It eliminates frustrating experiences, such as being put on hold or having to leave a voicemail, and allows customers to get the help they need, instantly and conveniently.

Furthermore, the 24/7 availability of chatbots contributes to an improved customer experience overall. Reliable and accessible customer service builds trust and loyalty among policyholders. They feel valued and supported, knowing that their insurance company is there for them whenever they require assistance, even during emergencies or unexpected situations.

Finally, from an operational standpoint, chatbots’ constant availability allows insurance companies to efficiently handle customer interactions. With chatbots handling common queries and routine tasks, human agents can focus their efforts on more complex issues and personalized service. This not only improves the speed and accuracy of response but also optimizes resource allocation, making the customer service process more efficient and cost-effective.

Quick Response Time

Chatbots in the insurance industry offer a significant advantage when it comes to providing quick response times to customer inquiries. Unlike traditional customer service methods that may involve long wait times or delayed email responses, chatbots are designed to provide instant and efficient support.

With chatbots, customers no longer have to navigate through intricate phone menus or endure lengthy hold times. They can simply initiate a chat conversation with the chatbot and receive immediate responses to their queries. This quick response time not only improves customer satisfaction but also saves valuable time for both customers and insurance providers.

Chatbots are programmed to understand and analyze customer inquiries in real-time. They utilize natural language processing and machine learning algorithms to interpret and respond to customer messages accurately. This allows them to provide relevant and timely information to the customers, resolving their issues or answering their questions promptly.

Furthermore, chatbots are capable of multitasking, which means they can handle multiple conversations simultaneously. This ability ensures that customers do not have to wait in line for their turn, as the chatbot can engage with multiple customers concurrently. This not only reduces response time but also enables efficient customer service without compromising on quality.

Quick response time is particularly crucial in the insurance industry, where customers often require urgent assistance. Whether it’s reporting an accident, filing a claim, or seeking information about policy coverage, customers need prompt responses to their queries. Chatbots provide immediate reassurance and support, making customers feel valued and attended to, even during high-demand periods.

Moreover, the instantaneous nature of chatbot responses helps in increasing first call resolution rates. Customers can receive comprehensive information or solutions to their problems in a single interaction, reducing the need for follow-up calls or emails. This efficient resolution not only saves time for both parties but also enhances the overall customer experience.

Overall, the quick response time provided by chatbots in the insurance industry plays a crucial role in meeting customer expectations for instant and efficient support. It eliminates delays, improves customer satisfaction, and optimizes resource utilization for insurance companies. By leveraging chatbots, insurance providers can deliver timely assistance and ensure a seamless customer service experience.

Personalized Recommendations

Chatbots in the insurance industry have the capability to provide personalized recommendations tailored to the unique needs and preferences of customers. By leveraging customer data and advanced algorithms, chatbots can analyze and understand individual circumstances, allowing them to offer customized insurance plan suggestions and coverage options.

One of the primary advantages of using chatbots for personalized recommendations is their ability to gather and process customer information in real-time. Through conversational interactions, chatbots can collect relevant data about a customer’s age, location, lifestyle, and preferences. This data is then used to generate personalized insurance recommendations that match the customer’s specific requirements.

With access to vast amounts of customer data, chatbots can quickly analyze and compare multiple insurance options, taking various factors into account. This includes factors such as the customer’s financial situation, risk profile, and desired coverage levels. By considering these variables, chatbots can recommend policies that align with the customer’s unique needs and provide optimal coverage.

Additionally, chatbots can help customers navigate complex insurance jargon and understand policy details. They can break down complex concepts into simple, easy-to-understand explanations, allowing customers to make well-informed decisions. Chatbots can also provide real-time quotes based on the information provided by the customer, helping them assess the cost implications of different coverage options.

Moreover, chatbots can offer personalized recommendations based on historical customer interactions and preferences. They can analyze previous conversations and transactions to better understand a customer’s specific needs, leading to more accurate and relevant recommendations. This helps build a personalized and tailored experience for individuals, making them feel valued and understood by the insurance company.

By providing personalized recommendations, chatbots can help customers find insurance plans that best suit their individual circumstances. Whether a customer is looking for auto insurance, home insurance, or life insurance, chatbots can recommend policies with the right coverage and features. This not only saves customers time and effort but also ensures they receive appropriate protection tailored to their specific requirements.

Overall, the ability of chatbots to provide personalized recommendations enhances the customer experience by simplifying the insurance decision-making process. Customers feel confident and supported, knowing that the insurance company has considered their unique needs and preferences. This personalized approach helps build trust and loyalty, fostering long-term relationships between insurance providers and their policyholders.

Streamlined Claims Processing

Chatbots have transformed the claims processing experience in the insurance industry by streamlining and simplifying the overall process. Traditionally, filing a claim and navigating through the complex paperwork could be a time-consuming and frustrating ordeal for policyholders. However, with the integration of chatbots, the entire claims process has become more efficient and user-friendly.

One of the primary advantages of using chatbots for claims processing is the ability to submit claims directly through the chatbot interface. Policyholders can easily initiate a conversation with the chatbot and provide the necessary details and documentation to file their claim. This eliminates the need for customers to manually fill out lengthy forms or send physical documents, reducing paperwork and expediting the claims process.

Moreover, chatbots assist customers throughout the claims journey by providing real-time updates and guidance. Policyholders can receive regular updates on the status of their claim, ensuring they are informed and aware of any progress or additional information required. Chatbots can also answer common questions related to the claims process, simplifying the experience and reducing the need for customers to contact a human representative.

By automating the claims process through chatbots, insurance companies can significantly reduce the time it takes to process claims. Chatbots can validate and verify claim details, check policy coverage, and assess the validity of documentation without human intervention. This quick and accurate assessment speeds up the claims process, allowing policyholders to receive their payouts in a timelier manner.

Furthermore, chatbots in claims processing enable streamlined communication between customers and insurance providers. Policyholders can easily communicate with the chatbot to provide additional information, request status updates, or ask questions about the claims process. This direct and efficient communication eliminates the need for customers to wait in long phone queues or send multiple emails, enhancing the overall customer experience.

Another advantage of chatbots in claims processing is their ability to handle multiple claims simultaneously. Chatbots have the capacity to manage and process multiple customer inquiries concurrently, ensuring efficient and timely service. This capability allows insurance companies to handle higher volumes of claims without compromising on response time or quality.

Overall, the integration of chatbots in claims processing has transformed the insurance industry by streamlining the cumbersome and time-consuming process. Through automated claim submissions, real-time updates, quick assessments, and efficient communication, chatbots provide a seamless and user-friendly claims experience. The use of chatbots in claims processing benefits both insurance companies and policyholders, improving efficiency, reducing costs, and enhancing customer satisfaction.

Automated Underwriting

Automated underwriting is a significant advantage of utilizing chatbots in the insurance industry. Traditionally, underwriting – the process of assessing risk and determining insurability – has been a manual and time-consuming task. However, chatbots with advanced algorithms and data analysis capabilities have automated and streamlined the underwriting process, improving efficiency and accuracy.

One of the key benefits of automated underwriting through chatbots is the ability to collect and analyze vast amounts of customer data quickly. Chatbots can gather information related to a customer’s age, health condition, lifestyle, and other relevant factors. This data is then processed in real-time to assess risk and determine the eligibility of a customer for insurance coverage.

The use of chatbots in underwriting enables consistent and objective decision-making. By relying on algorithms and predefined rules, chatbots remove the potential for human bias or error in the underwriting process. Decisions are based on factual data and predefined criteria, ensuring fairness and accuracy in determining premiums and coverage options.

Furthermore, automated underwriting through chatbots allows for more efficient processing times. Instead of manually reviewing individual applications, chatbots can analyze customer data and make underwriting decisions within a matter of minutes. This speed and efficiency not only reduce customer waiting time but also allow insurance providers to serve a larger volume of customers without compromising on accuracy or quality.

In addition to faster processing times, automated underwriting also contributes to cost savings for insurance companies. By reducing the need for manual underwriting by human agents, insurance providers can significantly decrease operational expenses. Chatbots can handle a substantial portion of underwriting tasks, enabling human agents to focus on more complex cases that require their expertise.

Moreover, chatbots provide consistent and reliable underwriting outcomes. The use of predefined rules and algorithms ensures that insurance companies adhere to their underwriting guidelines consistently. This creates transparency and instills confidence in policyholders, knowing that their underwriting decisions are based on a standard and unbiased process.

Automated underwriting through chatbots also allows for simplified and streamlined communication between insurance providers and customers. Chatbots can guide customers through the underwriting process, explaining requirements, collecting necessary information, and addressing any questions or concerns along the way. This proactive and accessible support enhances the overall customer experience and reduces confusion or frustration during the underwriting stage.

Overall, the integration of chatbots in automated underwriting provides insurance companies with significant advantages. This streamlined, efficient, and consistent process saves time, reduces costs, and improves customer satisfaction. By leveraging the capabilities of chatbots, insurance providers can enhance their underwriting operations and ensure a smooth and accurate assessment of risk and insurability.

Efficient Customer Support

Efficient customer support is a fundamental aspect of the insurance industry, and chatbots have proven to be highly effective in delivering streamlined and responsive assistance to policyholders. By utilizing chatbots, insurance companies can enhance their customer support processes and provide efficient and timely solutions to customer inquiries and concerns.

One of the key advantages of using chatbots for customer support is their ability to handle a high volume of inquiries simultaneously. Unlike human agents who have limitations in terms of handling multiple conversations at once, chatbots can engage in multiple conversations with customers concurrently. This capability ensures that customers don’t have to wait in long queues, resulting in quicker response times and improved customer satisfaction.

Additionally, chatbots are available 24/7, providing round-the-clock support to policyholders. Regardless of the time of day or night, customers can access chatbots and get the assistance they need. This availability eliminates the frustration of having to wait for business hours to seek help, providing immediate support whenever customers require it.

Chatbots are equipped with advanced algorithms that analyze and understand customer queries, enabling them to provide accurate and relevant responses. They can efficiently handle common and routine inquiries, such as account balances, policy information, and coverage options, without the need for human intervention. This frees up human agents to focus on more complex issues, ensuring efficient utilization of resources and improving overall support efficiency.

Another advantage of using chatbots for customer support is their ability to provide consistent and standardized responses. While human agents may have variations in communication style or knowledge, chatbots deliver information in a consistent manner, adhering to predefined scripts and guidelines. This ensures that customers receive the same level of service quality and information, regardless of which chatbot they interact with.

Furthermore, chatbots can provide instant access to relevant information and self-service options. Through their integration with insurance company databases, chatbots can instantly retrieve policy details, claim status, and other relevant information upon customer request. This empowers policyholders to access information independently, reducing the need for time-consuming phone calls or emails.

Moreover, chatbots can guide customers through various processes, such as updating personal information or submitting documentation, ensuring that the correct steps are followed. By providing step-by-step instructions and feedback, chatbots assist customers in navigating through complex procedures, minimizing errors and enhancing the overall customer experience.

Overall, chatbots enable insurance companies to provide efficient customer support by offering quick, accurate, and consistent assistance to policyholders. Through their multitasking capabilities, round-the-clock availability, standardized responses, and self-service options, chatbots enhance the overall support experience, ensuring customer satisfaction and optimizing operational efficiency.

Cost Savings

The use of chatbots in the insurance industry offers significant cost-saving opportunities for insurance companies. By leveraging artificial intelligence and automation, chatbots can handle a wide range of customer inquiries and tasks, reducing the need for human involvement and resulting in substantial cost savings.

One of the primary cost-saving benefits of chatbots is the reduction in human resources. Customer service representatives are expensive to hire, train, and maintain, especially considering the need for 24/7 support. By deploying chatbots to handle routine inquiries, insurance companies can significantly minimize their staffing requirements. This strategic allocation of resources optimizes cost efficiency while still maintaining quality customer service.

Additionally, chatbots operate on a self-service model, enabling customers to obtain information and perform basic transactions independently. This reduces the need for customer service agents to handle routine tasks, such as providing policy details, updating personal information, or answering frequently asked questions. As a result, insurance companies experience a reduction in customer service staff costs, further contributing to overall cost savings.

Chatbots also improve operational efficiency, resulting in cost reductions. Unlike human agents who are subject to fatigue and human errors, chatbots can perform repetitive tasks consistently and accurately. They can handle multiple conversations simultaneously, ensuring efficient handling of customer inquiries without compromising quality. This enhanced operational efficiency leads to lower operational costs and increased productivity for insurance companies.

Moreover, chatbots minimize the occurrence of human errors which could potentially lead to costly mistakes. By automating processes, chatbots reduce the likelihood of manual errors in tasks such as data entry or policy calculations. This leads to improved accuracy and prevents costly errors that could have financial implications for insurance providers, such as quoting incorrect premiums or misinterpreting policy terms.

Another aspect contributing to cost savings is the scalability of chatbot technology. Insurance companies experiencing periods of increased customer demand can easily scale their operations using chatbots. Chatbots can handle high volumes of inquiries and transactions without the need for additional resources, allowing insurance companies to avoid the costs associated with hiring and training additional staff during peak periods.

Chatbots also play a role in reducing administrative costs by facilitating streamlined and paperless processes. With automated document retrieval and data entry capabilities, chatbots minimize the need for manual handling of paperwork, resulting in cost savings associated with printing, storing, and processing physical documents. This not only reduces administrative overhead but also contributes to environmental sustainability.

Overall, the implementation of chatbots in the insurance industry offers significant cost-saving advantages. By reducing the need for human resources, improving operational efficiency, minimizing errors, enabling scalability, and promoting paperless processes, chatbots help insurance companies optimize their costs while maintaining high-quality customer service.

Data Collection and Analysis

Chatbots in the insurance industry play a crucial role in data collection and analysis, offering valuable insights that can inform business strategies and enhance customer experiences. By gathering and analyzing customer data, chatbots provide insurance companies with a wealth of information that can be leveraged to make more informed decisions and offer personalized services to policyholders.

One of the primary advantages of using chatbots for data collection is their ability to interact directly with customers. Through conversational exchanges, chatbots can gather detailed information about customers’ demographics, preferences, and specific insurance needs. This data can be used to create comprehensive customer profiles, allowing insurance companies to understand their target market better and tailor their offerings accordingly.

Chatbots are adept at collecting both structured and unstructured data, allowing for a deeper understanding of customer sentiments and preferences. Through natural language processing techniques, chatbots can analyze customer responses, identifying patterns, trends, and insights that can guide business strategies and decision-making processes. This data-driven approach helps insurance companies stay ahead of market trends and offer relevant and personalized insurance solutions to their customers.

Furthermore, chatbots facilitate the collection of real-time customer data. By engaging with customers in real-time conversations, chatbots can capture up-to-date information about customer needs, preferences, and behavior. This real-time data can provide insurance companies with valuable insights into customer behaviors, allowing them to adapt their product offerings and marketing strategies accordingly.

Chatbots also contribute to data analysis by leveraging machine learning algorithms and predictive modeling. By analyzing historical customer interactions and purchase data, chatbots can identify patterns and trends, enabling companies to anticipate customer needs and offer proactive recommendations. This predictive analysis empowers insurance companies to provide personalized offers and suggestions, ultimately enhancing customer satisfaction and driving business growth.

Moreover, chatbots play a critical role in data governance and compliance. As they collect customer data, chatbots can ensure compliance with data privacy regulations and security protocols. Through secure storage and encryption of data, chatbots help safeguard sensitive customer information, protecting privacy and building trust with policyholders.

By utilizing chatbots for data collection and analysis, insurance companies can gain a competitive edge in the market. The insights gained from data analysis can inform product development, customer segmentation, and targeted marketing strategies. Insurance providers can identify customer pain points, offer tailored solutions, and anticipate evolving customer needs, resulting in improved customer satisfaction and retention.

Overall, chatbots serve as powerful tools for data collection and analysis in the insurance industry. With their ability to gather real-time, structured, and unstructured data and leverage advanced analytics techniques, chatbots provide insurance companies with valuable insights that drive informed decision-making and personalized customer experiences.

Fraud Detection

Fraud is a significant concern for the insurance industry, leading to substantial financial losses. Fortunately, chatbots provide valuable support in fraud detection, helping insurance companies identify and prevent fraudulent activities. Through their advanced algorithms and data analysis capabilities, chatbots play a crucial role in protecting the interests of both insurance providers and policyholders.

Chatbots contribute to fraud detection by analyzing data patterns and identifying anomalies. By examining historical data, transaction records, and customer behavior, chatbots can detect suspicious patterns and flag potentially fraudulent activities. These patterns include irregular claim submissions, multiple claims from the same individual, or inconsistencies in customer information.

The real-time nature of chatbot interactions also facilitates prompt fraud detection. When engaging with customers, chatbots can immediately detect potential red flags in responses or claim details, triggering further investigation. This quick analysis helps insurance providers detect and address fraudulent activities in a timely manner, mitigating financial losses.

Moreover, chatbots can integrate with fraud databases and reference external sources to cross-reference customer information. By comparing customer data against known fraud indicators or suspicious profiles, chatbots enhance fraud detection capabilities. They can identify matches or potential matches, allowing insurance companies to initiate additional scrutiny and investigation.

Chatbots also contribute to fraud prevention by implementing verification processes. Through layers of authentication and verification checks during interactions, chatbots can confirm the identity of individuals and ensure that only legitimate claims and transactions are processed. This verification process reduces the risk of fraudulent activities and protects insurance companies and policyholders from potential financial harm.

Furthermore, chatbots aid in streamlining the fraud reporting process. Policyholders can use chatbots to report potential fraudulent claims or activities, providing a convenient and accessible channel for reporting suspicious behavior. By encouraging policyholders to report fraud through chatbots, insurance companies can gather valuable information and proactively investigate potential fraud cases.

By leveraging chatbots for fraud detection, insurance companies can significantly reduce financial losses associated with fraudulent activities. The proactive approach of chatbots helps prevent fraudulent claims from being paid out, thereby protecting the financial stability of insurance providers. Additionally, the reduction in fraud-related losses can lead to lower premium costs for policyholders, benefiting the entire insurance ecosystem.

Overall, chatbots play a vital role in fraud detection for the insurance industry. Their advanced algorithms, real-time analysis capabilities, and integration with external sources enable insurance companies to identify, prevent, and combat fraudulent activities effectively. By leveraging chatbots, insurance providers can safeguard their financial interests, protect policyholders from fraud-related risks, and maintain the trust and integrity of their operations.