What is an online wallet?

An online wallet, also known as a digital wallet or e-wallet, is a secure platform that allows users to store, manage, and transfer their digital assets. It acts as a virtual version of a physical wallet, enabling users to conveniently access and control their funds or cryptocurrencies through a web-based application or mobile device. With an online wallet, users can securely store various forms of digital currency, such as Bitcoin, Ethereum, or other altcoins.

Unlike traditional physical wallets, online wallets don’t store physical cash or credit cards. Instead, they store digital representations of currencies or cryptocurrencies. This digital nature provides several advantages, including faster transactions, increased accessibility, and reduced reliance on physical currency. Online wallets have revolutionized the way we manage our finances and make online payments.

Most online wallets have user-friendly interfaces that make it easy to view account balances, transaction history, and manage multiple currencies. They also offer features such as QR code scanning for quick transactions, two-factor authentication for enhanced security, and integration with other financial services. These features combine to make online wallets a convenient and versatile tool for managing digital finances.

Online wallets can be used for a wide range of purposes, from simple day-to-day transactions to more complex financial activities like trading or investing. They offer a secure way to store and manage digital assets, eliminating the need for physical storage solutions and providing peace of mind for users.

Now that you have a basic understanding of what an online wallet is, let’s take a closer look at how they work and the different types available.

How does an online wallet work?

An online wallet functions by utilizing a combination of encryption techniques, secure servers, and private keys to store and manage digital assets. When a user creates an account with an online wallet provider, they are issued a unique set of credentials, including a username and password.

When a user accesses their online wallet, they are connected to the wallet provider’s servers through a secure internet connection. The provider’s servers store the user’s encrypted account information and digital assets. This ensures that the user’s funds are securely stored and accessible only to them.

Transactions conducted through an online wallet are secured by cryptographic protocols. These protocols serve to verify the integrity of the transaction, ensuring that the sender is the rightful owner of the funds and that the funds are received by the intended recipient.

One important aspect of online wallets is the use of private keys. Private keys are cryptographic codes unique to each user that are used to authenticate transactions. These keys are stored securely within the online wallet and are required to access and transfer funds.

When a user initiates a transaction, such as sending funds to another wallet address, the online wallet uses the user’s private key to digitally sign and authenticate the transaction. This signature ensures that the transaction is valid and that the funds can be properly transferred.

Online wallets also provide users with a public key, which serves as their unique wallet address. This address is similar to a bank account number or an email address, allowing others to send funds to the user’s wallet. It is important to keep the public key secure and not share it with unauthorized parties to prevent unauthorized access to the wallet.

Types of online wallets

There are several types of online wallets available, each offering different features, levels of security, and compatibility with various digital assets. Here are the most common types:

- Web-based Wallets: These online wallets are accessed through web browsers and do not require any additional software installation. Users can conveniently access their funds from any device with an internet connection. Web-based wallets are often provided by cryptocurrency exchanges or online wallet service providers.

- Mobile Wallets: Mobile wallets are designed for use on smartphones and tablets. They usually come in the form of mobile applications, allowing users to manage their digital assets on-the-go. Mobile wallets offer convenience, quick access, and integration with mobile device features such as QR code scanning.

- Desktop Wallets: As the name suggests, desktop wallets are installed on a desktop or laptop computer. These wallets provide users with more control over their funds and offer offline storage solutions. Desktop wallets are considered more secure than web-based or mobile wallets because they are less susceptible to online attacks.

- Hardware Wallets: Hardware wallets are physical devices that are specifically designed to store cryptographic keys and facilitate cryptocurrency transactions. These wallets offer the highest level of security by keeping private keys offline. Users can connect the hardware wallet to their computer or mobile device when needed.

- Paper Wallets: A paper wallet involves printing out the user’s private keys and wallet address on a physical piece of paper. Paper wallets are completely offline, providing a secure storage option. However, they may not be suitable for everyday transactions and are more commonly used for long-term storage or as backup options.

It’s important to carefully evaluate the features, security measures, and compatibility of different online wallet types before choosing the one that best suits your needs. Consider factors such as convenience, security, and the types of digital assets you plan to store or transact with.

The importance of online wallets in Paybis

Online wallets play a crucial role in Paybis, a leading platform for buying and selling cryptocurrencies. They offer users a secure and convenient way to store their digital assets, make transactions, and manage their funds within the Paybis ecosystem.

One of the key benefits of using online wallets in Paybis is the ability to store multiple types of cryptocurrencies in a single wallet. This eliminates the need for multiple wallets and simplifies the management of digital assets. With Paybis, users can securely store popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and more, all in one place.

Online wallets in Paybis also provide seamless integration with the platform’s exchange services. Users can easily transfer funds from their wallet to the trading platform to participate in buying or selling activities. This streamlined process saves time and ensures a smooth user experience.

Furthermore, online wallets in Paybis offer enhanced security measures to protect user funds. The platform implements industry-standard encryption protocols to ensure that transactions and sensitive data are kept confidential. Additionally, Paybis employs strict authentication processes to prevent unauthorized access to wallets.

Another significant advantage of using online wallets in Paybis is the ability to transfer funds to other Paybis users instantly. This allows for quick and convenient peer-to-peer transactions within the platform, without the need for intermediaries or third-party services.

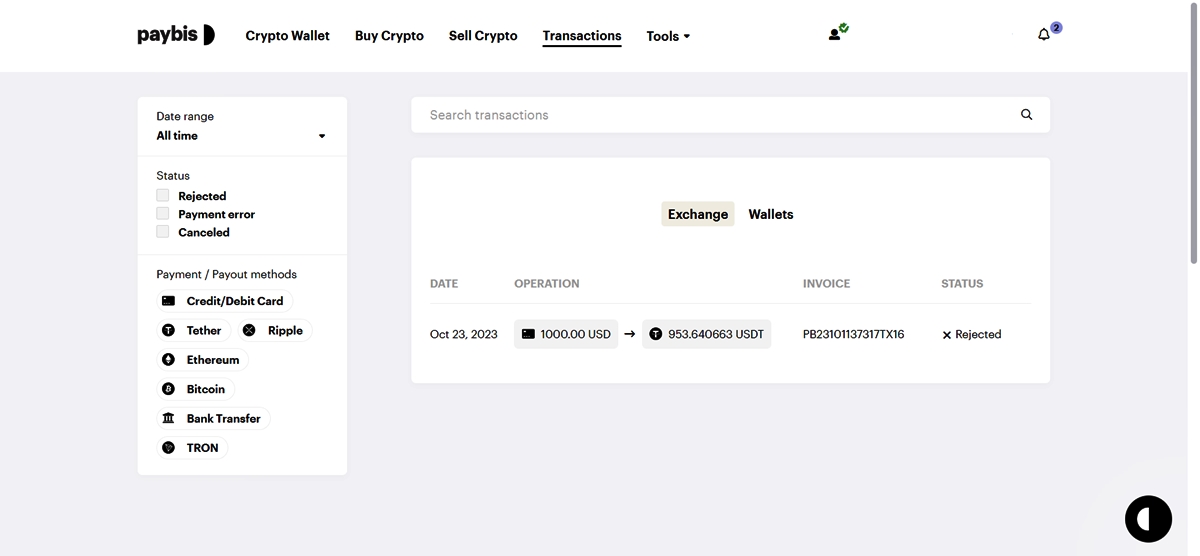

Additionally, online wallets in Paybis provide users with easy access to their transaction history and account balance. Users can easily view detailed information about their past transactions, including the date, time, and amount sent or received. This transparency contributes to better financial management and record-keeping.

Overall, online wallets play a crucial role in Paybis by providing users with a secure and efficient way to store, manage, and transact with various cryptocurrencies. With their user-friendly interfaces, seamless integration with the platform’s services, and robust security measures, online wallets in Paybis are essential tools for cryptocurrency enthusiasts seeking a reliable and convenient platform for their digital asset needs.

How to find the online wallet option in Paybis

To access the online wallet feature in Paybis, you can follow these simple steps:

- Open your web browser and navigate to the Paybis website.

- If you have an existing Paybis account, log in using your username and password. If you’re new to Paybis, you’ll need to create an account by clicking on the “Sign Up” or “Register” button.

- Once logged in, you will be directed to the Paybis dashboard. Look for the “Wallet” or “My Wallet” tab, which is usually located in the top navigation menu or sidebar.

- Click on the “Wallet” or “My Wallet” tab to access your online wallet.

- Upon accessing your online wallet, you will see the available balances of the cryptocurrencies you hold in your Paybis account.

- From here, you can perform various actions such as sending funds to another wallet address, receiving funds, or viewing transaction history.

It’s important to note that the location and appearance of the online wallet option may vary slightly depending on the specific design and layout of the Paybis website. If you’re having trouble finding the online wallet feature, you can also refer to the Paybis help documentation or contact their customer support for assistance.

Once you have located and accessed your online wallet in Paybis, you can conveniently manage your digital assets, make transactions, and enjoy the benefits of a secure and user-friendly wallet within the Paybis ecosystem.

Step-by-step guide to accessing the online wallet in Paybis

If you are new to Paybis or need assistance in accessing the online wallet feature, follow this step-by-step guide:

- Open your web browser and visit the official Paybis website.

- If you already have a Paybis account, log in using your username and password. If you don’t have an account, click on the “Sign Up” or “Register” button to create one.

- Once logged in, you will be redirected to the Paybis dashboard, which is your centralized control panel for all Paybis services.

- In the navigation menu or sidebar of the Paybis dashboard, look for the “Wallet” or “My Wallet” option. Click on it to proceed.

- Upon accessing the online wallet section, you will see a list of the cryptocurrencies you have in your Paybis account and their corresponding balances.

- To view the details of a specific cryptocurrency, click on its name or icon. This will open a new page displaying additional information and options related to that particular cryptocurrency.

- From the cryptocurrency details page, you can perform various actions such as sending funds, receiving funds, or viewing your transaction history.

- To send funds from your online wallet, click on the “Send” or “Send Funds” button and enter the recipient’s wallet address, the amount you want to send, and any additional required information.

- To receive funds into your online wallet, click on the “Receive” or “Receive Funds” button. This will generate a unique wallet address for that specific cryptocurrency, which you can provide to the sender.

- For transaction history, click on the “Transactions” or “Transaction History” tab. Here, you can view a detailed list of your past transactions along with relevant information such as date, time, and transaction status.

If you encounter any issues or have further questions while accessing the online wallet in Paybis, don’t hesitate to reach out to their customer support for assistance. Their team will be happy to guide you through the process and address any concerns you may have.

Common issues with online wallets in Paybis and how to resolve them

While online wallets in Paybis are designed to provide a smooth and hassle-free experience, users may occasionally encounter some common issues. Here are a few of these issues along with potential resolutions:

1. Forgot or Lost Password: If you forget or lose your Paybis online wallet password, you can usually initiate a password reset by clicking on the “Forgot Password” or “Reset Password” link on the login page. Follow the instructions provided, which may involve verifying your identity and resetting your password via email or SMS.

2. Transaction Delays: Sometimes, transactions may take longer than expected to be processed. This can be due to network congestion or other technical issues. It’s important to be patient and allow sufficient time for the transaction to be confirmed. If the delay persists, you can contact Paybis customer support to investigate the issue further and provide guidance.

3. Incorrect Recipient Address: It is crucial to double-check the recipient’s wallet address before initiating a transaction. Sending funds to an incorrect address may result in permanent loss of funds. If you mistakenly send funds to the wrong address, there is usually no way to recover them. Take extra caution when entering wallet addresses and consider using copy-paste to minimize errors.

4. Invalid or Expired QR Codes: When scanning QR codes for transactions, it’s possible to encounter invalid or expired codes. Make sure that the QR code is displayed correctly and not damaged. If the QR code is not scannable or appears invalid, you can manually enter the recipient’s wallet address to complete the transaction.

5. Unconfirmed Transactions: In some cases, transactions may remain unconfirmed for an extended period, causing concern among users. This can occur when the transaction fee is set too low or the network is experiencing high congestion. To resolve this, you can either wait for the transaction to be confirmed or contact Paybis support for further assistance.

For any other issues or concerns related to online wallets in Paybis, it is recommended to reach out to their customer support team. They are equipped to handle a wide range of problems and can provide personalized solutions based on your specific situation.

Benefits of using an online wallet in Paybis

Using an online wallet in Paybis offers numerous benefits for users looking to securely manage and transact with their digital assets. Here are some of the key advantages:

1. Convenience: Online wallets provide a convenient way to store and manage multiple types of cryptocurrencies in one place. With Paybis, users can access their online wallets from any device with an internet connection, making it easy to manage their funds on the go.

2. Quick Transactions: Online wallets in Paybis facilitate fast and efficient transactions. Users can instantly send and receive funds within the Paybis ecosystem, allowing for swift and seamless peer-to-peer transfers without the need for intermediaries.

3. Integration with Paybis Services: The online wallet in Paybis integrates seamlessly with the platform’s exchange services. Users can easily transfer funds from their wallet to the trading platform, enabling them to quickly buy or sell cryptocurrencies without needing to move funds to external wallets.

4. Wide Range of Cryptocurrencies: Paybis supports a variety of cryptocurrencies, and the online wallet allows users to store and manage multiple digital assets. This flexibility allows users to diversify their portfolios and easily access a broad spectrum of cryptocurrencies all in one platform.

5. Enhanced Security: Online wallets in Paybis implement robust security measures to protect user funds. These security features often include encryption protocols, two-factor authentication, and secure private key management. Paybis strives to maintain the highest levels of security to ensure the safety of user assets.

6. Transparent Transaction History: Paybis online wallets provide users with a detailed transaction history. Users can easily review and track their past transactions, including the date, time, and amount sent or received. This transparent transaction history enables better financial management and record-keeping.

7. Accessibility: With online wallets in Paybis, users can access their funds at any time without the limitations of banking hours or geographical restrictions. This accessibility allows for greater control and flexibility over their digital assets.

8. Support and Assistance: Paybis offers reliable customer support to assist users with any wallet-related inquiries or issues they may encounter. The dedicated support team is available to provide guidance, answer questions, and address any concerns that arise.

Security measures for online wallets in Paybis

Paybis takes the security of online wallets seriously and implements several measures to ensure the safety and protection of user funds. Here are some of the security features and protocols employed by Paybis:

1. Encryption: Paybis utilizes industry-standard encryption protocols to secure user data and communications. This ensures that sensitive information, such as personal details and transaction data, is kept confidential and protected from unauthorized access.

2. Two-Factor Authentication (2FA): Paybis encourages users to enable 2FA, which adds an extra layer of security to their online wallets. With 2FA, users are required to provide an additional authentication factor, such as a one-time password generated by an authentication app, in addition to their username and password.

3. Secure Private Key Management: Paybis follows stringent practices to protect the private keys associated with users’ online wallets. Private keys are stored in secure offline storage, commonly referred to as “cold storage,” minimizing the risk of unauthorized access or exposure to potential online threats.

4. Regular Security Audits: Paybis conducts regular security audits to identify and address any vulnerabilities in their platform and online wallet infrastructure. This proactive approach helps ensure that the highest security standards are upheld and that any potential security risks are promptly addressed.

5. IP Whitelisting: Paybis offers the option for users to whitelist specific IP addresses. This feature adds an extra layer of protection by allowing access to the online wallet only from designated IP addresses, limiting the chance of unauthorized access.

6. Monitoring and Suspicious Activity Alerts: Paybis employs advanced monitoring systems to detect and analyze suspicious activity and potential security threats. In the event of any suspicious activity, alerts are triggered, allowing the Paybis team to take immediate action to safeguard user accounts and funds.

7. Educational Resources: Paybis provides educational resources and security guidelines to help users better understand the importance of strong security practices. These resources aim to educate users about various security threats, best practices for password management, and general online security measures.

It is important for users to also implement their own security measures to further enhance the protection of their online wallets. This includes regularly updating passwords, enabling 2FA, avoiding clicking on suspicious links or downloading unknown files, and exercising caution when interacting with cryptocurrency-related platforms and services.

By combining the robust security measures implemented by Paybis with good user security practices, users can have confidence that their digital assets stored in Paybis’ online wallets are well-protected.

Tips for managing your online wallet effectively

Managing your online wallet effectively is essential to ensure the security and accessibility of your digital assets. Here are some tips to help you manage your online wallet in Paybis efficiently:

1. Set a Strong and Unique Password: Choose a strong and unique password for your Paybis online wallet. Avoid using easily guessable passwords or reusing passwords from other accounts. A strong password consists of a combination of upper and lowercase letters, numbers, and special characters.

2. Enable Two-Factor Authentication (2FA): Enable 2FA for your online wallet in Paybis. This extra layer of security provides an additional barrier against unauthorized access. Use an authenticator app, such as Google Authenticator or Authy, to generate one-time passwords for 2FA.

3. Regularly Update Your Software and Wallet: Keep your device’s operating system, web browser, and Paybis wallet software up-to-date. Software updates often include security patches and bug fixes that prevent vulnerabilities and enhance the overall security of your online wallet.

4. Backup Your Wallet: Regularly backup your online wallet and store the backup in a secure location, preferably offline. This ensures that you can recover your wallet and funds in case of device loss or failure. Follow the backup instructions provided by Paybis or consider using a hardware wallet for added security.

5. Beware of Phishing Attempts: Be vigilant and cautious of phishing attempts, where attackers try to trick you into revealing your wallet credentials or personal information. Avoid clicking on suspicious links or downloading attachments from unknown sources. It’s good practice to type the Paybis website address directly into your browser or use a bookmarked link.

6. Keep Your Private Keys Secure: Paybis manages the private keys for your wallet, but it’s still important to exercise caution. Never share your private keys with anyone and avoid storing them online. Memorize or write down your private keys in a secure offline location.

7. Monitor Your Account: Regularly review your account activity and transaction history. Keep an eye out for any unauthorized transactions or suspicious activities. If you notice any discrepancies, contact Paybis customer support immediately.

8. Stay Informed: Stay up-to-date with the latest news and developments in the cryptocurrency industry and security best practices. This will help you make informed decisions and stay ahead of potential threats or scams.

By following these tips and practicing good security hygiene, you can effectively manage your online wallet in Paybis, ensuring the safety and accessibility of your digital assets.