What is Trezor?

Trezor is a highly reputable and widely used hardware wallet in the cryptocurrency industry. It is a device that securely stores private keys and allows users to make secure transactions with their digital assets. Designed by SatoshiLabs, Trezor offers a reliable solution for individuals seeking to protect their cryptocurrencies, such as Bitcoin, Ethereum, and more.

Unlike software wallets that are vulnerable to hacking attacks, hardware wallets like Trezor provide an extra layer of security by keeping the private keys offline. This ensures that even if the computer or smartphone being used for transactions is compromised, the hacker will not have access to the private keys stored in the Trezor device.

Trezor wallets have gained popularity among cryptocurrency enthusiasts due to their user-friendly interface and robust security features. The device is built with tamper-proof hardware, ensuring that it cannot be easily modified or hacked. Additionally, Trezor wallets have a built-in screen that allows users to verify transaction details before confirming them, preventing any unauthorized transfers.

With its intuitive design, Trezor makes it simple for beginners to get started with cryptocurrency storage and transactions. Setting up the device involves creating a unique recovery seed, which acts as a backup in case the Trezor wallet is lost or damaged. Moreover, Trezor supports a wide range of cryptocurrencies, making it a versatile option for users with different digital assets.

Overall, Trezor has established itself as a reliable and secure hardware wallet that ensures the safety and integrity of users’ cryptocurrencies. Its user-friendly interface, robust security measures, and support for various cryptocurrencies make it a popular choice among both novice and experienced crypto enthusiasts.

The Importance of Hardware Wallets

When it comes to safeguarding your cryptocurrency investments, hardware wallets are crucial. These physical devices offer an added layer of security and protection that cannot be matched by software or online wallets. Here’s why hardware wallets, like Trezor, are essential for cryptocurrency users:

- Security: Hardware wallets store private keys offline, away from potential hacking attempts. This significantly reduces the risk of unauthorized access to your digital assets. Additionally, hardware wallets are designed with robust encryption algorithms and built-in security features, making them highly resistant to physical tampering.

- Protection against malware: Software wallets are susceptible to malware attacks, which can compromise the private keys stored on your device. Hardware wallets, on the other hand, are not vulnerable to these types of attacks. Since the private keys are stored on the hardware wallet itself, they are not exposed to the risk of malware infiltration.

- Peace of mind: By using a hardware wallet, you can have peace of mind knowing that your cryptocurrency is stored securely, even if your computer or smartphone is compromised. With the private keys stored offline, you have full control over your digital assets and can confidently transact without the fear of being hacked.

- Easy backup and recovery: Hardware wallets, such as Trezor, provide users with a recovery seed, which is a series of words that act as a backup for the private keys. In the event that your hardware wallet is lost, stolen, or damaged, you can easily recover your funds by using the recovery seed on a new device.

- Compatibility and versatility: Hardware wallets like Trezor support a wide range of cryptocurrencies, allowing you to securely store multiple digital assets in one device. This eliminates the need for multiple wallets and simplifies the management of your cryptocurrency portfolio.

Overall, the importance of hardware wallets cannot be overstated. The security, protection against malware, peace of mind, easy backup and recovery, and compatibility make them an essential tool for anyone involved in the world of cryptocurrencies. By investing in a reputable hardware wallet like Trezor, you can ensure that your digital assets are safe and secure, giving you the confidence to navigate the crypto space with peace of mind.

Possible Reasons for Trezor Company Failure

While Trezor has established itself as a reputable and trusted hardware wallet company, no organization is immune to challenges and potential pitfalls. Here are some possible reasons that could contribute to the failure of Trezor:

- Technological advancements: The cryptocurrency industry is constantly evolving, and new technological advancements can quickly make existing hardware wallets outdated. If Trezor fails to keep up with emerging technologies and fails to innovate, users may gravitate towards newer and more advanced hardware wallet options.

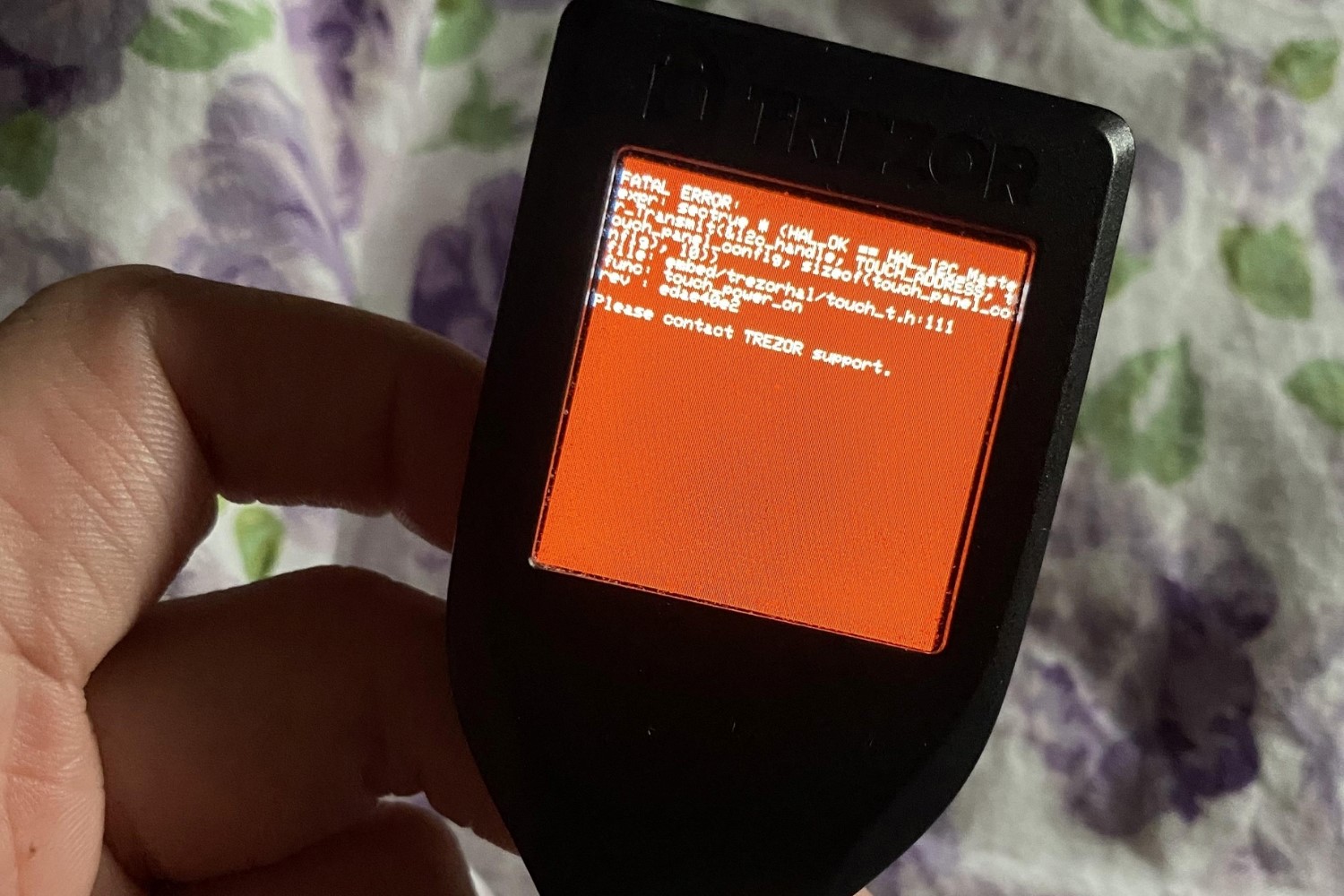

- Security breaches: Despite their solid reputation for security, no system is completely foolproof. If Trezor were to experience a significant security breach that compromises user funds or exposes vulnerabilities in their devices, it could lead to a loss of trust from the user base and ultimately result in the failure of the company.

- Competition: The hardware wallet market is becoming increasingly competitive as more companies enter the space. If Trezor fails to differentiate itself from the competition or offer unique features, it may struggle to retain its market share and customer base.

- Regulatory challenges: The cryptocurrency industry is subject to evolving regulations in different jurisdictions. If Trezor faces regulatory obstacles or fails to comply with new rules and regulations, it could face legal consequences that could negatively impact the company’s operations and reputation.

- Supply chain issues: Hardware wallets require precise manufacturing and quality control processes. If Trezor encounters supply chain issues, such as component shortages, production delays, or compromised security during the production process, it could lead to a disruption in product availability and a loss of customer confidence.

- Poor customer support: In a rapidly evolving industry like cryptocurrency, responsive and effective customer support is crucial. If Trezor fails to provide timely and adequate customer service, it could result in frustrated users seeking alternative wallet solutions.

It’s important to note that these potential reasons for failure are speculative, and Trezor’s current track record suggests that they have a solid foundation. However, the cryptocurrency industry is dynamic and subject to uncertainties, and companies must continually adapt to survive and thrive in this rapidly changing landscape.

Impact on Trezor Users

If Trezor were to experience a failure or shutdown, it would have significant implications for its user base. Here are some potential impacts that Trezor users might face:

- Loss of funds: The most immediate concern for Trezor users would be the potential loss of their cryptocurrency funds. Without access to their hardware wallet, users may be unable to retrieve or transfer their digital assets, leading to financial losses.

- Disruption of transactions: Trezor’s absence from the market would disrupt the ability of its users to conduct transactions with their cryptocurrencies. This could be particularly problematic for those who rely on their hardware wallets for daily or frequent transactions.

- Limited support and updates: With the cessation of operations, Trezor users would no longer receive software updates, bug fixes, or security patches. This could leave their wallets vulnerable to potential security threats or compatibility issues with new cryptocurrencies.

- Need for alternative wallets: In the event of Trezor’s failure, users would need to quickly find alternative hardware wallet options to safeguard their cryptocurrencies. This transition might involve a learning curve and potential challenges, as users become acquainted with new wallet interfaces and features.

- Uncertainty and loss of trust: Trezor’s failure could lead to a broader sense of uncertainty and disillusionment within the cryptocurrency community. Users may question the reliability and trustworthiness of other hardware wallet providers, which could have a cascading effect on the industry as a whole.

- Migration of user data: If Trezor were to close down, users would need to migrate their seed phrases or recovery keys to alternative wallets to ensure the continued security of their funds. This process can be complex and must be performed carefully to prevent any potential loss or compromise of assets.

It’s worth noting that as of now, there is no indication that Trezor is facing any imminent failure or shutdown. However, it’s always wise for cryptocurrency users to have contingency plans and be prepared for any unforeseen circumstances.

In the event of Trezor’s failure, it is crucial for users to stay informed, follow official announcements, and seek expert advice on how to secure their funds and transition to alternative wallet solutions.

Loss of Trust in the Crypto Industry

If Trezor or any other prominent company in the cryptocurrency industry were to experience a significant failure, it could lead to a loss of trust among users and have broader implications for the crypto industry as a whole. Here are some potential impacts on the trustworthiness of the industry:

- User skepticism: A high-profile failure like Trezor could generate skepticism and doubt among individuals who are considering entering the cryptocurrency market. They may question the reliability and security of digital assets, ultimately deterring them from participating in the industry.

- Increased regulatory scrutiny: The failure of a major player like Trezor could prompt regulators to scrutinize the cryptocurrency industry more intensely. Governments may introduce stricter regulations to prevent similar incidents and protect investors, potentially hindering the growth and innovation of the industry.

- Diminished investor confidence: The loss of trust in the crypto industry resulting from a company failure could lead to a decrease in investor confidence. This could impact the flow of capital into cryptocurrencies, leading to a decline in market values and hindering the development of new projects and technologies.

- Market volatility: If trust in the cryptocurrency industry is eroded, it could result in increased market volatility. Investors might become more cautious and hesitant to engage in trading or investment activities, causing price fluctuations and unstable market conditions.

- Slow adoption of cryptocurrencies: Trust is crucial for widespread adoption of cryptocurrencies in mainstream society. A loss of trust due to a high-profile failure could slow down the adoption process as individuals and businesses become more hesitant about embracing digital currencies.

- Importance of transparency and security: The failure of a major player like Trezor would underscore the importance of transparency and security in the crypto industry. It would serve as a reminder to companies and investors to prioritize robust security measures, proper auditing, and transparent business practices to regain and maintain trust.

While the failure of one company does not necessarily represent the entire crypto industry, public perception plays a significant role in shaping its future. It is essential for companies to adhere to stringent security protocols, engage in transparent business practices, and prioritize customer satisfaction to build trust and maintain the integrity of the crypto industry.

Alternatives to Trezor

In the event that Trezor or any other hardware wallet company experiences difficulties, users may need to consider alternative options to safeguard their cryptocurrencies. Here are some popular alternatives to Trezor:

- Ledger: Ledger is a well-known and trusted hardware wallet brand that offers a range of products, including the Ledger Nano S and Ledger Nano X. Similar to Trezor, Ledger wallets provide secure cold storage for cryptocurrencies and support various digital assets.

- KeepKey: KeepKey is another reputable hardware wallet option that offers a sleek and user-friendly design. It provides a secure storage solution for cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

- Coldcard: Coldcard is a unique hardware wallet known for its emphasis on security and privacy. It offers features like air-gapped signing, secure chip technology, and the ability to validate transactions directly on the device.

- BitBox: BitBox is a compact and minimalist hardware wallet that prioritizes simplicity and security. It is designed for both beginners and advanced users, offering a straightforward user interface and advanced security features.

- SecuX: SecuX is a hardware wallet company that focuses on providing a seamless and secure user experience. Their wallets are compatible with major cryptocurrencies and offer features like Bluetooth connectivity and multiple layers of security.

When choosing an alternative to Trezor, it is essential to consider factors such as security features, compatibility with your desired cryptocurrencies, ease of use, customer support, and reputation in the crypto community. It’s recommended to do thorough research, read user reviews, and compare the features and specifications of different hardware wallets before making a decision.

Remember, it is crucial to verify the legitimacy of any hardware wallet provider and ensure that you are purchasing from an authorized and reputable source. This will help mitigate the risk of falling victim to counterfeit products or scams within the crypto industry.

With a wide selection of hardware wallets available, users have the opportunity to choose the one that best suits their needs and preferences. Whether it’s Ledger, KeepKey, Coldcard, BitBox, SecuX, or another reputable brand, using a hardware wallet remains one of the most secure ways to store and manage cryptocurrencies.

What Happens to My Bitcoin if Trezor Fails?

If Trezor were to fail or shut down, you may be concerned about the fate of your Bitcoin and other cryptocurrencies stored in your Trezor wallet. Here’s what you need to know:

Private keys and recovery seed: Trezor operates on the principle of giving users complete control over their private keys. When you set up a Trezor wallet, you are provided with a recovery seed, which is a list of words that can be used to restore access to your funds. Even if Trezor were to shut down, you would still have access to your private keys and recovery seed, which means your Bitcoin would remain safe.

Transition to alternative wallets: In the event of Trezor’s failure, users would need to transfer their cryptocurrencies to alternative wallets. This process involves initializing a new wallet, using the recovery seed from your Trezor device, and transferring your Bitcoin to the new wallet. It is important to follow the guidelines provided by Trezor or seek assistance from knowledgeable sources to ensure a smooth transition and avoid any potential loss or errors during the transfer process.

Compatibility with other wallets: Since Trezor follows industry standards for private key generation, your recovery seed can be used with other compatible wallets. This means you have the flexibility to choose from a variety of wallets that support the BIP39 standard and import your recovery seed to access your Bitcoin. However, it is important to note that not all wallets are compatible, so thorough research and verification are necessary to ensure compatibility and security.

Importance of wallet backups: Regardless of the situation with Trezor, it is crucial to regularly back up your wallet and recovery seed. This ensures that you always have a copy of your private keys in a safe place, even if your hardware wallet is lost, damaged, or becomes obsolete. By keeping multiple backups in secure locations, you can protect your Bitcoin and other cryptocurrencies from potential risks.

Seeking professional advice: If you have concerns or questions regarding the process of transferring your Bitcoin from a failing Trezor wallet, it is highly recommended to seek professional advice or consult with experts in the field. They can provide personalized guidance based on your specific situation and help ensure a smooth and secure transfer process.

Remember, the key is to stay informed, keep your private keys and recovery seed secure, and be proactive in managing your cryptocurrency assets. By taking the necessary precautions and making informed decisions, you can effectively navigate any challenges that may arise in the event of Trezor’s failure.

Tips for Protecting Your Crypto AssetsProtecting your cryptocurrency assets is of utmost importance in the ever-evolving world of digital currencies. Here are some essential tips to help safeguard your crypto assets:

- Use a hardware wallet: Hardware wallets, such as Trezor, provide an added layer of security by keeping your private keys offline. Investing in a reputable hardware wallet is one of the most effective ways to protect your crypto assets from hacking attempts and malware attacks.

- Create strong and unique passwords: Choose strong and unique passwords for your digital wallets and cryptocurrency exchanges. Avoid using easily guessable or commonly used passwords, and consider using a password manager to securely store and manage your passwords.

- Enable two-factor authentication (2FA): Implementing 2FA adds an extra layer of security to your accounts. Enable 2FA on your cryptocurrency exchange accounts, wallets, and other relevant platforms to prevent unauthorized access.

- Regularly update your software: Keep your wallet software and any associated applications up to date with the latest security patches and updates. Regularly updating your software helps protect against known vulnerabilities and ensures optimal security.

- Be cautious of phishing attempts: Exercise caution when accessing links or emails related to your crypto assets. Avoid clicking on suspicious links or providing sensitive information on unverified websites. Verify the authenticity of platforms, emails, and messages before taking any action.

- Secure your devices: Ensure that your devices, including computers, smartphones, and hardware wallets, are protected with strong passwords and security measures. Regularly update your operating systems and antivirus software to further enhance your device’s security.

- Backup your wallet and recovery seed: Regularly backup your wallet and store your recovery seed in a secure location. This allows you to recover your crypto assets in the event of theft, damage, or loss of your hardware wallet.

- Stay informed: Stay up to date with the latest developments in the crypto industry, including security practices and potential threats. Regularly educate yourself about best practices and security measures to ensure the protection of your crypto assets.

Remember, protecting your crypto assets is an ongoing process that requires constant vigilance and proactive measures. By following these tips and remaining cautious, you can significantly reduce the risks associated with storing and managing your cryptocurrency investments.

The Future of Hardware Wallets

The future of hardware wallets appears promising as the demand for secure storage solutions for cryptocurrencies continues to rise. Here are some trends and developments that could shape the future of hardware wallets:

- Enhanced security features: Hardware wallet manufacturers are continually striving to improve security measures to stay ahead of emerging threats. We can expect to see the integration of more advanced authentication methods, biometric features, and multi-party computations to further enhance the security of hardware wallets.

- Greater compatibility: As the cryptocurrency landscape evolves, hardware wallet manufacturers are working to increase the number of supported cryptocurrencies. This will allow users to store a wider range of digital assets in one device, simplifying portfolio management and providing more options for diversification.

- Improved user experience: Hardware wallet companies are focusing on enhancing the user experience by developing more intuitive interfaces and easy-to-use features. User-friendly designs and streamlined processes will continue to play a significant role in attracting and retaining users.

- Integration with decentralized finance (DeFi) platforms: With the growing popularity of DeFi applications, we can expect hardware wallets to integrate with these platforms. This would enable users to securely access and manage their DeFi assets directly from their hardware wallets, further enhancing the convenience and security of DeFi transactions.

- Integration with mobile devices: Mobile devices have become an integral part of our daily lives, and hardware wallet manufacturers are exploring ways to seamlessly integrate their devices with smartphones and tablets. This would allow users to manage their crypto assets on the go, without compromising security.

- Increased regulatory compliance: In response to evolving regulations, hardware wallet manufacturers will likely place a greater emphasis on regulatory compliance. This includes implementing features that assist with compliance requirements, such as tax reporting and identity verification processes.

- Interoperability and standardization: Interoperability among different hardware wallet brands and standards can simplify the user experience and promote wider adoption. Efforts towards establishing common protocols and standards for hardware wallets could lead to improved compatibility and interoperability in the future.

As the crypto industry continues to mature, hardware wallets will remain an integral part of the ecosystem, addressing the critical need for secure storage and management of digital assets. With ongoing advancements in security, user experience, and integration with emerging technologies, hardware wallets are poised to play a vital role in facilitating the widespread adoption of cryptocurrencies in the years to come.