What is a Digital Check?

A digital check, also known as an e-check or electronic check, is a digital version of a traditional paper check. It is a secure and convenient alternative to physical checks, allowing users to receive and process payments electronically. Instead of writing a check on paper, signing it, and physically delivering it to the recipient, digital checks enable payments to be made online, saving time and effort.

With a digital check, the payment information is securely transmitted electronically, eliminating the need for manual processing. The recipient can then deposit the digital check into their bank account just like they would with a physical check.

Digital checks can be used for a variety of purposes, including paying bills, making purchases, and receiving payments from clients or customers. They have become increasingly popular in recent years, particularly with the rise of online banking and the digitization of financial transactions.

One of the key advantages of digital checks is the speed at which they can be processed. Unlike traditional checks that need to be physically transported and manually processed, digital checks can be transmitted and deposited electronically in a matter of seconds or minutes, depending on the banking system used. This makes digital checks a convenient and efficient payment method for both individuals and businesses.

To receive a digital check, the sender needs to have the recipient’s bank account information. This typically includes the bank’s name, the account number, and the routing number. Once the sender has this information, they can initiate the digital check payment through their online banking portal or a digital payment service provider.

How to Receive a Digital Check

Receiving a digital check is a straightforward process that requires a few essential steps. Here’s a simple guide to help you receive a digital check:

- Confirm your bank’s digital check capabilities: Before you can receive a digital check, ensure that your bank supports electronic payments. Most banks now offer digital check deposit options, but it’s always a good idea to double-check and understand their specific procedures.

- Provide your bank account details: To receive a digital check, you’ll need to share your bank account information with the sender. This typically includes your account number, routing number, and the name of your bank. Take care when sharing this information and ensure that it is transmitted securely.

- Communicate with the sender: Let the sender know that you are open to receiving a digital check. Provide them with your bank account details and any necessary information they require to initiate the payment.

- Receive the digital check: Once the sender has initiated the digital check payment, you will receive a notification via email, text message, or through your banking app, depending on your bank’s notification system. Open the notification to access the digital check.

- Review and endorse the digital check: Open the digital check and review the payment details carefully. Ensure that the amount, payee, and other relevant information match your expectations. If everything is in order, endorse the check by digitally signing it, if required by your bank.

- Deposit the digital check: After endorsing the check, follow your bank’s instructions to deposit the digital check into your bank account. This can typically be done through your bank’s mobile app, website, or by visiting a physical branch. Provide any additional information requested by your bank, such as the check number or deposit reference.

- Wait for the check to clear: Like traditional paper checks, digital checks need time to clear, and the funds become available in your account. The clearing time varies depending on the bank and other factors. Check with your bank to determine the estimated clearing time for digital checks.

Receiving and depositing a digital check is a convenient way to receive payments, saving you the hassle of physically depositing traditional checks. It’s important to ensure the accuracy of the payment details and conduct regular checks on your bank account to track the status of your deposits.

Understanding the Different Digital Check Services

As digital checks continue to gain popularity, various digital check service providers have emerged to offer convenient solutions for sending and receiving electronic payments. Understanding the different digital check services available can help you choose the best solution for your needs. Here are three common types of digital check services:

- Bank-provided digital check services: Many banks offer their own digital check services, allowing account holders to send and receive digital checks through their online banking platforms. These services are often integrated directly into the bank’s existing systems, making it seamless for customers to manage their payments within their familiar banking interface. Bank-provided digital check services can provide added security and peace of mind, as the transactions are facilitated by the bank’s trusted infrastructure.

- Third-party payment platforms: In addition to bank-provided digital check services, there are also third-party payment platforms that specialize in digital check processing. These platforms act as intermediaries between senders and recipients, facilitating the secure transmission and deposit of digital checks. Some popular third-party payment platforms include PayPal, Venmo, and Zelle. These platforms often offer additional features such as instant transfers, payment tracking, and integration with other financial apps and services. Using a third-party payment platform can be beneficial if you prefer a service that is independent of your specific bank or if you require additional functionality beyond basic digital check processing.

- Digital wallet applications: Digital wallet applications, such as Apple Pay and Google Pay, have also introduced digital check functionalities. These applications allow users to store their payment information securely and make payments digitally, including the option to send digital checks. With a digital wallet, users can easily send and receive payments using their mobile devices, eliminating the need for physical checks or even traditional payment cards in some cases. Digital wallet applications often provide a convenient and user-friendly interface for managing and tracking your digital check transactions.

When selecting a digital check service, consider factors such as ease of use, security measures, transaction fees (if applicable), and compatibility with your banking system. It’s also important to review the terms and conditions, privacy policies, and customer reviews of the digital check service provider to ensure they meet your requirements.

By understanding the different digital check services available, you can choose a solution that aligns with your preferences and simplifies your payment processes. Whether you opt for a bank-provided service, a third-party payment platform, or a digital wallet application, embracing digital checks can enhance the efficiency and convenience of your financial transactions.

Step-by-Step Guide to Cashing a Digital Check

Cashing a digital check is a simple process that requires a few basic steps. Whether you receive a digital check from a client, employer, or another individual, follow this step-by-step guide to cashing a digital check:

- Access your banking app or website: Open the banking app or website associated with the bank account where you want to deposit the digital check. Ensure that you have a stable internet connection and login to your account securely.

- Select the deposit option: Look for the deposit or check deposit option within your banking app or website. Depending on your bank, this may be listed as “Deposit a Check” or a similar phrase. Click on the appropriate option to proceed.

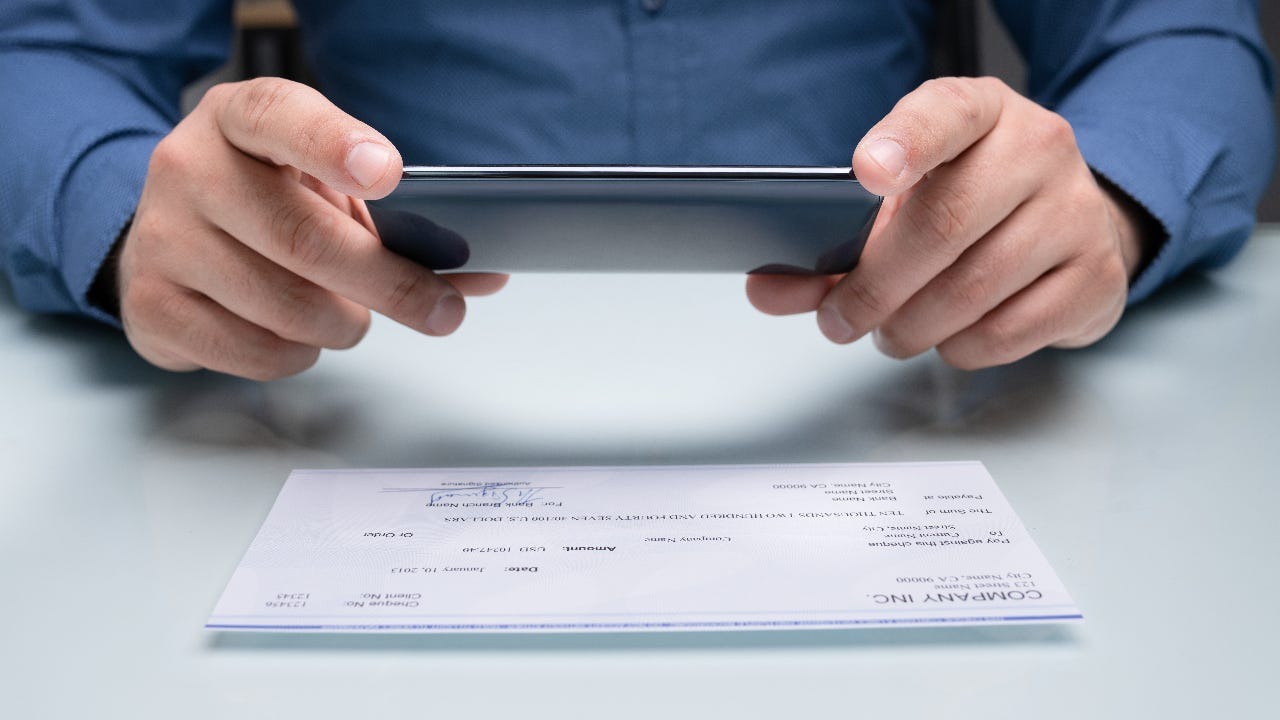

- Capture an image of the digital check: Follow the instructions to capture an image of the front and back of the digital check using your mobile device’s camera. Make sure that the check is well-lit, flat, and fully visible within the frame. Verify that the check images are clear and legible before proceeding.

- Verify the check details: Review the information displayed on the screen, including the check amount, payee, and other pertinent details. Confirm that the information matches your expectations and that you are depositing the correct check.

- Select the deposit account: Choose the bank account where you want to deposit the funds from the digital check. If you have multiple accounts with the same bank, ensure that you select the correct account for the deposit.

- Confirm the deposit: Double-check all the selected options and details before confirming the deposit. Once you are satisfied, click on the “Submit” or similar button to initiate the deposit process.

- Wait for the confirmation: After submitting the deposit, you will receive a confirmation message indicating that your deposit has been successfully submitted. The confirmation may include the estimated time it will take for the funds to become available in your account.

- Monitor your account: Keep an eye on your bank account for updates regarding the status of the digital check deposit. Most banks provide notifications or transaction history that will show the deposit as processing and then eventually as cleared.

- Access your funds: Once the digital check has cleared, the funds will be available in your bank account. You can now use the funds for payments, transfers, or withdrawals as needed.

Remember to keep a digital or physical record of the deposited digital check for your reference and financial records. If you encounter any issues or have questions during the process, reach out to your bank’s customer support for assistance.

Cashing a digital check is a convenient and efficient way to access funds without the need for physical checks or in-person visits to a bank branch. By following these simple steps, you can easily convert a digital check into usable funds in your bank account.

What You Need to Cash a Digital Check

To cash a digital check, there are a few essential requirements you need to fulfill. Before initiating the process, make sure you have the following:

- A bank account: To cash a digital check, you must have an active bank account. This is where the funds from the digital check will be deposited. If you don’t have a bank account, you will need to open one before you can cash a digital check. Choose a bank that offers digital check deposit services or is compatible with the digital check service you plan to use.

- Access to online banking: Cashing a digital check typically requires online banking access. Ensure that you have the necessary login credentials (username and password) to access your online banking account. If you haven’t set up online banking yet, follow your bank’s instructions to enroll in this service.

- Internet connection: A stable internet connection is necessary to access your online banking account and complete the digital check cashing process. Make sure you have a reliable internet connection, whether it’s through Wi-Fi or mobile data.

- Banking app or website: Install the mobile banking app provided by your bank on your smartphone, or ensure that you can access your bank’s website through a web browser on your computer. Having the appropriate banking application or website will allow you to initiate the deposit and cash the digital check.

- Smartphone or computer with a camera: Most digital check cashing processes involve capturing images of the front and back of the digital check using your device’s camera. Ensure that your smartphone or computer has a working camera and is capable of capturing clear, legible images.

- Digital check information: When cashing a digital check, you may need to enter specific information from the check, such as the amount, payee’s name, check number, or any additional details required by your bank. Keep this information handy and ensure it matches what you see on the physical or digital copy of the check.

- Valid identification: While not always necessary for cashing a digital check, it’s possible that your bank may require you to provide valid identification for security purposes. This may include a driver’s license, passport, or other government-issued identification. If unsure, check with your bank about their identification requirements.

Having these requirements in place will streamline the process of cashing a digital check. Check with your bank or digital check service provider for any additional requirements specific to their systems or policies.

Remember to safeguard your online banking credentials and treat your digital check transactions with the same level of security as traditional banking activities. By meeting the necessary requirements and taking precautions, you can effectively cash digital checks and manage your finances seamlessly.

Tips for Cashing a Digital Check

Cashing a digital check can be a smooth and efficient process if you follow these helpful tips:

- Ensure check eligibility: Confirm that the digital check you receive is eligible for electronic deposit. Some checks may have restrictions or requirements that prevent them from being cashed digitally. For example, certain types of checks, such as traveler’s checks or certain government-issued checks, may need to be cashed in person at a bank branch.

- Verify check authenticity: Check for security features and signs of authenticity on the digital check. Look for elements like watermarks, security codes, or holograms, which help confirm the validity of the check. If you have any concerns about the authenticity of the check, contact the issuer or your bank for verification.

- Review the deposit instructions: Familiarize yourself with your bank’s specific instructions for depositing digital checks. Understand the process, any limitations or requirements, and any fees associated with cashing a digital check.

- Capture clear images: When taking photos of the digital check, ensure that the images are clear and legible. Avoid blurriness or shadows that can make the check details difficult to read. Position the check on a flat surface with good lighting to capture the cleanest images possible.

- Double-check information accuracy: Before submitting the digital check for deposit, carefully review the information you entered, including the amount, payee, and check number. Ensure that all information matches the physical or digital copy of the check to avoid any errors or discrepancies.

- Save check confirmation and records: Keep a record of the confirmation message or receipt after successfully depositing the digital check. This serves as proof of the transaction and can be helpful for future reference or in case of any issues or discrepancies.

- Monitor your account regularly: Regularly check your bank account to monitor the status of the deposited digital check. Confirm that the funds have been successfully credited and be aware of any processing times or holds that may be applicable.

- Be cautious of scams: Be vigilant when receiving digital checks from unfamiliar sources. Digital check scams can occur, so be wary of unexpected or suspicious checks, and verify the legitimacy of the sender before depositing the check. If something seems too good to be true, it’s always wise to exercise caution.

- Keep your device and banking app secure: Maintain the security of your device and banking app to protect your personal and financial information. Use strong passwords, enable two-factor authentication, and ensure that your device’s software is up to date to safeguard against potential breaches or unauthorized access.

Following these tips will help you navigate the process of cashing a digital check with ease and reduce the likelihood of any complications or issues. If you have any questions or encounter problems along the way, don’t hesitate to reach out to your bank’s customer support for assistance.

The Pros and Cons of Cashing Digital Checks

Like any financial transaction method, cashing digital checks comes with its own set of advantages and disadvantages. Understanding the pros and cons can help you make an informed decision when it comes to using digital checks as a payment method. Here are some key points to consider:

Pros:

- Convenience: Cashing digital checks offers unparalleled convenience. You can deposit checks from anywhere and at any time using your smartphone or computer. This eliminates the need for physically visiting a bank branch or mail-in deposits, making it a time-saving and efficient method.

- Speed: Digital checks typically clear faster than traditional paper checks. Since the process is electronic, funds are often available in your bank account within a shorter time frame, allowing you to access and use the money more quickly.

- Reduced paper waste: Going digital with check deposits can help reduce paper waste, benefiting the environment. By eliminating the need for physical checks, envelopes, and transportation, digital checks contribute to a more sustainable approach to banking and financial transactions.

- Enhanced record-keeping: Cashing digital checks provides an automatic digital record of your financial transactions. Through your online banking portal or app, you can easily access and review your deposit history, helping with organization and simplifying future reference or tracking of payments.

- Access for remote banking: Digital checks are especially advantageous for individuals or businesses that are geographically distant from their bank’s physical branches. Remote banking becomes more accessible, allowing you to complete banking transactions without the need for in-person visits.

Cons:

- Dependence on technology: Cashing digital checks relies on technology, including internet connectivity, smartphones, and banking apps. Any disruption in these systems can temporarily hinder your ability to deposit digital checks, potentially causing inconvenience.

- Security risks: Digital transactions can carry security risks, including the possibility of unauthorized access to your banking information. It’s essential to adopt good security practices like using strong passwords, regularly updating software, and being cautious of potential scams to protect your online banking activities.

- Learning curve: For individuals who are not familiar with digital banking or using mobile apps, there may be a learning curve to overcome when cashing digital checks. Understanding the steps involved and navigating the banking platform may require some initial effort and adjustment.

- Potential holds and delays: While digital checks generally clear faster than paper checks, there can still be occasions where holds are placed on the funds or delays occur in the clearing process. These hold periods vary between banks and can impact your access to the funds until the check clears.

- Limitations on check types: Certain types of checks may not be eligible for digital deposit, such as certain government-issued checks or checks that exceed a specific amount. It’s important to check with your bank regarding any limitations or restrictions on the types of checks that can be cashed digitally.

By weighing the pros and cons, you can determine if cashing digital checks aligns with your preferences, needs, and comfort level. Consider your banking habits, technological proficiency, and the level of convenience you seek when deciding whether to embrace digital checks as part of your financial routine.

How Long Does It Take to Cash a Digital Check?

The time it takes to cash a digital check can vary depending on several factors, including your bank’s processing time, the day and time you initiate the deposit, and any hold periods that may be imposed. While digital checks generally clear faster than traditional paper checks, it’s important to understand the typical timeline involved.

In many cases, digital checks can be processed and the funds made available in your bank account within one to two business days. However, some digital check deposits may clear even faster, sometimes within a few hours or even minutes, depending on your bank’s electronic processing capabilities.

It’s important to note that weekends, holidays, and after-hours deposit submissions may impact the processing time. Deposits made outside of regular banking hours may not be processed until the next business day, potentially causing a slight delay in accessing the funds.

Hold periods may also affect the time it takes to cash a digital check. Banks typically place holds on larger deposits or if they suspect any irregularities. Common hold periods for digital checks range from one to three business days. This allows the bank time to verify the authenticity of the check and ensures that the funds are available.

Factors such as your banking relationship, the sender’s bank, or any intermediary processing systems can also affect the time it takes to cash a digital check. If the check is from a different bank or if there are additional verification steps involved, the processing time may be extended.

It is always beneficial to check with your bank for specific information on their processing times and any potential holds or delays that may apply to digital check deposits. Most banks provide detailed information about their deposit policies, including estimated clearing times, on their websites or through customer service channels.

While digital checks generally offer faster access to funds compared to paper checks, it’s important to plan accordingly and be aware of any potential delays. To ensure a smooth deposit process, submit your digital check during regular banking hours and allow for any necessary hold periods. Monitoring your bank account regularly will help you track the status of the deposit and determine when the funds become available for use.

Common Issues and Troubleshooting with Digital Checks

While cashing digital checks provides convenience and efficiency, it is not without its potential challenges. Being aware of common issues and how to troubleshoot them can help you navigate any obstacles that arise during the process. Here are some common issues with digital checks and possible troubleshooting steps:

- Image quality: One common issue when cashing digital checks is poor image quality. Blurry or unreadable images can cause rejection or delays in the deposit process. To troubleshoot this, ensure that you have good lighting and a stable surface when capturing images of the digital check. Clean your camera lens and make sure the check is flat and fully visible within the frame. Retake the photos if necessary to ensure clear and legible images.

- Verification issues: Occasionally, digital checks may fail the verification process due to discrepancies or suspected irregularities. If this occurs, contact your bank’s customer support for assistance. They may require additional documents or information to resolve the issue. Be prepared to provide any requested documentation promptly to expedite the verification process.

- Insufficient funds: Just like paper checks, digital checks can bounce if the issuer does not have sufficient funds in their account to cover the amount. If you receive a notification about insufficient funds, contact the sender to resolve the issue. Depending on the circumstances, you may need to request an alternative form of payment or arrange for the sender to provide sufficient funds to cover the check amount.

- Deposit rejection: In some cases, your bank may reject a digital check deposit. This can occur due to various reasons, including incompatible check formats or discrepancies in the check details. If your deposit is rejected, double-check the provided reason for rejection and contact your bank for further guidance. They can assist you in resolving the issue and provide alternative options for depositing the check.

- Technical glitches: Occasionally, technical glitches or connectivity issues may disrupt the digital check cashing process. To troubleshoot this, ensure that you have a stable internet connection and try logging out and logging back into your banking app or website. If the issue persists, contact your bank’s technical support for assistance.

- Security concerns: Protecting your personal and financial information is essential when cashing digital checks. If you encounter any suspicious activity or security concerns during the process, immediately contact your bank’s fraud department or customer support. They will guide you on the necessary steps to secure your account and prevent any fraudulent transactions.

It’s important to keep in mind that while digital checks offer convenience, occasional challenges may arise. By understanding common issues and being prepared with troubleshooting steps, you can navigate and resolve any problems that may occur. If you encounter persistent issues or need further assistance, always reach out to your bank’s customer support for guidance specific to your situation.

Security Measures to Protect Your Digital Checks

Ensuring the security of your digital checks is crucial to protect your financial information and prevent unauthorized access. Here are some security measures you can implement to safeguard your digital checks:

- Use strong, unique passwords: Create strong and unique passwords for your online banking account. Avoid using common passwords or personal information that can easily be guessed. Consider using a password manager to generate and store complex passwords securely.

- Enable two-factor authentication: Activate two-factor authentication (2FA) for your online banking account. This adds an extra layer of security by requiring a second verification step, such as a code sent to your mobile device, in addition to your password when logging in.

- Monitor your accounts regularly: Regularly review your bank account statements and transaction history for any discrepancies or unauthorized transactions. Promptly report any suspicious activity to your bank’s fraud department.

- Be cautious of phishing attempts: Be vigilant of phishing attacks, where scammers try to trick you into providing personal or banking information. Never click on suspicious links or provide sensitive information through unsolicited emails or calls. Instead, contact your bank directly through verified channels if you have concerns.

- Keep your devices and software updated: Regularly update your devices, operating systems, and banking apps to ensure you have the latest security patches and features. Outdated software can be vulnerable to security breaches.

- Secure your network: Use a secure and encrypted Wi-Fi network when accessing your online banking account. Avoid using public Wi-Fi networks, which may be less secure and susceptible to eavesdropping attacks. If you must use public Wi-Fi, consider using a virtual private network (VPN) for added security.

- Be cautious with personal information: Be mindful of sharing your personal and banking information online. Only provide it on secure and trustworthy websites, and avoid sharing sensitive information through unsecured means, such as unencrypted email or messaging services.

- Protect your mobile devices: Set up a lock screen or fingerprint/face recognition on your mobile device to prevent unauthorized access. Enable remote tracking and data wiping capabilities in case your device is lost or stolen.

- Safely dispose of physical checks: If you receive a physical copy of a digital check, securely dispose of it once the deposit is complete. Shred or destroy the check to prevent any potential misuse of the information.

- Stay informed: Keep yourself updated on the latest security practices and trends in digital banking. Follow your bank’s security guidelines and recommendations to ensure you are implementing the most effective security measures.

Implementing these security measures will help protect your digital checks and maintain the privacy and integrity of your financial information. By being proactive and staying vigilant, you can minimize the risk of falling victim to online fraud or unauthorized access to your bank account.

The Future of Digital Checks

With the continuous advancement of technology and the increasing digital transformation of financial processes, the future of digital checks looks promising. Here are some key trends and developments shaping the future of digital checks:

- Increased adoption: As more individuals and businesses become accustomed to digital payments and online banking, the adoption of digital checks is expected to grow. The convenience, speed, and efficiency of digital checks make them an attractive alternative to traditional paper checks.

- Enhanced security measures: As the financial industry continues to prioritize security, digital check providers will likely strengthen their security measures. This may include incorporating advanced encryption techniques, biometric authentication, and fraud detection algorithms to ensure the safety of digital check transactions.

- Artificial intelligence and machine learning: The integration of artificial intelligence (AI) and machine learning (ML) technologies can streamline the processing of digital checks. These technologies can improve accuracy in reading and verifying check information, reducing errors and the need for manual intervention.

- Integration with emerging technologies: Digital checks may integrate with emerging technologies such as blockchain and digital wallets. Blockchain technology provides enhanced security and transparency, ensuring the authenticity and integrity of digital check transactions. Integration with digital wallets can offer a seamless and user-friendly payment experience.

- Expanded interoperability: The future of digital checks may see increased interoperability between different banks and financial institutions. This would enable more seamless and efficient digital check transfers and clearing processes, benefiting both individuals and businesses.

- Mobile banking advancements: With the proliferation of smartphones and mobile banking apps, digital checks are likely to become more integrated within the mobile banking experience. This integration may include features such as real-time check deposits, instant notifications, and voice-activated digital check processing.

- Regulatory advancements: Regulatory frameworks around digital checks are expected to evolve to ensure consumer protection, standardization, and compliance. Stricter regulations may be implemented to combat fraud and ensure greater transparency within digital check transactions.

- International expansion: The use of digital checks may expand beyond domestic boundaries, enabling cross-border payments and facilitating global trade. This would provide increased convenience and efficiency for businesses and individuals operating in the global marketplace.

While the future of digital checks holds great promise, it is important to note that the transition from paper checks to fully digital processes may take time. Adoption rates and the pace of change may vary in different regions and among different demographic groups.

As digital technology continues to advance and consumer behavior evolves, it is expected that digital checks will become an increasingly common and convenient method of payment. By staying informed about emerging trends and embracing the advancements in digital banking, individuals and businesses can leverage the benefits that digital checks have to offer.