Setting up a budget is challenging, even for an astute planner. This is made increasingly difficult by inflationary pressures. Budgets are designed to map out expenditures for the coming month, but decreasing real wages (purchasing power parity) and increasing costs make this challenging. To this end, we must assess the situation on its merits, using all available tools, resources, and technologies to manage our financial affairs better.

Many households struggle with creating a sustainable food budget. As a necessary item and luxury item, food is the driving force behind many of our purchases. Food expenses come in many forms, notably grocery stores, cafes, restaurants, take-out, mobile food orders, gym supplements, etc. These are much larger expense items than most people realize.

Inflation is the elephant in the room. It complicates tactical and strategic planning to no end. For one thing, inflation erodes the real purchasing power of money, rendering budgets inoperable, perhaps even obsolete.

Fortunately, there are eclectic approaches to food cost management. These include using all available budgetary means, smart technology such as a trusted grocery cash back app, impulse control (especially when grocery shopping online or in person), substitute or complimentary products, lifestyle changes, etc.

The proof of the pudding is in the numbers. According to the CPI, the average cost of home food increased 11.4% in 2022 (year-on-year). Food prices have stabilized to some degree this year but remain uncomfortably expensive. Between September 2022 and September 2023, CPI reported that the food price index rose 3.7%.

These incremental increases certainly add up. It’s not just food costs that we are dealing with – it’s the cost of gasoline, maintenance, repairs, replacements, rentals, and homeownership, to name a few. Everything is increasing in price, and we cannot stop the inflationary uptick.

We can mitigate our expenditures through careful and methodical means. Money-saving or money-earning strategies must be the focal point of any strategic approach to tackling food costs.

Failsafe Techniques for Cutting Costs

Amidst escalating food prices, a grocery cash-back app is vital in consumers’ financial arsenal. With the potential to earn up to 30% back at grocery stores, such an app transforms the shopping experience into an opportunity for significant savings.

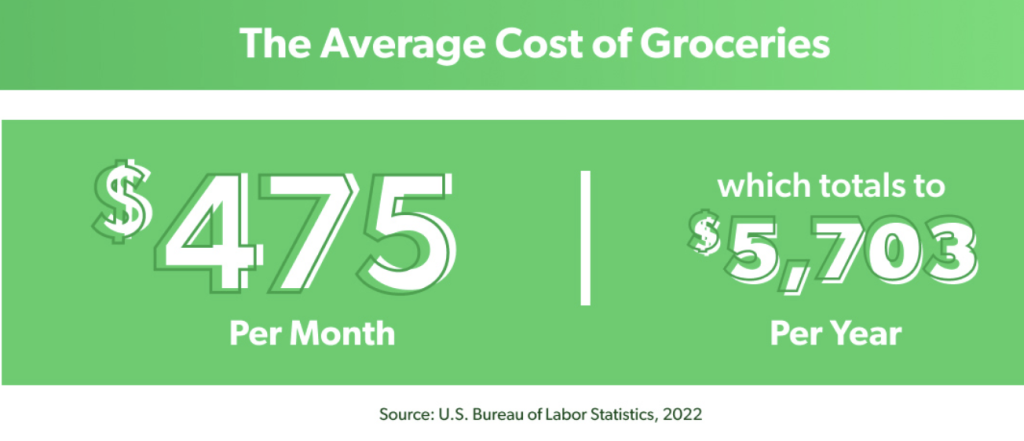

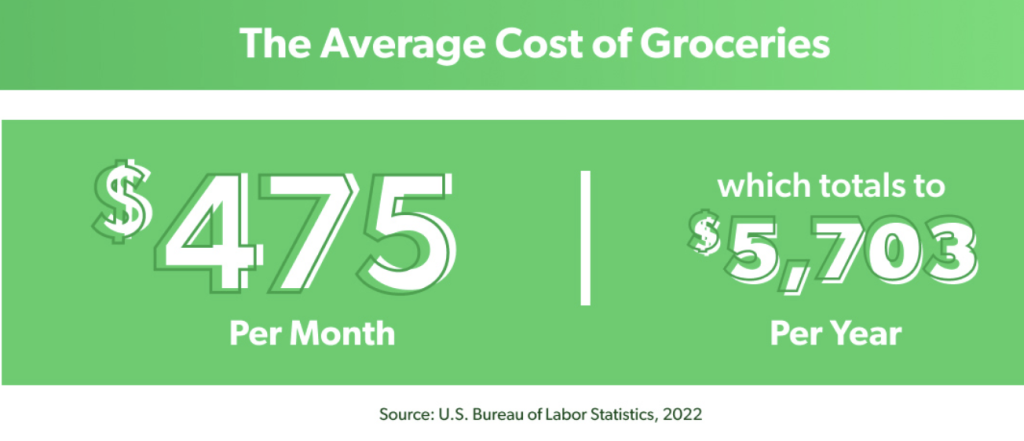

For instance, frequent users of this app can get an average of $340 per year just by integrating it into their regular shopping routine. This is especially notable given the average monthly grocery bill of $475.

The app’s extensive network, encompassing over 100,000 locations, including gas stations, grocery stores, and restaurants, ensures that cash-back opportunities are abundant and convenient. This means that users can earn cash back on a wide range of daily essentials, not just groceries, further enhancing their savings potential.

Notably, the app provides real cash back, not just points or credits, which can be directly transferred to a bank account or redeemed as e-gift cards at popular retailers like Amazon and Walmart.

By utilizing such a grocery cash-back app, consumers can effectively counter the impact of rising food prices, turning a portion of their regular expenditures into savings. This is an innovative approach to budgeting in an inflationary environment, where every dollar saved makes a significant difference.

The app’s ease of use, with features like a map function to view nearby cashback offers and the simplicity of claiming and paying for them, adds to its appeal as a practical, everyday financial tool.

The USDA Food Plans and Cost of Food Reports provide estimates of food spending on groceries. They divide consumer profiles into single-person households, a family of two, and a family of four. Within each category are subcategories, with thrifty, low-cost, moderate, and liberal plans.

On the low-income end, a single-person household should expect to spend up to $301 per month, and on a liberal plan, up to $455 per month. For a couple, the thrifty plan threshold is $596 per month, and the liberal plan is $945 per month. For a family of four, a thrifty plan is priced at $969 per month, and a liberal plan at $1578 per month.

How to Set Up a Grocery Budget

1. Assess Current Spending: Begin by reviewing your bank statements to understand your current grocery spending. Calculate the average monthly expenditure to establish a baseline.

2. Budget for Essentials: After setting your grocery budget, allocate funds for other critical expenses like housing, utilities, transportation, childcare, and any outstanding debts.

3. Adjust and Optimize: Aim for a zero-based budget where every dollar is assigned a purpose. Reassess and reallocate funds as necessary to balance your budget, ensuring you’re not overspending.

4. Align with Financial Goals: Tailor your grocery budget to support broader financial objectives, whether it’s debt repayment or saving. This might mean opting for cheaper meals or reducing dining out.

5. Shop Smart: Explore different grocery stores for better prices. Consider buying generic brands and take advantage of sales and seasonal produce.

6. Avoid Waste: Before shopping, check what you already have in your pantry and fridge to prevent unnecessary purchases. Get creative with recipes to use up existing ingredients.

7. Utilize Resources: Utilize meal planners and grocery guides for efficient shopping and to stay within budget.

These tactics and strategies can turn things around, if implemented correctly. When attempting to manage household expenditures, notably food costs, it’s important to take a holistic approach. Budgets, smart savings apps, commonsense, and focus can go a long way.